|

市場調查報告書

商品編碼

1524097

資料中心浸入式冷卻:市場佔有率分析、產業趨勢/統計、成長預測 (2024-2029)Immersion Cooling In Data Centers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

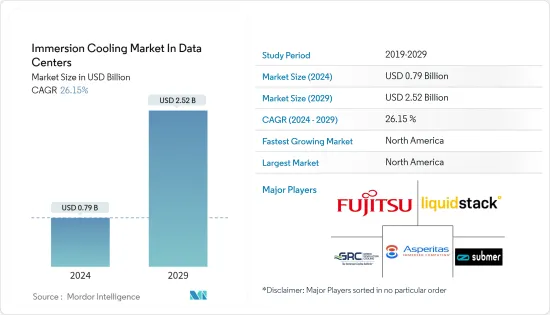

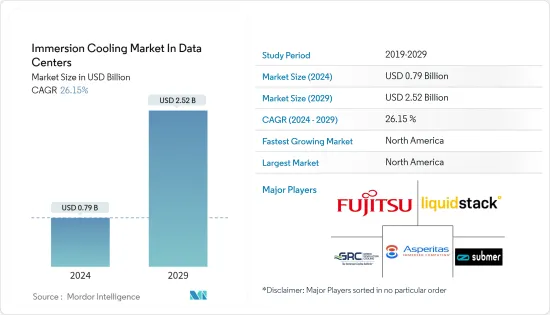

資料中心產業液浸冷卻市場預計將從2024年的7.9億美元成長到2029年的25.2億美元,預測期間(2024-2029年)複合年成長率為26.15%。

為了滿足對該技術不斷成長的需求,Supermicro 和 Fujitsu 等公司提供了多系列支援液浸冷卻的伺服器。一些硬體製造商已開始更新韌體和 BIOS,以通知伺服器在基於浸入式冷卻的安裝中不需要風扇,這主要是由於業界對向硬體冷卻技術過渡的反應表明已經做好準備。

主要亮點

- 資料中心不斷增加的碳排放也是導致擴大採用浸入式冷卻等先進液體冷卻技術的一個主要問題。浸入式冷卻市場領先的合成冷卻劑供應商 3M 最近進行的一項研究發現,採用傳統空氣冷卻技術的資料中心所需的電力有 38% 用於冷卻電子元件。

- 印度和中國等新興經濟體IT結構的發展預計將扭轉對資料中心的需求。由於擴大採用雲端模型,對資料中心的需求預計將會增加,這為 IT 產業帶來了成本和營運優勢。

- NTT Ltd 的一項調查顯示,超過一半的受訪者表示雲端模型將為他們組織的業務營運帶來最重大的變化。因此,資料中心冷卻的需求預計將增加,從而導致基於最終用戶偏好的液體冷卻方法的實施。

- Uptime 最近的年度調查發現,超過 20kW 的機架部署量正在下降。與前一年同期比較表明,大多數受訪者使用 10-19kW 範圍內密度最高的機架。當機架密度高於20-25kW時,直接液冷變得更經濟有效。

- 對於大型企業來說,從長遠來看,比平常更頻繁地更換故障伺服器可能比在較低溫度下運行超大規模設施更便宜。儘管如此,隨著對更大運算能力的需求推動了 GPU 在資料中心的整合,大型企業必須轉向有效的冷卻技術。

- COVID-19 的爆發給多個經濟體的各個部門帶來了進一步的壓力。這已將焦點轉移到數位經濟。中國領先的雲端運算供應商阿里雲正在投資數十億美元建設下一代資料中心,以支援「疫情後世界」的數位轉型需求。

- 由於 COVID-19 大流行帶來的遠程辦公和其他虛擬活動的增加,資料中心的能源使用量進一步增加。因此,使用永續冷卻技術的開發正在不斷增加。

資料中心液浸冷卻市場趨勢

邊緣運算正在顯著成長

- 在預測期內,企業預計將快速採用 IP 連線的行動裝置和處理大量 IP 流量的機器對機器 (M2M) 裝置。對線上提供者提供的更快 Wi-Fi 服務和應用傳輸的需求預計將會增加。一些 M2M 設備(例如自動駕駛汽車)需要與本地處理資源進行即時通訊以確保安全。

- 邊緣資料中心部署將支援許多新技術,包括第五代(5G)網路、物聯網和工業物聯網設備、虛擬實境和增強智慧、人工智慧和機器學習、資料分析、自動駕駛汽車、視訊串流和監控等。

- 5G 無線基礎設施的出現促使資料中心營運商選擇邊緣運算基礎設施以及提供更低延遲和更高彈性的網路。多接取邊緣運算(MEC)可協助網路服務與使用者更緊密地連接。

- 因此,由於多種因素,包括5G技術在全球範圍內的引入、自動駕駛和自動駕駛汽車以及智慧城市的成長趨勢,對高效邊緣資料中心的需求預計將增加。英特爾預計,2024 年全球自動駕駛汽車註冊佔有率為 0.49%,2030 年預計將達到 12%。

- 然而,大規模邊緣運算部署的一個關鍵要求是低營運成本。浸入式冷卻可在邊緣部署中顯著節省能源。液體冷卻解決方案的可靠性和非接觸式功能滿足了對更長的平均維護時間和更長的干涉間隔的需求,以實現遠端位置安裝的設備的可行操作和管理。

- 人工智慧 (AI) 是許多公司數位轉型的一部分,預計將對資料中心管理、生產力和基礎設施產生重大影響。全球資料中心建設產業也在蓬勃發展,雲端應用的不斷成長為巨量資料和物聯網投資帶來了新的機遇,從而導致超大型資料中心的增加。

- 人工智慧和巨量資料分析需要高冷卻能力,許多浸入式和冷卻供應商正在與OEM合作來改善他們的服務。公司需要策略性地、創造性利用IT基礎設施來獲得競爭優勢。浸入式冷卻可有效降低功耗,同時保持人工智慧應用等密集工作負載的效能。

北美佔據主要市場佔有率

- 資料中心投資者正在投資直接晶片冷卻和浸入式解決方案。隨著5G網路在全球興起,邊緣資料中心變得越來越重要,而美國是最早採用此技術的國家之一。在美國,許多業者已經開始投資邊緣資料中心,包括EdgePresence、EdgeMicro和American Towers。

- 根據Cisco的報告,美國的行動資料流量每年都在大幅成長,從 2017 年每月 1.26Exabyte資料流量增加到 2022 年每月 7.75Exabyte資料流量。據愛立信稱,到 2030 年,這筆資料流量預計將進一步增加兩倍。因此,分散式雲端正在成為實用化,有可能提供如此規模的輕鬆連接所需的低延遲和高頻寬。

- 美國的網路使用量顯著增加。該國是最大的資料中心營運市場,並且由於最終用戶資料消耗的增加而不斷擴大。物聯網 (IoT) 的普及正在推動美國超大型資料中心市場的發展,從而催生更多能夠支援企業用戶和消費者產生的Exabyte資料的設施。

- Switch 與戴爾和聯邦快遞合作,在美國部署邊緣資料中心設施。主機代管服務供應商DataBank已向美國邊緣資料中心供應商EdgePresence投資3,000萬美元,將客戶工作負載主機代管到邊緣中心,以減少服務延遲。

- 全球位置諮詢提供者(經濟獎勵、企業房地產服務、空氣冷卻系統)Site Selection Group 表示,該地區的經濟冷卻能力已達到最大。隨著越來越多的資料中心致力於將機架裝滿,液體冷卻已成為更實用的解決方案。

資料中心浸沒式冷卻產業概述

市場競爭激烈,預計在預測期內將進一步加劇。 Fujitsu Limited、Green Revolution Cooling Inc.、Submer Technologies SL、Liquid Stack Inc. 和 Asperitas Company 等主要企業正在合作、協作、協作,以加強產品系列併採用收購等策略確保永續的競爭優勢。

- 2023 年 11 月 - Liquid Stack 推出了一系列新的通用冷卻劑分配單元 (CDU),可進行配置以適應大多數商用晶片直接 (DTC) 解決方案。 Liquid Stack 的通用 CDU 系列適用於 AI、HPC 和高階雲端運算應用,提供 800kW 至 1.5MW 的排熱功率,專為 DTC 設計。

- 2023 年 10 月 - 英特爾和 Submer 合作,為單相浸入式技術奠定堅實的基礎,在強制對流散熱器 (FCHS) 封裝方面實現突破。 FCHS 徹底改變了資料中心的冷卻方式,減少了熱設計功率 (TDP) 大於 1000W 的晶片全面吸熱和散熱所需的組件數量和成本。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭程度

- 替代品的威脅

- 評估 COVID-19 對產業的影響

- 產業供應鏈分析

- 氟化液體供應商/製造商

- 浸入式冷卻浴設備供應商

- 資料中心供應商

第5章市場動態

- 市場促進因素

- 超大規模資料中心的增加

- 應對高密度功耗

- 市場限制因素

- 資金投入大

第 6 章 技術概覽

- 資料中心冷卻的演變

- 能耗和計算密度指標以及關鍵考慮因素

- 流體、處理器、GPU、機架和基礎設施供應商的細分

第7章 市場區隔

- 按類型

- 單相浸沒式冷卻系統

- 兩相浸沒式冷卻系統

- 透過冷卻劑

- 礦物油

- 去離子水

- 氟碳液

- 合成液

- 按用途

- 高效能運算

- 邊緣運算

- 人工智慧

- 加密貨幣挖礦

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- Fujitsu Limited

- Green Revolution Cooling Inc.

- Submer Technologies SL

- Liquid Stack Inc.

- Asperitas Company

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd

- Wiwynn Corporation

- DCX Ltd

第9章投資分析

第10章市場的未來

The Immersion Cooling Market In Data Centers Industry is expected to grow from USD 0.79 billion in 2024 to USD 2.52 billion by 2029, at a CAGR of 26.15% during the forecast period (2024-2029).

Owing to the increasing demand for this technology, companies such as Supermicro and Fujitsu offer several server lines ready for immersion cooling. Several hardware manufacturers are launching firmware and BIOS updates to inform servers that fans are not required in immersion-cooling-based installations, primarily indicating the industry's readiness to shift to hardware cooling technologies.

Key Highlights

- The increasing carbon footprint of the data centers is another major issue leading to the increased adoption of advanced liquid cooling technology, such as immersion cooling. In a recent study conducted by company 3M, a prominent synthetic coolant provider in the immersion cooling market, it was identified that 38% of the electricity needed in data centers equipped with traditional air-based cooling technologies is utilized to cool the electronic components.

- The developments in the IT structure in emerging economies, such as India and China, are expected to boost the demand for data centers favorably. The demand for data centers is anticipated to increase due to the increasing adoption of the cloud model, which has cost and operational benefits for the IT industry.

- According to an NTT Ltd study, over half of the respondents stated that the cloud model would have the most transformational impact on their organization's business operations. Therefore, the demand for the cooling of data centers is anticipated to increase, leading to the execution of liquid cooling methods based on end-user preferences.

- Uptime launched its recent annual survey, which found that racks consisting of 20 kW and advanced are decreasingly deployed. On a time-over-year base, most respondents highlighted their highest density rack usage in the 10-19 kW range. Direct liquid cooling becomes more economical and effective when rack densities higher than 20- 25 kW are preferred.

- For large enterprises, replacing failed servers more constantly than usual may be less expensive over time than operating a hyperscale facility at lower temperatures. Still, with the growing integration of GPUs in data centers urged by the need for better computing power, large enterprises must move toward an effective cooling technology.

- The outbreak of COVID-19 posed further stress on multiple economies across various sectors. This shifted the focus toward a digital economy. China's top cloud computing provider, Alibaba Cloud, invests billions in building next-generation data centers to support digital transformation needs in a"post-pandemic world."

- Data center energy usage has been compounded due to increased teleworking and other virtual activities brought on by the COVID-19 pandemic. Thus, developments using sustainable cooling technologies are on the rise.

Data Center Immersion Cooling Market Trends

Edge Computing to Witness Major Growth

- In the forecast period, organizations are expected to witness rapid growth in IP-connected mobile and machine-to-machine (M2M) devices, which handle significant amounts of IP traffic. The demand for faster Wi-Fi service and application delivery from online providers is expected to rise. Some M2M devices, such as autonomous vehicles, require real-time communications with local processing resources to ensure safety.

- The deployment of edge data centers benefits many new technologies, including fifth-generation (5G) networks, IoT and IIoT devices, virtual and augmented reality, artificial intelligence and machine learning, data analytics, autonomous vehicles, and video streaming and surveillance.

- The emergence of 5G wireless infrastructure has urged data center operators to opt for edge computing infrastructure to work with networks offering lower latency and higher resiliency. Multi-access edge computing (MEC) aids network services in connecting to users closely.

- Hence, the demand for efficient edge data centers is expected to be augmented by many factors, including the introduction of 5G technology worldwide and the growing trend of autonomous or self-driving vehicles and smart cities. According to Intel, the projected global autonomous vehicle registration share in 2024 is 0.49%; by 2030, the registration share is expected to reach 12%.

- However, a key requirement of large-scale edge computing roll-outs will be low operating costs. In edge deployments, immersive liquid cooling provides dramatic energy-saving benefits. The reliability and no-touch features of liquid cooling solutions will match the need for extended mean time to maintenance and longer intervention intervals for viable operation and management of remotely located equipment.

- Artificial intelligence (AI), a part of the digital transformation for many enterprises, is anticipated to impact data center management, productivity, and infrastructure significantly. The global data center construction industry is also booming, as increasing cloud adoption fuels new opportunities in big data and IoT investment, leading to more hyper-scale data centers.

- AI and big data analytics require a high cooling power, encouraging many liquid immersion and cooling vendors to partner with OEMs to improve their offerings. Enterprises must leverage their IT infrastructure strategically and creatively to gain a competitive advantage. Immersion cooling effectively reduces power consumption while maintaining performance across high-density workloads like AI applications.

North America to Hold Significant Market Share

- The data center investors are investing in direct-to-chip cooling and liquid immersion solutions. The emergence of 5G networks worldwide facilitates the importance of edge data centers, and the United States is among the earliest adopters of the technology. Many operators in the United States, such as EdgePresence, EdgeMicro, and American Towers, have started investing in these centers.

- The mobile data traffic in the United States increased considerably over the years, from 1.26 exabytes per month of data traffic in 2017 to 7.75 exabytes per month of data traffic by 2022, as reported by Cisco Systems. According to Ericsson, this data traffic is expected to triple further by 2030. Thus, the distributed cloud that may secure the low latency and high bandwidth required to easily connect at such a scale is coming into action.

- The United States is witnessing a substantial increase in internet usage. The country is the largest data center operations market, and it continues to expand due to the higher data consumption by end users. The popularity of the Internet of Things (IoT) is driving the US hyper-scale data center market, leading to additional facilities that can support exabytes of data generated by business users and consumers.

- Switch partnered with Dell and FedEx to deploy edge data center facilities in the United States. DataBank, a colocation service provider, invested USD 30 million in EdgePresence, an edge data center provider in the United States, to collocate their customer workloads to edge centers to reduce latency in their services.

- According to the Site Selection Group, a global location advisory provider, economic incentive, corporate real estate services, and air-cooled systems, it reached its maximum economic cooling capability in the region. As more data centers aim to pack racks to capacity, liquid cooling becomes a more viable solution.

Data Center Immersion Cooling Industry Overview

The market studied reflects high competitiveness and is expected to intensify further during the forecast period. Key players, including Fujitsu Limited, Green Revolution Cooling Inc., Submer Technologies SL, Liquid Stack Inc., and Asperitas Company, employ strategies like partnerships, collaborations, and acquisitions to fortify their product portfolios and secure sustainable competitive advantages.

- November 2023 - Liquid Stack announced its new range of universal coolant distribution units (CDUs), which can be configured to support the most commercially available direct-to-chip (DTC) solutions. Suitable for AI, HPC, and advanced cloud computing applications, LiquidStack's universal CDU range delivers 800 kW to 1.5 MW of heat rejection and is designed specifically for DTC.

- October 2023 - Intel and Submer collaborated in establishing a formidable foundation for single-phase immersion technology, which has achieved a groundbreaking advancement in the form of the Forced Convection Heat Sink (FCHS) package. Set to revolutionize data center cooling, the FCHS reduces the quantity and cost of components required for comprehensive heat capture and the dissipation of chips with thermal design power (TDP) exceeding 1000 W.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Degree of Competition

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of the Impact of COVID-19 on the Industry

- 4.4 Industry Supply Chain Analysis

- 4.5 Fluorine-based Liquid Suppliers/Manufacturers

- 4.6 Immersion Cooling Bath Equipment Vendors

- 4.7 Data Center Vendors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Hyper-scale Data Centers

- 5.1.2 Dealing with High-density Power Consumption

- 5.2 Market Restraint

- 5.2.1 High Investment with Greater Capital Expenditure

6 TECHNOLOGY SNAPSHOT

- 6.1 Evolution of Data Center Cooling

- 6.2 Energy Consumption and Computing Density Metrics, and Key Considerations

- 6.3 Teardown of Fluid, Processor, GPUs, Racks, and Infrastructure Providers

7 MARKET SEGMENTATION

- 7.1 By Type

- 7.1.1 Single-Phase Immersion Cooling System

- 7.1.2 Two-Phase Immersion Cooling System

- 7.2 By Cooling Fluid

- 7.2.1 Mineral Oil

- 7.2.2 Deionized Water

- 7.2.3 Fluorocarbon-Based Fluids

- 7.2.4 Synthetic Fluids

- 7.3 By Application

- 7.3.1 High-Performance Computing

- 7.3.2 Edge Computing

- 7.3.3 Artificial Intelligence

- 7.3.4 Cryptocurrency Mining

- 7.3.5 Other Applications

- 7.4 By Geography***

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia

- 7.4.4 Australia and New Zealand

- 7.4.5 Latin America

- 7.4.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles*

- 8.1.1 Fujitsu Limited

- 8.1.2 Green Revolution Cooling Inc.

- 8.1.3 Submer Technologies SL

- 8.1.4 Liquid Stack Inc.

- 8.1.5 Asperitas Company

- 8.1.6 LiquidCool Solutions

- 8.1.7 Midas Green Technologies

- 8.1.8 Iceotope Technologies Ltd

- 8.1.9 Wiwynn Corporation

- 8.1.10 DCX Ltd