|

市場調查報告書

商品編碼

1521674

全球低溫運輸服務 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Cryogenic Transportation Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

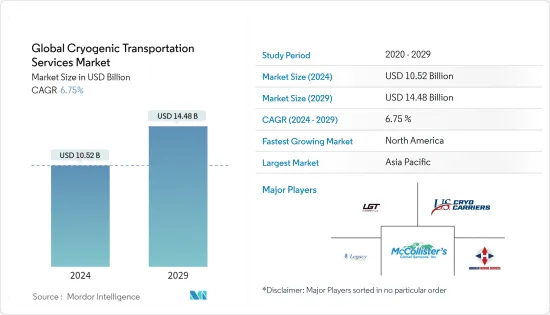

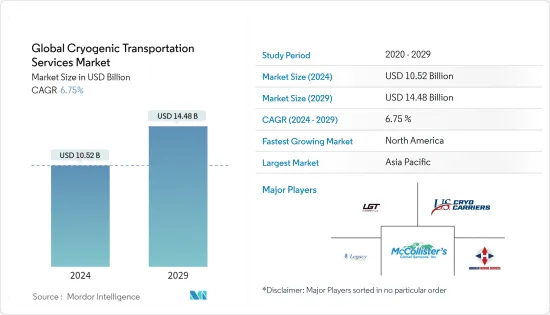

2024年全球低溫運輸服務市場規模預計為105.2億美元,預計到2029年將達到144.8億美元,在預測期內(2024-2029年)複合年成長率預計為6.75%。

主要亮點

- 在低溫氣體和液體需求不斷成長、嚴格的法規和技術進步的推動下,低溫運輸服務市場預計將繼續成長。我們也預期市場將變得更加整合,大公司收購小公司以擴大其服務範圍和地理覆蓋範圍。例如,2023年10月,Chart Industries的低溫生物產品業務被領先的低溫運輸物流方案供應商Cryoport收購。此次收購使 Cryoport 能夠擴大其低溫運輸生物材料(例如細胞和基因療法)的服務。

- 低溫運輸對於安全運輸醫學研究和交付中使用的生物檢體、組織和器官是必要的。隨著製藥業的不斷進步,對低溫運輸服務的需求預計將會增加。許多醫藥產品都需要低溫儲存和運輸,包括疫苗、生技藥品和一些醫藥產品。隨著新藥物和治療方法的開發,對低溫運輸服務的需求預計將會增加。

- 藥品的研發、製造和分銷是全球製藥業的責任。 2021年市場規模為2098.5億美元,預計2030年將成長至3,529.8億美元。 2022年全球製藥業產值1.48兆美元。

全球低溫運輸服務市場趨勢

北美將主導未來全球市場佔有率

- 在北美,對液化天然氣作為清潔能源來源的需求正在穩定成長。因此,對液化天然氣從生產場地到倉儲設施和最終用戶的低溫運輸的需求不斷增加。截至2023年11月,美國能源資訊署(EIA)預計,到2027年,北美液化天然氣(LNG)出口能力將達到243億立方英尺/天(Bcf/d)。這是該地區目前 11.4 Bcf/d 出口能力的兩倍多。

- 北美的製藥工業正在不斷擴張,許多產品,例如疫苗和一些藥品,需要在極低的溫度下儲存和運輸。 2024年,北美製藥業預計將產生6,644億美元的收益。 2022年北美活性藥物成分(API)市值為659.5106億美元,預計2030年將達到876.622億美元。

- 冷藏運輸產業取得了顯著的技術進步,包括開發更有效率、更安全的冷藏儲存槽和拖車。這些改進使該行業能夠更安全可靠地遠距運輸大量低溫材料。

化學領域的需求以最大的市場佔有率推動市場

- 低溫液體是沸點低於 -100°F (-73°C) 的物質。大多數低溫液體的溫度低於-150°C。常見的低溫液體包括氮氣、氬氣、氦氣、氫氣、甲烷和一氧化碳。沸點稍高的氧化亞氮和二氧化碳有時也會被添加到此類中。使用這些液體存在多種危險。因此,必須適當控制其使用,避免與零件和液體接觸以及接觸氣體。

- 2022年,全球化學品和藥品出口總額約2.76兆美元(1.89兆歐元),全球製藥業佔9,810億歐元(1.5668兆美元)。歐洲將在2022年成為全球最大的化學品進口國。亞太地區和北美地區對化學品的需求也很高,進口額分別為 6,036 億美元和 2,470 億美元。

- 2022年,全球化學品消費量將超過5.77兆歐元。整體而言,未來幾年亞洲區域化學品消費量預計將成長最快。亞洲在全球化學品市場中發揮重要作用,到2022年將佔市場佔有率約60%。然而,中國是近期亞洲化學品出口和消費成長的唯一主要貢獻者。

全球低溫運輸服務產業概況

全球低溫運輸服務市場高度分散,許多全球和本地公司進入市場以滿足不斷成長的需求。隨著太陽能冷凍裝置、多溫卡車和貨運最佳化軟體的採用等進步,該產業正在不斷發展。 LGT Transport、McCollister's、Hingham Moving、KAG 等國際和本地公司都活躍在這個市場。競爭對手必須專注於透過獨特的價值提案來區分其產品,才能在市場上站穩腳跟。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 目前的市場狀況

- 政府法規和舉措

- 技術趨勢和自動化見解

- COVID-19大流行對市場的影響

第5章市場動態

- 市場促進因素

- 生命科學和醫學的成長

- 食品和飲料行業的擴張

- 可再生能源日益受到關注

- 市場限制因素

- 初期投資成本高

- 缺乏技術純熟勞工

- 基礎設施

- 市場機會

- 技術進步

- 永續解決方案

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第6章 市場細分

- 按類型

- 拖車運輸

- 卡車運輸

- 按用途

- 化學品

- 藥品

- 生物標本

- 工業氣體

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 西班牙

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 新加坡

- 印尼

- 韓國

- 馬來西亞

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 卡達

- 阿曼

- 其他中東/非洲

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

- 其他拉丁美洲

- 北美洲

第7章 競爭格局

- 市場集中度概覽

- 公司簡介

- LGT Transport

- McCollister's

- Hingham Moving

- KAG

- Legacy Cryogenic

- US Cryo Carriers

- New England Cryogenic Center

- Champion Moving

- COREX Logistics

- Core Cryolab

- Applied Cryo Technologies

- GetCryo

- Texas Gas Transport*

- 其他公司

第8章 市場未來展望

第9章 附錄

The Global Cryogenic Transportation Services Market size is estimated at USD 10.52 billion in 2024, and is expected to reach USD 14.48 billion by 2029, growing at a CAGR of 6.75% during the forecast period (2024-2029).

Key Highlights

- The cryogenic transportation services market is expected to continue to grow in the coming years, driven by the increasing demand for cryogenic gases and liquids, stringent regulations, and technological advancements. The market is also expected to see consolidation as larger companies acquire smaller players to expand their service offerings and geographic reach. For example, in October 2023, Chart Industries' Cryobiological products business was acquired by Cryoport, a leading provider of cold chain logistics solutions. This acquisition has enabled Cryoport to expand its services to include the transport of biological materials, such as cell and gene therapies, in cryogenic conditions.

- Cryogenic transport is necessary to ensure the safe transportation of biosamples, tissues, and organs utilized in medical research and delivery. As advances in medicines continue, demand for cryogenic transport services is expected to increase. Storage and transport at extreme temperatures are required for a large number of medicinal products, e.g., vaccines, biologics, and some drugs. The demand for cryogenic transport services is expected to increase as new drugs and treatments are developed.

- Research, development, manufacture, and distribution of medicines are the responsibilities of the global pharmaceutical industry. The market was valued at USD 209.85 billion in 2021, and it is expected to grow to US 352.98 billion by 2030. The global pharmaceutical industry generated USD 1.48 trillion in 2022.

Global Cryogenic Transportation Services Market Trends

North America Dominates the Global Market Share in the Coming Years

- Demand for LNG as a cleaner energy source in North America has been growing steadily. Consequently, demand for cryogenic transport of LNG from production sites to storage facilities and end users has been increasing. As of November 2023, the US Energy Information Administration (EIA) expected North America's liquefied natural gas (LNG) export capacity to reach 24.3 billion cubic feet per day (Bcf/d) by 2027. This is more than double the region's current capacity of 11.4 Bcf/d.

- The North American pharmaceutical industry is expanding, requiring storage and transport at extremely low temperatures for many products, such as vaccines and some medicinal products. In 2024, the North American pharmaceutical industry is expected to generate USD 664.4 billion in revenue. The North American active pharmaceutical ingredients (API) market was valued at USD 65,951.06 million in 2022, and it is expected to reach USD 87,662.20 million by 2030.

- Significant technical advances, such as the development of more efficient and secured cold storage tanks and trailers, have taken place within the Cryogenic Transport Industry. These improvements have enabled the industry to transport a larger volume of cryogenic materials over longer distances with greater safety and reliability.

Demand in Chemical Segment is Driving the Market With the Largest Market Share

- Cryogenic liquids are materials with a boiling point of less than - 100 °F (-73 °C). Most cryogenic liquids are below -150°C. Common cryogenic liquids that are concerning include nitrogen, argon, helium, hydrogen, methane, and carbon monoxide. Nitrous oxide and carbon dioxide, which have slightly higher boiling points, are sometimes added to this category as well. Several hazards are associated with the use of these liquids. Therefore, their usage must be properly controlled to avoid any contact with components or liquids or exposure to gases.

- In 2022, the global total exports of chemicals and pharmaceuticals accounted for approximately USD 2.76 trillion, or EUR 1.89 trillion, and the global pharmaceutical industry accounted for EUR 981 billion (USD 1,056.68 billion). Europe was the world's largest chemical importer in 2022. There is also a high demand for chemicals in Asia-Pacific and North America, with imports accounting for USD 603.6 billion and USD 247 billion, respectively.

- In 2022, chemical consumption worldwide accounted for over EUR 5.77 trillion. Overall, regional chemical consumption is expected to grow the most rapidly in Asia in the coming years. Asia plays a notable role in the global chemicals market, accounting for roughly a 60% share of the market in 2022. However, China alone is primarily responsible for the recent increases in Asia's exports and consumption of chemicals.

Global Cryogenic Transportation Services Industry Overview

The global cryogenic transportation services market is highly fragmented, with a large number of global and local players in the market to cater to the growing demand. The industry is evolving with advancements such as the introduction of solar-powered refrigerated units, multi-temperature trucks, and freight optimization software. Both international and local players like LGT Transport, McCollister's, Hingham Moving, KAG, and numerous others are actively operating in this market. Competitors must focus on differentiating their product offerings with unique value propositions to strengthen their foothold in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights

- 4.1 Current Market Scenario

- 4.2 Government Regulations and Initiatives

- 4.3 Technological Trends and Automation Insights

- 4.4 Impact of the COVID-19 Pandemic on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growth of Life Sciences and Healthcare

- 5.1.2 Expanding Food and Beverage Industry

- 5.1.3 Growing Focus on Renewable Energy

- 5.2 Market Restraints

- 5.2.1 High Initial Investment Costs

- 5.2.2 Skilled Workforce Shortage

- 5.2.3 Infrastructure

- 5.3 Market Opportunities

- 5.3.1 Technological Advancements

- 5.3.2 Sustainable Solutions

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Buyers/consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 intensity of Competitive Rivalry

6 Market Segmentation

- 6.1 By Type

- 6.1.1 Trailer Transportation

- 6.1.2 Truck Transportation

- 6.2 By Application

- 6.2.1 Chemicals

- 6.2.2 Drug

- 6.2.3 Biological Specimens

- 6.2.4 Industrial Gases

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.1.3 Mexico

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.2.4 United Kingdom

- 6.3.2.5 Spain

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Australia

- 6.3.3.5 Singapore

- 6.3.3.6 Indonesia

- 6.3.3.7 South Korea

- 6.3.3.8 Malaysia

- 6.3.3.9 Rest of Asia-Pacific

- 6.3.4 Middle East and Africa

- 6.3.4.1 Saudi Arabia

- 6.3.4.2 Qatar

- 6.3.4.3 Oman

- 6.3.4.4 Rest of Middle East and Africa

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Chile

- 6.3.5.4 Rest of Latin America

- 6.3.1 North America

7 Competitive Landscape

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 LGT Transport

- 7.2.2 McCollister's

- 7.2.3 Hingham Moving

- 7.2.4 KAG

- 7.2.5 Legacy Cryogenic

- 7.2.6 US Cryo Carriers

- 7.2.7 New England Cryogenic Center

- 7.2.8 Champion Moving

- 7.2.9 COREX Logistics

- 7.2.10 Core Cryolab

- 7.2.11 Applied Cryo Technologies

- 7.2.12 GetCryo

- 7.2.13 Texas Gas Transport*

- 7.3 Other Companies