|

市場調查報告書

商品編碼

1521625

衛生紙加工機:市場佔有率分析、產業趨勢、成長預測(2024-2029)Tissue Paper Converting Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

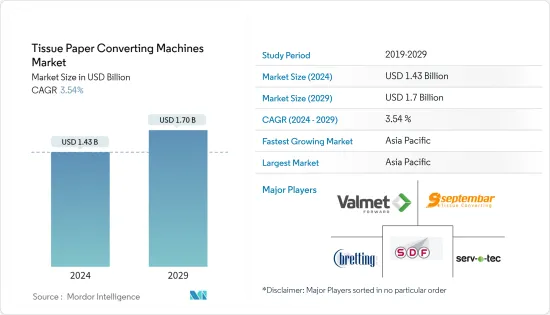

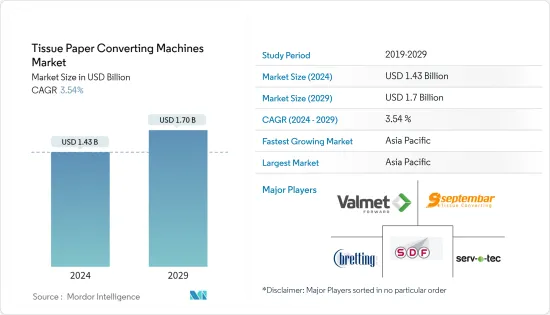

生活用紙加工機械市場規模預計到 2024 年為 14.3 億美元,預計到 2029 年將達到 17 億美元,在預測期內(2024-2029 年)複合年成長率為 3.54%。

薄頁紙的生產對環境有巨大的影響。生活用紙由回收的廢紙和原漿製成,會產生溫室氣體排放(原漿估計比廢紙多排放 30%)。隨著人們對環境永續性的日益關注,衛生紙加工機械製造商正在廣泛實施綠色製造模式。這包括使用回收材料、減少水和能源消耗以及採用盡量減少對環境影響的製程。

主要亮點

- 在生活用紙製造中,研發集中在幾個主要領域,包括節能、纖維節省、最終產品品質和機器運作能力。引流和流漿箱是衛生紙生產中能源最集中的階段。製造商正在積極探索新的智慧選項來最佳化該區域,實現更好的漿料均質化,促進更快的等級變化,並增加流漿箱的高度,以實現一致性。這些努力對於提高整個流程的效率、降低能源消耗、提高薄頁紙產品的品質至關重要。

- 智慧技術與自動化的整合正在興起,有助於提高整體工作效率、減少浪費並提高準確性。此外,隨著人事費用的上升和對更高效率的要求,對高速、全自動加工線的需求正在擴大。全自動加工機器連接纏繞和包裝等不同流程,消除浪費並減少人工干預的需要。隨著領先公司向新的製造領域擴張,他們正在大力投資利用尖端機器人、視覺和人工智慧進行最佳化。

- 創新的加工技術有助於有效利用原料,特別是紙纖維。精密切割和壓花技術是減少材料浪費的方法的例子,先進的控制系統最佳化了製造過程中的水和化學品消耗。

- 建立衛生紙加工廠所需的初始投資包括取得土地、建造或重建建築物、購買和安裝機械以及開發基礎設施的費用。大部分資金用於流動資金,但機械設備費用可佔總投資的25%以上。確保足夠的資金來支付這些成本可能很困難,特別是對於小型新業務而言。有限的財務資源、風險意識和監管合規性等因素使資金籌措過程更加複雜。為了應對這些挑戰,公司可以尋求合作夥伴關係,考慮政府支持計劃,制定全面的產業計畫,並最佳化成本以提高財務可行性。

- 根據AFRY(造紙業專家)和Suzano(全球領先的紙張和紙漿製造商)發布的報告,全球紙張消費量將從2021年的4,100萬噸增加到2032年的5,500萬噸,預計將大幅增加。全球對生活用紙不斷成長的需求將為許多中小型生產商進入生活用紙製造業創造機會,這可能會增加對加工機械的需求。

生活用紙加工機械市場趨勢

衛生捲紙加工線成為最大的機器類型部分

- 包括廁所用衛生紙在內的普通生活用紙產品佔據了加工機械市場的大部分。由於人口成長、都市化和衛生標準提高等因素,廁所用衛生紙的需求預計將穩步成長。

- 根據人口研究所預測,2023年全球都市化率為57%。北美、拉丁美洲和加勒比海地區是都市化最高的地區,五分之四以上的人口居住在都市區。

- 此外,針對濕紙巾應用的加工設備製造商可以透過開發能夠高效生產高品質、防潮紙巾的機器而受益。此外,濕紙巾包裝和分配器系統的創新為製造商提供了實現機器產品差異化並響應不斷變化的市場需求的機會。

- 日益成長的環境問題和消費者對永續性議題的認知不斷提高,正在推動廁所用衛生紙紙業採用環保做法。製造商正在投資可加工再生纖維、減少廢棄物並最大限度降低能源消耗的加工設備。對生物分解性和環保廁所用衛生紙產品的需求促使製造商投資於能夠處理物料輸送的機械。

- 此外,消費者對個人化和創新廁所用衛生紙產品的偏好促使製造商投資靈活的加工設備。需要能夠生產各種產品的機器,包括不同的紙張尺寸、層配置、壓花圖案和包裝選項。客製化能力使製造商能夠瞄準利基市場並在競爭格局中使他們的產品脫穎而出。此外,可支配收入較高的消費者傾向於購買和投資更多豪華壓花衛生紙。

- 紙巾產品製造商認知到消費者對壓花紙巾有美學。品牌通常使用壓花來增強獨特的圖案、標誌和其他特殊功能,以提高消費者的忠誠度和一致的購買意願。儘管壓花衛生紙特別適合美學吸引力和其他消費者偏好,但重要的是不要忽視產品的品質。

- 壓花會影響組織特性,尤其是機械強度和硬度。透過設計正確的壓花圖案和工藝,正確的組合可以促進層壓,從而產生客戶認為高品質的多層成品。透過與壓花專家合作,您可以在品質和美觀方面使您的衛生紙產品脫穎而出。

亞太地區預計將佔據主要市場佔有率

- 日本在成田國際機場的廁所裡安裝了一項獨特的功能:智慧型手機清潔紙,從而提高了其清潔聲譽。為了提高公共便利性,人們採取了一種新穎的方法,鼓勵人們從廁所用衛生紙旁的分配器中取出一張紙來消毒智慧型手機螢幕。這種清潔紙的推出是基於研究結果,該結果表明智慧型手機螢幕上比馬桶座圈上更容易生長細菌。研究表明,海外遊客一直對日本公共衛生間的清潔度和適應性感到驚訝。預計這將對目標市場產生影響。

- 印度的衛生紙產業目前正在透過創新和收購進行整合。這使得公司能夠提高市場地位、擴大產品範圍並投資先進的加工技術來滿足不斷成長的需求。都市化的加速、Swachh Bharat 等政府舉措對衛生的日益關注,以及醫療保健和酒店業需求的大幅增加,預計將推動紙巾、餐巾紙、廁所用衛生紙和毛巾紙的消費。

- 2024 年 1 月,製漿造紙行業領先公司安得拉紙業有限公司 (APL) 獲得董事會核准,在其 Kadiyam 工廠安裝最先進的衛生紙機。該機器採用最先進的技術,生產能力為每天 100 噸,使公司能夠實現產品系列的多樣化。擬增加產能為每年 35,000 噸(TPA),生產各種等級的面紙、廁所紙、餐巾紙、毛巾等。該公司計劃在 15 個月內開始生產。

- 為了加強我們在中國國內市場的生產能力,我們進口了包括最新TAD技術的高階衛生紙機。例如,恆安新增兩台維美德混合型衛生紙機,主要用於生產優質面紙和廚房紙巾。

- 此前,恆鋼已安裝了兩台拓斯克TAD衛生紙機。第一步是利用先進技術和設備開發差異化產品,提升產品的使用效能。例如,新的衛生紙機械技術和加工機械推出了厚度改進的產品。 Mind Act Upon Mind的雲系列紙巾、維達的羊絨感官系列衛生紙以及Villejoy的採用TAD技術的熱風廚房毛巾都是此類產品發布的一些例子。

- 印尼造紙業蓬勃發展,衛生紙機市場預計將成長。這種成長是由對薄紙產品的需求快速成長、對製造能力的投資、技術進步和不斷變化的環境考慮所推動的。

- 衛生紙機供應商可以透過提供創新解決方案並滿足紙張製造商的特定需求來利用這些機會。 2023年11月,印尼國際紙鏈工業展(Paper Chain Indonesia)在印尼雅加達JIEXPO展覽中心拉開序幕。

生活用紙加工機械產業概況

衛生紙加工機械市場高度分散。主要公司包括 CG Bretting Manufacturing Company, Inc.、Valmet Oyj、9 September Tissue Converting、Serv-o-Tec GmbH 和 SDF Schnitt-Druck-Falz Spezialmaschinen GmbH。市場參與者正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 產業生態系分析-供應商、材料製造商等。

第5章市場動態

- 市場促進因素

- 衛生紙製造業自動化趨勢不斷發展

- 加工技術創新提高永續性

- 市場限制因素

- 薄頁紙加工廠設備成本高

- 主要技術創新與發展—生活用紙加工設備及輔助設備

- 行業標準和法規

第6章 市場細分

- 依技術

- 自動的

- 半自動

- 按機器類型

- 衛生紙加工線

- 廚房捲紙

- 折疊式紙巾生產線

- 餐巾紙加工線

- 獨立系統

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 亞洲

- 日本

- 印度

- 中國

- 印尼

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章生活用紙需求趨勢及其對生產設備市場的影響

第8章 衛生紙加工機械市場趨勢

- 未來市場趨勢及主要成長預期

- 製造商面臨的主要挑戰與 OMET 主要競爭對手的創新

- 比較分析 - OMET Srl 與 OMET Srl 主要競爭對手

- 技術見解 - 組織加工機

第9章 競爭格局

- 公司簡介

- CG Bretting Manufacturing Company, Inc.

- Valmet Oyj

- 9.Septembar Tissue Converting

- SERV-O-TEC GMBH

- SDF Schnitt-Druck-Falz Spezialmaschinen GmbH

- ZAMBAK KAGIT

- Omet Srl

- Kawanoe Zoki Co. Ltd

- MTorres Disenos Industriales SAU

- Baosuo Paper Machinery Manufacture Co. Ltd(Baosuo Enterprise)

- A.Celli Paper SpA(italia Technology Alliance SpA)

- United Converting Tissue SRL

- Futura SpA

- Paper Converting Machine Company(PCMC)

- Fujian Tmx Machinery Manufacturing Co. Ltd

- Chan Li Machinery Co. Ltd

- Unimax Group Engineering & Development Corporation

- ICM Makina

第10章 客戶名單

The Tissue Paper Converting Machines Market size is estimated at USD 1.43 billion in 2024, and is expected to reach USD 1.70 billion by 2029, growing at a CAGR of 3.54% during the forecast period (2024-2029).

Tissue paper production has a significant impact on the environment. Tissue paper is made from recycled wastepaper and virgin pulp, contributing to greenhouse gas emissions (estimates state that virgin pulp contributes 30% more than wastepaper). With the escalating concerns about environmental sustainability, tissue paper converting equipment manufacturers are extensively implementing green manufacturing models. This includes using recycled materials, reducing water and energy consumption, and adopting processes that minimize environmental impact.

Key Highlights

- In tissue paper manufacturing, research and development efforts remain focused on several key areas, including energy saving, fiber saving, final product quality, and the ability to run the machine. The approach flow and headbox area are some of the most energy-intensive stages in tissue-making. Manufacturers are actively exploring new smart options to optimize this area, aiming to achieve better stock homogenization, facilitate quick grade changes, and work toward higher consistencies in the headbox. These efforts are essential for improving overall process efficiency, reducing energy consumption, and enhancing the quality of tissue paper products.

- The integration of smart technology and automation is on the rise, helping to improve overall operational efficiency, reduce waste, and enhance accuracy. Also, the demand for high-speed, fully automated converting lines is expanding, along with rising labor costs and efficiency demands. The fully automatic converting machines reduce waste and the need for human intervention by connecting different processes, such as winding and packaging. Major companies spend heavily on cutting-edge robots, vision, and artificial intelligence-driven optimization as they expand into new manufacturing areas.

- Innovative converting technologies facilitate the efficient utilization of raw materials, particularly paper fibers. Precision cutting and embossing techniques are examples of methods that reduce material waste, while advanced control systems optimize the consumption of water and chemicals during manufacturing.

- The initial investment needed to establish a tissue-converting plant can be substantial, covering expenses like land procurement, building construction or renovation, machinery purchase and installation, and infrastructure development. Much of the capital will be required as working capital, while the cost of machinery and equipment can be as high as 25% or more of the total investment. Securing enough capital for these costs can be tough, especially for small or new businesses. Factors like limited financial resources, perceived risk, and regulatory compliance further complicate the funding process. To address these challenges, businesses may seek partnerships, explore government support programs, develop thorough business plans, and optimize costs to enhance financial viability.

- According to a report published by AFRY (Paper industry specialist) and Suzano (a key global paper and pulp producer), the global consumption of paper is expected to rise to a massive 55 million tons in 2032 from 41 million tons in 2021. This rising demand for tissue paper across the globe would open opportunities for many small and medium-scale producers to enter the tissue paper manufacturing industry, thereby increasing the demand for converting equipment.

Tissue Paper Converting Machines Market Trends

Toilet Roll Converting Lines to be the Largest Machine Type Segment

- Regular tissue products, including toilet paper, constitute a significant portion of the market for converting machinery. The demand for toilet paper is expected to rise steadily due to factors such as population growth, urbanization, and improving hygiene standards.

- According to the Population Reference Bureau, in 2023, the degree of urbanization worldwide was 57 %. North America, Latin America, and the Caribbean were the regions with the highest level of urbanization, with over four-fifths of the population residing in urban areas.

- Moreover, manufacturers of converting machinery targeting wet paper towel applications can capitalize by developing machinery capable of efficiently producing high-quality, moisture-resistant paper towels. Additionally, innovations in packaging and dispensing systems for wet paper towels present opportunities for manufacturers to differentiate their machinery offerings and cater to evolving market needs.

- Growing environmental concerns and increasing consumer awareness of sustainability issues are driving the adoption of eco-friendly practices in the toilet paper industry. Manufacturers invest in converting machinery capable of processing recycled fibers, reducing waste, and minimizing energy consumption. Demand for biodegradable and environmentally friendly toilet paper products prompts manufacturers to invest in machinery capable of handling recycled material.

- Furthermore, consumer preferences for personalized and innovative toilet paper products are driving manufacturers to invest in flexible converting machinery. Machinery capable of producing a variety of products, including different sheet sizes, ply configurations, embossing patterns, and packaging options, are in high demand. Customization capabilities enable manufacturers to cater to niche markets and segregate their products in a competitive landscape. In addition, consumers with higher disposable incomes often are more inclined to buy and invest more in luxurious embossed toilet tissue.

- Manufacturers of tissue products are aware of consumers' aesthetic associations with embossed tissue. Brands commonly utilize embossing to reinforce unique patterns, logos, or other special features to drive consumer loyalty and purchases consistently. Embossed toilet tissue is especially well-suited for aesthetic appeal and other consumer preferences; however, it is important not to overlook product quality.

- The embossing process can impact certain tissue attributes, particularly mechanical strength, and stiffness. By designing an appropriate embossing pattern and process, the correct combination can facilitate lamination, resulting in multi-ply finished products that customers perceive as high quality. By partnering with embossing machinery experts, toilet tissue products can be qualitatively and aesthetically distinguished.

Asia Pacific is Expected to Hold Significant Market Share

- Japan enhanced its reputation for cleanliness by introducing a unique addition to the toilets at Narita International Airport: smartphone cleaning paper. In a fresh approach to public convenience, individuals are encouraged to tear off a paper sheet from a dispenser beside the regular toilet paper roll to sanitize their phone screens. This introduction of cleaning paper was a response to research indicating that smartphone screens tend to harbor more germs than toilet seats. Surveys have consistently shown that tourists from other countries are consistently amazed by the cleanliness and adaptability of Japan's public restrooms. This is expected to impact the target market.

- The tissue paper sector in India is currently experiencing consolidation through innovation and acquisitions. This has allowed companies to enhance their market position, broaden their product range, and invest in advanced converting technologies to meet the growing demand. The escalating urbanization, increased focus on hygiene resulting from government initiatives like Swachh Bharat, and a significant rise in the demand from the healthcare and hospitality industries are projected to drive the consumption of tissue paper, napkins, and toilet and towel-grade paper.

- In January 2024, Andhra Paper Limited (APL), a top player in the paper and pulp industry, received approval from its Board of Directors to install a cutting-edge tissue paper machine at its Kadiyam manufacturing facility. The machine will employ state-of-the-art technology and have a daily production capacity of 100 tons, allowing diversification of the company's product portfolio. The proposed capacity addition is set at 35,000 Tons Per Annum (TPA) for producing various grades of tissue paper, including facial, toilet, napkin, and towel-grade tissue. The company aims to commence production within an estimated 15 months.

- To enhance production capacity within China's domestic market, high-end tissue machines, including the latest TAD technology, have been imported. For instance, Hengan incorporated two additional Valmet Hybrid tissue machines primarily used to produce superior facial tissue and kitchen towels.

- Before this, Hengan had implemented two Toscotec TAD tissue machines. The initial step involved the development of differentiated products using advanced technology and equipment to enhance the performance of products during usage. For instance, products with improved thickness were introduced by implementing novel tissue machine technology and converting machines. Cloud series tissue by Mind Act Upon Mind, cashmere sensory series toilet roll by Vinda, and hot air kitchen towels with TAD technology by Virjoy are some examples of such product launches.

- The proliferation of the paper industry in Indonesia is poised to drive growth in the tissue paper machine market. This growth will be fueled by surging demand for tissue paper products, investments in manufacturing capacity, technological advancements, and evolving environmental considerations.

- Tissue paper machine suppliers can capitalize on these opportunities by offering innovative solutions and addressing the specific needs of paper manufacturers. In November 2023, the Indonesia International Paper Chain Industry Exhibition (Paper Chain Indonesia) was launched at the JIEXPO Exhibition Center in Jakarta, Indonesia.

Tissue Paper Converting Machines Industry Overview

The tissue paper converting machines market is highly fragmented. There is the presence of major players like C.G. Bretting Manufacturing Company, Inc., Valmet Oyj, 9 September Tissue Converting, Serv-o-Tec GmbH, and SDF Schnitt-Druck-Falz Spezialmaschinen GmbH. Players in the market are adopting tactics such as partnerships and acquisitions in order to enhance their product offerings as well as gain a sustainable competitive advantage.

- January 2024 - United Converting Tissue SRL announced its collaboration with Lila Kagit in Turkey to supply a new Nexus Series Automatic Converting Line.

- January 2024 - Valmet will provide Suzano Papel e Celulose in Brazil with a comprehensive tissue line comprising a tissue-making line, converting equipment, and a biomass boiler. Although the total order value is undisclosed, such an order typically amounts to around EUR 100 million (USD 108 million).

- November 2023 - Valmet's acquisition of Korber Group's Business area tissue represents a strategic move aimed at expanding its market presence and diversifying its product portfolio in the tissue industry. The acquisition provides Valmet access to innovative converting and packaging technologies and services tailored to the tissue sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Industry Ecosystem Analysis - Suppliers, Material Manufacturers, Etc.

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Trend of Automation in Tissue Manufacturing Industry

- 5.1.2 Innovation in the Converting Technologies to Improve Sustainability

- 5.2 Market Restraints

- 5.2.1 High Setup Cost for Tissue-converting Plant

- 5.3 Key Innovations and Developments - Tissue-converting and Auxiliary Equipment

- 5.4 Industry Standards and Regulations

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Automatic

- 6.1.2 Semi-automatic

- 6.2 By Machine Type

- 6.2.1 Toilet Roll Converting Lines

- 6.2.2 Kitchen Roll Converting Lines

- 6.2.3 Folded Tissue Converting Lines

- 6.2.4 Paper Napkin Converting Lines

- 6.2.5 Standalone Systems

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.2.4 United Kingdom

- 6.3.3 Asia

- 6.3.3.1 Japan

- 6.3.3.2 India

- 6.3.3.3 China

- 6.3.3.4 Indonesia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 TISSUE PAPER DEMAND TRENDS AND IMPACT ON THE PRODUCTION & EQUIPMENT MARKET

8 MARKET TRENDS IN THE TISSUE CONVERTING MACHINES INDUSTRY

- 8.1 Future Market Trends and Key Growth Expectations

- 8.2 Key Challenges for Manufacturers Vs. Innovations By Key Competitors of OMET

- 8.3 Comparative Analysis - OMET Srl Vs. Key Competitors

- 8.4 Technology Insights - Tissue Converting Machines

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles*

- 9.1.1 C.G. Bretting Manufacturing Company, Inc.

- 9.1.2 Valmet Oyj

- 9.1.3 9.Septembar Tissue Converting

- 9.1.4 SERV-O-TEC GMBH

- 9.1.5 SDF Schnitt-Druck-Falz Spezialmaschinen GmbH

- 9.1.6 ZAMBAK KAGIT

- 9.1.7 Omet Srl

- 9.1.8 Kawanoe Zoki Co. Ltd

- 9.1.9 MTorres Disenos Industriales S.A.U

- 9.1.10 Baosuo Paper Machinery Manufacture Co. Ltd (Baosuo Enterprise)

- 9.1.11 A.Celli Paper SpA (italia Technology Alliance SpA)

- 9.1.12 United Converting Tissue SRL

- 9.1.13 Futura SpA

- 9.1.14 Paper Converting Machine Company (PCMC)

- 9.1.15 Fujian Tmx Machinery Manufacturing Co. Ltd

- 9.1.16 Chan Li Machinery Co. Ltd

- 9.1.17 Unimax Group Engineering & Development Corporation

- 9.1.18 ICM Makina