|

市場調查報告書

商品編碼

1521869

汽車維修與保養服務:市場佔有率分析、產業趨勢、成長預測(2024-2029)Automotive Repair And Maintenance Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

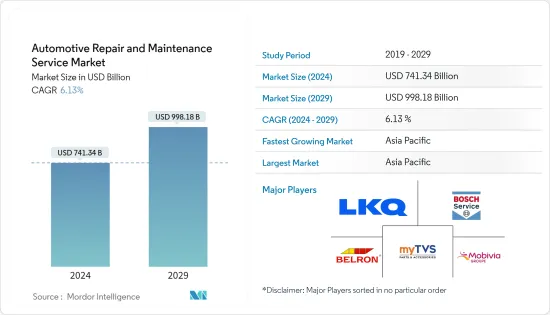

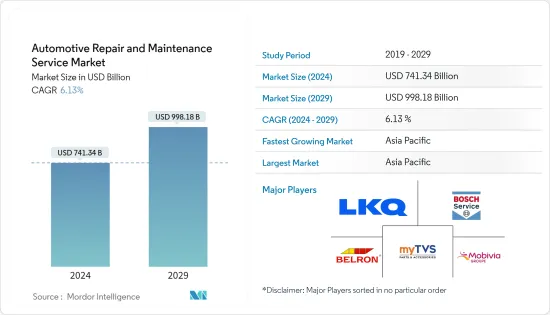

2024年汽車維修和保養服務市場規模預計為7,413.4億美元,預計到2029年將達到9,981.8億美元,在預測期內(2024-2029年)複合年成長率為6.13%。

汽車持有的增加、車齡的增加以及政府對汽車安全標準的嚴格監管以減少道路死亡人數是全球汽車維修和保養服務市場成長的關鍵決定因素。隨著汽車的老化,日常檢查和定期維護的需求越來越大,以確保平穩運行。此外,為了在二手車市場保持較高的轉售價值,乘用車和商用車車主往往傾向於更換零件並將組件升級到最新標準,這增加了對汽車維修和保養的需求。

主要亮點

- 2023年第一季美國汽車持有將達到2.86億輛,而2022年第四季為2.852億輛,與去年同期的2022年第四季和2023年第一季相比,具體成長率為0.1% 。

- 此外,根據英國運輸部的數據,2022年英國汽車持有數量將達3,320萬張,而2021年為3,270萬張,2021年至2022年年增1.5%。

- 根據德國聯邦汽車運輸局的數據,到2023年,5至9歲的兒童將佔德國道路上乘用車的最高佔有率,達到26.8%,而10至14歲的兒童將佔21.7%。

然而,電動車的激增正在阻礙汽車維修服務公司的業務潛力,因為電動車比傳統內燃機汽車需要更少的維護頻率。電動車缺乏傳統的引擎、變速箱和某些相關零件。因此,隨著電動車在道路上的比例增加,對變速箱和排氣服務以及換油的需求預計將下降。這些公司指出,雖然對電動車電池更換等其他服務的需求可能會增加,但不能保證該需求足以維持過去的銷售表現。

主要亮點

- 根據國際能源總署(IEA)預測,2022年全球電池式電動車(BEV)總銷量將達到730萬輛,而2021年為460萬輛,2021年至2022年比與前一年同期比較成長58.6%。 。

為了滿足自動駕駛汽車、聯網汽車和其他現代車輛日益成長的需求,維修和保養技術的快速進步預計將成為汽車維修和保養服務市場的關鍵驅動力。服務中心擴大引入讀碼器和掃描器等診斷工具,以快速檢測和診斷車輛故障。

此外,Revv 等公司正在大力投資為維修中心建造數位平台,以檢測高度複雜的 ADAS 系統中的問題。因此,隨著技術整合的不斷加強和積極投資,不斷為服務中心提供創新軟體,汽車維修和保養服務市場預計將在2024-2029年期間呈現快速成長。

汽車維修保養服務市場趨勢

預計2024年至2029年乘用車市場將快速成長

消費者對私家車的日益偏好、共享出行需求的增加以及車輛的老化正在推動乘用車市場的發展。全球乘用車銷量不斷成長,推動了汽車維修和保養服務市場的發展。因此,車主每 3 至 6 個月就去服務中心進行定期保養,這推動了市場的成長。

- 根據歐洲汽車工業協會(ACEA)的數據,2023年乘用車註冊數量最多的歐洲主要國家是德國、英國和法國。

- 2023年,德國乘用車新註冊量將達280萬輛,其次是英國160萬輛和法國150萬輛。

此外,由於消費者偏好低成本的通勤方式,近年來共享出行服務,特別是叫車服務的需求量很大。與私家車相比,這些車輛必須行駛遠距,並且通常需要更長的行駛時間,因此更難選擇頻繁更換機油和濾清器以及車身護理等其他日常維護服務,從而增加了這種需求。此外,隨著車輛車車齡的增加,對汽車輪胎更換和輪圈定位等服務的需求不斷增加,這有助於汽車維修服務市場的成長。

- 到 2023 年,美國乘用車的平均車齡將達到 13.6 年,而 2022 年約為 12.7 年。

此生態系統中的各個參與企業正在積極為其客戶提供附加價值服務,例如線上預訂選項、接送服務和家庭維護服務選項,以涵蓋廣泛的客戶群。上班族無聊的生活方式也支持了這項服務的發展,因為它幫助他們節省了前往服務中心和長時間等待的時間。因此,未來幾年,新參與企業預計將廣泛關注提供上門汽車服務選項,從而促進該細分市場從 2024 年到 2029 年的成長。

預計 2024 年至 2029 年亞太地區將主導市場

亞太地區,尤其是印度和中國等國家的都市化不斷提高,導致消費者選擇私家車進行日常交通和通勤。因此,全部區域銷售的乘用車數量不斷增加,汽車維修和保養服務的需求不斷增加。此外,越南等一些地區的道路狀況尚未修復,這對汽車的狀況產生了負面影響。因此,這些國家的消費者必須經常前往維修店進行汽車維修,這促進了該細分市場的成長。

- 印度汽車工業商協會(SIAM)預計,2023會計年度印度乘用車銷量將達到389萬輛,而2022會計年度為307萬輛,2022會計年度至2023財與前一年同期比較%。

此外,印度和中國持有數量的不斷增加也刺激了汽車維修和保養服務的需求。除了乘用車服務市場外,該地區還為商用車服務業提供了巨大的機會。公路貨運產業的擴張以及開發區域大眾交通工具生態系統的投資增加也促進了汽車維修和保養服務市場的成長。

- 印度汽車工業商協會(SIAM)預計,2023年印度輕型商用車新車銷量將達到603,400輛,而2022年為475,900輛,2022年和2023年與前一年同期比較成長。

- 根據國際汽車工業協會(OICA)的預測,日本商用車銷量將從2022年的753,020輛成長到2023年的786,360輛,2022年至2023年與前一年同期比較成長0.4%。

認知到這個市場的利潤豐厚的機會,包括 Nippon 在內的多家公司正在策略性地擴展其在亞太地區的業務。例如,2024年4月,日本汽車宣佈在印度推出Mastercraft品牌,以滿足售後市場汽車車身和油漆維修服務的需求。未來幾年,亞太地區預計將出現多品牌維修中心的整合,以與當地車庫競爭。

汽車維修保養服務產業概況

汽車維修和保養服務市場高度細分,並且與在生態系統中運作的國內、國際和區域參與企業競爭激烈。市場上著名的參與企業包括 LKQ Corporation、Robert Bosch GmbH(Bosch Car Service)、Belron International Limited、TVS Motor Company(myTVS Parts & Accessories)、Mobivia Groupe、Inter Cars Service、M&M Car Care Center 和 Sun Auto Service。公司等這些公司正積極致力於擴大業務並與零件元件供應商合作,為消費者提供高效、無縫的汽車維修設施。

- 2024年4月,歐洲領先的汽車維修保養品牌Mobivia宣布與VinFast合作,擴大在法國和德國的電動車售後服務業務,並為VinFast在這些國家的客戶提供服務。根據協議,VinFast 客戶將可以使用 Mobivia 在法國和德國的 1,200 個服務中心獲得電動車維修和保養服務。

- 2024年4月,總部位於杜拜的維修服務供應商Meta Mechanics Auto Repair Center LLC宣布推出新的車輛維修方案。該套餐使用最新的技術和設備為客戶提供高效的車輛維修選擇。透過這項新方案,該公司旨在加強其現有的車輛維修產品組合併贏得市場競爭。

此外,預計未來幾年市場將看到測試、資料庫管理和 CRM 軟體等先進技術的整合,以減少汽車維修和維護的停機時間。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場動態

- 市場促進因素

- 汽車持有量的增加和汽車車車齡的增加推動了市場需求

- 市場限制因素

- 電動車推進技術的採用增加阻礙了市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模:美元)

- 按車型

- 客車

- 商用車

- 摩托車

- 按服務類型

- 機械(輪胎、潤滑油等)

- 外觀/結構(車身修理、窗戶等)

- 電氣/電子(電線、點火系統等)

- 依零件類型

- 胎

- 床單

- 電池

- 其他(引擎等)

- 按服務供應商

- 目標商標產品製造商 (OEM) 授權服務中心

- 汽車保養及維修專利權

- 其他(當地車庫等)

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 其他

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- LKQ Corporation

- Robert Bosch GmbH(Bosch Car Service)

- Abu Dhabi National Oil Company(ADNOC Distribution)

- Belron International Limited

- Inter Cars Service

- M&M Car Care Center

- Sun Auto Service

- TVS Motor Company(myTVS Parts & Accessories)

- Mobivia Groupe

- Wrench Inc.

- USA Automotive

- Hance's European Auto Repair Shop

- GoMechanic

- McGaw's Automotive Inc.

第7章 市場機會及未來趨勢

- 汽車維修和保養技術(包括診斷工具)的快速整合推動了市場成長

The Automotive Repair And Maintenance Service Market size is estimated at USD 741.34 billion in 2024, and is expected to reach USD 998.18 billion by 2029, growing at a CAGR of 6.13% during the forecast period (2024-2029).

Growing vehicle parc, increasing vehicle age, and the government's strict regulations on automotive safety standards to reduce road fatalities and traffic accidents serve as significant determinants to the growth of the automotive repair and maintenance service market worldwide. With the increasing age of vehicles, there exists an extensive need for routine checks and periodic maintenance to ensure smooth operation. Further, to maintain a higher resell value in the used vehicles market, passenger car and commercial vehicle owners often tend to replace parts and upgrade components with modern standards, which, in turn, positively impacts the demand for auto maintenance and repair.

Key Highlights

- The number of vehicles in operation in the United States reached 286 million in Q1 2023 compared to 285.2 million in Q4 2022, representing a Y-o-Y growth of 0.1% between Q4 2022 and Q1 2023.

- Further, according to the United Kingdom Department of Transport, the number of licensed cars in the United Kingdom reached 33.2 million in 2022 compared to 32.7 million in 2021, representing a 1.5% Y-o-Y growth between 2021 and 2022.

- According to the German Federal Motor Transport Authority, passenger cars aged 5-9 years contributed to the highest share of 26.8% plying on German roads, while vehicles aged 10-14 years accounted for 21.7% in 2023.

However, the greater adoption of electric vehicles hinders the business potential of automotive maintenance and service companies as these vehicles require less frequent maintenance than traditional ICE vehicles. Electric cars do not have traditional engines, transmissions, and certain related parts. Therefore, as the proportion of electric vehicles on the road increases, the demand for transmission and exhaust services and oil changes is expected to decrease. Although these companies might witness an increase in demand for other services, such as electric vehicle battery replacement, there can be no assurance that the demand will be sufficient to maintain their historical sales performance.

Key Highlights

- According to the International Energy Agency (IEA), the total number of battery electric vehicles (BEVs) sold worldwide reached 7.3 million units in 2022, compared to 4.6 million units in 2021, recording a 58.6% year-over-year growth between 2021 and 2022.

Rapid repair and maintenance technology advancement to cater to the increasing demand for autonomous, connected, and other modern-age vehicles is expected to be a vital driver in the automotive repair and maintenance service market. Service centers are increasingly adopting code readers, scanners, and other diagnostic tools to detect and diagnose vehicles' malfunctions faster.

Moreover, companies such as Revv are investing hefty sums to build digital platforms for repair centers to detect issues with ADAS systems, which are highly complex. Therefore, with the rising integration of technologies and aggressive investments to constantly offer innovative software to service centers, the automotive repair and maintenance service market is anticipated to showcase surging growth between 2024 and 2029.

Automotive Repair and Maintenance Service Market Trends

The Passengers Cars Segment is Expected to witness Surging Growth Between 2024 and 2029

The passenger cars segment of the market is driven by consumers' increasing preference to avail of private transportation mediums, increasing demand for shared mobility, and the increasing age of cars. The growing passenger car sales worldwide foster the market for automotive repair and maintenance services, as vehicle owners tend to ensure the efficient operation of their cars and compliance with recent government standards. Consequently, vehicle owners visit service centers every 3-6 months for routine service checking, which assists the market growth.

- According to the European Automobile Manufacturers Association (ACEA), Germany, the United Kingdom, and France were the leading nations across Europe with the highest passenger car registrations in 2023.

- The number of new passenger car registrations in Germany reached 2.8 million units in 2023, followed by the United Kingdom, with new car registrations reaching 1.6 million units, and France, with new car registrations reaching 1.5 million units during the same period.

Furthermore, shared mobility services, especially ride-hailing services, have witnessed a massive demand in recent years, attributed to the consumers' preference for low-cost commuting options. Since these cars are required to cover longer distances and generally travel for a longer duration compared to private vehicles, there exists a greater need to frequently replace oil and filters and opt for other routine maintenance services such as body care, which, in turn, positively impacts the demand for this segment. Moreover, with the increasing car age, a greater demand exists for services such as automotive tire replacement and wheel alignment, which contributes to the growth of the automotive maintenance and service market.

- The average age of passenger cars in the United States reached 13.6 years in 2023, compared to 2022, wherein the average age of passenger cars stood at approximately 12.7 years.

Various players in the ecosystem actively offer customers value-added services, such as online booking options, pick-up and drop-service, and home-based maintenance service options to attract a broader customer base. The tedious lifestyle of working professionals also supports the growth of this service as it helps eliminate the time required to visit a service center and wait for a longer duration. Therefore, in the coming years, new entrants in the market will extensively focus on offering doorstep car servicing options, which is expected to contribute to the segment's growth between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market Between 2024 and 2029

The growing urbanization rate across Asia-Pacific, especially in countries such as India and China, leads consumers to opt for private vehicles for daily transportation and commuting. Therefore, the increasing passenger car sales across the region facilitate the growing need for automotive repair and maintenance services. Moreover, under-developed road conditions in certain areas in Vietnam and other countries negatively impact vehicle conditions. Hence, consumers in these countries require frequent visits to repair shops for vehicle servicing purposes, which, in turn, positively affects the growth of this segment.

- According to the Society of Indian Automobile Manufacturers (SIAM), passenger car sales in India reached 3.89 million units in FY 2023 compared to 3.07 million units in FY 2022, representing a Y-o-Y growth of 26.7% between FY 2022 and FY 2023.

Furthermore, the growing vehicle parc in India and China also catalyzes the demand for automotive repair and maintenance services, owing to older vehicles requiring frequent servicing to maintain their optimal condition. Apart from the market for passenger car servicing, the region also witnesses a massive opportunity for the commercial vehicle servicing industry. The expanding road freight sector, coupled with rising investments to develop the regional public transportation ecosystem, is also contributing to the growth of the automotive repair and maintenance service market.

- According to the Society of Indian Automobile Manufacturers (SIAM), the sales of new light commercial vehicles in India reached 603.4 thousand units in FY 2023 compared to 475.9 thousand units in FY 2022, recording a Y-o-Y growth of 26.7% between FY 2022 and FY 2023.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), commercial vehicle sales in Japan stood at 786.36 thousand units in 2023 compared to 753.02 thousand units in 2022, recording a 0.4% Y-o-Y growth between 2022 and 2023.

Assessing the lucrative opportunity in the market, various players, such as Nippon, are strategizing to expand their business presence in Asia-Pacific. For instance, in April 2024, Nippon announced the launch of its brand Mastercraft in India to cater to the aftermarket body and paint repair service needs. In the coming years, Asia-Pacific witnessed the integration of multi-brand repair workshop centers to compete with local garages, which is highly favorable among consumers in the area for minor maintenance and repair work.

Automotive Repair and Maintenance Service Industry Overview

The automotive repair and maintenance service market is highly fragmented and competitive due to several domestic, international, and regional players operating in the ecosystem. Some prominent players in the market include LKQ Corporation, Robert Bosch GmbH (Bosch Car Service), Belron International Limited, TVS Motor Company (myTVS Parts & Accessories), Mobivia Groupe, Inter Cars Service, M&M Car Care Center, Sun Auto Service, and Wrench Inc. These players actively focus on business expansion and forming partnerships with parts and component suppliers to offer consumers efficient and seamless automotive servicing facilities.

- In April 2024, Mobivia, a leading automotive maintenance and repair brand across Europe, announced its collaboration with VinFast to expand its electric vehicle aftersales business in France and Germany to cater to VinFast customers in these countries. As per the agreement, VinFast customers can access Mobivia's 1,200 service centers in France and Germany for repair and maintenance services of their electric vehicles.

- In April 2024, Meta Mechanics Auto Repair Center LLC, a Dubai-based maintenance service provider, announced the commencement of its new vehicle maintenance package. This package offers customers efficient vehicle servicing options using modern technology and equipment. Through this new package, the company aims to enhance its existing vehicle servicing portfolio to gain a competitive edge in the market.

Further, the market is anticipated to witness the integration of advanced technologies, such as inspection, database management, and CRM software, to reduce automotive maintenance and servicing downtime in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Vehicle Parc and Increasing Vehicle Age Foster the Market Demand

- 4.2 Market Restraints

- 4.2.1 Rising Adoption of Electric Vehicle Propulsion Technology is Hindering the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.1.3 Two-Wheelers

- 5.2 By Service Type

- 5.2.1 Mechanical (Tires, Lubricants, etc.)

- 5.2.2 Exterior and Structural (Body Repair, Windows, etc.)

- 5.2.3 Electrical and Electronics (Electrical Wirings, Ignition Systems, etc.)

- 5.3 By Component Type

- 5.3.1 Tires

- 5.3.2 Seats

- 5.3.3 Batteries

- 5.3.4 Others (Engine, etc.)

- 5.4 By Service Provider

- 5.4.1 Original Equipment Manufacturer (OEM) Authorized Service Centers

- 5.4.2 Auto Care and Repair Franchise

- 5.4.3 Others (Local Garages, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 LKQ Corporation

- 6.2.2 Robert Bosch GmbH (Bosch Car Service)

- 6.2.3 Abu Dhabi National Oil Company (ADNOC Distribution)

- 6.2.4 Belron International Limited

- 6.2.5 Inter Cars Service

- 6.2.6 M&M Car Care Center

- 6.2.7 Sun Auto Service

- 6.2.8 TVS Motor Company (myTVS Parts & Accessories)

- 6.2.9 Mobivia Groupe

- 6.2.10 Wrench Inc.

- 6.2.11 USA Automotive

- 6.2.12 Hance's European Auto Repair Shop

- 6.2.13 GoMechanic

- 6.2.14 McGaw's Automotive Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Integration of Automotive Repair and Maintenance Technology such as Diagnostic Tools is Fueling the Growth of the Market