|

市場調查報告書

商品編碼

1521833

視訊會議硬體:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Video Conferencing Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

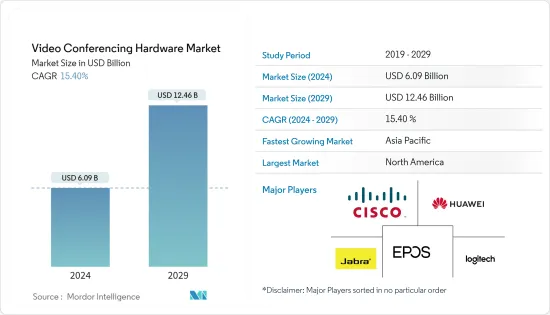

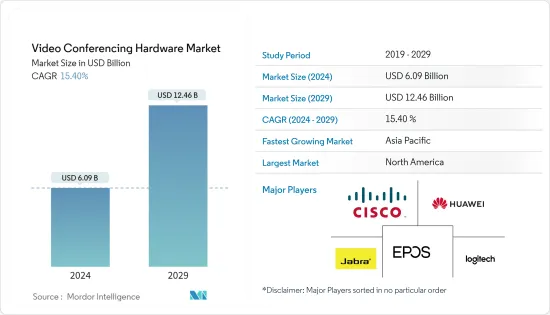

視訊會議硬體市場規模預計到 2024 年為 60.9 億美元,預計到 2029 年將達到 124.6 億美元,在預測期內(2024-2029 年)複合年成長率為 15.40%。

主要亮點

- 視訊會議已成為現代通訊的重要工具,連接世界各地的個人和企業。它的重要性超出了日常會議的範圍,也影響到設施和商業空間等領域。

- 隨著全球化和機器容量等因素使遠距工作計畫越來越被接受,人們對視訊會議硬體的興趣也在增加。跨產業的組織透過視訊會議進行虛擬會議、協作和通訊。

- 此外,隨著勞動力的靈活性和自主性,結合遠距和麵對面工作的混合工作模式變得越來越受歡迎。這一趨勢需要視訊會議解決方案能夠無縫連接遠端和現場員工,無論身在何處都能實現高效協作。隨著組織轉向混合職場環境,對提供虛擬會議室、螢幕共用和行動輔助功能等功能的視訊會議硬體的需求很高,從而推動了對視訊會議硬體市場的需求。

- 高速網路的普及以及筆記型電腦、平板電腦和智慧型手機的廣泛採用,使視訊會議成為全球企業、辦公室和個人的重要通訊解決方案。此外,根據中國國家統計局的數據,2024年1月至2月,中國電腦成品產量達4,545萬台。

- 新興低度開發國家有限的通訊基礎設施阻礙了高品質的視訊傳輸。通訊基礎設施的缺乏是視訊會議硬體市場的主要挑戰。

- 政府對視訊會議硬體產品進出口的監管等宏觀經濟因素可能對市場成長產生重大影響。這些法規因國家/地區而異,通常需要廣泛的認證、測試並遵守特定標準。儘管這些法規旨在確保安全和品質,但它們可能給製造商、經銷商和最終用戶帶來重大挑戰。

視訊會議硬體市場趨勢

商業航太領域預計將佔據較大佔有率

- 對有效通訊和協作工具日益成長的需求推動了視訊會議硬體在商業領域的廣泛採用,特別是隨著遠端和混合工作模式趨勢的增加。

- 企業正在使用視訊會議來實現虛擬會議、計劃協作以及地理位置分散的團隊之間的即時通訊。對安全和無縫通訊解決方案的需求,加上提高生產力和決策流程的需求,使企業處於視訊會議採用的最前沿。

- 辦公室對視訊會議的需求正在增加,因為它有助於提高生產力。員工無需向同事或員工發送電子郵件並期望第二天得到回复,而是可以進行快速視訊會議並使用螢幕共用工具來推動計劃向前發展。

- 此外,視訊會議的移動性和靈活性使員工能夠更好地控制自己的工作時間,從而提高忠誠度。當遠距工作者定期與同事見面並互動時,他們會感覺聯繫更加緊密,並成為團隊的一部分。這些好處將增加商業空間中視訊會議的採用,並在預估期間內推動市場成長。

- 此外,市場上的多家供應商都致力於提供新的視訊會議產品以改善用戶體驗。例如,2024年1月,創通通訊在CES 2024上發布了AI視訊會議解決方案的新產品。本公告旨在提升業務溝通協作的體驗與效率。該解決方案基於一體化視訊欄,基於高通視訊協作 VC5 平台,配有四個攝影機。該解決方案使用戶能夠享受優質且引人入勝的視訊會議。

- 此外,辦公空間的建設和擴張的增加預計也將促進市場成長。根據澳洲統計局的數據,2023 年澳洲辦公大樓工程價值約為 100 億澳元(66 億美元),而 2022 年為 87 億澳元(57.4 億美元)。

預計北美將佔據主要佔有率

- 北美對視訊會議硬體的需求正在增加,因為美國和加拿大擁有完善的網路基礎設施,其中包括眾多電信業者和硬體供應商。一旦速度更快、影像和聲音品質更高的5G網路出現,視訊會議產業預計將發生重大變化。

- 遠距工作的盛行和對無縫虛擬通訊的需求正在推動北美對視訊會議硬體的需求。文化向靈活工作的持續轉變以及對高效且具有成本效益的溝通平台的需求也推動了市場的成長。隨著企業尋求提高生產力和簡化通訊流程,視訊會議市場不斷發展,為遠端協作解決方案的創新和市場擴張提供了充足的機會。

- Tech.co 的一項調查顯示,到 2023 年,在允許完全遠距工作的公司工作的美國受訪者中有90% 表示他們的組織使用視訊會議;只有70% 的受訪者計劃在辦公室待至少五天。

- 該地區許多跨國公司(例如IBM公司)都致力於普及這些硬體以進行員工培訓,預計這將對市場成長產生有利影響。例如,IBM公司使用Cisco視訊會議系統為在世界各地工作的員工提供全面的培訓。

- 該地區的多家視訊會議硬體供應商正在透過多樣化和複雜的產品來推動市場發展,以滿足視訊會議硬體技術改善日益成長的需求。例如,2024年3月,FS宣布推出FS FC570S,這是一款精心設計的4K一體機會議攝影機,旨在改善所有參與者的視訊會議體驗。該設備配備超高清4K感測器,並擁有121個超廣角鏡頭,覆蓋整個房間。 FC570S 4K 配備四個麥克風和最先進的降噪和迴聲消除功能,可為沉浸式會議提供清晰的音訊。

- 此外,2024 年 4 月,Mobile Video Devices Inc. (MVD) 宣布與 Telycam 建立新的經銷合作夥伴關係。 MVD 將向美國和加拿大的系統整合商和經銷商銷售和支援 Telycam 的 PTZ 攝影機和網路攝影機,包括用於直播製作的旗艦產品 Explore 系列,並擁有美國獨家經銷權。

視訊會議硬體產業概況

隨著全球參與企業不斷創新其產品以向用戶提供具有成本效益的產品,視訊會議硬體市場正在見證市場競爭對手的高度整合。擁有重要市場佔有率的領先公司正在利用策略合作計劃,並專注於擴大海外基本客群,以提高市場佔有率和盈利。主要參與企業包括思科系統公司、羅技國際公司、Jabra、EPOS 和華為技術有限公司。

- 2024 年 3 月,思科宣布推出一款新型多功能設備,旨在為當今的混合勞動力提供現代化的協作體驗。 Cisco Board Pro G2 是一款由 AI 提供支援的觸控協作設備。 Cisco 桌上型電話 9800 系列旨在為每張辦公桌提供現代化、個人化的生產力中心。

- 2024 年 1 月,巴可宣布推出 ClickShare Bar,這是一款創新視訊欄,可在中小型會議室中實現無線會議。該視訊欄是一款功能強大的設備,它智慧地整合了高品質的音訊和視訊功能,以增強著名的點擊共享體驗。 Clickshare 欄易於安裝、總擁有成本低,並提供無與倫比的靈活性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈

- COVID-19 後遺症和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 遠距工作的趨勢日益成長

- 快速遷移至雲端視訊會議

- 市場限制因素

- 實施硬體解決方案的成本高昂

第6章 市場細分

- 依硬體類型

- 多重控制單元(MCU)

- 協作欄

- 轉碼器系統

- USB攝影機

- 基於 USB 的交錯條

- 其他捆綁套件

- 企業耳機

- 按最終用戶

- 教育機構

- 商業空間

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東/非洲

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 北美洲

第7章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- Logitech International SA

- Jabra

- Huawei Technologies Co. Ltd

- EPOS

- Poly

- Barco

- TrueConf LLC

- Nexvoo

- Aver

第8章市場展望

The Video Conferencing Hardware Market size is estimated at USD 6.09 billion in 2024, and is expected to reach USD 12.46 billion by 2029, growing at a CAGR of 15.40% during the forecast period (2024-2029).

Key Highlights

- Video conferencing has become an essential tool in modern communication, connecting individuals and businesses worldwide. Its importance extends beyond everyday meetings and impacts sectors such as institutional and commercial spaces.

- As remote work plans become increasingly accepted due to factors such as globalization and mechanical capacity, interest in video conferencing hardware is growing. Organizations of various businesses conduct virtual meetings, collaborative work, and correspondence through video conferencing.

- Moreover, hybrid work models that combine remote and in-person work are becoming increasingly popular as the workforce embraces flexibility and autonomy. This trend requires a video conferencing solution that seamlessly connects remote and on-site employees to enable productive collaboration regardless of physical location. As organizations transition to hybrid work environments, there is a high demand for video conferencing hardware that offers features including virtual meeting rooms, screen sharing, and mobile accessibility, thus driving the demand for the video conferencing hardware market.

- With the proliferation of high-speed internet and the wide spread of laptops, tablets, and smartphones, video conferencing has become an indispensable communication solution for enterprises, offices, and individuals globally. Furthermore, according to the National Bureau of Statistics of China, during January/February of 2024, the production value of finished computers in China stood at 45.45 million units.

- Limited communication infrastructure in emerging and underdeveloped nations hinders high-quality video transmission. Thus, the lack of a strong communication infrastructure represents a significant challenge for the video conferencing hardware market.

- Macroeconomic factors such as government regulation on the import/export of video conferencing hardware products can significantly impact the market's growth. These regulations vary from country to country, often requiring extensive certifications, testing, and adherence to specific standards. While these regulations aim to ensure safety and quality, they can pose significant challenges for manufacturers, distributors, and end-users.

Video Conferencing Hardware Market Trends

Commercial Space Segment Expected to Hold Significant Share

- The wide adoption of video conferencing hardware in the commercial space is driven by the need for effective communication and collaboration tools, especially as the trend toward remote and hybrid working models increases.

- Businesses use video conferencing to enable virtual meetings, project collaboration, and real-time communication between geographically distributed teams. The need for secure and seamless communication solutions, combined with the need to improve productivity and decision-making processes, has put the business at the forefront of video conferencing implementation.

- The demand for video conferencing in the office is increasing as it helps to boost productivity. Instead of sending an email to a colleague or employee and expecting an answer the next day, employees can connect for a fast video conference session and use a screen-share tool to go on with their project.

- Moreover, the mobility and flexibility of video conferencing give employees more control over their work time, which increases loyalty. When remote workers can interact face-to-face with colleagues on a regular basis, they feel more connected and part of a team. Thus, such benefits increase the adoption of video conferencing in commercial spaces and drive the market's growth during the projected timeline.

- Furthermore, several vendors in the market are focusing on offering new products for video conferencing to improve the user experience. For instance, in January 2024, Thundercomm announced introducing its new set of AI video conferencing solutions at CES 2024. The launch aims to improve the experience and efficiency of business communication and collaboration. It is based on the all-in-one video bar based on the Qualcomm Video Collaboration VC5 platform and comes with a four-camera implementation. This solution allows users to enjoy a premium and engaging video conferencing experience.

- Moreover, the rising construction and expansion of office space are also expected to support the market's growth. According to the Australian Bureau of Statistics, in 2023, the value of construction work done on offices in Australia came to approximately AUD 10 billion (USD 6.60 Billion) compared to AUD 8.7 billion (USD 5.74 billion) in 2022.

North America is Expected to Hold Major Share

- The demand for video conferencing hardware in North America is increasing as the United States and Canada have well-established internet infrastructure, including numerous telecommunications companies and hardware providers. The development of 5G networks with faster speeds and higher image and video quality is expected to transform the video conferencing industry.

- The widespread adoption of remote work and the need for seamless virtual communication has increased the demand for video conferencing hardware in North America. Additionally, the continued shift in culture toward flexible working arrangements and the demand for efficient and cost-effective communication platforms have accelerated the market's growth. As businesses aim to improve productivity and streamline communication processes, the video conferencing market continues to evolve, providing ample opportunity for innovation and market expansion for remote collaboration solutions.

- According to a survey by Tech.co, in 2023, 90% of respondents working for companies in the United States and able to work fully remotely reported that their organization was using video conferencing, while only 70% of respondents expected to be in the office at least five days a week mentioned using this tool.

- Many multinational companies in the region, such as IBM Corporation, are focusing on the widespread use of these hardware for employee training, which will have a beneficial impact on the market's growth. For example, IBM Corporation uses Cisco Systems video conferencing systems to provide integrated training to employees working in various locations worldwide.

- Several video conferencing hardware providers in the region are offering diverse and sophisticated products to meet the growing demand for improved technology in video conferencing hardware, thereby boosting the market. For instance, in March 2024, FS announced the launch of the FS FC570S 4K all-in-one conference camera, carefully designed to enhance the video conferencing experience for all participants. The device is built with an ultra-high-definition 4K sensor and boasts a 121 ultra-wide-angle lens that covers the entire room. With an impressive array of four microphones and cutting-edge noise reduction and echo cancellation, the FC570S 4K delivers pristine audio clarity for an immersive meeting experience.

- Furthermore, in April 2024, Mobile Video Devices Inc. (MVD) announced a new distribution partnership with Telycam. MVD will distribute and support Telycam's PTZ cameras and webcams, including the flagship Explore series for live broadcast production, to system integrators and resellers in the United States and Canada, with exclusive US distribution rights.

Video Conferencing Hardware Industry Overview

The video conferencing hardware market is consolidated as global players innovate their products to provide cost-benefit offers to users, which creates high rivalry among market competitors. Major players with a prominent share in the market are focusing on expanding their customer base across foreign countries by leveraging strategic collaborative initiatives to increase their market share and profitability. Key players are Cisco System Inc., Logitech International SA, Jabra, EPOS, Huawei Technologies Co. Ltd, etc.

- March 2024: Cisco announced the launch of a new multifunction device purpose-built to deliver a modernized collaboration experience for today's hybrid workforce. Cisco Board Pro G2 is an AI-powered, touch-enabled collaboration device. The Cisco Desk Phone 9800 Series is designed to deliver a modern, personalized productivity hub to every desk.

- January 2024: Barco announced the launch of ClickShare Bar, an innovative video bar that enables wireless conferencing in medium-sized and small meeting rooms. This video bar enhances the renowned ClickShare experience with high quality audio and video features intelligently integrated into one powerful device. ClickShare Bar is easy to install, has a low total cost of ownership, and offers unparalleled flexibility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Trend for Remote Works

- 5.1.2 Rapid Migration to Cloud Video Conferencing

- 5.2 Market Restraints

- 5.2.1 High Cost of Hardware Solutions Deployment

6 MARKET SEGMENTATION

- 6.1 By Type of Hardware

- 6.1.1 Multi Control Units (MCU)

- 6.1.2 Collaboration Bars

- 6.1.3 Codec Systems

- 6.1.4 USB Cameras

- 6.1.5 USB-based Interagted Bars

- 6.1.6 Other Bundled Kits

- 6.1.7 Enterprise Headsets

- 6.2 By End User

- 6.2.1 Institutions

- 6.2.2 Commercial Spaces

- 6.3 By Geography***

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Brazil

- 6.3.5.2 Argentina

- 6.3.5.3 Mexico

- 6.3.6 Middle East and Africa

- 6.3.6.1 South Africa

- 6.3.6.2 United Arab Emirates

- 6.3.6.3 Saudi Arabia

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Logitech International SA

- 7.1.3 Jabra

- 7.1.4 Huawei Technologies Co. Ltd

- 7.1.5 EPOS

- 7.1.6 Poly

- 7.1.7 Barco

- 7.1.8 TrueConf LLC

- 7.1.9 Nexvoo

- 7.1.10 Aver