|

市場調查報告書

商品編碼

1692085

美國家庭整理與儲存:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)US Home Organizers And Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

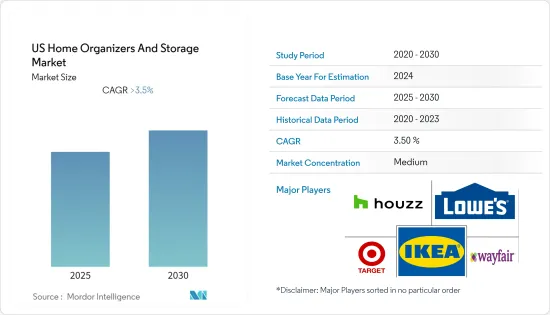

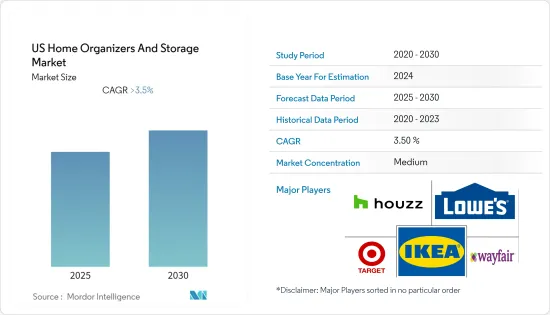

預計預測期內美國家庭組織和儲存市場將以超過 3.5% 的複合年成長率成長。

美國家居整理和儲存市場體現了消費者對家居效率、便利性和美觀度不斷變化的偏好。該市場匯聚了許多大型和專業製造商,並透過創新和客製化不斷發展。

智慧儲存和數位化存儲,利用科技來提升儲存體驗和功能,是智慧儲存解決方案的三大趨勢之一。美國越來越多的住宅改造計劃都注重住宅自訂儲存解決方案。消費者正在選擇客自訂儲存解決方案,例如定製衣櫃和廚房存儲,以最大限度地利用儲存空間。

COVID-19 疫情導致我們的家居使用方式急劇改變。在家工作、在家上學、將車庫改造成健身空間等都是疫情的結果。這導致消費者生活方式的適應和重塑。整理可用空間並安裝新的創新儲存空間已成為疫情後常見的家庭重組計劃。

疫情爆發後,人們對家庭整理的興趣立即激增。許多家庭組織公司,例如 Freshly Organized LLC,報告稱諮詢量、網站流量、與定期訂閱激增。人們對家庭整理興趣的突然激增與人們對疫情的反應有關。

美國家庭整理與儲存市場趨勢

住宅建設增加推動市場

美國現有住宅銷售量和住宅量的上升預計將在預測期內推動家居整理和儲存產品的需求。短期內,該國住宅裝修活動的活性化可能會刺激對家居整理和儲存的需求。

預計2022年美國私部門新建住宅建築產出將達到約9,000億美元,連續第三年強勁成長。因此,以獲準建造的住宅數量計算,德克薩斯州達拉斯-沃斯堡大都會圈的阿靈頓地區創下了美國住宅建設產量最高紀錄。

2023年2月自住住宅建設工程數為140萬套,較1月預測成長9.8%。

美國家庭整理器市場以模組化單元為主

模組化儲物櫃是整理日常用品和配件的熱門選擇。它們是傳統架子或櫥櫃的現代版本,通常很大而且實用。隨著紐約(美國)等城市的快速發展,對模組化住宅和儲存解決方案的需求預計將持續成長。

FREAKS Architecture 證明,透過將模組化儲存解決方案融入建築設計,設計師和開發商可以客製化儲存單元以滿足特定空間的要求。透過創造客製化的設計元素,靈活性和功能性被融入設計過程中,在設計領域創造了一個專注於現代化生活空間的全新類別。

美國家居收納及儲存行業概況

在美國,家庭整理和儲存市場比較分散,只有少數幾家大公司和許多小型公司。美國主要市場參與企業包括亞馬遜、Bed Bath and Beyond、Houzz、宜家、勞氏、塔吉特、The Container Store 和家得寶。這些公司專門生產定製家居整理器和儲存產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態與洞察

- 市場概況

- 市場促進因素

- 市場限制

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 購買者和消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 洞察產業技術進步

- COVID-19 市場影響

第5章 市場區隔

- 按產品

- 收納籃

- 收納盒

- 收納袋

- 吊掛存儲

- 多用途收納袋

- 旅行行李收納袋

- 模組化單元

- 其他產品

- 按應用

- 臥室衣櫃

- 洗衣房

- 內政部

- 食品儲藏室和廚房

- 車庫

- 其他用途

- 按分銷管道

- 大賣場/超級市場

- 專賣店

- 線上

- 其他分銷管道

第6章 競爭格局

- 市場集中度概覽

- 公司簡介

- Amazon

- Bed Bath & Beyond

- Houzz

- IKEA

- Lowe's

- Target

- The Container Store

- The Home Depot

- Walmart

- Wayfair

- Menards

- Neat Method*

第7章 市場機會與未來趨勢

第8章 免責聲明及發布者

The US Home Organizers And Storage Market is expected to register a CAGR of greater than 3.5% during the forecast period.

The evolving preferences of consumers seeking efficiency, convenience, and aesthetics within their homes are reflected in the US housing organizers and storage market. With a blend of established giants and specialized players, the market continues to evolve through innovation and customization.

Smart and digital storage, which uses technologies to increase the storage experience and functionalities, is one of three trends in intelligent storage solutions. In the United States, there is an increasing number of home renovation projects that are focusing on custom storage solutions for homes. Consumers are opting for custom storage solutions, such as custom-made closets and kitchen storage, that provide maximum storage.

The COVID-19 pandemic brought a radical change in the way homes are used. Work-from-home settings, homeschooling setup, and transforming the garage to a workout space are the result of the pandemic. This brought adaptation and reconstruction in the consumer's lifestyle. Organizing the available space and setting up new and innovative spaces for storage has become common re-organization home projects post-pandemic.

Immediately after the pandemic, there was a surge in the number of people interested in home organization. A number of home organization companies, such as Freshly Organized LLC, reported a massive rise in inquiries, website traffic, virtual appointments with experts, and subscriptions. This sudden increase in interest in home organization was related to a coping mechanism for the pandemic.

US Home Organizers and Storage Market Trends

Growing Residential Construction is Driving the Market

The demand for home organizers and storage is likely to rise during the forecast period, owing to an increase in existing house sales and housing starts in the United States. In the short term, rising home renovation activities in the country may stimulate the demand for home organizers and storage.

New home construction output in the United States private sector reached nearly USD 900 billion in 2022, the third year of strong growth in a row. As a result, in the Dallas Fort Worth Metropolitan Arlington region of Texas, housing units approved under construction permits have recorded some of the highest house-building output in the United States.

Compared to the January estimate, construction of privately owned housing in February 2023 accounted for 1.4 million units, increasing by 9.8%.

The United States Home Organizers Market is Dominated by the Modular Units Segment

Modular storage cubes are a popular choice for organizing everyday items and accessories. They are a modern version of traditional shelves and cupboards and are typically larger and more practical. With the rapid growth of cities like New York (United States), the demand for modular housing and storage solutions is expected to continue to grow in the years to come.

FREAKS Architecture has shown that modular storage solutions can be incorporated into architectural designs, allowing designers and developers to customize storage units to suit the requirements of a particular space. By creating bespoke design elements, flexibility and functionality are built into the design process, creating a whole new category within the design world focused on modernizing living spaces.

US Home Organizers and Storage Industry Overview

The home organizers and storage market is fragmented in the United States, with several substantial firms and numerous small and medium-sized businesses. Some of the top market participants in the United States are Amazon, Bed Bath and Beyond, Houzz, IKEA, Lowe's, Target, The Container Store, and Home Depot. These businesses specialize in making customized home organizers and storage items.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights into Technological Advancements in the Industry

- 4.7 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Storage Baskets

- 5.1.2 Storage Boxes

- 5.1.3 Storage Bags

- 5.1.4 Hanging Storage

- 5.1.5 Multipurpose Organizers

- 5.1.6 Travel Luggage Organizers

- 5.1.7 Modular Units

- 5.1.8 Other Products

- 5.2 By Application

- 5.2.1 Bedroom Closets

- 5.2.2 Laundry Rooms

- 5.2.3 Home Offices

- 5.2.4 Pantries and Kitchen

- 5.2.5 Garages

- 5.2.6 Other Applications

- 5.3 By Distribution Channel

- 5.3.1 Hypermarkets and Supermarkets

- 5.3.2 Specialty Stores

- 5.3.3 Online

- 5.3.4 Other Distribution Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Amazon

- 6.2.2 Bed Bath & Beyond

- 6.2.3 Houzz

- 6.2.4 IKEA

- 6.2.5 Lowe's

- 6.2.6 Target

- 6.2.7 The Container Store

- 6.2.8 The Home Depot

- 6.2.9 Walmart

- 6.2.10 Wayfair

- 6.2.11 Menards

- 6.2.12 Neat Method*