|

市場調查報告書

商品編碼

1521664

AC-DC 電源供應器:市場佔有率分析、產業趨勢/統計、成長預測 (2024-2029)AC DC Power Supply - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

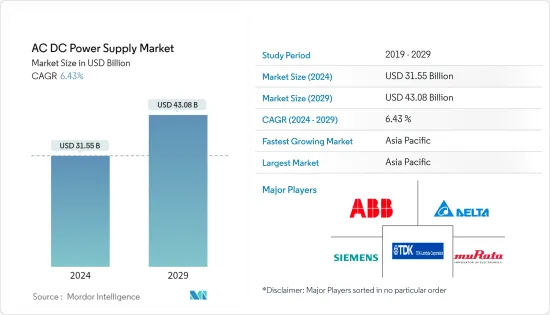

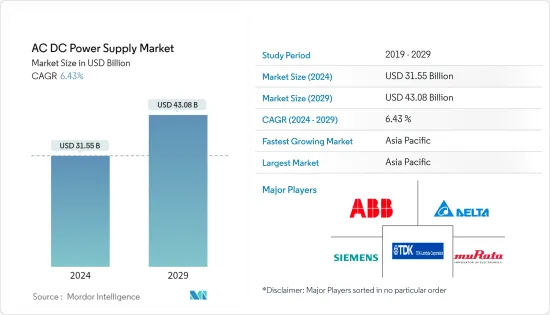

AC-DC電源市場規模預計2024年為315.5億美元,預計2029年將達到430.8億美元,在預測期內(2024-2029年)複合年成長率預計為6.43%。

多年來,交流-直流電源變得越來越流行,因為它們在為電力負載提供能源以供消耗和運行方面發揮著重要作用。各行業和工業設備對電源的需求增加預計將進一步推動這一需求。

主要亮點

- AC-DC電源轉換器用於為筆記型電腦、智慧型手機和平板電腦等各種設備維持穩定的電壓供應。隨著更多設備的銷售,對這些轉換器的需求也在增加。然而,AC-DC電源供應器使用劣質材料製造,因此成品品質較低。目前正在測試通用 AC-DC 適配器。由於物聯網 (IoT) 技術,現在市場上已經出現了輸出只有幾瓦的 AC-DC 電源供應器。

- AC/DC電源的主要用途是為電子電氣設備產生穩定的電壓輸出。隨著筆記型電腦、電腦、行動電話和其他家用電器等電子設備的生產和需求不斷增加,這些小工具對穩定直流電源的需求也隨之增加。

- 消費性電子產業對交流/直流轉換器的需求預計將增加,該產業預計將主導全球市場。隨著智慧型手機、平板電腦和其他可攜式電子設備的普及,對保持這些設備充電和運行的 AC-DC 電源的需求正在迅速增加。隨著這些設備變得更加強大和功能豐富,它們需要更複雜的電源管理解決方案以確保最佳效能和電池壽命。此外,物聯網 (IoT) 正在推動對需要電源解決方案的連網型設備的需求。

- 由於物聯網 (IoT) 在智慧家庭、智慧城市、機器對機器 (M2M)通訊和工業IoT(IIoT) 等各個領域的使用不斷增加,該市場正在不斷成長。家庭自動化和大樓自動化系統的日益普及也有助於市場的擴張。然而,由於地區和國家之間的法規和安全標準存在差異,預計市場成長將受到阻礙。由於對輸入電源和非標準交直流輸入的嚴格設計要求,電源市場預計將面臨挑戰。

- 由於獲取關鍵原料(例如用於電力設備的稀土元素、礦物和半導體材料)而引發的地緣政治緊張局勢正在擾亂供應鏈並推高製造成本。對特定地區或國家的關鍵資源的依賴使製造商面臨地緣政治風險和脆弱性。例如,去年美國和中國之間的地緣政治緊張局勢顯著加劇,導致過去十年來持續的全球供應鏈徹底轉變。

AC-DC電源市場趨勢

消費領域有望成為最大的最終用戶產業

- 智慧型手錶和健身追蹤器等穿戴式裝置的日益普及增加了對緊湊高效電源解決方案的需求。這些設備需要高能源效率組件來延長電池壽命並實現不間斷使用,從而推動了對交流-直流電源的需求。智慧型手機技術的最新進步和對 5G 智慧型手機的需求不斷成長正在推動行動裝置的銷售。三星、蘋果、小米、Oppo 和 Vivo 等智慧型手機製造商的產品創新努力也推動了對 AC-DC 電源供應器的需求。

- 據 GSMA 稱,預計到 2023 年,亞太地區、拉丁美洲和撒哈拉以南非洲地區的智慧型手機普及率將出現最高成長。智慧型手機的平均售價正在下降,各種措施正在成功地促進採用。預計到2030年,連網智慧型手機數量將達到90億部,佔連網智慧型手機總數的92%。網際網路普及率的提高、智慧型手機供應商的行銷力度以及社交媒體註冊的增加預計將推動智慧型手機的銷售,從而導致對電源的需求大幅增加。

- 消費性電子產品銷售的擴大也促進了市場的成長。例如,根據消費者科技協會的數據,美國的消費性電子產品(CE)零售額連續多年錄得持續成長。預計 2024 年消費性電子產品零售額將達到 5,120 億美元,而 2023 年為 4,980 億美元。消費領域的顯著成長可能會產生對各種規格電源的需求。

- 此外,筆記型電腦和桌上型電腦的使用不斷增加在推動消費者對電源的需求方面發揮關鍵作用。除電池外,CPU 和 GPU 等關鍵內部組件也依賴直流電源,這凸顯了可靠直流電源的重要性。如果CPU/GPU對效能要求不高,可以工作在較低的電壓下,從而節省電力。

- 電源在數位相機中的重要性正在迅速增加,因為電源是將電網中的高電壓交流電(AC) 轉換為低壓直流電(DC) 所必需的,而低壓直流電(DC) 對於大多數位相機的運行至關重要。 2023年4月,Powerstream Technology推出了專為數位相機設計的壁插式通用交流輸入可調輸出轉接器。此交流/直流轉接器結構緊湊、品質優良,可作為輸出可調的開關模式穩壓電源,與多種數位相機型號相容。

亞太地區實現顯著成長

- 工業信部表示,憑藉技術創新和品牌建立能力的增強,我國已成為家電產銷第一大國。該地區用於提高消費性電子產品產能的投資正在增加,預計該市場將獲得牽引力。

- 在快速都市化、不斷提高的網際網路普及率和先進通訊技術的推動下,中國擁有世界上最大的通訊市場之一。行動網路、資料中心和通訊塔等通訊基礎設施依靠整流器、轉換器和備用電源系統等電源來確保不間斷運作。

- 由於智慧型手機的普及、數位化舉措和不斷成長的網際網路連接,印度通訊業正在經歷快速成長。隨著通訊業者不斷擴展網路並升級基礎設施以支援 5G 等新技術,預計對具有遠端監控和能源最佳化等先進功能的高效電源的需求將會增加。

- 印度的消費電子產業受到可支配收入增加、都市化和技術進步等因素的推動。交流電轉接器、充電器和電池管理系統等電源供應器是智慧型手機、筆記型電腦、電視和家用電器等消費性電子產品的重要組件。隨著人口眾多以及消費者對電子設備的需求不斷增加,人們不斷需要高效、緊湊的電源解決方案,以提供快速充電、能源效率以及與各種設備的兼容性。

AC-DC電源產業概況

AC-DC電源市場以半固體電源為主,大多數主要企業,如台達電子公司、西門子公司、ABB有限公司、村田製作所和TDK-lambda公司( TDK Corporation),我對市場有長期的信任。因此,市場滲透率很高,供應商和分銷關係也很強。

- 2024年3月,Delta集團旗下台Delta電子(泰國)PCL宣布收購子公司,為Delta全球客戶擴大電動車(EV)電力電子產品的生產和開發,開設了一家子公司。工業的全新Delta第八廠及研發中心。新廠和研發中心占地面積達30,400平方公尺,旨在為快速成長的電動車業務提高產能。

- 2024年2月,村田製作所在2024年應用電力電子大會(APEC)上宣布推出三款新的電源產品解決方案,旨在解決電力電子產業的挑戰、限制和限制。其中包括革命性的超高效率電荷泵IC“PE25208”,旨在為筆記型電腦和其他USB PD高功率應用等未來可攜式電子產品提供動力,以及高密度光收發器模組,該產品包括PE24109和PE24110 。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業供應鏈分析

第5章市場動態

- 市場促進因素

- 家庭自動化和大樓自動化系統的採用率不斷提高

- 節能設備的需求增加

- 市場限制因素

- 嚴格的法規遵循和安全標準

第6章 市場細分

- 按最終用戶產業

- 通訊

- 產業

- 消費者

- 汽車/交通

- 照明

- 伺服器

- 人工智慧伺服器

- 其他

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 市場數量分析

第8章 競爭格局

- 供應商排名分析

- 公司簡介

- Delta Electronics Inc.

- Siemens AG

- ABB Ltd

- Murata Manufacturing Co. Ltd

- TDK-lambda Corporation(TDK Corporation)

第9章市場展望

- 當前地緣政治情勢對市場的影響

- 市場主要投資併購場景

- 產品公告、技術聯盟等

The AC DC Power Supply Market size is estimated at USD 31.55 billion in 2024, and is expected to reach USD 43.08 billion by 2029, growing at a CAGR of 6.43% during the forecast period (2024-2029).

AC-DC power supply devices have become increasingly popular over the years, as they play a crucial role in providing energy to electric loads for consumption and operation. The growing demand for power supply in various industries and industrial equipment is anticipated to boost its demand further.

Key Highlights

- AC-DC power supply converters are used to maintain a stable voltage supply for a variety of devices, such as laptops, smartphones, and tablets. The demand for these converters is increasing as more and more devices are sold. However, due to the low-quality materials used in the manufacturing of AC-DC Power supply adapters, the finished products are of poor quality. The universal AC-DC adapter is currently being tested. Owing to the Internet of Things (IoT) technology, AC-DC power supply adapters with a power output of just a few watts are currently available on the market.

- The primary objective of AC/DC power supplies is to generate a regulated voltage output for electronic and electrical devices. As the production and demand for electronic devices like laptops, computers, mobile phones, and other consumer electronics continue to rise, the need for a consistent DC power supply for these gadgets is also increasing.

- The AC/DC converters are expected to witness an increase in demand from the consumer electronics sector, which is projected to dominate the global market. With the proliferation of smartphones, tablets, and other portable electronic devices, the demand for AC-DC power supply devices is increasing rapidly to keep these devices charged and operational. As these devices become more powerful and feature-rich, more sophisticated power management solutions are necessary to ensure optimal performance and battery life. Further, the Internet of Things (IoT) is driving the demand for connected devices that require power supply solutions.

- The market is experiencing growth due to the rising use of Internet of Things (IoT) in different areas like smart homes, smart cities, Machine-to-machine (M2M) communications, and Industrial IoT (IIoT). The increasing implementation of home and building automation systems is also contributing to market expansion. However, obstacles are anticipated in the market growth because of regulatory and safety standards that vary by region and country. The power supply devices market is expected to encounter difficulties because of strict design requirements for input power and nonstandard AC and DC inputs.

- The geopolitical tensions over access to critical raw materials such as rare earth metals, minerals, and semiconductor materials used in power devices are disrupting the supply chains and driving up manufacturing costs. Dependence on specific regions or countries for critical resources exposes manufacturers to geopolitical risks and vulnerabilities. For instance, over the last year, there has been a significant rise in geopolitical tensions between the United States and China, leading to a complete transformation of global supply chains that have been in place for the past ten years.

AC DC Power Supply Market Trends

Consumer Segment is Expected to be the Largest End-user Industry

- The increasing adoption of wearable devices such as smartwatches, fitness trackers, and other devices is fueling the demand for compact and efficient power supply solutions. These devices need power-efficient components to enhance battery life and enable uninterrupted usage, driving demand for AC-DC power supply devices. The recent advancement in smartphone technologies and rising demand for 5G smartphones have driven the sales of mobile devices. Efforts by smartphone makers such as Samsung, Apple, Xiaomi, Oppo, and Vivo to innovate their products are also driving up demand for AC DC power adapters.

- According to GSMA, the Asia-Pacific, Latin America, and Sub-Saharan Africa are expected to experience the highest surge in smartphone adoption by 2023 due to the growing affordability of these devices. The average selling prices of smartphones are decreasing, and various initiatives are proving successful in driving uptake. It is projected that by 2030, there will be 9 billion smartphone connections, which will account for 92% of total connections. The increasing Internet penetration, marketing activities by smartphone vendors, and increasing subscriptions in social media are expected to boost smartphone sales, leading to a significant increase in demand for power supplies.

- The growing sales of consumer electronics contribute to the market growth. For instance, according to the Consumer Technology Association, the retail revenue of consumer electronics (CE) in the United States has recorded continuous growth over the years. The retail sales of consumer electronics are expected to reach USD 512 billion by 2024, compared to USD 498 billion in 2023. This significant growth in the consumer segment is likely to create demand for power supply devices with different specifications.

- Moreover, the increased use of laptops and desktops plays a key role in driving consumers' demand for power supply devices. In addition to the battery, crucial internal components such as CPUs and GPUs rely on DC power, highlighting the importance of a dependable DC supply. When the CPU/GPU does not require high performance, it can operate on a lower voltage, resulting in power savings.

- The significance of power supplies in digital cameras is growing rapidly as power supplies are essential in converting the high-voltage alternating current (AC) from the power grid into low-voltage direct current (DC), which is essential for most digital cameras' operation. In April 2023, Powerstream Technology introduced a wall plug Universal AC input adjustable output adapter specifically designed for digital cameras. This AC/DC adapter is compact, of superior quality, and operates as a switch mode regulated power supply with adjustable output, making it compatible with various digital camera models.

Asia-Pacific to Register Significant Growth

- According to the Ministry of Industry and Information Technology, China is the largest country in the production and sales of consumer electronics through its enhanced innovation and brand-building capacity. With the increasing investments in the region to enhance its consumer electronics production capabilities, the market is expected to gain traction.

- China has one of the largest telecommunications markets in the world, driven by rapid urbanization, increasing internet penetration, and the adoption of advanced communication technologies. Telecommunications infrastructure, including mobile networks, data centers, and communication towers, relies on power supply devices such as rectifiers, converters, and backup power systems to ensure uninterrupted operation.

- The telecommunications sector in India is witnessing rapid growth due to increasing smartphone penetration, digitalization initiatives, and expanding internet connectivity. As telecom companies continue to expand their networks and upgrade infrastructure to support emerging technologies like 5G, the demand for high-efficiency power supplies with advanced features such as remote monitoring and energy optimization is expected to increase.

- India's consumer electronics industry is driven by factors, including rising disposable incomes, urbanization, and technological advancements. Power supply devices such as AC adapters, chargers, and battery management systems are integral components of consumer electronics products such as smartphones, laptops, TVs, and home appliances. With a large population and increasing consumer demand for electronic gadgets, there is a continuous need for efficient and compact power supply solutions that offer fast charging, energy efficiency, and compatibility with a wide range of devices.

AC DC Power Supply Industry Overview

The AC DC power supply market is semi-consolidated as most top players, including Delta Electronics Inc, Siemens AG, ABB Ltd, Murata Manufacturing Co. Ltd, and TDK-lambda Corporation (TDK Corporation), have long-standing credibility in the market. Thus, market penetration is also high, with supplier-distribution solid relations.

- In March 2024, Delta Electronics (Thailand) PCL, a subsidiary of Delta Group, inaugurated its new Delta Plant 8 and R&D Center at Bangpoo Industrial Estate, Thailand, to facilitate Delta's expansion of production and development of electric vehicle (EV) power electronics products for global customers. The new factory and R&D center, which has 30,400 square meters of floor space, aim to increase production capacity for the rapidly growing EV business.

- In February 2024, at the 2024 Applied Power Electronics Conference (APEC), Murata announced the launch of three new power product solutions designed to help solve the power electronics industry's challenges, constraints, and limitations. These include the PE25208, a revolutionary ultra-high efficiency charge pump IC aimed to fuel the future of portable consumer electronics, including laptops and other USB PD high-power applications, and the PE24109 and PE24110, two compact, low-profile, and ultra-high efficiency step-down DC-DC converter solutions for low output voltage applications targeting applications such as high density, optical transceiver modules.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Supply Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Home And Building Automation Systems

- 5.1.2 Increasing Demand For Energy-efficient Devices

- 5.2 Market Restraints

- 5.2.1 Stringent Regulatory Compliance And Safety Standards

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Communication

- 6.1.2 Industrial

- 6.1.3 Consumer

- 6.1.4 Automotive/Transportation

- 6.1.5 Lighting

- 6.1.6 Servers

- 6.1.6.1 AI Server

- 6.1.6.2 Others

- 6.1.7 Other End-user Industries

- 6.2 By Geography***

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 MARKET VOLUME ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Vendor Ranking Analysis

- 8.2 Company Profiles*

- 8.2.1 Delta Electronics Inc.

- 8.2.2 Siemens AG

- 8.2.3 ABB Ltd

- 8.2.4 Murata Manufacturing Co. Ltd

- 8.2.5 TDK-lambda Corporation (TDK Corporation)

9 MARKET OUTLOOK

- 9.1 Impact of Current Geopolitical Scenarios on the Market

- 9.2 Key Investments and M&A Scenarios in the Market

- 9.3 Product Launches, Technology Partnerships, Etc.