|

市場調查報告書

商品編碼

1521638

空間電力電子:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Space Power Electronics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

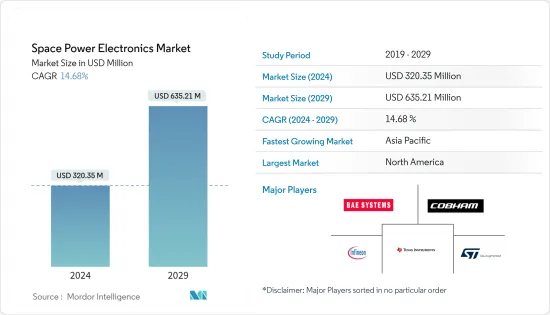

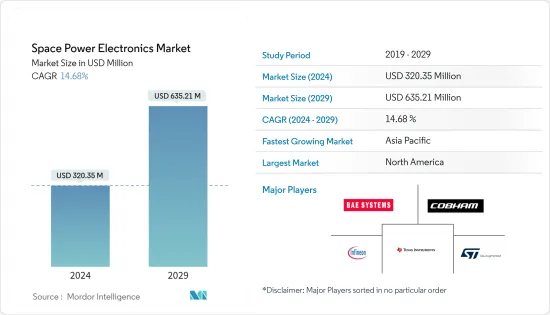

太空電力電子市場規模預計到2024年為3.2035億美元,預計到2029年將達到6.3521億美元,在預測期內(2024-2029年)複合年成長率為14.68%。

半導體技術的進步和對高效能電源管理系統的需求推動了太空電力電子技術的發展。例如,寬能能隙半導體已成為一項重要的創新,其性能優於傳統材料。太空電力電子系統還包括模組化電力電子子系統(PESS),透過輸入和輸出電源連接埠連接到電源和負載。這些系統對於衛星、太空船、火箭、探測車等的運作至關重要,確保它們擁有執行其功能所需的電力。

由於低地球軌道(LEO)衛星和可重複使用火箭市場開發的不斷開拓,空間電力電子市場正在不斷成長。這些進步推動了對更先進電源管理設備、電池和電源轉換器的需求,這些設備對於太空任務的長期永續性和效率至關重要。

然而,市場面臨重大挑戰,包括設計和開發這些複雜系統的高成本以及空間應用所需的嚴格整合和品質檢查流程。儘管面臨這些挑戰,該行業的研發工作預計將克服這些阻礙因素,並在預測期內實現顯著成長。

空間電力電子市場趨勢

預計衛星將在預測期內主導市場

由於通訊、導航和地球觀測等各種應用對衛星的需求不斷增加,預計衛星產業將在預測期內主導市場。過去十年,在重大技術進步、產業商業化和私人資本湧入的推動下,小型衛星產業快速成長。人們對太空探勘的興趣日益濃厚,以及對小型衛星執行姿態控制、軌道控制、軌道轉移和負責任的終端脫軌策略等複雜任務的需求,推動了這一勢頭。

電力電子設備的小型化對於立方衛星特別有利,可以提高其性能和可靠性。同時,新興的航太產業正在擁抱模組化,小型化輻射固化MOSFET、閘極啟動器、DC-DC轉換器和固態繼電器等組件成為常態,使其更加高效、可擴展並得到體現。成本效益的衛星設計趨勢。

例如,2023年1月,空中巴士與比利時國防部簽署契約,為軍方提供為期15年的戰術衛星通訊服務。到2024年,空中巴士計劃為其他歐洲國家和北約盟國的軍隊推出新的超高頻(UHF)通訊服務。此類新興市場的開拓正在支撐市場成長。

預計亞太地區在預測期內將維持最高複合年成長率

亞太地區正在經歷太空產業的重大進步,特別是在航太電力電子領域。主要趨勢包括人們日益認知到太空是國家安全的重要組成部分、小型私人商業太空新興企業的崛起以及重點轉向太空資源開發。中國、印度和日本等國家正在引領雄心勃勃的太空計劃,尋求透過開發月球探勘和小行星採礦技術來在太空中佔有一席之地。

由於對高速網路連線的需求不斷成長,該地區的衛星通訊設備市場正在成長。這一成長得到了 Singtel 和 Thaicom 等主要衛星通訊業者的支持,這些營運商為亞洲用戶。例如,2023年12月,中國宣布將建造自己版本的星鏈,這是一個利用低地球軌道的衛星網路衛星群,我們計畫發射。

因此,太空電力電子技術的進步對於衛星電源管理的發展至關重要,這對於長期任務和深空探勘至關重要,因為它們能夠建立更有效率、更可靠的系統。

航太電力電子產業概況

航太電力電子市場得到整合,主要企業佔據重要的市場佔有率。該市場的主要企業是: BAE Systems PLC、Cobham Limited、英飛凌科技股份公司、德州儀器公司和意法半導體這些公司處於開發能夠承受太空惡劣條件(例如極端溫度和輻射)的強大電子設備的前沿。

市場領導企業越來越注重贏得合約以維持其市場地位。這種方法通常會透過引進配備最尖端科技的創新產品來補充。例如,2023年4月,採埃孚與義法半導體簽署了碳化矽元件多年供應協議。此次合作幫助建立了一個致力於開發空間電力電子設備的研發中心,體現了對這一高科技領域創新和發展的堅定承諾。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 市場限制因素

- 波特五力分析

- 買家/消費者的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 平台

- 衛星

- 太空船和火箭

- 其他

- 類型

- 抗輻射

- 抗輻射

- 目的

- 通訊

- 地球觀測

- 導航、全球定位系統 (GPS)、監控

- 技術開發/教育

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- BAE Systems PLC

- Cobham Limited

- Microchip Technology Inc.

- RUAG Group

- STMicroelectronics NV

- Teledyne Technologies Incorporated

- Texas Instruments Incorporated

- Honeywell International Inc.

- Microsemi Conduction

- ON Semiconductor

- Analog Devices Inc.

- Renesas Electronics Corporation

- Infineon Technologies AG

The Space Power Electronics Market size is estimated at USD 320.35 million in 2024, and is expected to reach USD 635.21 million by 2029, growing at a CAGR of 14.68% during the forecast period (2024-2029).

The development of power electronics for space applications has been driven by advancements in semiconductor technologies and the need for efficient power management systems. Wide bandgap semiconductors, for instance, have emerged as a significant innovation, offering improved performance over traditional materials. Power electronics systems in space also include modular power electronic subsystems (PESS) that connect to a source and load at their input and output power ports. These systems are integral to operating satellites, spacecraft, launch vehicles, and rovers, ensuring they have the necessary power to perform their functions.

The space power electronics market is experiencing growth due to the increasing development of low-Earth orbit (LEO) satellites and reusable launch vehicles. These advancements drive the demand for more sophisticated power management devices, batteries, and power converters, which are essential for the long-term sustainability and efficiency of space missions.

However, the market faces significant challenges, such as the high costs associated with designing and developing these complex systems and the rigorous integration and quality inspection process required for space applications. Despite these challenges, the industry's commitment to research and development is expected to overcome these restraining factors, leading to considerable growth over the forecast period.

Space Power Electronics Market Trends

Satellites are Expected to Dominate the Market During the Forecast Period

The satellite segment is expected to dominate the market during the forecast period owing to the increasing demand for satellites for various applications such as communication, navigation, earth observation, and others. A surge in the small satellite sector was witnessed in the last decade, fueled by significant technological advancements, the commercialization of the industry, and an influx of private capital. This momentum was propelled by increased interest in space exploration and the need for small satellites to perform complex tasks such as attitude and orbit control, orbital transfers, and responsible end-of-life deorbiting strategies.

The miniaturization of power electronics has been particularly beneficial for CubeSats, enhancing their performance and reliability. Concurrently, the burgeoning NewSpace industry is embracing modularization, with components like miniaturized radiation-hardened MOSFETs, gate drivers, DC-DC converters, and solid-state relays becoming standard, reflecting a trend toward more efficient, scalable, and cost-effective satellite designs.

For instance, in January 2023, Airbus signed a contract with the Belgian Ministry of Defense to provide tactical satellite communications services to the armed forces for 15 years. Airbus plans to launch a new ultra-high frequency (UHF) communications service by 2024 for the armed forces of other European nations and NATO allies. Developments such as these are driving the growth of the market.

Asia-Pacific is Expected to Register the Highest CAGR During the Forecast Period

The Asia-Pacific region is witnessing a significant evolution in the space industry, particularly in space power electronics. Key trends include the increasing recognition of space as a vital part of national security, the rise of small private commercial space startups, and a shift in focus toward exploiting space resources. Countries like China, India, and Japan are leading the way with ambitious space programs to establish their presence in space by developing technologies for lunar exploration and asteroid mining.

The satellite communication equipment market in the region is experiencing growth due to the rising demand for high-speed internet connectivity. This growth is supported by major satellite operators such as Singtel and Thaicom, which contribute to the more than 100 million active pay satellite TV subscribers in Asia. For instance, in December 2023, China announced that it would be building its version of StarLink, a satellite internet constellation using low-Earth orbit, with plans to launch around 26,000 satellites to cover the entire world, led by state-run companies.

Thus, the advancements in space power electronics are crucial for these developments, as they enable the creation of more efficient and reliable systems for power management in satellites, which is essential for long-term missions and deep space exploration.

Space Power Electronics Industry Overview

The space power electronics market is consolidated, with key players occupying a significant market share. The major players in this market are BAE Systems PLC, Cobham Limited, Infineon Technologies AG, Texas Instruments Incorporated, and STMicroelectronics NV. These companies are at the forefront of developing powerful electronic devices that can withstand harsh conditions in space, such as extreme temperatures and radiation.

The leading market players are focusing more on acquiring contracts to maintain their market position. This approach is often complemented by introducing innovative products featuring cutting-edge technologies. For instance, in April 2023, ZF signed a multi-year supply agreement with STMicroelectronics for silicon carbide devices. Collaborations have become instrumental in establishing specialized research and development centers dedicated to advancing space power electronics equipment, signifying a robust commitment to innovation and growth in this high-tech field.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Platform

- 5.1.1 Satellites

- 5.1.2 Spacecraft and Launch Vehicles

- 5.1.3 Others

- 5.2 Type

- 5.2.1 Radiation-Hardened

- 5.2.2 Radiation-Tolerant

- 5.3 Application

- 5.3.1 Communication

- 5.3.2 Earth Observation

- 5.3.3 Navigation, Global Positioning System (GPS) and Surveillance

- 5.3.4 Technology Development and Education

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BAE Systems PLC

- 6.2.2 Cobham Limited

- 6.2.3 Microchip Technology Inc.

- 6.2.4 RUAG Group

- 6.2.5 STMicroelectronics NV

- 6.2.6 Teledyne Technologies Incorporated

- 6.2.7 Texas Instruments Incorporated

- 6.2.8 Honeywell International Inc.

- 6.2.9 Microsemi Conduction

- 6.2.10 ON Semiconductor

- 6.2.11 Analog Devices Inc.

- 6.2.12 Renesas Electronics Corporation

- 6.2.13 Infineon Technologies AG