|

市場調查報告書

商品編碼

1523308

汽車引擎管理系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Engine Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

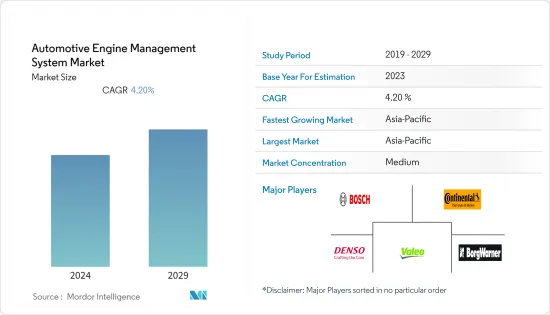

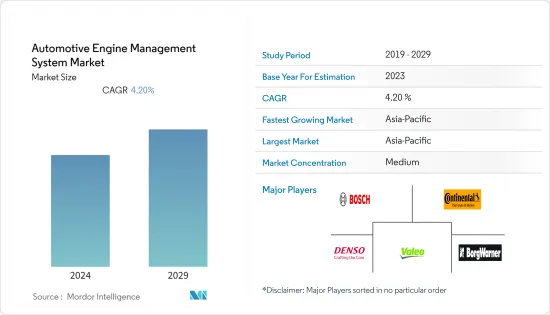

汽車引擎管理系統市場規模預計到 2024 年將達到 662 億美元,預計到 2029 年將達到 848 億美元,在預測期內(2024-2029 年)複合年成長率為 4.20%。

從長遠來看,消費者對省油車的需求不斷成長,正在推動製造商開發先進的組件來控制引擎的運作。全球溫室氣體濃度的上升可能會顯著促進更嚴格的排放法規的製定。

隨著乘用車產銷量的增加,全球汽車產業逐年快速成長。例如,2022-23年印度乘用車銷量將從14,67,039輛增加到17,47,376輛,多用途車將從14,89,219輛增加到20,03,718輛,貨車銷量將從1,13,265輛增加與上年度相比,增加到 1,000 台,達到 39,020 台。

隨著汽車需求的不斷成長,引擎管理公司正在採取產品推出、產能擴張和合併等策略措施來滿足高需求。

主要亮點

- 2023年7月,法雷奧將其Sanand工廠的超音波感測器產能擴大至700萬個。薩南德的第一條生產線於 2021 年 11 月啟動。這條新增生產線將總產能從每年 300 萬台增加到 700 萬台。

- 2023 年 1 月,森薩塔展示了適用於汽車和重型車輛越野 (HVOR) 應用的各種關鍵任務感測器和電氣保護解決方案。

北美是全球成長最快的汽車引擎管理系統市場。然而,由於汽車銷售量較高,汽車引擎管理系統在亞太地區佔據了很大的市場佔有率,尤其是在中國和印度。印度和中國的客戶越來越意識到提高車輛的性能,預計將推動汽車引擎管理系統市場的發展。

汽車引擎管理系統市場趨勢

乘用車市場佔有率最高

乘用車以其時尚、緊湊、經濟等特點深受消費者喜愛。乘用車需求的增加也受到新興國家中產階級人口不斷成長和生活水準提高的影響。

由於運動型多用途車銷量佔印度乘用車銷量的 50% 以上,運動型多用途車 (SUV) 需求的不斷成長為市場參與者創造了商機。在印度和中國等國家,由於多種因素,包括對離地間隙較高的大型車輛的偏好,對運動型多用途車的需求激增。

此外,由於稅收補貼和充電基礎設施的擴大,對電動車的需求不斷增加也導致了市場的成長。 2023年第一季印度電動車銷量是2022年同期的兩倍。

根據國際清潔交通理事會統計,美國已售出超過100萬輛電動車。特別是,2023年第一至第三季的銷量較2022年同期成長約58%。

隨著乘用車領域的成長,對電控系統和引擎感知器等各種引擎管理系統的需求預計將繼續大幅成長。隨著與安全性和便利性相關的先進功能的趨勢持續發展,汽車配備的功能也越來越多。此外,對自動駕駛和電動車不斷成長的需求預計將為引擎管理系統帶來新的機會。

公司也致力於創造技術先進的產品並擴大生產能力,以滿足高市場需求。例如,2023年6月,基於MEMS的固態汽車雷射雷達和ADAS(高級駕駛員輔助系統)解決方案的領導者MicroVision Inc.推出了基於固態快閃記憶體的MOVIA雷射雷達感測器。 MOVIA 感測器體積小、重量輕,適合各種應用。

亞太地區市場佔有率最高

預計亞太地區將在預測期內佔據主要市場佔有率。該地區的成長主要由印度、中國和日本等頂級汽車生產國推動。

其他促進因素包括對能夠提供更好的駕駛體驗、舒適性和安全性的車輛的需求增加,以及對節能引擎的需求增加。電動車銷售的成長得益於引擎管理系統的使用,印度等國家正在透過嚴格的法規、補貼、稅額扣抵和其他激勵措施進一步支持引擎管理系統的採用。

- 印度道路運輸和公路部 (MoRTH) 已強制要求車輛從 2023 年起必須滿足燃油效率標準,以提高燃油效率。靈活燃料汽車的新指南正在促進內燃機汽車的成長。

- 中國在供應燃油泵和噴油器的引擎管理系統(EMS)領域佔據全球市場佔有率。新的柴油引擎排放法規可能為中國引擎管理公司帶來更多商機。

除傳統內燃機汽車外,電動車的需求預計將推動市場成長。由於每個地區更嚴格的排放法規,在預測期內對電動車的需求可能會增加。根據國際清潔交通理事會的數據,中國仍是全球最大的電動車市場,2023 年上半年電動車銷量約 300 萬輛。

- 截至2024年1月,中國製造商在自動駕駛技術的雷射雷達創新方面繼續處於主導,自2000年以來,提交的雷射雷達相關專利申請數量達到驚人的25,957件,超過了美國和日本公司。

汽車引擎管理系統產業概況

汽車引擎管理系統市場由全球和地區知名企業整合和主導。公司採用新產品推出、聯盟和合併等策略來維持其市場地位。

- 例如,2023年4月,TTTech Auto推出了N4網路控制器,這是一款具有先進網路功能的高效能ECU。 N4 旨在在現代汽車 E/E架構中發揮核心作用,為軟體定義汽車鋪平道路。

該市場的主要企業包括大陸集團、Denso公司、法雷奧公司和羅伯特博世有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 乘用車銷量增加

- 市場限制因素

- 由於增加安全設備而導致車輛成本增加

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按車型

- 客車

- 商用車

- 依組件類型

- 引擎控制單元(ECU)

- 引擎感知器

- 燃油幫浦

- 其他組件類型

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Robert Bosch GmbH

- Continental AG

- BorgWarner Inc.

- DENSO Corporation

- Hella KGaA Hueck & Co.

- Infineon Technologies AG

- Sensata Technologies

- Mobiletron Electronics Co. Ltd

- NGK Spark Plugs Pvt Ltd.

- Hitachi Automotive Systems Ltd

- Dover Corporation

第7章 市場機會及未來趨勢

The Automotive Engine Management System Market size is estimated at USD 66.20 billion in 2024, and is expected to reach USD 84.80 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

Over the long term, the growing consumer trend toward fuel-efficient vehicles has encouraged manufacturers to develop advanced components that control engine operation. The enactment of stringent emission norms is likely to increase significantly due to the rise in greenhouse gas levels globally.

With the growth in sales and production of passenger cars, the global automotive sector has been witnessing exponential growth year on year. For instance, the sales of passenger cars in India increased from 14,67,039 to 17,47,376, utility vehicles from 14,89,219 to 20,03,718, and vans from 1,13,265 to 1,39,020 units in FY 2022-23, compared to the previous year.

With the growth in demand for vehicles, engine management companies are adopting strategic moves such as product launches, capacity expansion, and mergers to cater to the high demand.

Key Highlights

- In July 2023, Valeo expanded its ultrasonic sensor manufacturing capacity to 7 million units at the Sanand plant. The first production line at Sanand was started in November 2021. With this additional line, the total production capacity increased from 3 million to 7 million units annually.

- In January 2023, Sensata showcased its broad range of mission-critical sensors and electrical protection solutions for automotive and heavy vehicle off-road (HVOR) applications.

North America is the fastest automotive engine management systems market in the world. However, due to the more significant automotive sales, especially in China and India, the automotive engine management systems in Asia-Pacific hold the major market share. Customers in India and China are becoming more aware of enhancing their vehicles' performance, which is expected to boost the automotive engine management system market.

Automotive Engine Management System Market Trends

Passenger Cars Holds Highest Market Share

Passenger cars have become exceptionally popular among consumers due to features like their stylish and compact design and economic value. The rise in the demand for passenger cars is also influenced by the increasing middle-class population and the enhanced standard of living in emerging countries.

The rise in demand for sports utility vehicles (SUVs) creates profitable opportunities for market players as the sale of sports utility vehicles accounts for more than 50% of passenger car sales in India. The demand for sports utility vehicles in countries like India and China surged due to various factors, such as buying preference for bigger cars with high ground clearance.

Furthermore, the increase in demand for electric vehicles due to tax subsidies and expansion in charger infrastructure also resulted in the growth of the market. Electric car sales in India in the first quarter of 2023 were double what they were in the same period in 2022.

According to the International Council of Clean Transportation, the sales of electric vehicles in the United States crossed 1 million. Notably, the sales through the first three quarters of 2023 were about 58% higher than the same period in 2022.

With the growth in the passenger car segment, demand for various engine management systems, such as electronic control units and engine sensors, is expected to continue to grow exponentially in the future. With the ongoing trend of advanced features related to safety and convenience, cars are becoming more feature-loaded. Moreover, the rise in demand for autonomous and electric vehicles is anticipated to create new opportunities for engine management systems.

Companies are also focusing on creating technologically advanced products and expanding their capacity to cater to the high demand in the market. For example, in June 2023, MicroVision Inc., a leader in MEMS-based solid-state automotive lidar and advanced driver-assistance systems (ADAS) solutions, launched its solid-state flash-based MOVIA lidar sensor. The small form factor and light weight of the MOVIA sensor make it appealing for a wide variety of applications.

Asia-Pacific Holds the Highest Market Share

Asia-Pacific is expected to hold a major market share during the forecast period. The regional growth is mainly driven by the top-producing automotive countries like India, China, and Japan.

Other driving factors include the increase in demand for automobiles that provide enhanced driving experiences, comfort, and safety and an increase in demand for fuel-efficient engines. The rise in the sale of electric vehicles has further boosted the use of engine management systems, as countries like India are promoting their adoption through strict regulations, subsidies, tax credits, and other incentives.

- The Ministry of Road Transport and Highways (MoRTH) in India made it mandatory for vehicles to comply with fuel consumption standards from 2023 to make vehicles fuel efficient. The new guidelines on flex-fuel vehicles contribute to the growth of ICE engines.

- China is leading the global market share in the engine management system (EMS) segment, supplying fuel pumps and injectors. New emission norms for diesel engines could mean additional opportunities for Chinese engine management companies.

Apart from conventional IC engine vehicles, the demand for electric vehicles is anticipated to boost the growth of the market. With stringent emission regulations across every region, the demand for electric vehicles is likely to increase during the forecast period. According to the International Council of Clean Transportation, China remained the world's largest EV market, with approximately 3 million EVs sold in 2023 H1.

- As of January 2024, Chinese manufacturers continue to lead the charge in lidar innovation of autonomous driving technology and have filed a staggering 25,957 patent applications related to lidar since 2000, surpassing American and Japanese companies.

Automotive Engine Management System Industry Overview

The automotive engine management system market is consolidated and led by globally and regionally established players. The companies adopt strategies such as new product launches, collaborations, and mergers to sustain their market positions.

- For instance, in April 2023, TTTech Auto launched the N4 Network Controller, a high-performance ECU with advanced networking capabilities. The N4 is designed to play a central role in modern automotive E/E architectures, paving the way to software-defined vehicles.

Some of the major players in the market include Continental AG, DENSO Corporation, DENSO Corporation, Valeo, and Robert Bosch GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Increase in Sales of Passenger Cars

- 4.3 Market Restraints

- 4.4 Increased Cost of Vehicles Due to Additional Safety Features

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Car

- 5.1.2 Commercial Vehicle

- 5.2 By Component Type

- 5.2.1 Engine Control Unit (ECU)

- 5.2.2 Engine Sensors

- 5.2.3 Fuel Pump

- 5.2.4 Other Component Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Continental AG

- 6.2.3 BorgWarner Inc.

- 6.2.4 DENSO Corporation

- 6.2.5 Hella KGaA Hueck & Co.

- 6.2.6 Infineon Technologies AG

- 6.2.7 Sensata Technologies

- 6.2.8 Mobiletron Electronics Co. Ltd

- 6.2.9 NGK Spark Plugs Pvt Ltd.

- 6.2.10 Hitachi Automotive Systems Ltd

- 6.2.11 Dover Corporation