|

市場調查報告書

商品編碼

1523315

豪華車:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Luxury Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

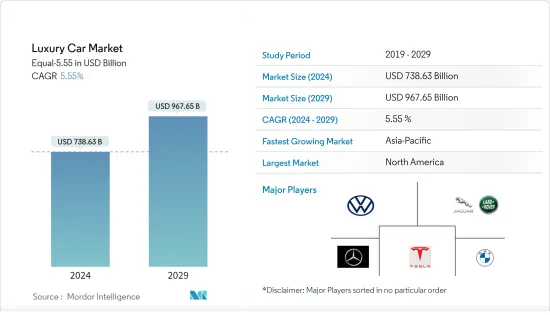

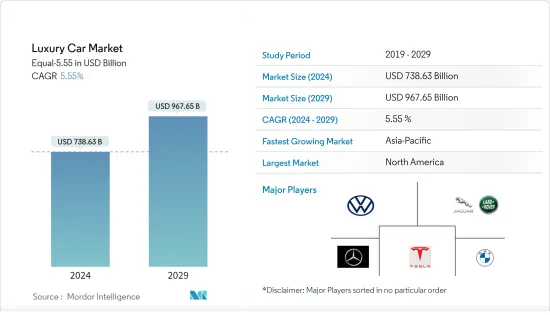

豪華車市場規模預計將從2024年的7,386.3億美元成長到2029年的9,676.5億美元,預測期間(2024-2029年)複合年成長率為5.55%。

在全球人口日益富裕和可支配收入增加等關鍵因素的推動下,豪華車市場預計在 2022 年實現強勁成長,尤其是在新興市場,促使更多消費者考慮豪華車。此外,包括電動車和自動駕駛汽車創新在內的技術進步正在改變遊戲規則,吸引了尋求尖端汽車體驗的精通技術的消費者。

電動和混合模式在豪華汽車市場中迅速增加,各大製造商都在研發上投入大量資金,以滿足對環保替代品的需求。物聯網功能、人工智慧主導的介面和自動駕駛技術等連接功能正在成為常態,改善駕駛體驗。

然而,經濟的不確定性和更嚴格的排放法規給豪華車市場帶來了挑戰。全球經濟和環境問題的變化可能會影響消費者信心和購買力。此外,較高的進口關稅預計將阻礙豪華車市場的成長。例如,在印度,CIF(成本、保險和運費)價格高於 40,000 美元的汽車需繳納 100% 關稅,CIF(成本、保險和運費)價格低於 40,000 美元的汽車需繳納 100% 關稅。關稅。

隨著這些新興市場的不斷開拓,豪華車市場預計在預測期內將繼續實現正成長。

豪華車市場趨勢

SUV成為豪華車市場的主要細分市場

SUV已成為豪華車市場的一個主要部分。這種成長背後有幾個因素塑造了豪華汽車產業的格局。豪華 SUV 集多功能性、先進技術、安全性和聲望認可於一體,擁有大量追隨者。

豪華SUV對包括家庭和年輕專業人士在內的廣大消費者越來越有吸引力。市場對這些車輛的性能、舒適性和實用性的結合反應良好,使其成為豪華車購買者的熱門選擇。

SUV較高的駕駛位置和堅固的構造賦予其安全感,與既希望汽車安全又希望豪華的消費者產生共鳴。此外,ADAS(高級駕駛輔助系統)和連接選項等最新技術功能進一步增強了這款豪華SUV的吸引力。

區域差異在塑造豪華SUV市場方面也發揮著重要作用。例如,北美和中國對豪華SUV表現出強烈的偏好。在中國,大型SUV尤其受到富裕階層的歡迎。豪華轎車歷來在歐洲佔有很大佔有率,但現在人們開始轉向豪華SUV,反映出消費者偏好和生活方式的變化。

此外,經濟狀況和環境因素等因素也影響豪華SUV市場的趨勢。某些地區的經濟繁榮導致更大、更昂貴的SUV車型銷售增加。此外,電動車和混合SUV 的興起響應了消費者日益成長的環保意識,並促進了整個豪華車市場的發展。

隨著汽車產業越來越注重永續性,汽車製造商正在大力投資電動車技術,以提供具有零排放功能的豪華 SUV。例如

- 2023年11月,印度最大的豪華汽車品牌賓士推出了GLE LWB SUV和AMG C43 4MATIC轎車。該公司在印度推出了 SUV GLE 的拉皮版,起價為 96.40 印度盧比(不含稅),共有三種車型。這款 SUV 與 C43 AMG 4Matic 轎車一起首次亮相,售價為 98,000 盧比(117,937.12 美元)。

預計未來幾年市場將經歷進一步轉型,尤其是隨著電動豪華 SUV 的出現。

北美是最大市場,亞太是成長最快的市場

包括美國和加拿大在內的北美地區仍然是豪華車的最大市場,並對整個行業收益做出了巨大貢獻。尤其是美國,經濟強勁,富人眾多,是豪華車銷售的主要動力。 2022年,該地區豪華車收益超過70億美元。光是在美國,2022 年銷售額就超過 60 億美元。

北美地區對豪華車的需求受到高可支配收入、重視汽車聲譽的文化以及對大型豪華SUV的強烈偏好等因素的推動。由於可支配收入高,消費者可以更偏好豪華車。

儘管北美在整體市場規模上處於領先地位,但憑藉其豐富的汽車傳統和豪華汽車製造商的強大影響力,歐洲佔據了重要地位。歐洲消費者往往更喜歡豪華轎車和跑車,這促成了全球豪華車市場的多樣性。

在中國和印度等國家經濟成長的推動下,亞太地區正成為豪華車市場的重要參與者。預計該地區將成為預測期內成長最快的市場。近年來,中國和印度的富裕人士和超高淨值人士數量大幅增加。隨著這些地區中中階中產階級人口的不斷擴大,豪華車被視為身分的象徵,需求迅速增加。豪華車產業的汽車製造商也越來越關注這些市場,看到了高成長潛力。例如:

- 2023年8月,奧迪在印度推出了新款電動車Q8 e-tron和e-tron Sportback。 Q8 e-tron 系列有兩種型號,分別配備 95kWh 和 114kWh 電池組。

總體而言,北美的主導地位在未來幾年可能會受到亞太和歐洲等地區的挑戰,這些地區越來越多的高所得消費者正在大力投資豪華車。

豪華車產業概況

豪華車市場由少數參與者整合。梅賽德斯-奔馳、寶馬、大眾集團和特斯拉佔據主要市場佔有率。

在先進技術、提高舒適度、增加對電動車技術的投資以及不斷提高的全球生活水準的推動下,主要企業不斷產品推出並投資於研發。例如

- 2023年4月,捷豹路虎宣布計劃透過其位於英國的海伍德工廠加速轉型成為全球領先的現代豪華汽車製造商之一。該工廠將是全電動生產設施。

- 2023 年 9 月,路特斯在紐約推出了首款 4 門超級 GT「Emeya」。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 對舒適駕駛體驗和車輛安全的需求不斷成長推動市場發展

- 高淨值人士(HNWI)和超級富豪階級的增加將推動需求

- 市場限制因素

- 初始持有高是一個問題

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模 - 十億美元)

- 車型

- 掀背車

- 轎車

- 運動型公共事業車(SUV)

- 多用途汽車(MPV)

- 其他車型(運動型等)

- 驅動系統

- 內燃機(ICE)

- 電動和混合

- 車輛類別

- 入門豪華艙

- 中級豪華級

- 超豪華級

- 地區

- 北美洲

- 美國

- 加拿大

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Mercedes-Benz Group AG

- BMW AG

- Volvo Group

- Volkswagen Group

- Jaguar Land Rover Automotive PLC

- Fiat Chrysler Automobiles

- Ford Motor Company

- FAW Car Company

- Hyundai Motor Group

- Tesla Inc.

第7章 市場機會及未來趨勢

- 豪華車採用自動駕駛技術成大趨勢

- 純電動車 (BEV) 將主導所有豪華汽車領域

第8章 市場規模和基於單位數量的預測

第9章主要企業市場參與者產品基準

The Luxury Car Market size in terms of Equal-5.55 is expected to grow from USD 738.63 billion in 2024 to USD 967.65 billion by 2029, at a CAGR of 5.55% during the forecast period (2024-2029).

The luxury car market has experienced robust growth in 2022, driven by key factors such as the expanding affluence of the global population, especially in emerging markets, where rising disposable incomes propel an increasing number of consumers to consider luxury cars. Furthermore, technological advancements, including innovations in electric and autonomous vehicles, are reshaping the landscape, attracting tech-savvy consumers seeking cutting-edge automotive experiences.

The luxury car market is experiencing a surge in electric and hybrid models, with major players investing heavily in research and development to meet the demand for eco-friendly alternatives. Connectivity features such as IoT capabilities, AI-driven interfaces, and autonomous driving technologies are becoming standard, elevating the driving experience.

However, economic uncertainties and stringent emission standards pose challenges for the luxury car market. Fluctuations in the global economy and environmental concerns can impact consumer confidence and influence purchasing power. In addition, an increase in import tariffs is expected to hinder the growth of the luxury car market. For instance, in India, cars with CIF (Cost, Insurance, and Freight) value over USD 40,000 incur a 100% customs tax, while those under USD 40,000 face a 60% import duty.

Based on these ongoing developments, the luxury car market is expected to continue its positive growth trajectory during the forecast period.

Luxury Car Market Trends

SUVs will be the Leading Segment in the Luxury Car Market

SUVs have emerged as the leading segment in the luxury car market. This growth could be attributed to several factors shaping the landscape of the luxury automotive industry. Luxury SUVs have gained significant traction, offering a combination of versatility, advanced technology, and a perceived sense of safety and prestige.

Luxury SUVs are becoming increasingly appealing to a broad range of consumers, including families and young professionals. The market has responded positively to the combination of performance, comfort, and practicality that these vehicles offer, making them a popular choice among luxury car buyers.

The elevated driving position and robust build of SUVs contribute to a sense of security, which resonates well with consumers seeking both safety and luxury in their vehicles. In addition, the incorporation of the latest technological features, such as advanced infotainment systems, driver assistance technologies, and connectivity options, has further enhanced the appeal of luxury SUVs.

Regional variances also play a key role in shaping the market for luxury SUVs. For instance, North America and China have shown a strong inclination for luxury SUVs. In China, the popularity of large SUVs among high-net-worth individuals has been particularly significant. While luxury sedans have historically held a significant market share in Europe, there is a growing shift toward luxury SUVs, reflecting changing consumer preferences and lifestyle choices.

Furthermore, factors such as economic conditions and environmental concerns also influence the dynamics of the luxury SUV market. Economic prosperity in certain regions has led to increased sales of larger and more expensive SUV models. Moreover, the rise of electric and hybrid SUVs addresses growing environmental consciousness among consumers, contributing to the overall evolution of the luxury car market.

As the automotive industry places greater emphasis on sustainability, automakers are investing heavily in electric vehicle technology, offering luxury SUVs with zero-emission capabilities. For instance:

- In November 2023, India's largest luxury auto brand, Mercedes-Benz, launched the GLE LWB SUV and AMG C43 4MATIC sedan. The company launched the face-lifted version of the GLE SUV in India at a starting price of INR 96.40 lakh (ex-showroom) across three variants. The SUV has made its debut alongside the C43 AMG 4Matic sedan, with a price tag of INR 98 lakh (USD 117937.12).

The market studied is expected to witness further transformations in the coming years, particularly with the emergence of electric luxury SUVs.

North America is the Largest while APAC is the Fastest Growing Market

North America, encompassing the United States and Canada, remains the largest market for luxury cars, contributing significantly to the industry's overall revenue. The United States, in particular, has been a key driver of luxury car sales, with a robust economy and a substantial population of wealthy consumers. In 2022, the region generated revenue of over USD 7000 million from luxury cars. The United States alone generated revenue of over USD 6000 million in 2022.

The demand for luxury vehicles in North America has been fueled by factors such as high disposable incomes, a culture emphasizing automotive prestige, and a strong preference for larger luxury SUVs. High disposable incomes enable consumers to indulge in premium automotive offerings.

While North America leads in terms of overall market size, Europe, with its rich automotive heritage and a strong presence of luxury car manufacturers, holds substantial significance. European consumers often favor luxury sedans and sports cars, contributing to the diverse global luxury car market landscape.

The Asia-Pacific region, driven by the economic growth of countries such as China and India, is increasingly becoming a significant player in the luxury car market. The region is expected to be the fastest-growing market during the forecast period. In recent years, the number of HNWIs and UHNWIs has grown significantly in China and India. The expanding middle and upper-middle-class populations in these regions have led to a surge in demand for luxury vehicles, as they are perceived as status symbols. Automakers involved in the luxury car business have also started increasingly focusing on these markets, seeing their high growth potential. For instance:

- In August 2023, Audi launched its new electric duo, the Q8 e-tron and e-tron Sportback in India. The Q8 e-tron range is available in two trims with 95kWh and 114kWh battery packs, respectively.

Overall, in the coming years, North America's dominance will be challenged by regions like APAC and Europe, with their growing high-income groups investing heavily in luxury cars.

Luxury Car Industry Overview

The luxury car market is consolidated with a small number of players. Mercedes-Benz, BMW, Volkswagen Group, and Tesla hold the major share of the market studied.

The key players are engaged in continuous product launches and R&D investments, highly driven by advanced technology, more comfort, growing investment in EV technology, and improved living standards worldwide. For instance:

- In April 2023, JLR announced its plans to accelerate its transition to become the world's leading modern luxury car manufacturer through its Halewood plant in the United Kingdom. The plant will become an all-electric production facility.

- In September 2023, Lotus unveiled Emeya, the company's first four-door hyper-GT, in New York City.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Demand for Comfortable Driving Experience and Vehicle Safety is Driving the Market

- 4.1.2 Increasing Number of High Net Worth Individuals (HNWI) and Ultra HNWIs Drives Demand

- 4.2 Market Restraints

- 4.2.1 High Initial Cost of Ownership is a Challenge

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD billion)

- 5.1 Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sports Utility Vehicles (SUV)

- 5.1.4 Multi-Purpose Vehicles (MPV)

- 5.1.5 Other Vehicle Types (Sports, etc.)

- 5.2 Drive Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Electric and Hybrid

- 5.3 Vehicle Class

- 5.3.1 Entry-level Luxury Class

- 5.3.2 Mid-level Luxury Class

- 5.3.3 Ultra Luxury Class

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Mercedes-Benz Group AG

- 6.2.2 BMW AG

- 6.2.3 Volvo Group

- 6.2.4 Volkswagen Group

- 6.2.5 Jaguar Land Rover Automotive PLC

- 6.2.6 Fiat Chrysler Automobiles

- 6.2.7 Ford Motor Company

- 6.2.8 FAW Car Company

- 6.2.9 Hyundai Motor Group

- 6.2.10 Tesla Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Adoption of Autonomous Driving Technology in Luxury Cars to be a Key Trend

- 7.2 Battery-Electric Vehicles (BEVs) will be Dominant Across all Luxury Segment