|

市場調查報告書

商品編碼

1521649

強力運動:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Powersports - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

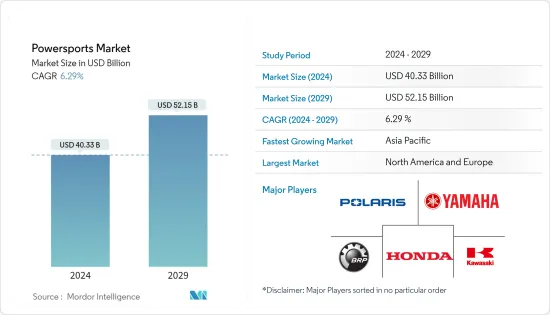

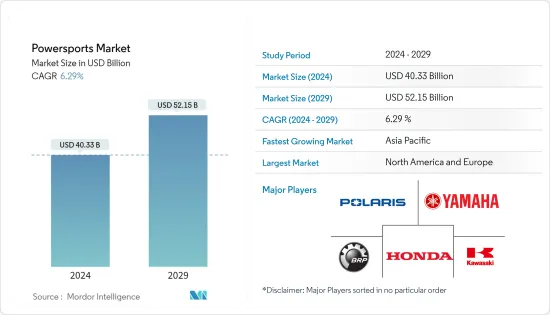

預計2024年強力運動市場規模將達到403.3億美元,預計2029年將達到521.5億美元,在預測期內(2024-2029年)複合年成長率為6.29%。

強力運動市場呈現出由北極星公司、雅馬哈汽車公司、哈雷戴維森公司、BRP公司、本田汽車公司、川崎重工公司和鈴木汽車公司等少數全球巨頭主導的格局。這些公司透過廣泛的產品系列、技術進步和策略聯盟在這個市場上建立了自己的據點。

強力運動產業在全球經濟中佔有重要地位,為創造就業、旅遊業以及休閒和運動整體做出了貢獻。近年來,由於可支配收入增加、都市化以及對冒險運動和休閒的興趣日益濃厚等因素,該市場穩步成長。 2023年全球可支配所得為69.64兆美元,較上年(2022年)成長0.89%。這些資料顯示收入增加,這肯定會影響此類休閒和有趣遊樂設施的支出。

有幾個關鍵因素促進了強力運動市場近期的成長。關鍵因素之一是對冒險和旅行的需求不斷成長。 2022年,旅行和旅遊業對全球國內生產總值(GDP)的總貢獻比2019年下降23%。 2022年,就旅行總量和旅遊業對GDP的貢獻而言,美國和中國是迄今為止領先的旅遊市場。德國、英國和日本當年的排名緊隨其後。此外,技術進步促進了更有效率、更環保、更先進的車輛的開發,使它們對消費者更具吸引力。此外,汽車行業日益成長的個人化和客製化趨勢也延伸到了強力運動車輛,讓客戶可以客製化他們的機器以滿足他們的特定需求和偏好。

儘管有這些成長趨勢,強力運動市場仍面臨一些挑戰和障礙。主要挑戰之一是對環境永續性的日益關注以及廢氣標準和監管要求的收緊。製造商必須投資研發,開發符合這些準則的環保車輛,同時保持性能和吸引力。另一個挑戰是全球經濟的波動,可能會影響消費者支出和對強力運動跑車的需求。

但這些挑戰也帶來了成長和創新的機會。例如,對永續性的推動導致了電動和混合強力運動跑車的出現,開拓了新的市場領域。此外,全球對探險旅遊和戶外休閒活動不斷成長的需求為強力運動製造商提供了巨大的潛在基本客群。此外,人們對永續性的興趣日益濃厚,將鼓勵電動和混合動力汽車的開拓,擴大市場並回應消費者日益成長的環保意識。

強力運動市場趨勢

技術進步帶來的消費者偏好變化推動市場需求

近年來,消費者的偏好明顯轉向戶外活動、探險運動和健身。這種變化是由於人們越來越渴望過著更健康、更積極的生活方式,並尋求令人興奮和新穎的體驗。因此,對滿足這些愛好的運動用品和車輛的需求激增。

人們現在更傾向於冒險和戶外活動。 2021年,美國有5,140萬人參加公路自行車、山地自行車和小輪車賽事。這導致了對強力運動車輛的需求激增,這些車輛可以讓您探索不同的地形並享受驚險的體驗。對新奇和刺激的渴望刺激了對冒險運動和戶外活動的需求。全地形車和越野自行車等強力運動車輛描述了令人興奮的體驗,讓使用者能夠探索新地形並挑戰自我。

此外,個人化和客製化趨勢的不斷成長鼓勵製造商提供各種型號和配件來滿足個人偏好。高品質運動器材和車輛的可用性和可及性的增加使個人更容易參與這些活動。然而,社群媒體的興起使人們更容易共用他們的經歷並展示他們的成就。因此,其他活動也開始採取積極的生活方式,從事體育運動和戶外活動。此外,體育產業影響者在推動這些活動並鼓勵更多人參與方面發揮關鍵作用。

隨著先進技術的採用,強力運動產業不斷發展。製造商專注於提高其產品的性能、效率和安全性。例如,將電子燃油噴射(EFI)系統整合到馬達和全地形車中可以提高燃油效率並減少排放氣體。此外,電動強力運動的發展為製造商迎合有環保意識的消費者提供了新的機會。例如

*北極星於 2023 年 8 月推出全球首款全電動 Ranger XP Kinetic 和 Ranger XD 1500,進一步擴大了其產品陣容。它配備 110 馬力和 140 磅英尺瞬時扭矩引擎,可提供最大的功率和能力,包括牽引高達 2,500 磅和行業領先的 1,250 磅的能力。

*2023年2月,VOLTERRA Motors宣布推出其電動強力運動系列DTFe-50和DTFe-110。配備藍牙連接和可更換的鋰離子電池。

隨著這些發展,我們相信對創新車輛的需求將持續成長。此外,先進技術的持續發展和對永續性的日益重視將進一步推動該市場的未來擴張。

預計亞太地區在預測期內將實現最高成長

由於中國、印度和日本等國家的多種因素,亞太地區的強力運動市場正在不斷成長。促成這一成長的因素包括可支配收入的增加、中階的壯大以及休閒活動的增加。 2023年,亞太地區可支配所得將達20.77兆美元,較2019年成長7.62%。人們對休閒的需求也不斷增加,尤其是年輕一代,馬達、Scooter、全地形車和水上摩托車等強力運動車輛的受歡迎程度直線上升。這些國家的政府正在推動綠色和永續交通途徑,導致人們對電動和混合強力運動車輛的興趣增加。

儘管有這些正面因素,亞太強力運動市場仍面臨來自公共運輸和汽車共享服務等其他交通途徑的競爭等挑戰。經濟波動也會影響消費者在強力運動車輛等非必需品上的支出。然而,市場也存在成長機會,包括冒險旅行需求的增加和極限運動的日益普及。此外,強力運動產業仍在發展的新興經濟體也存在市場拓展潛力。

政府政策和法規在塑造亞太強力運動市場方面發揮關鍵作用。該地區各國政府正在推出政策和法規,以推廣更清潔、更環保的強力運動車輛。例如,中國實施了嚴格的排放法規,導致電動馬達和Scooter的產量和銷售增加。日本透過獎勵和補貼鼓勵電動車的採用。該地區的製造商透過推出新產品、建立合作夥伴關係以及投資於技術進步來應對這些發展。例如

*2024年1月,Altmin在印度獲得了1億美元的鋰離子電池創新投資,彰顯了該公司在市場上的戰略地位,標誌著電動車價值鏈的重大進步。

*2023年9月,雅馬哈與CFMOTO建立合作關係,在中國生產摩托車,包括強力運動跑車。

考慮到這些發展,由於休閒需求的增加、中階的崛起以及對環保交通方式日益濃厚的興趣,亞太地區強力運動市場的未來被認為是充滿希望的。由於技術進步、產品創新和新經營模式的採用,預計未來幾年該市場將顯著成長。電動和混合動力汽車的日益普及預計也將有助於市場成長。

強力運動產業概況

強力運動市場呈現出一個統一的格局,由北極星公司、雅馬哈汽車公司、哈雷戴維森公司、BRP公司、本田汽車公司、川崎重工公司和鈴木汽車公司等幾家大型全球參與企業主導。這些公司透過廣泛的產品系列、技術進步和策略聯盟在這個市場上站穩了腳跟。

*2023 年 11 月,領先的強力運動公司 Taiga 宣布推出一款創新的互聯雲端行動應用程式,以改變強力運動的擁有體驗。這款尖端應用程式旨在透過提供即時車輛資料、個人化乘車建議和無縫連接來提高用戶參與度和便利性。該應用程式的推出是強力運動產業的重要一步,為用戶帶來了更互聯和互動的體驗。

*2023 年 3 月,Polaris推出了Polaris Xchange,這是一個致力於買賣二手強力運動車輛的市場。這個創新平台旨在為買家和賣家提供無縫、安全的體驗,並提供多種經過認證的二手北極星車輛選擇。

*2023 年 2 月,Ski-Doo 和 Lynx 計劃於 2024 年推出最新電動車型 Grand Touring Electric 和 Adventure Electric。

*2023 年 3 月,BRP 將與 Tread Lightly 和 RideSafe 合作,促進負責任的騎乘並提高強力運動的安全性。此次合作旨在教育騎士在享受強力運動車輛時環保和安全駕駛的重要性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場動態

- 市場概況

- 市場促進因素

- 可支配收入的增加和消費者對冒險運動的偏好推動了市場的成長

- 市場限制因素

- 高昂的初始投資和維護成本阻礙了市場成長

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- PESTLE分析

第5章市場區隔

- 汽車模型

- 個人水上自行車

- 全地形車

- 大型摩托車

- 並排的車

- 雪上摩托車

- 推進力

- 柴油引擎

- 汽油

- 電

- 目的

- 在公路式

- 越野

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 併購

- 公司簡介

- Polaris Inc.

- Yamaha Motor Co., Ltd.

- BRP Inc.

- Honda Motor Co., Ltd.

- Kawasaki Heavy Industries

- Suzuki Motor Corporation

- KTM AG

- Arctic Cat Inc.

- Changjiang Motorcycle Co., Ltd.

- Harley-Davidson, Inc.

第7章 市場機會及未來趨勢

The Powersports Market size is estimated at USD 40.33 billion in 2024, and is expected to reach USD 52.15 billion by 2029, growing at a CAGR of 6.29% during the forecast period (2024-2029).

The powersports market exhibits a consolidated landscape, dominated by a few major global players such as Polaris Inc., Yamaha Motor Co. Ltd, Harley-Davidson Inc., BRP Inc., Honda Motor Co. Ltd, Kawasaki Heavy Industries, Suzuki Motor Corporation, and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

The powersports industry holds significant importance in the global economy, contributing to job creation, tourism, and the overall leisure and sports sector. In recent years, the market has experienced steady growth, driven by factors such as increasing disposable incomes, urbanization, and a growing interest in adventure sports and recreational activities. In 2023, global disposable income was USD 69.64 trillion, which is 0.89 % greater than the previous year (2022). This data shows the incremental increase in income, which surely impacts spending on such recreational and interesting vehicles.

Several key factors have contributed to the growth of the Powersports market in recent times. One of the primary drivers is the rising demand for adventure and travel, as people seek to escape their daily routines and engage in thrilling experiences. In 2022, the total contribution of travel and tourism to the global gross domestic product (GDP) was 23 percent lower than in 2019. In 2022, the United States and China were by far the leading travel markets based on the total contribution of travel and tourism to GDP. That year, Germany, the United Kingdom, and Japan followed in the ranking. Additionally, advancements in technology have led to the development of more efficient, eco-friendly, and technologically advanced vehicles, making them more appealing to consumers. Furthermore, the growing trend of personalization and customization in the automotive industry has extended to Powersports vehicles, allowing customers to tailor their machines to their specific needs and preferences.

Despite the growth trends, the powersports market faces several challenges and obstacles. One of the significant challenges is the increasing focus on environmental sustainability, leading to stricter emissions standards and regulatory requirements. Manufacturers must invest in research and development to create eco-friendly vehicles that adhere to these guidelines while maintaining performance and appeal. Another challenge is the fluctuating global economy, which can impact consumer spending and demand for powersports vehicles.

However, these challenges also present opportunities for growth and innovation. For instance, the push for sustainability has led to the emergence of electric and hybrid powersports vehicles, opening new segments in the market. Additionally, the increasing global demand for adventure tourism and outdoor recreational activities provides a vast potential customer base for powersports manufacturers. Furthermore, the increasing focus on sustainability is likely to drive the development of electric and hybrid vehicles, expanding the market and catering to the growing environmental consciousness of consumers.

Powersports Market Trends

Changing Consumer Preferences due to technological Advancements Drives the Demand in the Market

In recent years, there has been a notable shift in consumer preferences toward outdoor activities, adventure sports, and fitness-related pursuits. This change is driven by an increasing desire among people to lead healthier, more active lifestyles and seek experiences that offer excitement and novelty. As a result, the demand for sports equipment and vehicles that cater to these interests has surged.

People are now more inclined toward adventure and outdoor activities. In 2021, 51.4 million people participated in Road biking, mountain biking, and BMX events in the United States. This has led to a surge in demand for Powersports vehicles that allow them to explore various terrains and enjoy thrilling experiences. The desire for novelty and thrill has fuelled the demand for adventure sports and outdoor activities. Powersport vehicles, such as ATVs and off-road motorcycles, provide exciting experiences that enable users to explore new terrains and challenge themselves.

Furthermore, the growing trend of personalization and customization has encouraged manufacturers to offer a wide range of models and accessories to cater to individual preferences. The increasing availability of high-quality sports equipment and vehicles, coupled with improved accessibility, has made it easier for individuals to participate in these activities. However, the rise of social media has made it easier for people to share their experiences and showcase their achievements. This has inspired others to adopt an active lifestyle and engage in sports and outdoor activities. Additionally, influencers in the sports industry have played a significant role in promoting these activities and encouraging more people to participate.

The Powersports industry is continuously evolving with the introduction of advanced technology. Manufacturers are focusing on improving the performance, efficiency, and safety of their products. For instance, the integration of electronic fuel injection (EFI) systems in motorcycles and ATVs has led to better fuel efficiency and reduced emissions. Additionally, the development of electric-powered powersports has opened new opportunities for manufacturers to cater to environmentally conscious consumers. For instance,

* In August 2023, Polaris unveiled its first-of-its-kind all-electric Ranger XP Kinetic and the Ranger XD 1500, further expanding its product lineup. It has an engine of 110 horsepower and 140 lb-ft of instant torque delivering maximum power and capability, including the ability to effortlessly tow up to 2,500lbs and haul an industry-best 1,250 lbs.

* In February 2023, VOLTERRA Motors announced the launch of an electric powersports line-up, the DTFe-50 and DTFe-110. This bike comes with Bluetooth connectivity and swappable lithium-ion batteries.

With such development, the demand for innovative vehicles will continue to grow. Additionally, the ongoing development of advanced technologies and a focus on sustainability will further fuel the future expansion of this market.

Asia-Pacific is Anticipated to Register the Highest Growth During the Forecast Period

The Asia-Pacific powersport market is experiencing growth due to several factors in countries such as China, India, Japan, and others. Factors contributing to this growth include rising disposable income, a growing middle class, and an increase in leisure activities. In 2023, the Asia-Pacific disposable income reached USD 20.77 trillion, a 7.62% increase from 2019. There has also been a rise in demand for recreational activities, particularly among the younger generation, leading to a surge in popularity for Powersport vehicles like motorcycles, scooters, ATVs, and personal watercraft. Governments in these countries are promoting eco-friendly and sustainable transportation, resulting in increased interest in electric and hybrid powersport vehicles.

Despite these positive factors, the Asia-Pacific powersport market faces challenges such as competition from other modes of transportation like public transit and car-sharing services. Economic fluctuations can also impact consumer spending on discretionary items like powersport vehicles. However, the market presents opportunities for growth, including the increasing demand for adventure tourism and the growing popularity of extreme sports. Additionally, the market has potential for expansion in emerging economies where the Powersport industry is still developing.

Government policies and rules play a vital role in shaping the Asia-Pacific Powersport market. Governments in the region have introduced policies and rules to promote cleaner and greener Powersport vehicles. For instance, China has implemented strict emission norms, leading to an increase in electric motorcycle and scooter production and sales. Japan has encouraged electric vehicle adoption through incentives and subsidies. Manufacturers in the region respond to these developments by launching new products, forming partnerships, and investing in technological advancements. For example -

* In January 2024, Altmin secured a USD100 million investment for lithium-ion battery innovation in India, demonstrating the company's strategic position in the market and representing a significant advancement in the electric vehicle value chain.

* In September 2023, Yamaha entered a partnership with CFMOTO for Chinese motorcycle manufacturing, including Powersport vehicles.

Considering these developments, the future of the Asia-Pacific Powersport market looks promising due to the increasing demand for recreational activities, the rise of the middle class, and the growing interest in eco-friendly transportation. The market is expected to witness significant growth in the coming years, driven by technological advancements, product innovations, and the introduction of new business models. The increasing adoption of electric and hybrid Powersport vehicles is also expected to contribute to the market's growth.

Powersports Industry Overview

The Powersports market exhibits a consolidated landscape, dominated by a few major global players such as Polaris Inc., Yamaha Motor Co. Ltd, Harley-Davidson Inc., BRP Inc., Honda Motor Co. Ltd, Kawasaki Heavy Industries, Suzuki Motor Corporation, and others. These companies have established a stronghold in the market through extensive product portfolios, technological advancements, and strategic collaborations.

* In November 2023, Taiga, a leading Powersports company, unveiled its innovative connected cloud mobile app, transforming the Powersports ownership experience. This cutting-edge app aims to enhance user engagement and convenience by providing real-time vehicle data, personalized ride recommendations, and seamless connectivity. The app's launch marks a significant step forward in the Powersports industry, offering users a more connected and interactive experience.

* In March 2023, Polaris launched Polaris Xchange, a dedicated marketplace for buying and selling pre-owned Powersports vehicles. This innovative platform aims to provide buyers and sellers with a seamless and secure experience, offering a wide range of certified pre-owned Polaris vehicles.

* In February 2023, Ski-Doo and Lynx are planning to unveil their latest electric in 2024, the Grand Touring Electric and Adventure Electric models.

* In March 2023, BRP formed partnerships with Tread Lightly and RideSafe to promote responsible riding and enhance Powersports safety. This collaboration aims to educate riders on the importance of environmental stewardship and safe practices while enjoying their Powersports vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing disposable income and consumer preferences for adventure sports propel the market growth

- 4.3 Market Restraints

- 4.3.1 High initial investment and maintenance costs obstruct the market growth

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porters 5 Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Vehicle type

- 5.1.1 Personal watercrafts

- 5.1.2 All-terrain vehicles

- 5.1.3 Heavy weight motorcycles

- 5.1.4 Side by side vehicles

- 5.1.5 Snow mobiles

- 5.2 Propulsion

- 5.2.1 Diesel

- 5.2.2 Gasoline

- 5.2.3 Electric

- 5.3 Application

- 5.3.1 On-Road

- 5.3.2 Off-Road

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 UK

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.5 Middle East

- 5.4.5.1 UAE

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers & Acquisitions

- 6.3 Company Profiles

- 6.3.1 Polaris Inc.

- 6.3.2 Yamaha Motor Co., Ltd.

- 6.3.3 BRP Inc.

- 6.3.4 Honda Motor Co., Ltd.

- 6.3.5 Kawasaki Heavy Industries

- 6.3.6 Suzuki Motor Corporation

- 6.3.7 KTM AG

- 6.3.8 Arctic Cat Inc.

- 6.3.9 Changjiang Motorcycle Co., Ltd.

- 6.3.10 Harley-Davidson, Inc.