|

市場調查報告書

商品編碼

1521890

工業金屬包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Industrial Metal Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

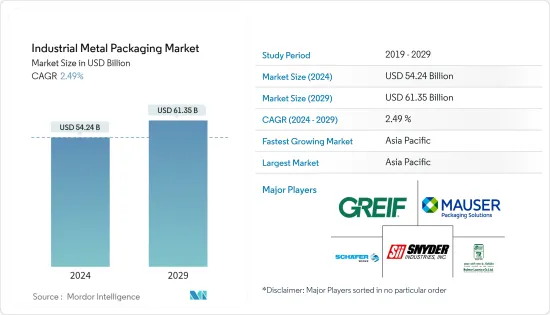

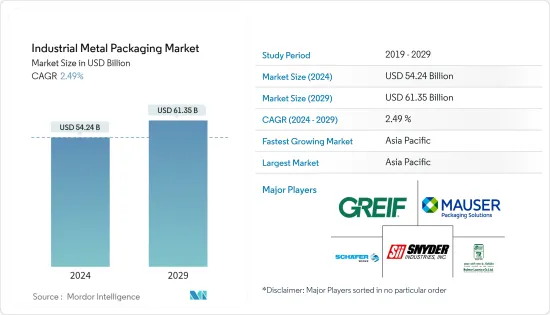

工業金屬包裝市場規模預計到2024年為542.4億美元,預計到2029年將達到613.5億美元,在預測期內(2024-2029年)複合年成長率為2.49%。

主要亮點

- 金屬散裝容器,尤其是由鋼和鋁製成的容器,具有卓越的耐用性和保護性,使其成為產品完整性至關重要的行業的首選容器。此外,全球經濟的持續擴張和工業化,特別是新興經濟體的持續擴張和工業化,預計將刺激對工業潤滑油和液體的需求。因此,對堅固耐用的包裝解決方案的需求將會增加,金屬包裝將顯著成長。

- 重要的是要考慮到包裝在產品運輸過程中經常暴露於扭矩力、外部和內部壓力、極端溫度和其他不利條件下。鋼材的機械性質包括高強度、耐高壓,且不易損壞。這確保了包裝產品的安全性,並使其更易於儲存、運輸、處理和使用。

- 鋼桶是儲存石油工業中使用的低黏度液體和其他危險化學品的安全方法,塑膠桶不如鋼桶。當與高效的滅火系統一起使用時,可回收鋼桶可提供最佳的高溫火災保護。這種獨特的性能預計將推動石油和潤滑油領域的工業鼓。

- 此外,生產力、進口和石油出口的成長將導致國際貿易的成長,從而可能增加對工業金屬包裝的需求。來自各個最終用戶行業的化學品和石油潤滑劑市場的不斷成長以及對加強供應鏈能力的更加重視預計將推動工業金屬包裝需求。

- 在永續性考量的推動下,工業包裝領域正在經歷運輸和航運領域的重大變革,其中鋼製中型散貨箱(IBC) 佔據關鍵地位。鋼製中型散裝容器代表了對環境負責的包裝,因為其堅固性和再生性等固有特性可顯著減少其在使用壽命內對環境的影響。

工業金屬包裝市場趨勢

對液體運輸散裝包裝解決方案的需求不斷成長

- IBC 和圓桶是工業和非工業產品的散裝包裝解決方案或運輸容器。這些解決方案專為儲存和運輸大量危險和非危險液體和半液體產品而設計。 IBC 等散裝包裝解決方案廣受歡迎,因為它們可以為包裝產品提供最佳的衛生環境並減少溢出的可能性。

- 化學、製藥、食品和飲料公司正在尋找高品質、可靠的散裝容器來運輸其產品,這為桶和 IBC 等工業金屬包裝解決方案創造了新的機會。隨著跨境運輸注重永續性和環保包裝,以及對散裝貨櫃的需求增加,圓桶製造商和 IBC 製造商正在經歷不斷變化的市場。

- 根據 ITP Packaging 的研究,鋼桶是一種多功能、持久且經濟高效的工業桶形式,可用於許多行業的多種應用。鋼桶是交通運輸、物流業的支柱。此外,鋼桶儲存汽油和柴油,這是物流業使用的燃料,為該產業提供動力。

- 中型散貨箱(IBC) 因其耐用性、多功能性和成本效益而通常用於包裝和運輸工業化學品。 IBC 的設計能夠承受運輸和裝卸過程中遇到的惡劣條件。根據美國化學理事會預測,2021-2022年出貨收益將達50,655億美元,2022-2023年將達到57,214億美元,全球出貨收益大幅成長。預計2024年化學品產量與前一年同期比較為3.5%,2023年為0.6%。化學品出貨量的增加預計將在預測期內推動桶裝和 IBC 市場的發展。

- 不斷發展的石化產業需要安全的包裝解決方案來保護其產品。新興市場油漆和潤滑油產量的增加以及對安全供應鏈和產品運輸的需求不斷成長預計也將推動需求。最終用戶產業增加生產投資預計將為工業鋼桶市場提供重大成長機會。因此,金屬桶因其相對可重複使用性和在運輸危險材料方面的安全聲譽而將繼續被廣泛使用。

增加國內危險物質產量和原料供應將有助於亞太市場的成長

- 金屬包裝因其耐用性和抗外力能力而成為危險材料儲存的理想解決方案。金屬桶可以提供出色的防衝擊刺穿保護,並且還可以抵抗紫外線 (UV) 輻射,因此適合戶外儲存。如果不小心管理和處理,物料輸送可能會構成威脅。

- 有效封裝化學品可以降低洩漏、爆炸和腐蝕的風險。危險包裝描述了化學和製藥行業廣泛使用的化學品的保護解決方案。

- 由於需求的增加和政府的優惠政策,印度的化學工業正在蓬勃發展。印度作為化學品生產國享有獨特的地位。印度政府在化學和石化行業中製定了生產連結獎勵(PLI)計劃,以鼓勵國內製造和出口。該計劃根據產品在國內銷量的增加向公司提供獎勵。

- 在2023-2024年聯盟預算中,中央政府向化學和石化部撥款2,093萬美元。這項撥款凸顯了政府對支持和進一步發展化學產業的承諾。化學工業不斷成長的需求預計將在預測期內推動危險材料工業金屬包裝市場。

- 包裝製造商受益於該地區鋼材等原料的供應。據印度品牌資產基金會稱,印度鋼鐵業正在顯著成長。 2013會計年度,粗鋼產量125.32噸,成品鋼材產量121.29噸。

- 必須嚴密管理危險物質的運輸,以盡量減少資產損失並監控所有合法的貨櫃合規要求。中型散裝容器的電子標籤有望促進工業材料的可追溯性,要求製造商降低因中型散裝容器遺失或損壞而導致的成本。 IBC 的儲存成本比桶低,用於大量運輸液體。 IBC確保有效的空間利用,而圓形的滾筒形成了足夠的未使用空間。此外,金屬包裝的可用性可以重複使用,從而推動市場成長。

工業金屬包裝產業概況

工業金屬包裝市場被細分為各種全球和本地公司為不同的最終用戶行業提供不同的產品系列。該市場的主要企業包括 Greif Inc.、Mauser Packaging Solutions、Balmer Lawrie &、Snyder Industries Inc.、SCHAFER Werke GmbH 和 Time Mauser Industries Pvt.參與企業正在進行策略性收購,以擴大其市場足跡並增強其能力。

2024年5月,毛瑟包裝解決方案公司宣布收購墨西哥Taenza SA de CV公司,該公司生產鋼桶、錫鋼通用線、衛生槽和氣霧槽。此次收購將增強該公司的製造能力和在墨西哥的業務。

2023 年 5 月,ENVASES OHRINGEN GMBH 宣布收購 Domiberia Group,該集團在西班牙和荷蘭生產食品和工業產品金屬包裝。由此,ENVASES OHRINGEN GMBH 擴大了在歐洲的地理覆蓋範圍。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 地緣政治情勢對市場的影響

第5章市場動態

- 市場促進因素

- 對液體運輸散裝貨櫃包裝解決方案的需求不斷成長

- 用於儲存危險材料的金屬包裝的創新

- 市場限制因素

- 存在塑膠桶等替代包裝解決方案

第6章 市場細分

- 依材料類型

- 鋁

- 鋼

- 依產品類型

- 中型散裝容器

- 運輸桶和桶

- 散裝容器(提桶、桶子等)

- 按最終用戶產業

- 飲食

- 化學/製藥

- 石油/石化

- 建築/施工

- 車

- 按地區*

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 亞洲

- 中國

- 印度

- 日本

- 泰國

- 越南

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 阿拉伯聯合大公國

- 北美洲

第7章 競爭格局

- 公司簡介

- Greif Inc.

- Mauser Packaging Solutions

- Balmer Lawrie & Co. Ltd

- ENVASES OHRINGEN GMBH

- SCHAFER Werke GmbH

- Sicagen India Limited

- Time Mauser Industries Pvt. Ltd

- THIELMANN PORTINOX SPAIN SA

- Snyder Industries Inc.

- American Keg Company(BLEFA BEVERAGE SYSTEMS)

- Lancaster Container Inc.

- P. Wilkinson Containers Ltd

- Bison IBC Ltd

- Colep Packaging(RAR Group Company)

- Peninsula Drums

第8章投資分析

第9章市場的未來

The Industrial Metal Packaging Market size is estimated at USD 54.24 billion in 2024, and is expected to reach USD 61.35 billion by 2029, growing at a CAGR of 2.49% during the forecast period (2024-2029).

Key Highlights

- Metal bulk containers, particularly those composed of steel and aluminum, provide exceptional durability and protection, making them the preferred container for industries that prioritize product integrity. Also, the continued global expansion and industrialization, especially in developing economies, are expected to stimulate the demand for industrial lubricants and fluids. As a result, there will be an increased demand for sturdy packaging solutions, positioning metal packaging for substantial growth.

- Throughout product shipment, it is important to consider that the package is regularly exposed to torque forces, external and internal pressure, extreme temperatures, and other unfavorable conditions. Steel's mechanical performance includes high strength and high-pressure resistance and cannot be damaged easily. This ensures the safety of packaged products and facilitates storage, transportation, handling, and use.

- The steel drums are a safe way to store low-viscosity fluids and other hazardous chemicals used in the oil industry; plastic drums are inferior to steel drums. When employed with an efficient fire suppression system, steel drums of the retrieving type provide the best protection against high-temperature fires. Such unique properties are expected to drive industrial drums in the petroleum and lubricant sector.

- In addition, the rising productivity, imports, and oil exports result in the growth of international trade, potentially increasing demand for industrial metal packaging. The rise in the market for chemicals and petroleum lubricants from varied end-user industries and a significant focus on strengthening the supply chain capability is expected to drive the need for industrial metal packaging.

- The landscape of industrial packaging is undergoing a profound transformation in transportation and shipping fueled by sustainability considerations, and steel intermediate bulk containers (IBCs) occupy a prominent position. Steel IBCs illustrate environmentally responsible packaging due to their inherent characteristics, such as robustness and reusability, which significantly reduce environmental impact throughout their lifespan.

Industrial Metal Packaging Market Trends

Growing Demand for Bulk Container Packaging Solutions for Liquid Transportation

- IBCs and drums are bulk-packaging solutions or shipping containers for industrial and non-industrial products. These solutions are designed to store and transport large quantities of hazardous and non-hazardous liquid and semi-liquid products. Bulk packaging solutions such as IBCs are gaining wider popularity due to their ability to provide an optimal hygienic environment for packed products and reduce the possibilities of spillage.

- Chemical, pharmaceutical, food, and drink companies seek high-quality and reliable bulk containers for product transportation, creating new opportunities for industrial metal packaging solutions such as drums and IBCs. Drum and IBC manufacturers are encountering a changing market as the demand for bulk containers grows, with cross-border transportation focusing on sustainability and eco-friendly packaging.

- According to a study conducted by ITP Packaging, steel drums are a versatile, long-lasting, cost-effective form of industrial drums with multiple uses across many industries. Steel drums are the mainstay of the transportation and logistics industry. Steel drums also store the petrol and diesel that fuel the logistics industry and keep the industry running in steel drums.

- Intermediate bulk containers (IBCs) are often utilized for packaging and transporting industrial chemicals due to their durability, versatility, and cost-effectiveness. IBCs are designed to withstand harsh conditions encountered during shipping and handling. According to the American Chemistry Council, the value of chemical shipments in 2021-2022 was USD 5,065.5 billion and reached USD 5,721.4 billion in 2022-2023; global chemical shipments experienced a significant surge. The Y-o-Y growth of chemical output is projected to be 3.5% in 2024 compared to 2023, which was 0.6%. Such an increase in chemical shipments would drive the market for drums and IBCs during the forecast period.

- The growing petrochemical industry requires safe packaging solutions to protect its products. Also, the rising production of paints and lubricants in emerging markets and the ever-increasing demand for a secure supply chain and transportation of products are anticipated to drive the demand. Increased investment in end-user industries' production will provide significant growth opportunities for the industrial steel drums market. Therefore, metal drums will remain widely used due to their relative reusability and reputation for safety in transporting hazardous materials.

Increasing Domestic Production of Hazardous Materials and Availability of Raw Materials Aids the Market Growth in the APAC Region

- Metal packaging is an ideal solution for hazardous material storage due to its durability and resistance against external forces. Metal drums provide superior protection from impact puncture and are resistant to ultraviolet (UV) radiation, making them suitable for outdoor storage. Hazardous materials could pose a threat if not managed or handled carefully.

- Effective encapsulation of chemical products reduces the risk of spillage, explosion, and corrosion. Hazardous material packaging offers a protective solution to chemicals extensively used in the chemical and pharmaceutical industries.

- India's chemical industry thrives due to increasing demand and favorable government policies. India boasts a unique position as a chemical producer. The Government of India established a Production Linked Incentive (PLI) scheme for the chemical and petrochemical sector to boost domestic manufacturing and exports. This scheme incentivizes businesses based on increased product sales within the country.

- In the Union Budget 2023-2024, the central government allotted USD 20.93 million to the Department of Chemicals and Petrochemicals. This allocation highlights the government's commitment to support and further develop the chemical sector. Such increased demand from the chemical industry would drive the industrial metal packaging of hazardous materials market during the forecast period.

- The availability of raw materials such as steel in the region benefits the packaging manufacturers. According to the India Brand Equity Foundation, India's steel sector has grown significantly. In FY23, crude and finished steel production stood at 125.32 metric tons and 121.29 metric tons, respectively.

- Shipping hazardous materials must be managed closely to minimize asset loss and monitor all legal container compliance requirements. Electronic tagging of IBCs is forecast to facilitate traceability of industrial substances, which manufacturers need to reduce the cost of lost or damaged IBCs. IBCs are used for the low storage cost and transportation of fluids in bulk quantity compared to drums. The round shape of drums forms ample unused space, while IBCs ensure efficient space utilization. Also, the usability of metal packaging can be used multiple times to drive market growth.

Industrial Metal Packaging Industry Overview

The industrial metal packaging market is fragmented due to various global and local players offering various product portfolios for different end-user industries. The key players operating in the market include Greif Inc., Mauser Packaging Solutions, Balmer Lawrie & Co. Ltd, Snyder Industries Inc., SCHAFER Werke GmbH, and Time Mauser Industries Pvt. Ltd. The players are entering into strategic acquisitions to expand their footprint in the market and strengthen their capabilities.

In May 2024, Mauser Packaging Solutions announced the acquisition of Taenza SA de CV, a company in Mexico that manufactures steel pails, tin-steel general line, sanitary, and aerosol cans. The acquisition would help the company strengthen its manufacturing capability and presence in Mexico.

In May 2023, ENVASES OHRINGEN GMBH announced the acquisition of Domiberia Group, a manufacturer of metal packaging for food and industrial products in Spain and the Netherlands. This will help the company broaden its geographical reach in Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Geopolitical Scenario on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Bulk Container Packaging Solutions for Liquid Transportation

- 5.1.2 Innovation in Metal Packaging for Storage of Hazardous Materials

- 5.2 Market Restraints

- 5.2.1 Presence of Alternate Packaging Solutions such as Plastic Drums and Others

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Aluminium

- 6.1.2 Steel

- 6.2 By Product Type

- 6.2.1 IBCs

- 6.2.2 Shipping Barrels and Drums

- 6.2.3 Bulk Containers (Pails, Kegs, etc.)

- 6.3 By End-user Industry

- 6.3.1 Food & Beverage

- 6.3.2 Chemicals and Pharmaceuticals

- 6.3.3 Oil and Petrochemicals

- 6.3.4 Building and Construction

- 6.3.5 Automotive

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Spain

- 6.4.2.5 Italy

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Thailand

- 6.4.3.5 Vietnam

- 6.4.3.6 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Argentina

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 South Africa

- 6.4.5.3 Egypt

- 6.4.5.4 United Arab Emirates

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Greif Inc.

- 7.1.2 Mauser Packaging Solutions

- 7.1.3 Balmer Lawrie & Co. Ltd

- 7.1.4 ENVASES OHRINGEN GMBH

- 7.1.5 SCHAFER Werke GmbH

- 7.1.6 Sicagen India Limited

- 7.1.7 Time Mauser Industries Pvt. Ltd

- 7.1.8 THIELMANN PORTINOX SPAIN SA

- 7.1.9 Snyder Industries Inc.

- 7.1.10 American Keg Company (BLEFA BEVERAGE SYSTEMS)

- 7.1.11 Lancaster Container Inc.

- 7.1.12 P. Wilkinson Containers Ltd

- 7.1.13 Bison IBC Ltd

- 7.1.14 Colep Packaging (RAR Group Company)

- 7.1.15 Peninsula Drums