|

市場調查報告書

商品編碼

1521709

生物丙酮:市場佔有率分析、產業趨勢、成長預測(2024-2029)Bio-Acetone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

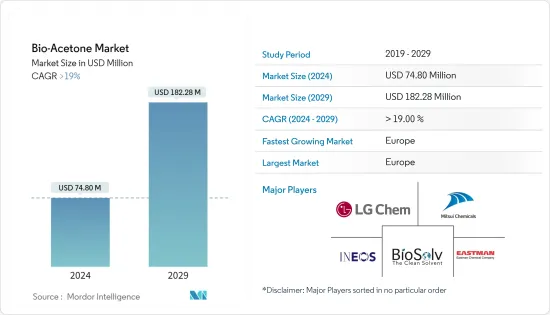

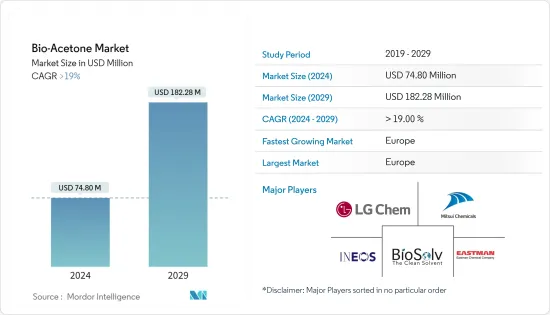

生物丙酮市場規模預計到 2024 年將達到 7,480 萬美元,到 2029 年將達到 1.8228 億美元,在預測期內(2024-2029 年)複合年成長率將超過 19%。

由於各國實施的停工和限制,COVID-19 大流行對市場需求產生了負面影響。然而,由於各行業應用的增加,市場於2021年復甦,並於2022年和2023年恢復到大流行前的水平。

短期內,對生物丙酮的需求將受到油漆和被覆劑等各行業對生物基產品的需求的推動。

相反,各種替代品的出現預計將阻礙未來的市場成長。

預計在預測期內,生物基產品製造技術的增加將為生物丙酮市場創造機會。

生物丙酮市場趨勢

對生物基油漆和塗料的需求不斷成長

- 生物丙酮是普通丙酮的可再生版本,具有與丙酮相同的化學性質。

生物丙酮的優點是:

- 安全無致癌性。它是一種高性能溶劑,可用於多種油漆和被覆劑。

- 由可再生資源製成,可生物分解。適用於聚氨酯塗料、紫外線固化塗料、瓷漆及清漆。

- 它在油漆和被覆劑的生產中用作稀釋劑。油漆和被覆劑用於多種應用,包括汽車、建築、包裝、家具和紡織品。

- 許多行業已開始使用揮發性有機化合物 (VOC) 較低的產品,VOC 法規的收緊導致近期市場需求增加。由於生物丙酮是由玉米等植物來源原料生產的,因此該生物溶劑主要用於低揮發性有機化合物的油漆和塗料產品。

- 在汽車產業,由於各種VOC法規,對生物基塗料的需求不斷增加。生物丙酮用作生物基塗料的溶劑,並應用於多種應用,例如儀表板、輪圈、車門裝飾和其他汽車應用。

根據OICA(國際汽車工業組織)發布的最新資料,汽車總產量已從2021年的8,000萬輛增加到2022年的約8,500萬輛。

- 此外,各國電動車產量不斷增加,進一步推動了汽車產業對生物基塗料的需求。

- 由於不同國家對VOC法規的不斷提高,對生物基油漆和被覆劑的需求正在上升,預計將對預測期內的市場需求產生積極影響。

歐洲成為最大消費國

- 由於有關可再生產品的各種法規,歐洲預計將成為生物丙酮的最大消費國之一。

- 塗料產業排放的揮發性有機化合物會造成各種環境和人類健康問題。這導致各國在塗料產業遵循歐盟制定的指令。

- 歐盟 (EU) 已開始實施 VOC 溶劑排放指令 (SED),以減少工業活動(包括油漆和塗料行業)的 VOC排放。

- SED 對 VOC排放設定了限制,並要求油漆和被覆劑製造商等行業在其製造過程中使用低 VOC 或零 VOC 溶劑。

- 在化妝品行業,生物丙酮被用作指甲油去光水,因為與丙酮相比,它具有優越的性能和較低的毒性。

- 根據個人護理協會歐洲化妝品協會的數據,2022年化妝品產業的市場規模為880億歐元(約949億美元)。

- 該地區最大的化妝品市場是德國、法國、義大利、英國和波蘭。所有這些國家均佔該地區化妝品市場總量的 67% 以上。

- 所有這些因素預計將在預測期內推動歐洲國家對生物丙酮的需求。

生物丙酮產業概況

全球生物丙酮市場已鞏固。主要參與企業(排名不分先後)包括 LG Chem、三井化學、INEOS、Bio Brands LLC 和 Eastman Chemical Company。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場動態

- 促進因素

- 各種工業應用對生物基原料的需求不斷成長

- VOC法規增加

- 其他司機

- 抑制因素

- 替代品的可用性

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(以金額為準))

- 種類

- 純度99%以下

- 純度99以上

- 目的

- 塑膠

- 橡皮

- 繪畫

- 其他(去光水、清洗劑、化學中間體等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 土耳其

- 俄羅斯

- 北歐國家

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率**/排名分析

- Stratergies Adopted by Leading players

- 公司簡介

- INEOS

- Bio Brands LLC

- Celtic Renewables

- Circular Industries

- Eastman Chemcial Company

- LanzaTech

- LG Chem

- Mitsui Chemcials

- Sigma Aldrich(Merck KGaA)

- Vertec BioSolvents Inc.

第7章市場機會與未來趨勢

- 增加生物基丙酮生產技術

- 其他機會

The Bio-Acetone Market size is estimated at USD 74.80 million in 2024, and is expected to reach USD 182.28 million by 2029, growing at a CAGR of greater than 19% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted demand in the market due to lockdowns and restrictions imposed by various countries. However, the market recovered in 2021 and returned to pre-pandemic levels in 2022 and 2023 with the rise in applications in various industries.

Over the short term, the demand for bio-acetones is propelled by the demand for bio-based products from various industries, such as paints and coatings.

Conversely, the availability of various alternatives is expected to hinder the market's growth in the future.

The increasing technology for producing bio-based products is expected to create opportunities for the bio-acetone market during the forecast period.

Bio-Acetone Market Trends

Growing Demand For Bio-Based Paints and Coatings

- Bio-acetone is a renewable version of regular acetone and has the same characteristics as acetone with identical chemical properties.

Some of the advantages of bio-acetones include:

- They are safe and non-carcinogenic. They are high-performance solvents and can be used in various paints and coatings.

- They are made of renewable sources and are bio-degradable. They are effective in polyurethane paints, UV-curable coatings, enamels, and varnishes.

- They are used as thinners in paints and coatings manufacturing. Paints and coatings are used in various applications, including automotive, construction, packaging, furniture, textiles, and other applications.

- Many industries have started using products with low volatile organic compounds (VOC), and the increase in VOC regulations has led to a rise in demand in the market in recent times. Since bio-acetones are manufactured from plant-based raw materials such as corn, bio-solvents are used mainly in lower VOC-based paints and coating products.

- In the automotive industry, the demand for bio-based coatings is increasing owing to various VOC regulations. Bio acetone is used as a solvent in bio-based coatings and is applied to various applications such as dashboards, steering wheels, door trims, and other automotive vehicles.

According to the latest data released by the International Organization Of Motor Vehicle Manufacturers (OICA), the total number of vehicles manufactured in 2022 was around 85 million units compared to 80 million in 2021.

- In addition, there has been a rise in electric vehicle manufacturing in various countries, further propelling the demand for bio-based coatings in the automotive industry.

- Due to the rise in VOC regulations in various countries, the demand for bio-based paints and coatings is on the rise, which is expected to positively impact the demand in the market during the forecast period.

Europe To Become the Largest Consumer

- Europe is expected to be one of the largest consumers of bio-acetone due to various regulations set up for renewable-based products.

- The VOC emission from the coatings industry has raised various environmental and human health issues. This has led various countries to follow the directives laid by the European Union in the coatings industry.

- The European Union has started the implementation of the VOC solvents emission directive (SED) to reduce VOC emissions from industrial activities, including the paints and coatings industry.

- The SED has set up emission limits for VOCs and requires industries such as paints and coatings manufacturing to use low-VOC or zero-VOC-based solvents in the manufacturing process.

- In the cosmetics industry, bio-acetone is used as a nail polish remover owing to its superior characteristics and low toxicity compared to acetones.

- According to Cosmetics Europe, the personal care association, the cosmetics industry was valued at EUR 88 billion (~USD 94.9 billion) in 2022.

- The largest cosmetics markets in the region are Germany, France, Italy, the United Kingdom, and Poland. All these countries account for more than 67% of the total cosmetics market in the region.

- All these factors are expected to drive the demand for bio-acetones in various European countries during the forecast period.

Bio-Acetone Industry Overview

The global bio-acetone market is consolidated. Some major players (not in any particular order) include LG Chem, Mitsui Chemicals, INEOS, Bio Brands LLC, and Eastman Chemical Company.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Bio Based Raw Materials in Various Industrial Applications

- 4.1.2 Increase in VOC Regulations

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size In Value)

- 5.1 Type

- 5.1.1 Purity <99%

- 5.1.2 Purity >99%

- 5.2 Application

- 5.2.1 Plastics

- 5.2.2 Rubber

- 5.2.3 Painting

- 5.2.4 Other Applications (Nail Polish Remover, Cleaning Agent, Chemicals Intermediaries, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Nigeria

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 United Arab Emirates

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market share**/Ranking Analysis

- 6.3 Stratergies Adopted by Leading players

- 6.4 Company Profiles

- 6.4.1 INEOS

- 6.4.2 Bio Brands LLC

- 6.4.3 Celtic Renewables

- 6.4.4 Circular Industries

- 6.4.5 Eastman Chemcial Company

- 6.4.6 LanzaTech

- 6.4.7 LG Chem

- 6.4.8 Mitsui Chemcials

- 6.4.9 Sigma Aldrich (Merck KGaA)

- 6.4.10 Vertec BioSolvents Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technologies for Bio Based Acetone Production

- 7.2 Other Opportunities