|

市場調查報告書

商品編碼

1521730

RISC-V 技術 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)RISC-V Tech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

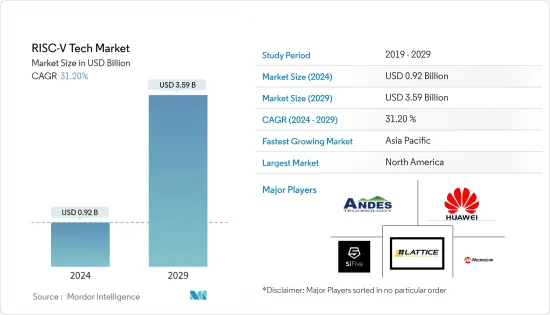

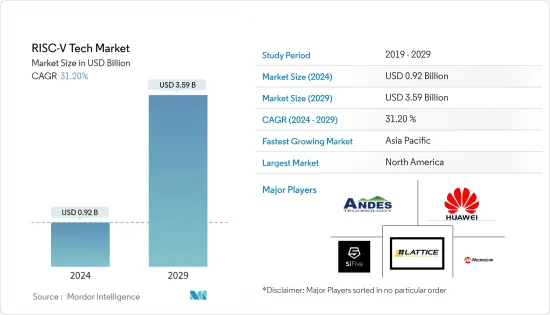

RISC-V技術市場規模預計到2024年為9.2億美元,預計到2029年將達到35.9億美元,在預測期內(2024-2029年)複合年成長率為31.20%。

主要亮點

- RISC-V技術架構為處理器提供了執行各種任務的簡化指令,預計該市場將出現高速成長。開發人員可以創建數千個潛在的自訂處理器,從而縮短上市時間。 IP 處理器的標準化也減少了軟體開發時間。 RISC-V架構比傳統ISA更具適應性和靈活性。此外,它可以支援多種應用,有助於市場成長。

- RISC-V 的發展得到了致力於制定技術標準、鼓勵創新和培育多元化生態系統的全球社區的支持。全球社區貢獻了公共 IP,並創建了一組可與基本 ISA 一起使用的通用擴展。所有擴充均不是專有的;它們都是開放原始碼且公開的。

- Android 生態系統正藉助 RISC-V 快速邁向未來。谷歌宣布將在 Android 中正式支援 RISC-V,旨在利用與 ARM 晶片相當的架構,進一步強化了這一轉變。 2024 年,Google計劃推出功能齊全的 RISC-V 模擬器,允許用戶在不同類型的裝置(包括行動電話和平板電腦)上測試應用程式和遊戲。因此,由於配備更好技術的智慧型手機生產和銷售的擴大以及5G和6G整合度的快速增加,ROISC-V技術市場預計將在全球範圍內佔據廣泛佔有率。

- 此外,新產品開拓、併購和策略聯盟等供應商活動也很活躍,正在推動市場發展。例如,2024年3月,Tenstorrent宣布與MosChip Technologies建立策略夥伴關係,共同設計Tenstorrent的尖端RISC-V解決方案。透過此次合作,Tentorrent 旨在設計最強大的 RISC-V 解決方案並鞏固其在市場中的地位。

- 同樣在 2023 年 6 月,Bluespec Inc. 宣布發布其新型 MCUX RISC-V 處理器,該處理器可協助開發人員實現自訂指令並為 FPGA 和 ASIC 添加加速器。 Bluespec 的 MCUX 嵌入式處理器是為那些需要小型處理器來取代可程式設計硬體狀態機的使用者配置和控制自訂模組、I/O 設備、感測器、致動器和加速器而設計的。這使得 MCUX 成為許多使用案例的理想選擇,包括影像處理、視訊解碼、音訊解碼、雷達警報應用以及邊緣系統、工業自動化、國防和物聯網。

- 此外,RISC-V架構也用於HPC和行動裝置等高效能應用。高 PPA 要求還需要業界領先的設計自動化工具和方法,這帶來了市場挑戰。

RISC-V技術市場趨勢

汽車和交通運輸業可望高成長

- 汽車產量的增加和先進功能的增加是推動汽車產業對 RSIC-V 技術需求的關鍵因素。 RISC-V 生態系統是支援和實現車載計算所有發展的技術和專業知識的來源。在汽車領域,RISC-V 技術支援開發客製化、高度專業化和擴展的功能,以解決高度專業化汽車 SoC 中的功耗、功能安全和安全性等關鍵行業挑戰。

- RISC-V 提供了完美的處理平衡,可在核心層級進行配置,從簡單的低功耗感測器和致動器到區域控制器、網域控制器,以及車輛中的集中式高效能運算。

- 汽車產業對 ADAS(高級駕駛輔助系統)、資訊娛樂系統和動力傳動系統控制等應用的 RISC-V 很感興趣。 RISC-V 的開放原始碼程式碼和可自訂指令集使汽車製造商能夠針對特定需求(例如即時處理、安全關鍵操作和低功耗)最佳化處理器。

- 近年來,自動駕駛汽車的發展趨勢備受關注,隨著自動駕駛汽車預計將配備大量電子/控制單元,車輛安全變得更加重要。因此,該領域的進一步努力預計將為所研究的市場帶來機會。此外,英特爾預計,到 2030 年,全球汽車銷售將達到約 1.014 億輛,其中自動駕駛汽車約佔當年車輛登記量的 12%。

- 此外,世界各國政府正在採取措施加速自動駕駛汽車的部署,刺激了對 ADAS 的需求。英國政府最近宣布推出自動車道維持系統(ALKS)技術。 ALKS 專為低速交通而設計,允許車輛在單車道上自動駕駛,同時保留必要時將控制權交還給駕駛員的能力。

- 此外,印度政府也透過各種法規和政策積極推動ADAS的採用。預計這些舉措將反映全球趨勢,並要求新車配備某些 ADAS 功能。在此類法規的支持下,預計RISC-V的普及將會加速。

亞太地區預計將出現顯著成長

- 由於家用電子電器和汽車銷量的增加、政府促進電子製造的舉措、多家公司的存在以及對其他行業的投資,該地區的 RISC-V 技術市場預計將成長。該區域市場的主要企業包括中國、印度、韓國和日本,這些國家在半導體產業取得了重大進展。由於先進電子設備的激增,該地區獲得了巨大的市場佔有率。

- 印度品牌資產基金會(IBEF)表示,印度的目標是到2025-26年實現電子製造業3,000億美元、出口1,200億美元的目標。此外,2023-24 年聯邦預算已為電子和資訊技術部累計1,654.9 億印度盧比(20 億美元),這意味著每年大幅成長約 40%。許多公司持續大力投資建立製造設施,預計將進一步推動市場成長。

- 此外,該地區各國政府正致力於採取舉措擴大 RISC-V 技術的採用,這將進一步推動市場成長。例如,2023年11月,印度政府宣布啟動數位印度RISC-V(DIR-V)計畫的全國路演。 RISC-V (DIR-V) 計畫為新興企業、企業家和學生提供了進一步推動印度半導體生態系統的機會。

- 同樣,2023年11月,中國政府宣布了發展以RISC-V為核心的國產晶片的綜合計畫。政府正在資助RISC-V晶片的開發工作,許多大學和科研機構也專注於以RISC-V為中心的晶片開發。

- 此外,中國科學院 (CAS) 也與阿里巴巴、騰訊和中興通訊等主要企業合作開發名為「香山-v3」的先進 RISC-V 晶片。

- 此外,該地區資料中心的擴張將促進市場成長。例如,Colt 資料 Center Services (Colt DCS) 於 2024 年 3 月宣布,將透過在清奈收購 10 英畝的新場地來擴大其在印度南部的業務。到 2027 年,該公司計劃在清奈的Ambattur(一個快速成長的數位中心)提供一個超大規模資料中心。

RISC-V技術產業概況

RISC-V技術市場是一個半固定市場,著名參與企業包括Lattice Semiconductor、Microchip Technology、Andes Technology Corporation、SiFive Inc.和華為技術有限公司。

- 2024 年 4 月,Imagination Technologies 宣布推出新 RISC-V 應用處理器 IP:ImaginationAPXM-6200 CPU。它側重於功率密度,通常稱為效率核心。該 CPU 的目標市場包括消費者和工業設備,並且最終將包括汽車版本。這款新處理器是 Catapult CPU IP 處理器產品組合的一部分。

- 2024 年 3 月,瑞薩電子發布了一款基於 RISC-V 的 32 位元通用微控制器 (MCU),配備了內部開發的 CPU 核心。全新 R9A02G021 微控制器系列為嵌入式系統設計人員提供了一條清晰的途徑,可基於開放原始碼指令集架構ISA 創建各種節能且經濟高效的應用。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19副作用和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 高效能運算的需求不斷成長

- 連網型和自動駕駛車輛的激增

- 市場限制因素

- 缺乏實施

- 轉換成本高

第6章 市場細分

- 按用途

- 智慧型手機

- 5G設備

- 資料中心

- 電腦/遊戲機

- 行動電話網路裝置

- 物聯網設備

- 其他

- 按最終用戶產業

- 運算和儲存

- 通訊基礎設施

- 消費性電子產品

- 汽車/運輸設備

- 醫療保健

- 航太/軍事

- 產業

- 其他

- 按地區*

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 中東/非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Codasip

- Microchip Technology

- Bluespec

- Google Inc.(Alphabet Inc.)

- Alibaba Group Holdings Ltd.

- Andes Technology Corp.

- Huawei Technologies Co. Ltd.

- Starfive Technology Co. Ltd.

- SiFive, Inc.

- Lattice Semiconductor

第8章投資分析

第9章 市場機會及未來趨勢

The RISC-V Tech Market size is estimated at USD 0.92 billion in 2024, and is expected to reach USD 3.59 billion by 2029, growing at a CAGR of 31.20% during the forecast period (2024-2029).

Key Highlights

- The RISC-V Tech market will witness high growth as the architecture provides the processor with simplified instructions to perform various tasks. Developers can create thousands of potential custom processors, reducing time to market. The standardization of IP processors also saves time in software development. The RISC-V architecture is easier to adapt to than traditional ISAs and allows a greater degree of flexibility. Furthermore, they are compatible with a wide variety of applications and thus contribute to market growth.

- RISC-V growth is supported by a global community working to develop technical standards, encourage innovation, and foster a diverse ecosystem. The global community contributed to public IP to create a common set of extensions that can be used with the base ISA. None of the extensions are proprietary; they are all open-source and publicly available.

- The Android ecosystem is moving quickly into the future with RISC-V. This shift was reinforced when Google announced official support for RISC-V in Android, aiming to use the architecture on par with the ARM chip. In 2024, Google plans to make a full-featured RISC-V emulator publicly available to allow users to test apps and games on different types of devices, including phones and tablets. Thus, with the growing production and sales of smartphones with better technologies, along with the surging incorporation of 5G and 6G, the ROISC-V Tech market is expected to gain a wide share of traction globally.

- Moreover, the market is also witnessing significant vendor activities such as new product development, mergers & acquisitions, and strategic partnerships, thereby driving the market. For instance, in March 2024, Tenstorrent announced a strategic partnership with MosChip Technologies on design for Tenstorrent's cutting-edge RISC-V solutions. Through this partnership, Tenstorrent will design the strongest RISC-V solution and aim to strengthen its position in the market.

- Similarly, in June 2023, Bluespec Inc. announced the release of its new MCUX RISC-V processor that assists developers in implementing custom instructions and adding accelerators to FPGAs and ASICs. Bluespec's MCUX embedded processor is designed for applications that require a small processor to configure and control custom modules, I/O devices, sensors, actuators, and accelerators and to replace fixed hardware state machines that are programmable. This makes MCUX ideal for image processing, video decoding, audio decoding, and radar alarm applications, as well as many other use cases in edge systems, industrial automation, defense, IoT, and beyond.

- Furthermore, the RISC-V architecture is used for high-performance applications such as HPC and mobile devices. PPA requirements are also high, requiring industry-leading design automation tools and methodologies, which can act as a challenge for the market.

RISC-V Tech Market Trends

The Automotive & Transportation Industry is Expected to Witness High Growth

- Growing automotive production and the addition of advanced features are some of the major factors driving the demand for RSIC-V technology in the automotive sector. The RISC-V ecosystem is a source of technology and expertise that can support and enable any development in automotive computing. In automobiles, RISC-V technology enables the development of customized, highly specialized extensions and addresses key industry challenges such as power consumption, functional safety, and security in highly specialized automotive SoCs.

- The demand for RISC-V in vehicles is increasing as it offers the perfect balance of processing, configurable at the core level, from simple, low-power sensors and actuators to zone controllers, domain controllers, and centralized high-performance computing in vehicles.

- The automotive industry has shown interest in RISC-V for applications including advanced driver assistance systems, infotainment systems, and powertrain control. RISC-V's open-source code and customizable instruction set enable automakers to optimize their processors for specific needs such as real-time processing, safety-critical operations, and low power consumption.

- With the trend of autonomous vehicles gaining prominence in recent years, the importance of vehicle safety becomes even more crucial as autonomous vehicles are anticipated to contain a large number of electronic/control units. Hence, further work in this area will create opportunities in the studied market. Moreover, Intel estimates that global car sales will reach approximately 101.4 million units by 2030, and autonomous cars are predicted to account for around 12% of car registrations by that year.

- Furthermore, governments around the globe are taking measures to speed up the deployment of autonomous vehicles, which will fuel demand for ADAS. The UK Government recently announced the launch of automated lane-keeping system (ALKS) technology, which will help expedite the deployment of self-driving cars in the region. Designed for use in slow traffic, ALKS allows a vehicle to drive itself in a single lane while retaining the ability to return control to the driver when necessary.

- Furthermore, the Indian government is also actively promoting the adoption of ADAS through various regulations and policies. Initiatives are expected to mandate certain ADAS features in new vehicles, reflecting global trends. This regulatory push is expected to accelerate the widespread adoption of RISC-V.

Asia-Pacific is Expected to Witness Significant Growth

- The RISC-V Tech market in the region is expected to grow due to increasing sales of consumer electronics and automotive, government initiatives to promote electronics manufacturing and the presence of several companies and investments in other industries. Key players in the region's market include China, India, South Korea, and Japan, which have made significant strides in the semiconductor industry. The region commands substantial market share due to the widespread adoption of advanced electronic devices.

- According to the Indian Brand Equity Foundation (IBEF), India has aimed to achieve a target of USD 300 billion in electronics manufacturing and USD 120 billion in exports by 2025-26. Furthermore, the Union Budget 2023-24 has earmarked INR 16,549 crore (USD 2 billion) for the Ministry of Electronics and Information Technology, representing a substantial annual increase of approximately 40%. Numerous companies are consistently making significant investments in establishing manufacturing facilities, which will further support the market's growth.

- Moreover, the government in the region is focusing on taking the initiative to increase the adoption of RISC-V technology, which will further support the market's growth. For instance, in November 2023, the government of India announced the flag of the Nationwide Roadshow on Digital India's RISC-V (DIR-V) Program. RISC-V (DIR-V) Program will offer opportunities to startups & entrepreneurs, and students to further catalyze the semiconductor ecosystem in India.

- Similarly, in November 2023, the Chinese government announced its comprehensive plan to develop domestic chips around RISC-V. The government has funded RISC-V chip development efforts, and many universities and science labs are also focusing on chip development around RISC-V.

- In addition, the Chinese Academy of Sciences (CAS) is also developing an advanced RISC-V chip called XiangShan-v3 in collaboration with top Chinese companies, including Alibaba, Tencent, and ZTE.

- Furthermore, the expansion of data centers in the region will drive the market's growth. For instance, in March 2024, Colt Data Centre Services (Colt DCS) announced the expansion of its presence in Southern India with the acquisition of a new 10-acre plot in Chennai. It plans to deliver a hyperscale data center in the fast-growing digital hub of Ambattur, Chennai, by 2027.

RISC-V Tech Industry Overview

The RISC-V Tech market is characterized as a semi-consolidated market featuring prominent players like Lattice Semiconductor, Microchip Technology, Andes Technology Corporation, SiFive Inc., and Huawei Technologies Co. Ltd. These key players in the market are actively pursuing various strategies, including partnerships and acquisitions, to enhance their product portfolios and establish sustainable competitive advantages.

- In April 2024, Imagination Technologies announced the introduction of a new RISC-V applications processor IP, the Imagination APXM-6200 CPU. The focus is on power density, commonly called the efficiency core. Target markets for the CPU include consumer and industrial devices, and eventually, an automotive version will also be included. The new processor is part of the Catapult CPU portfolio of IP processors.

- In March 2024, Renesas announced the release of general-purpose 32-bit RISC-V-based microcontrollers (MCUs) built with an internally developed CPU core. The new R9A02G021 microcontroller family offers embedded system designers a clear path to creating a wide range of energy-efficient and cost-effective applications based on the open-source instruction set architecture ISA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For High Performance Computing

- 5.1.2 The Surge of Connected Autonomous Vehicles

- 5.2 Market Restraints

- 5.2.1 Lack of Implementation

- 5.2.2 High Switching Costs

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Smartphones

- 6.1.2 5G Devices

- 6.1.3 Data Centers

- 6.1.4 Personal Computer and Game Consoles

- 6.1.5 Cellular Network Devices

- 6.1.6 IoT Devices

- 6.1.7 Other Applications

- 6.2 By End-user Industry

- 6.2.1 Computing and Storage

- 6.2.2 Communication Infrastructure

- 6.2.3 Consumer Electronics

- 6.2.4 Automotive & Transportation

- 6.2.5 Medical

- 6.2.6 Aerospace & Military

- 6.2.7 Industrial

- 6.2.8 Other End-user Industries

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Middle East and Africa

- 6.3.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Codasip

- 7.1.2 Microchip Technology

- 7.1.3 Bluespec

- 7.1.4 Google Inc. (Alphabet Inc.)

- 7.1.5 Alibaba Group Holdings Ltd.

- 7.1.6 Andes Technology Corp.

- 7.1.7 Huawei Technologies Co. Ltd.

- 7.1.8 Starfive Technology Co. Ltd.

- 7.1.9 SiFive, Inc.

- 7.1.10 Lattice Semiconductor