|

市場調查報告書

商品編碼

1521727

太陽能板 -市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Solar Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

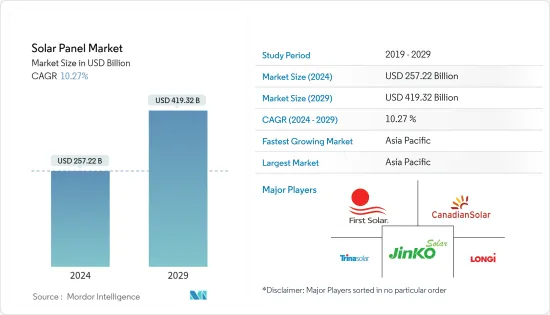

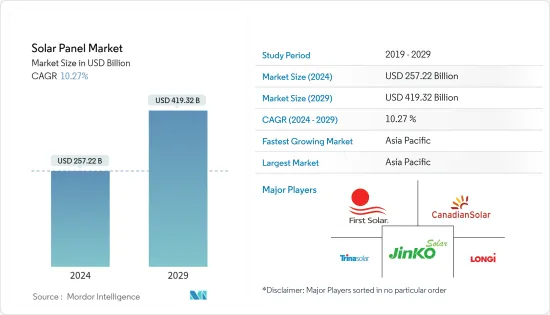

太陽能板市場規模預計到2024年為2,572.2億美元,預計到2029年將達到4,193.2億美元,在預測期內(2024-2029年)複合年成長率為10.27%。

主要亮點

- 從中期來看,政府對太陽能採用的支持政策和太陽能價格下降等因素預計將成為預測期內太陽能板市場的最大促進因素之一。

- 同時,來自生質能源、風力發電和水力發電等其他可再生能源的競爭在預測期內威脅著市場。

- 然而,更具創新性和更有效率的太陽能電池板的開發仍在繼續取得進展。預計這一因素將在未來為市場創造一些機會。

- 亞太地區在市場上佔據主導地位,並且可能在預測期內實現最高的複合年成長率。中國、印度和日本等國家正在推動太陽能板市場,不僅因為它們擁有強大的太陽能板製造基礎,還因為它們積極參與新興市場和基礎設施開拓活動。

太陽能板市場趨勢

薄膜太陽能板經歷顯著成長

- 薄膜太陽能模組被認為是太陽能電池技術的突破,並正在迅速獲得光伏領域的市場佔有率。薄膜太陽能電池包括非晶質(a-Si)、碲化鎘(CdTe)和硒化鎵(CIGS)電池。 CIGS薄膜太陽能電池將太陽光轉化為電能,是透過在玻璃基板上塗覆多層薄膜製成的。 CIGS薄膜太陽能電池在非晶矽太陽能電池中具有較高的吸收係數,因此具有高轉換效率和長穩定性。在所有類型中,CdTe應用最為廣泛,預計在薄膜太陽能電池行業中佔據很大的市場佔有率。

- 薄膜太陽能電池比傳統晶矽太陽能電池需要更少的建築材料,因此生產成本(每千瓦)可能略低。例如,薄膜太陽能電池的材料成本約為每瓦0.50美元至1美元,而傳統太陽能電池的成本約為每瓦3美元。由於成本較低,薄膜太陽能電池比矽晶型更容易大量生產。然而,它的效率低於矽晶型。

- 薄膜太陽能板可以在不銹鋼或卷狀塑膠等軟性基板上製造。這種靈活性允許在彎曲表面和屋頂上的不規則形狀上進行獨特的安裝。薄膜面板的多功能性為製造商開拓了新的市場。

- 由於這些太陽能電池板類型的獨特功能,太陽能裝置近年來經歷了顯著成長。根據國際可再生能源機構預測,2023年太陽能發電裝置容量約為1,412.09GW,而去年同期為1,066.55GW,顯示全球太陽能板安裝進展迅速。

- 此外,太陽能投資正在世界各地掀起熱潮。在面板成本下降和應對氣候變遷的緊迫感日益增強的推動下,太陽能投資預計在 2024 年首次超過石油和天然氣投資。

- 2024年2月,義大利政府宣布將向Enel位於西西里島的太陽能發電面板工廠3Sun投資9,000萬歐元(約9,700萬美元)。國家恢復和恢復計畫已為該計劃累計了9000萬歐元,該項目將加強現有工廠的實力,並有潛力生產不同類型的太陽能電池板,包括薄膜太陽能電池板,並在工廠內建立一條新的生產線。

- 因此,預計薄膜太陽能電池板在預測期內將顯著成長。

亞太地區預計將主導市場

- 由於快速成長的能源需求、有利的政府政策以及對可再生能源轉型的堅定承諾,亞太地區正在成為全球太陽能板市場的重要力量。這個廣闊而多樣化的地區包括中國、印度、日本、澳洲和東南亞等國家,為太陽能板製造商、安裝商和相關行業提供了巨大的成長機會。

- 亞太地區是印度和中國等一些人口最多且發展迅速的經濟體的所在地。隨著該地區工業化和都市化的不斷推進,能源需求迅速增加。隨著這些國家太陽能發電潛力巨大且太陽能成本不斷下降,迫切需要部署可再生能源,太陽能已成為理想的解決方案。

- 中國擁有龐大的製造設施,在太陽能板製造方面處於世界領先地位。該國負責全球約80%的太陽能板及相關設備製造,凸顯了該地區對太陽能板產業的重要性。

- 除了中國已經建立的太陽能板製造業之外,各國目前正在努力發展其製造基礎設施。例如,2023年10月,中國太陽能電力公司隆基與馬來西亞政府簽訂契約,在馬來西亞首都吉隆坡以北25公里的雙文丹(Serendah)建設三座太陽能光伏(PV)工廠。

- 促進清潔能源的有利政府政策和不斷下降的太陽能電池板價格使太陽能成為越來越有吸引力的選擇。這一趨勢在屋頂太陽能領域尤其明顯,商業和工業部門正在部署太陽能解決方案以降低能源成本並提高永續性,進一步推動該地區的太陽能板市場。

- 除了分散式屋頂太陽能之外,亞太地區大型太陽能發電工程也在激增。中國、印度、澳洲和越南等國家正在大力投資太陽能園區和公共產業規模設施,以實現可再生能源目標並減少碳排放。這些大型計劃需要大型太陽能電池板,為電池板製造商和供應商創造了利潤豐厚的市場。

- 因此,預計亞太地區在預測期內將主導太陽能板市場。

太陽能板產業概況

太陽能電池板市場部分分割。該市場的主要企業(排名不分先後)包括隆基綠色能源科技、天合光能、晶科能源、阿特斯陽光電力和第一太陽能公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章執行概述

第3章調查方法

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 政府扶持政策及政策

- 太陽能價格下降

- 抑制因素

- 與其他可再生能源的競爭

- 促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品服務的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 類型

- 結晶

- 多晶

- 薄膜

- 矽晶型

- 其他

- 最終用戶

- 住宅

- 商業/工業

- 公共產業

- 地區(2029 年之前的市場規模和需求預測)(僅按地區)

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 俄羅斯

- 土耳其

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 卡達

- 南非

- 其他中東/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- First Solar Inc.

- Hanwha Q CELLS Technology Co. Ltd

- Canadian Solar

- JinkoSolar Holding Co. Ltd

- Trina Solar Europe

- LONGi Solar

- JA SOLAR Technology Co. Ltd

- SunPower Corporation

- Adani Solar

- TataPower Solar

- Market Ranking/Share Analysis

第7章 市場機會及未來趨勢

- 技術創新進展

簡介目錄

Product Code: 50002210

The Solar Panel Market size is estimated at USD 257.22 billion in 2024, and is expected to reach USD 419.32 billion by 2029, growing at a CAGR of 10.27% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as supportive government policies for solar energy adoption and decreasing solar energy prices are expected to be among the most significant drivers for the solar panel market during the forecast period.

- On the other hand, competition from other renewable energy sources, such as bioenergy, wind energy, and hydropower, threatens the market during the forecast period.

- However, advancements in developing more innovative and efficient solar panels are ongoing. This factor is expected to create several opportunities for the market in the future.

- The Asia-Pacific region dominates the market and will likely register the highest CAGR during the forecast period. Due to the growing number of industries and infrastructural development activities in countries such as China, India, and Japan, as well as their high solar panel manufacturing base, they are driving the solar panel market.

Solar Panel Market Trends

Thin Film Solar Panel to Witness Significant Growth

- The thin-film photovoltaic module is considered a breakthrough in solar technology and is rapidly increasing its share in the solar power sector. Thin-film solar cells include amorphous silicon (a-Si), cadmium telluride (CdTe), and gallium selenide (CIGS) cells. CIGS thin-film solar cells convert sunlight into electrical energy and are made by coating multiple thin films on a glass substrate. They have a relatively higher absorption coefficient among non-silicon-based cells, which results in high conversion efficiency and long stability. Among all the types, CdTe is the most widely used and is estimated to hold a significant market share in the thin-film industry.

- Thin-film solar PV cells can be slightly less expensive to produce (per kW) than traditional silicon solar cells, as they require fewer construction materials. For instance, thin-film solar panels cost around USD 0.50 to USD 1 per watt for the materials, while traditional solar panels cost around USD 3 per watt. Due to their lower cost, mass production of thin-film solar cells is much easier than crystalline silicon. However, they are less efficient than crystalline silicon.

- Thin-film solar panels can be manufactured on flexible substrates, such as rolls of stainless steel or plastic. This flexibility allows for unique installations with irregular shapes on curved surfaces and rooftops. The versatility of thin-film panels opens up a new market for manufacturers to explore.

- With such unique features of this solar panel type, solar energy installation has witnessed significant growth in recent years. According to the International Renewable Energy Agency, the installed solar PV capacity in 2023 was around 1412.09 GW compared to 1066.55 GW, signifying the rapid solar panel installations worldwide.

- Additionally, investment in solar energy is experiencing a global boom. Driven by falling panel costs and a growing urgency to combat climate change, solar is on track to surpass oil and gas investment for the first time as of 2024.

- In February 2024, the Italian government announced an investment of EUR 90 million (USD 97 million) in Enel's 3Sun solar photovoltaic panel factory in Sicily. The National Recovery and Resilience Plan has EUR 90 million for this project, which allows the current factory to strengthen itself and establish a new production line potentially manufacturing different solar panel types in the factory, including thin film solar panels.

- Therefore, the thin-film solar panel is expected to grow significantly during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is emerging as a powerhouse in the global solar panel market, driven by rapidly growing energy demands, favorable government policies, and a solid commitment to transitioning toward renewable energy sources. This vast and diverse region, encompassing countries like China, India, Japan, Australia, and Southeast Asia, presents immense growth opportunities for solar panel manufacturers, installers, and associated industries.

- Asia-Pacific is home to the most populous and rapidly developing economies like India and China. As industrialization and urbanization activities in the region increase, there is a surge in energy demand. With the imperative of renewable energy adoption, solar energy has emerged as an ideal solution as these countries have high solar potential, and the cost of solar energy is declining.

- With its massive manufacturing facilities, China has been a global leader in solar panel manufacturing. The country is responsible for approximately 80% of the global solar panel and associated equipment manufacturing, highlighting the region's importance in the solar panel industry.

- Beyond China's already established solar panel manufacturing sector, various countries are still striving to develop their manufacturing base. For instance, in October 2023, China-based photovoltaics company Longi announced that the company reached an agreement with the Malaysian government to build three photovoltaic (PV) factories in Serendah, a town located 25km north of the country's capital, Kuala Lumpur.

- Favorable government policies promoting clean energy and declining solar panel prices are making solar power an increasingly attractive option. This trend is particularly evident in the rooftop solar segment, where commercial and industrial sectors are embracing solar solutions to reduce energy costs and enhance their sustainability profile, further driving the solar panel market in the region.

- In addition to distributed rooftop solar, Asia-Pacific is witnessing a surge in large-scale, utility-scale solar power projects. Countries like China, India, Australia, and Vietnam invest heavily in solar parks and utility-scale installations to meet their renewable energy targets and reduce carbon footprints. These massive projects require substantial solar panels, creating a lucrative market for panel manufacturers and suppliers.

- Therefore, the Asia-Pacific region is expected to dominate the solar panel market during the forecast period.

Solar Panel Industry Overview

The solar panel market is partially fragmented. Some key players in this market (in no particular order) include LONGI Green Energy Technology Co. Ltd, Trina Solar Co. Ltd, JinkoSolar Holding Co. Ltd, Canadian Solar Inc., and First Solar Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies and Regulations

- 4.5.1.2 Decreasing Solar Prices

- 4.5.2 Restraints

- 4.5.2.1 Competition from Other Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Monocrystalline

- 5.1.2 Polycrystalline

- 5.1.3 Thin Film

- 5.1.4 Crystal Silicon

- 5.1.5 Other Types

- 5.2 End Users

- 5.2.1 Residential

- 5.2.2 Commercial and Industrial

- 5.2.3 Utility

- 5.3 Geography [Market Size and Demand Forecast till 2029 (for Regions Only)]

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 NORDIC

- 5.3.2.7 Russia

- 5.3.2.8 Turkey

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Australia

- 5.3.3.4 Japan

- 5.3.3.5 South Korea

- 5.3.3.6 Malaysia

- 5.3.3.7 Thailand

- 5.3.3.8 Indonesia

- 5.3.3.9 Vietnam

- 5.3.3.10 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 Saudi Arabia

- 5.3.4.2 United Arab Emirates

- 5.3.4.3 Nigeria

- 5.3.4.4 Egypt

- 5.3.4.5 Qatar

- 5.3.4.6 South Africa

- 5.3.4.7 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Colombia

- 5.3.5.4 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 First Solar Inc.

- 6.3.2 Hanwha Q CELLS Technology Co. Ltd

- 6.3.3 Canadian Solar

- 6.3.4 JinkoSolar Holding Co. Ltd

- 6.3.5 Trina Solar Europe

- 6.3.6 LONGi Solar

- 6.3.7 JA SOLAR Technology Co. Ltd

- 6.3.8 SunPower Corporation

- 6.3.9 Adani Solar

- 6.3.10 TataPower Solar

- 6.4 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Innovation

02-2729-4219

+886-2-2729-4219