|

市場調查報告書

商品編碼

1523400

AC-DC電源供應器:市場佔有率分析、產業趨勢、成長預測(2024-2029)AC-DC Power Adapters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

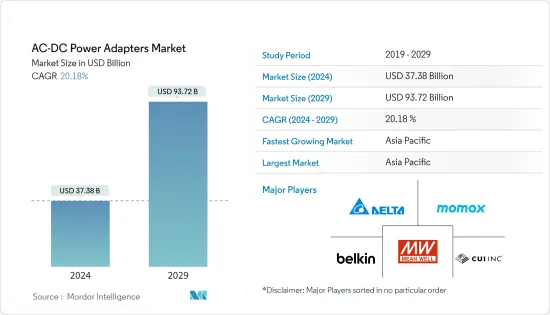

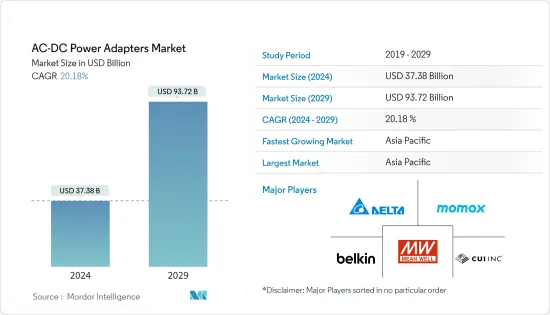

AC-DC電源供應器市場規模預計2024年為373.8億美元,預計2029年將達到937.2億美元,在預測期內(2024-2029年)複合年成長率預計為20.18%。

AC-DC電源供應器(有時稱為AC適配器)是一種外部電源,由變壓器和整流和濾波單元組成,通常安裝在緊湊的密封單元中,以確保安全和美觀。這些適配器將交流電源轉換為直流電源,用於可攜式設備以及家用和商務用電子產品。本市場研究涵蓋各種應用,包括電腦、行動裝置、消費性電子產品和工業應用。

主要亮點

- 電源適配器等電源多年來變得越來越受歡迎,因為它們在為電力負載提供能源以供消耗和操作方面發揮著重要作用。各行業和工業設備對電源的需求不斷成長,預計將進一步推動這一需求。

- 近年來,由於智慧型手機、筆記型電腦、平板電腦和其他計算設備的日益普及,市場經歷了顯著成長。全球對智慧家電和穿戴式裝置的需求正在加速成長,為AC-DC電源供應器供應商創造了龐大的商機。此外,醫療/保健、政府、軍事/航太等各行業對電源的需求很高,為市場創造了商機。

- AC/DC 適配器主要用作無法直接從主網路獲取電力的電氣設備的外部電源裝置。這些設備將交流電 (AC) 轉換為直流電 (DC)。電源轉接器的機殼中通常沒有足夠的空間來容納此轉換所需的巨大組件。電源供應器可保護您的設備免受損壞和火災。電流或電壓升高可能導致火災或設備損壞。

- 消費性電子產品、行動裝置、運算設備以及馬達和汽車等工業應用的日益普及正在加速市場的發展。然而,市場成長預計將受到地區和國家法規以及安全標準的阻礙。預計電力供應市場在預測期內將面臨挑戰。

- 世界各國政府正在對電子製造公司實施與 USB-C 型充電埠相關的嚴格強制性法規,以減少電子廢棄物。例如,從 2024 年起,歐盟的所有行動裝置都必須配備 USB-C 充電埠。這是由於歐洲議會通過了一項新法律。很快,大多數行動裝置將需要 USB-C 連接埠進行充電。大多數這些設備已經使用 USB-C 充電,但蘋果是主要的例外。

- 然而,由於成本較低,許多低階設備使用 Micro USB 進行充電。從 2026 年開始,相容於 USB PD(攜帶式設備)3.0 的高達 100 瓦的筆記型電腦也需要透過 USB-C 充電。不幸的是,歐盟並未強制要求遵守 USB PD(可程式設備)3.1 標準,該標準的最大功率輸出為 240 瓦。歐盟也宣布將實施全球最受歡迎的無線充電標準Qi標準。歐盟計畫在2024年實施Qi標準。

AC-DC電源供應器市場趨勢

行動裝置佔據主要市場佔有率

- 行動裝置是所研究市場的重要最終用戶之一。智慧型手機技術的最新進展和對 5G 智慧型手機的需求不斷成長正在推動該細分市場的成長。三星、蘋果、小米、Oppo 和 Vivo 等智慧型手機製造商的產品創新努力也推動了電源供應器的需求。

- 特別是,交流電源適配器在智慧型手機充電器領域的需求量很大,因為交流電源穿過建築物的牆壁,並且需要直流電源來為電池(例如行動電話和筆記型電腦電池)充電。技術創新催生了USB電源適配器的誕生,它擴大取代普通的行動電話適配器。 USB電源轉接器的一個顯著優點是它們可以用來為行動電話充電。

- 例如,蘋果的 USB 電源適配器是最受歡迎的,它允許用戶將其直接連接到他們的設備,並透過閃電電纜將其充電到他們的錢包插座。儘管大多數設計緊湊,但它們被認為是快速移動適配器,因為它們提供快速且高效的充電,並且可以比正常情況更快地為設備充電。

- 全球大多數市場的行動普及率已接近飽和狀態,特別是在成年人和城市人口中。預計所有地區的大部分新增用戶將是年輕消費者和農村居住者。網路在世界各地的日益普及也刺激了智慧型手機的普及。

- 根據GSMA的數據,2022年5G全球市場滲透率為13%,預計2030年將成長至64%。波灣合作理事會(GCC)國家科威特、巴林、阿曼、沙烏地阿拉伯、卡達和阿拉伯聯合大公國是全球5G普及率最高的地區,預計2030年將達到95%。

- 5G 智慧型手機處於技術進步的前沿,提供更快的資料速度、更低的延遲和增強的網路容量。隨著消費者轉向配備最新技術的智慧型手機,對 5G 智慧型手機的需求預計將會增加。 5G技術的出現將使智慧型手機製造商能夠改善用戶體驗。憑藉低延遲和高網路速度,5G 將帶來虛擬實境 (VR) 和擴增實境(AR) 等新的可能性,以改善遊戲體驗。

- 愛立信預計,全球5G用戶數量預計將快速成長,從2019年的1,269萬戶增加至2027年的43.7273億戶。東北亞擁有最多的 5G用戶數量,預計到 2027 年將達到 17.056 億用戶。

亞太地區實現顯著成長

- 中國作為電動車(EV)全球領導者的地位使其電動車充電器產業成為外商直接投資(FDI)的新興領域。這為國際企業積極參與充電設備的成長、生產和營運創造了巨大的潛力。此外,這些公司的參與可能有助於充電服務的進步,並改善中國動態電動車市場的整體用戶體驗。因此,這些公司的投資預計將為該地區的交流電-直流適配器市場創造重大機會。

- 行動裝置普及率的提高和促進國內生產的投資增加預計將推動該地區的交流-直流適配器市場。印度是消費性電子產品銷售和投資成長最快的地區之一。印度品牌股權基金會 (IBEF) 報告稱,印度的目標是到 2025-26 年電子製造業達到 3,000 億美元,出口達 1,200 億美元。

- 此外,2023-24 年聯邦預算向電子和資訊技術部撥款 1,654.9 億印度盧比(20 億美元),年成長率約 40%。許多公司正在積極投資建立製造工廠,導致AC-DC適配器的需求增加。

- 日本主要汽車公司持續進行研究和開發舉措,以增強和推廣傳統汽車的電氣化模式,預計將在可預見的未來提高日本電動車的市場佔有率。日本政府持續努力並實施各種減少溫室氣體排放和二氧化碳排放的政策,預計在未來幾年推動電動車的需求並促進市場擴張。

- 據韓國國土交通省稱,到 2023 年 5 月,電動車將佔韓國汽車市場的約 1.8%。韓國政府有一個雄心勃勃的目標,即到 2030 年將電動和氫動力汽車在新車銷量中的比例提高到 33%。

- 此外,KAMA資料顯示,韓國國內電動車銷量大幅成長,2022 年銷量約 123,700 輛,高於 2021 年的 74,000 輛。這些決定電動車成長的因素可能會推動充電基礎設施的投資,從而促進市場成長。

AC-DC電源供應器產業概況

AC-DC適配器市場正在變得半固體。創新水平、上市時間和性能是區分參與者的重要特徵。參與者包括 Delta Electronics Inc.、Momax、Belkin International(富士康)、Mean Well Enterprises 和 CUI。

2024年3月,Delta宣布推出UFC 500 500kW直流超快速電動車充電器。 UFC 500配備460kW大容量電池,可在兩小時內為一輛大型電動車(電動卡車/電動巴士)充滿電,平均運行一天。

2024 年 1 月,貝爾金在 CES 2024 上宣布推出無線充電、強大的 GaN 裝置和巧妙的 iPhone 支架。貝爾金基於改進的 MagSafe 標準的新 Qi2 充電器總合包括四款產品:BoostCharge Convertible Qi2 Pad、BoostCharge Pro 三合一無線充電板、BoostCharge Pro 二合一無線充電板、BoostCharge Pro 磁力支架。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業供應鏈分析

- 單口與多口產品比較分析

第5章市場動態

- 市場促進因素

- 對智慧型手機和筆記型電腦等消費性電子產品的需求不斷成長

- 節能設備的需求增加

- 市場限制因素

- 嚴格的法規遵循和安全標準

第6章 市場細分

- 按最終用戶產業

- 消費者

- 個人電腦

- 筆記型電腦

- 行動裝置

- 其他

- 車

- 電動車充電適配器

- 其他

- 工業的

- 消費者

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Delta Electronics Inc.

- Momax

- Belkin International(Foxconn)

- Mean Well Enterprises Co. Ltd

- CUI

- Anker Innovations Technology Co. Ltd

第8章 未來展望

The AC-DC Power Adapters Market size is estimated at USD 37.38 billion in 2024, and is expected to reach USD 93.72 billion by 2029, growing at a CAGR of 20.18% during the forecast period (2024-2029).

AC-DC power adapters, sometimes called AC adapters, are external power supplies consisting of a transformer and rectifying and filtering units typically enclosed in a compact, sealed unit for safety and aesthetic purposes. These adapters convert AC power to DC for portable devices or household and commercial electronics. The market study comprises various applications such as computing, mobile devices, consumer electronics, and industrial applications.

Key Highlights

- Power supply devices such as power adapters have become increasingly popular over the years, as they play a crucial role in providing energy to electric loads for consumption and operation. The growing demand for power supply in various industries and industrial equipment is anticipated to boost its demand further.

- The market has witnessed significant growth in recent years due to the increasing adoption of smartphones, laptops, tablets, and other computing devices. The demand for smart home appliances and wearables has accelerated worldwide, creating enormous opportunities for AC-DC power adapter vendors. Additionally, there is a high demand for power supply in various industries such as medical and healthcare, government, and military & aerospace, which presents a profitable opportunity for the market.

- AC/DC adapters are primarily used as external power supply units for electrical equipment that cannot draw power directly from the main network. These devices convert alternating current (AC) into direct current (DC). Typically, power adapters do not have space in their casing for the huge components required for this conversion. Power adapter saves equipment from damage and fire. The rise in current and voltage can cause fires and damage equipment.

- The increasing adoption of consumer electronics, mobile devices, computing devices, and other industrial applications such as motors and automotive is accelerating the market. However, the market growth is expected to face obstacles due to regional and country-specific regulatory and safety standards. The power supply market is projected to face challenges in the forecast period.

- The government of various countries are applying strict and mandatory regulations related to USB-C type charging ports on the electronics manufactruing companies to reduce the electronic waste. For instance, starting in 2024, USB-C charging ports will be mandatory for all mobile devices within the European Union. This is according to a new law passed by the European Parliament. Shortly, most mobile devices will need USB-C ports for charging. Most of these devices already use USB-C for charging, with Apple being the main exception.

- However, many low-end devices use micro USBs for charging because of their lower cost. From 2026 onwards, laptops that adhere to USB PD (Portable Device) 3.0, up to 100 watts, will also need to charge through USB-C. Unfortunately, the EU has not enforced support for the USB PD (Programmable Device) 3.1 standard, which has a power output of up to 240 watts. The EU has also announced that it will enforce the Qi standard for wireless charging, the world's most popular wireless charging standard. The EU is expected to implement the Qi standard by 2024.

AC-DC Power Adapters Market Trends

Mobile Devices to Hold Major Market Share

- The mobile devices are one of the significant end users of the market studied. The recent advancement in smartphone technologies and rising demand for 5G smartphones drive the segment's growth. Efforts by smartphone makers such as Samsung, Apple, Xiaomi, Oppo, and Vivo to innovate their products are also driving up demand for power adapters.

- Notably, the demand for AC power adapters is significantly high in the smartphone charger segment because buildings have AC electricity running through their walls, and batteries (like cell phones and laptop batteries, for example) need DC electricity to charge. Technological innovation has given rise to USB power adapters that are turning out to be an adequate replacement for regular phone adapters. One noteworthy advantage of USB power adapters over regular adapters is that they can be utilized to charge phones.

- For instance, Apple USB power adapters are the most popular, allowing users to connect directly to devices and charge them into the wallet socket through a lightning cable. While the majority come with a compact design, they provide fast, efficient charging, and it is considered a fast mobile adapter as it facilitates charging devices faster than usual.

- Mobile penetration is approaching saturation in most markets worldwide, especially among adult and urban populations. Most new subscribers are expected to be young consumers and rural dwellers in every region. The increasing internet penetration across the world further fuels the adoption of smartphones.

- According to GSMA, as of 2022, 5G is expected to grow from a global market penetration of 13% in 2022 to 64% in 2030. The Gulf Cooperation Council (GCC) States of Kuwait, Bahrain, Oman, Saudi Arabia, Qatar, and the United Arab Emirates are expected to have the highest 5G adoption rates of any region globally in 2030, at 95%.

- 5G smartphones are at the forefront of technological advancements, offering faster data speeds, lower latency, and enhanced network capacity. The demand for 5G smartphones is expected to increase as consumers switch to smartphones with the latest technology. The advent of 5G technology allows smartphone manufacturers to improve the user experience. With lower latency and faster network speeds, 5G enables new possibilities, such as virtual reality (VR) and augmented reality (AR), for enhanced gaming experiences.

- As per Ericsson, the global number 5G subscriptions are anticipated to expand rapidly, from 12.69 million in 2019 to 4,372.73 million by 2027. Northeast Asia is expected to hold the most significant 5G subscribers, reaching 1,705.6 million subscribers by 2027.

Asia-Pacific to Witness Significant Growth

- China's status as the global leader in electric vehicles (EVs) makes its electric vehicle charger industry an up-and-coming sector for foreign direct investment (FDI). This creates substantial prospects for international companies to actively participate in charging equipment's growth, production, and operation. Moreover, their involvement will contribute to the progress of charging services and improve the overall user experience in China's dynamic EV market. Consequently, the investments made by these companies are anticipated to generate significant opportunities for the AC-DC adapters market in the region.

- The increasing penetration of mobile devices and growing investments to boost domestic production are expected to drive the market for AC-DC adapters in the region. India is one of the fastest-growing regions in consumer electronics sales and investments. The Indian Brand Equity Foundation (IBEF) has reported that India is targeting USD 300 billion in electronics manufacturing and USD 120 billion in exports by 2025-26.

- Additionally, the Union Budget 2023-24 has allocated INR 16,549 crore (USD 2 billion) for the Ministry of Electronics and Information Technology, marking a yearly rise of around 40%. Many companies are actively investing in setting up manufacturing plants, leading to an increased demand for AC-DC adapters.

- The continuous research and development initiatives by top automotive companies in Japan to enhance and promote the electrified models of traditional cars are projected to boost Japan's electric vehicle market share in the foreseeable future. The persistent endeavors of the Japanese government to lower greenhouse gas emissions and carbon footprint, along with the enforcement of various policies, are anticipated to drive up the demand for electric vehicles in the coming years, thereby fostering the expansion of the market.

- As per KAMA, EVs represented roughly 1.8% of the South Korean automobile market by May 2023, as the Ministry of Land, Infrastructure and Transport indicated. The South Korean government has set an ambitious target of increasing the proportion of electric and hydrogen vehicles in new vehicle sales to 33% by 2030.

- Furthermore, KAMA's data demonstrates a notable increase in domestic electric vehicle sales in South Korea, with approximately 123.7 thousand units sold in 2022, up from the 74 thousand units sold in 2021. Such factors in determining the growth of EVs will drive investments in the charging infrastructure, thereby enhancing the market's growth.

AC-DC Power Adapters Industry Overview

The AC-DC adapters market is semi-consolidated. The level of innovation, time-to-market, and performance are the key characteristics by which the players differentiate themselves. Some players include Delta Electronics Inc., Momax, Belkin International (Foxconn), Mean Well Enterprises Co. Ltd, and CUI.

In March 2024, Delta announced the launch of its 500 kW DC Ultra-fast EV Charger UFC 500. The UFC 500 can charge one heavy-duty electric vehicle (e-truck/e-Bus) with a large battery capacity of 460 kW power within 2 hours, which, on average, results in a driving range for a full-day operation.

In January 2024, Belkin announced at CES 2024 the launch of wireless charging, powerful GaN devices, and a clever iPhone stand. Belkin's new Qi2 chargers, based on the improved MagSafe standard, include a total of four products: BoostCharge Convertible Qi2 Pad, BoostCharge Pro 3-in-1 Wireless Charging Pad, BoostCharge Pro 2-in-1 Wireless Charging Pad, BoostCharge Pro Magnetic Stand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Supply Chain Analysis

- 4.4 Comparative Analysis of Single-port vs Multi-port Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Consumer Electronics Products Including Smartphones and Laptops

- 5.1.2 Increasing Demand for Energy-efficient Devices

- 5.2 Market Restraints

- 5.2.1 Stringent Regulatory Compliance and Safety Standards

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Consumer

- 6.1.1.1 Personal Computers

- 6.1.1.2 Laptops

- 6.1.1.3 Mobile Devices

- 6.1.1.4 Others

- 6.1.2 Automotive

- 6.1.2.1 EV Charging Adapters

- 6.1.2.2 Others

- 6.1.3 Industrial

- 6.1.1 Consumer

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 United Kingdom

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Delta Electronics Inc.

- 7.1.2 Momax

- 7.1.3 Belkin International (Foxconn)

- 7.1.4 Mean Well Enterprises Co. Ltd

- 7.1.5 CUI

- 7.1.6 Anker Innovations Technology Co. Ltd