|

市場調查報告書

商品編碼

1689868

企業員工交通服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Corporate Employee Transportation Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

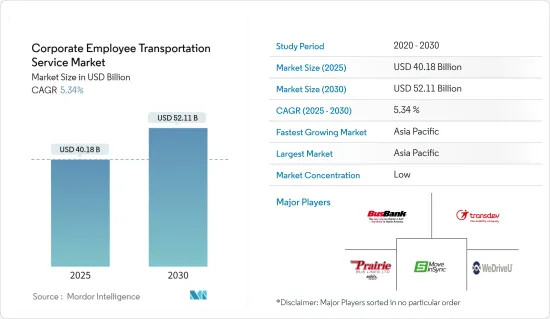

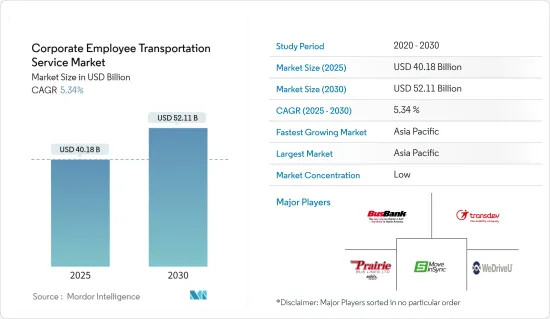

預計 2025 年企業員工交通服務市場規模為 401.8 億美元,到 2030 年將達到 521.1 億美元,預測期間(2025-2030 年)的複合年成長率為 5.34%。

新冠疫情迫使許多公司在家工作,導致員工流動減少,阻礙了市場發展。然而,隨著經濟從封鎖中復甦,預計未來幾年重返辦公室將為運輸服務提供者提供許多機會。此外,州政府也努力改善員工的通勤系統。例如

主要亮點

- 2022 年 4 月:巴爾的摩市長宣布啟動該市創新交通計畫「讓我們騎車上班」。市長就業發展辦公室 (MOED) 和 Lyft, Inc. 合作制定了這項議程。該計劃的主要目標是透過提供前四周的免費交通服務來幫助新就業的巴爾的摩市居民。該舉措由美國救援計劃法案資助,是巴爾的摩市新冠疫情就業恢復策略的一部分。

從長遠來看,隨著人們越來越意識到改善道路安全措施的價值,員工運輸服務會變得越來越受歡迎。此外,交通工具提供的低價也鼓勵員工選擇他們,以節省旅行時間和精力。因此,公司正在開發和推出新的員工交通服務產品。例如

主要亮點

- 2022 年 11 月:CharterUP 是一個面向企業、消費者和企業的完全整合的包車市場,宣佈在全國範圍內推出 Corporate Shuttles,這是一個用於預訂和管理日常員工交通的新平台。目前,希爾頓、凱悅、思科、 德克薩斯和德州儀器等公司都依賴 CharterUP 來滿足其日常公司接駁車需求。

交通不安全、攻擊、粗魯行為以及叫車和共乘車輛高昂票價等事件的增加,促使雇主開始考慮員工的安全。這一因素也推動了市場成長。

由於企業辦事處的不斷增加,預計亞太地區將主導市場。這是因為,許多北美和歐洲的跨國公司由於產品需求不斷成長且人事費用低廉,正在印度、中國和菲律賓等國家設立辦事處、工廠、倉庫和生產廠。例如

主要亮點

- 2022 年 4 月:招募和租賃服務公司 Siam Rajathanee Public (SO) 與東南亞領先的運輸技術供應商 SWAT Mobility Pte Ltd (SWAT Mobility) 合作。兩家公司聯合推出「SWAT Mobility」應用程式,旨在提升員工通勤體驗,滿足公共和私營企業的需求。

員工交通服務市場趨勢

網際網路使用率的提高和技術進步推動了市場需求

隨著全球網路使用者數量的不斷增加,近年來,運輸服務和汽車租賃等市場成為企業營運的主要受益者。預訂方便、預先報價、舒適的旅程、準時到達和及時付款方式只是推動全球共享旅遊和員工交通服務市場發展的部分因素。

交通運輸業是網際網路商業領域的傑出領導者,主導著數位經濟。隨著網路平台的成長和市場營運商之間競爭的加劇,快速反應和解決問題已成為企業在當前競爭環境中維持業務的最重要因素。

由於我們業務的性質,我們高度依賴和依靠網際網路。對於在多個城市設有辦事處的企業來說,他們需要的網路使用者數量超出了他們所需的數量。因此,公司通常會接受不同地點內或不同地點之間的價格差異,並需要協助來提高與供應商的談判能力。

使用這些服務的其他原因包括交通技術的進步,例如即時追蹤、無現金付款、取消和即時車輛監控。此外,上世紀末全球IT和其他科技領域的興起,也帶來了彈性工作和業務的需求。此次行動為許多相關企業和就業創造了機會。員工流動就是其中之一,並且是根據有關員工安全的法律規定所必需的。

網際網路使用量的增加和技術的進步正在鼓勵營運商為其業務營運維護良好的車隊,預計在預測期內市場將持續成長。

亞太地區可望主導市場

由於企業數量的增加以及公司為吸引多元化勞動力而對公共交通解決方案的需求不斷增加,預計亞太地區將在預測期內顯著成長。此外,印度、日本和中國等國家的低人事費用預計將鼓勵大公司在這些國家設立辦事處,從而推動該地區在預測期內對企業運輸服務的需求。例如,

- 2021年,日本勞動人口總量預估為6,860萬人。勞動人口比上年的約6,870萬人減少。

此外,市場上的幾家主要企業正在實施夥伴關係和聯盟等各種成長策略,以擴大市場佔有率。例如

- 2022年6月,提供企業員工交通解決方案的公司Share Mobility融資1,200萬美元,協助企業為員工提供交通服務。

由於全國員工數量的增加,預計預測期內市場將大幅成長。

員工交通服務業概況

企業員工交通服務市場較為分散,很少參與者利用技術手段來管理車隊和員工通勤。除了利用最新的輔助技術外,許多領先的公司還在擴大其提供的服務範圍。例如,

- 2021 年 10 月,辦公室通勤者的巴士聚合商 Shuttl 被線上巴士票務Start-UpsChalo 以全現金方式收購。金額尚未披露。 Shuttle 已在曼谷開展業務,並且正在向 Charodid 尚未開展業務的印度主要城市擴張。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 市場促進因素

- 市場限制

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

第5章 市場區隔

- 所有權

- 直達運輸服務

- 委託服務

- 租賃

- 取送運送服務

- 乘用車類型

- 搭乘用車

- 範

- 公車

- 服務類型

- Mobility as a Service(MaaS)

- Software as a Service(SaaS)

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 供應商市場佔有率

- 公司簡介

- Busbank(Global Charter Services Ltd.)

- Transdev

- Prairie Bus Line Limited

- Move-In-Sync

- First Class Tours

- Janani Tours

- Shuttl

- Eco rent a car

- Sun Telematics

第7章 市場機會與未來趨勢

The Corporate Employee Transportation Service Market size is estimated at USD 40.18 billion in 2025, and is expected to reach USD 52.11 billion by 2030, at a CAGR of 5.34% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the market by forcing many companies to work from home, resulting in less employee transportation. However, as economies have recovered from the lockdown, a return to office is expected to provide transportation service operators with numerous opportunities in the coming years. Moreover, governments in various states are also initiatives to improve employee commute systems. For instance,

Key Highlights

- April 2022: Baltimore Mayor announced the launch of the city's innovative transportation program, "Let's Ride to Work." The Mayor's Office of Employment Development (MOED) and Lyft, Inc. collaborated on the agenda. Its main goal is to help newly hired Baltimore City residents by providing free rides to and from work for the first four weeks. This initiative is funded by the American Rescue Plan Act and is part of Baltimore City's COVID-19 employment recovery strategy.

Over the long term, employee transportation services are becoming more popular as people have become more aware of the significance of improved transportation safety measures. In addition, with the low prices offered by transportation providers, employees are choosing them to save time and effort when traveling. Therefore, players are coming up with new product developments and launches for employee transportation services. For instance,

Key Highlights

- November 2022: CharterUP, the fully integrated charter bus marketplace for corporations, consumers, and operators, announced the national launch of Corporate Shuttles, a new platform for booking and managing day-to-day employee transportation. Hilton, Hyatt, Sysco, H-E-B, Texas Instruments, and other companies are currently using CharterUP to address their daily corporate shuttle needs.

Rising incidents of transportation insecurity, assaults, rude behavior, and high fees in ride-hailing and ride-sharing vehicles have prompted employers to consider their employees' safety. This factor is also in charge of driving market growth.

Asia-Pacific is expected to dominate the market due to a growing corporate office presence. It is because many North American and European MNCs are establishing offices, factories, warehouses, and plants in countries such as India, China, and the Philippines, owing to rising demand for goods and low labor costs. For instance,

Key Highlights

- April 2022: Siam Rajathanee Public Co., Ltd (SO), a personnel recruitment service provider and a rental and service business, partnered with SWAT Mobility Pte Ltd (SWAT Mobility), Southeast Asia's leading transportation technology provider. The companies collaborated to launch the "SWAT Mobility" application to improve employees' commute experience to meet the demands of businesses in both the public and private sectors.

Employee Transportation Services Market Trends

Increasing Internet Usage and Technological Advancements to Drive Demand in the Market

With the increased internet use among the global population, markets such as transportation services, vehicle rentals, and so on have primarily benefited their business operations in recent years. The booking ease, pre-estimated fee, comfortable journey, on-time arrival, and quick payment options are just a few factors driving markets such as shared mobility and employee transportation services worldwide.

The transportation industry is tremendously leading among internet-based business sectors, accounting for most of the digital economy. With the online platform's growth and increased competition among market operators, quick action and resolution of issues have become the most critical factor for companies to sustain their businesses in the current competitive environment.

Due to the inherent operations nature, there is a high reliance and dependency on the internet. More internet users are required than necessary for companies with a multi-city presence. As a result, companies frequently accept differential pricing arrangements within and/or across locations and need help to exercise greater bargaining power with vendors.

Other reasons for using these services include technological advancements in transportation, such as live tracking, cashless payments, cancellations, real-time vehicle monitoring, etc. Furthermore, the global IT emergence and other technology sectors toward the end of the last century necessitate the need for flexible working and operations. This operation created opportunities for many associated businesses and jobs. Employee transportation is one of them, becoming a requirement due to statutory regulations regarding employee safety.

With increased internet usage and technological advancements, the market is expected to grow consistently for operators, prompting them to maintain a good vehicle fleet for their business operations during the forecast period.

Asia-Pacific Region Expected to Dominate the Market

The Asia-Pacific region is expected to grow significantly during the forecast period due to increasing corporate companies and rising demand for mass transit solutions by companies to attract a diverse employee range. Furthermore, the low labor cost in countries such as India, Japan, and China, attracts big firms to open their offices in these countries, expecting to drive demand for corporate transportation services in the region over the forecast period. For instance,

- In 2021, Japan's total labor force was estimated to be 68.6 million. The labor force dropped from approximately 68.7 million the previous year.

Furthermore, several key players in the market are implementing various growth strategies, such as partnerships and collaborations, capturing a growing market share in the region. For instance,

- In June 2022, Share Mobility, a company providing transportation solutions for businesses, raised USD 12 million to assist businesses in providing transportation to their employees.

The market in focus is expected to grow significantly during the forecast period due to an increase in employee numbers across the country.

Employee Transportation Services Industry Overview

The market for corporate employee transportation services is fragmented, with few players utilizing technological assistance for fleet and employee commute management. Apart from using the most recent assistive technology, many major players are broadening the scope of their offerings. For instance,

- In October 2021, Shuttl, a bus aggregator for office commute, was acquired by online bus ticketing startup Chalo in an all-cash deal. The amount was not disclosed. The acquisition enabled Chalo to accelerate its plans for international expansion, as Shuttlalready is already present in Bangkok and have entered large Indian metro cities that Chalodid does not have a presence in.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in USD Billion)

- 5.1 Ownership

- 5.1.1 Company-owned Transportation Service

- 5.1.2 Outsourced Transportation Service

- 5.1.3 Rentals

- 5.1.4 Pick and Drop Transportation Service

- 5.2 Passenger Vehicle Type

- 5.2.1 Cars

- 5.2.2 Vans

- 5.2.3 Bus

- 5.3 Service Type

- 5.3.1 Mobility as a Service (MaaS)

- 5.3.2 Software as a Service (SaaS)

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of the South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of the Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Busbank (Global Charter Services Ltd.)

- 6.2.2 Transdev

- 6.2.3 Prairie Bus Line Limited

- 6.2.4 Move-In-Sync

- 6.2.5 First Class Tours

- 6.2.6 Janani Tours

- 6.2.7 Shuttl

- 6.2.8 Eco rent a car

- 6.2.9 Sun Telematics