|

市場調查報告書

商品編碼

1537709

電動車維修服務:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Electric Vehicle Repair Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

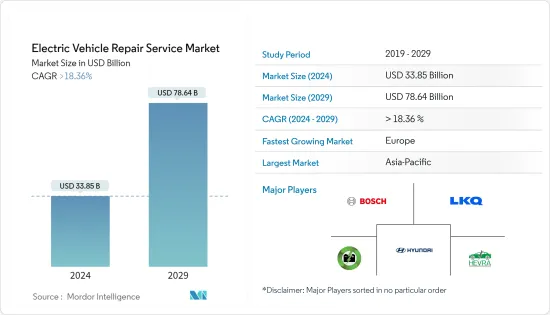

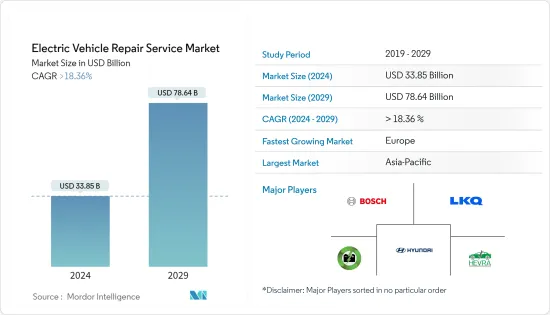

電動車維修服務市場規模預計到 2024 年為 338.5 億美元,預計到 2029 年將達到 786.4 億美元,在預測期內(2024-2029 年)複合年成長率將超過 18.36%。

從長遠來看,由於政府的各種舉措,電動車的銷售量預計將增加。這些舉措預計將對市場成長產生正面影響。例如,電動車在低度開發汽車市場的快速普及將進一步提高電動車的佔有率,進而有助於市場擴張。

全球對永續交通和清潔能源不斷成長的需求正在推動對電池式電動車的需求。促銷和政府立法解決了消費者的限制,例如車輛範圍、更好的初始價格、有限的車型可用性和缺乏知識。這些變數預計將影響電動車的需求並推動電動車維修服務市場。

由於快速的工業化和都市化以及中國和印度等國家對電動車的需求不斷增加,預計亞太地區將引領電動車維修服務市場。北美和歐洲等其他地區預計也將出現顯著的市場成長。

電動車維修服務市場趨勢

預計電動車銷售將在預測期內推動目標市場的需求

電動車的快速採用可能會對目標市場產生重大影響。由於政府的措施和對環境改善的支持以減少對原油的依賴,電動車得到了廣泛採用。預計電池電動車的維修和維護成本將相對低於內燃機汽車(ICE)。透過使營運和產品更具永續,公司可以透過使用回收材料和提高對電動車零件的技術理解來提高競爭力。世界各國政府都有雄心勃勃的排放目標,而採用電動車是實現這些目標的一種方式。例如,歐盟的目標是到2030年將溫室氣體排放減少55%。中國設定了2025年銷售的新車中25%為電動車的目標。

大多數電動車使用的鋰離子電池顯著提高了能量密度、充電時間和整體性能。這使得電動車更加實用,對消費者也更有吸引力。

儘管去年汽車銷量整體下滑,但2022年全球電動車銷量將比2021年成長約60%,首次突破1,000萬輛。根據國際能源總署 (IEA) 的數據,到 2022 年,全球購買的七分之一的乘用車將是電動車。

電動車相對於傳統汽車的成本優勢可能會在預測期內支持市場擴張。預計將為行業參與者提供重大發展前景的另一個因素是電池組價格的下降。根據國際清潔交通理事會發布的研究報告,預計美國電池組成本將在2025年降至104美元/度,2030年降至72美元/度。

隨著產業相關人員和政府機構積極參與電動車產業發展,未來電動車滲透率的成長有望改善。因此,車輛數量增加越多,電動車維修服務供應商產生收益的機會就越多,推動整體市場擴張。

預計北美將佔據目標市場的很大佔有率

市場的成長被認為是由於越來越多的公共和私人舉措鼓勵人們轉換電動車。這些措施促進了電動車的銷售,同時也提高了消費者對擁有電動車好處的認知。

美國正在實施積極的排放政策和區域舉措,以降低大氣中二氧化碳的濃度。許多大城市,包括紐約、洛杉磯和休士頓,空氣品質差,導致呼吸道疾病。這些條件使其很難在當前的環境中生存。

隨著特斯拉、福特和通用汽車等許多電動車製造商 (OEM) 提供各種電動車並吸引了許多消費者的興趣,電動車市場正在不斷擴大。

此外,2021 年 11 月推出的國家新基礎設施法案的一部分將重點放在改善目前的電動車充電基礎設施,以滿足未來幾年許多電動車不斷變化的需求。

因此,主要城市及其管理機構已開始升級現有充電站並在全國引入新的電動車充電站。例如

- 美國運輸部(DOT) 聯邦運輸管理局 (FTA) 宣布透過 2023 會計年度低排放或無排放排放氣體和公車設施競爭計畫資金籌措機會通知提供約 17 億美元的可用資金。這筆資金將幫助各州和地方政府使用低排放氣體、無污染的公車對老化的運輸車隊進行現代化改造,維修和建造公車設施,並支持勞動力發展。

- 2022 年 9 月,美國運輸部核准了在全美 50 個州、華盛頓特區和波多黎各建立電動車充電站的計畫。

此外,電動車的需求為OEM、售後零件供應商、輪胎製造商和其他產業供應鏈參與者創造了新的商機。隨著電動車越來越普及,內燃機和汽車零件服務中心可能會擴展到電動車領域。

由於上述因素,預計目標市場在預測期內將顯著成長。

電動車維修服務產業概況

目標市場集中,主要企業佔有較大佔有率。其他人則希望擴大其足跡並提高電動車維修意識。這可能有助於該公司佔領大量市場佔有率。

- 2024 年 3 月,Meineke 汽車護理中心宣佈在南卡羅來納州印第安地開設首個電動車服務中心,旨在滿足卡羅來納州不斷成長的需求。

- 2023年12月,GoMechanic宣佈為印度主要車隊營運商推出電動車服務。根據新的擴大策略,Go Mechanic 將把其服務組合從內燃機擴展到電動車,為業界領先的車隊領導者提供服務。

- 2022 年 7 月,通用汽車啟動了一項計劃,向汽車購買者提供有關電動車的教育,並瞄準首次購買者,以追趕並超越競爭對手特斯拉。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 電動車銷量增加推動電動車維修服務需求

- 政府努力普及電動車

- 市場限制因素

- 熟練工程師的短缺可能會阻礙市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模:10億美元)

- 按電動汽車類型

- 電池電動車

- 插電式混合電動車

- 混合車

- 燃料電池電動車

- 依組件類型

- 機械的

- 外觀/結構

- 其他零件類型

- 按服務提供者

- 專利權一般維修

- OEM授權服務中心

- 其他服務提供者

- 按車型分類

- 客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Robert Bosch GmbH

- Hyundai Motor Company

- LKQ Corporation

- The Hybrid Shop

- Certified Service

- HEVRA Europe OU

- YCC Service Center

- RAD AIR COMPLETE CAR CARE

- SK Innovation Co. Ltd

- Axalta Refinish

第7章 市場機會及未來趨勢

- 售後電動汽車零件市場的成長

The Electric Vehicle Repair Service Market size is estimated at USD 33.85 billion in 2024, and is expected to reach USD 78.64 billion by 2029, growing at a CAGR of greater than 18.36% during the forecast period (2024-2029).

Over the long term, the sale of electric vehicles is anticipated to increase due to various government initiatives. These initiatives will positively affect market growth. For instance, rapid electric vehicle uptake in underdeveloped auto markets has increased electric vehicle shares even more, which, in turn, will help the market expand.

Globally rising demand for sustainable transportation and cleaner energy has engaged the demand for battery electric vehicles. Promotional activities and government legislation solve consumer constraints such as vehicle range, more excellent upfront prices, limited model availability, and lack of knowledge. These variables will impact the demand for electric vehicles, which will drive the EV repair service market.

Asia-Pacific is expected to lead the market for EV repair services owing to rapid industrialization and urbanization, as well as the increasing demand for electric vehicles in countries like China and India. Other areas, such as North America and Europe, are also expected to experience significant growth in the market.

Electric Vehicle Repair Service Market Trends

Electric vehicle sales are expected to foster the demand of the target market during the forecast period

The rapid adoption of electric vehicles may have a significant impact on the target market. Electric cars are highly adopted because of government initiatives and support for improving the environment to reduce reliance on crude oil. It is anticipated that battery electric vehicle repair and maintenance costs will be comparatively lower than those of internal combustion engine (ICE) vehicles. Making operations and products more sustainable can give businesses a competitive edge by using reclaimed materials and developing a technical understanding of electric vehicle components. Governments worldwide are setting ambitious targets to reduce emissions, and promoting electric vehicles is a way to achieve these goals. For example, the European Union aims to reduce its greenhouse gas emissions by 55% by 2030. China has set a target to have 25% of new cars sold by 2025 be electric.

Lithium-ion batteries, used in most electric vehicles, have seen significant improvements in energy density, charging time, and overall performance. This has made electric cars more practical and appealing to consumers.

Global sales of electric cars increased by around 60% in 2022 compared to 2021, surpassing 10 million for the first time, even though car sales broadly were weak last year. According to the International Energy Agency (IEA), one in every seven passenger cars purchased globally in 2022 was an electric vehicle.

The cost advantages of electric vehicles over conventional cars and other factors will help the market expand during the forecast period. Another element anticipated to generate considerable development prospects for industry participants is a drop in battery pack prices. The cost of battery packs is predicted to decrease in the United States to USD 104/Kwh in 2025 and USD 72/Kwh in 2030, according to a study released by the International Council on Clean Transportation.

With the active participation of industry players and government organizations in EV industry development, the growth of electric vehicle adoption is expected to improve in the future. Thus, as the number of vehicles increases, so will the opportunity for electric vehicle repair service providers to generate revenue, facilitating overall market expansion.

North America is expected to witness a considerable share in the target market

The growing initiatives by the public and private sectors to encourage people to switch to electric vehicles can be attributed to market growth. These initiatives have boosted the sales of electric cars while also raising consumer awareness of the benefits of owning one.

The United States is implementing aggressive emission reduction policies and regional initiatives to reduce atmospheric CO2 concentrations. Many major cities, including New York City, Los Angeles, and Houston, have been plagued by poor air quality, which has resulted in respiratory diseases. Such conditions make survival in the current environment difficult.

Many electric vehicle original equipment manufacturers (OEMs), such as Tesla, Ford, and General Motors, offer a diverse range of electric vehicles that have piqued the interest of many consumers, resulting in an expanded market for electric cars.

Also, part of the country's new infrastructure bill introduced in November 2021 significantly focused on improving the current electric vehicle charging infrastructure to better cater to the changing needs of many electric cars in the coming years.

As a result, major cities and their governing bodies have begun upgrading the existing stations or introducing new electric vehicle charging stations across the country. For instance,

- The Federal Transit Administration (FTA) of the United States Department of Transportation (DOT) announced nearly USD 1.7 billion in available funding through the Low or No Emission and Grants for Buses and Bus Facilities Competitive Programs FY2023 Notice of Funding Opportunity. The funds will help states and municipalities modernize aging transit fleets with low- and no-emission buses, renovate and build bus facilities, and support workforce development.

- In September 2022, the US Transportation Department approved electric vehicle charging station plans for all 50 states, Washington D.C., and Puerto Rico, covering roughly 75,000 miles of highways.

In addition, the demand for electric vehicles opens up new business opportunities for OEMs, suppliers of aftermarket parts and components, producers of tires, and other participants in the industry supply chain. As electric vehicles become more widely available, IC engine and vehicle parts and components service centers will expand into them.

Based on the factors above, the target market is expected to witness significant growth during the forecast period.

Electric Vehicle Repair Service Industry Overview

The target market is concentrated, as major players hold significant market shares. Also, some companies promote either the expansion of their footprint or awareness of electric vehicle repair. This will contribute to the firm gaining a large share of the market.

- In March 2024, Meineke Car Care Center announced its first-ever electric vehicle service center, which aims to meet growing demand in the Carolinas, in Indian Land, South Carolina.

- In December 2023, GoMechanic announced the launch of electric vehicle services for India's key fleet operators in the EV space. Under its new expansion strategy, GoMechanic will enlarge its service portfolio from internal combustion engines to electric vehicles for leading Industry fleet leaders.

- In July 2022, General Motors launched a program to educate car shoppers about electric vehicles and target first-time buyers as the automaker seeks to catch up with and outperform rival Tesla.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising EV Sales To Fuel EV Repair Service Demand

- 4.1.2 Government Initiatives To Promote The Use of EVs

- 4.2 Market Restraints

- 4.2.1 Skilled Technician Shortage May Hamper The Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Value in USD Billion)

- 5.1 Electric Vehicle Type

- 5.1.1 Battery Electric Vehicle

- 5.1.2 Plug-in Hybrid Electric Vehicle

- 5.1.3 Hybrid Electric Vehicle

- 5.1.4 Fuel Cell Electric Vehicle

- 5.2 Component Type

- 5.2.1 Mechanical

- 5.2.2 Exterior and Structural

- 5.2.3 Other Component Types

- 5.3 Service Provider

- 5.3.1 Franchise General Repairs

- 5.3.2 OEM Authorized Service Centers

- 5.3.3 Other Service Providers

- 5.4 Vehicle Type

- 5.4.1 Passenger Car

- 5.4.2 Commercial Vehicle

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE**

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Hyundai Motor Company

- 6.2.3 LKQ Corporation

- 6.2.4 The Hybrid Shop

- 6.2.5 Certified Service

- 6.2.6 HEVRA Europe OU

- 6.2.7 YCC Service Center

- 6.2.8 RAD AIR COMPLETE CAR CARE

- 6.2.9 SK Innovation Co. Ltd

- 6.2.10 Axalta Refinish

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Market For Aftermarket EV Parts And Acessories