|

市場調查報告書

商品編碼

1524101

整合工作場所管理系統 -市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Integrated Workplace Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

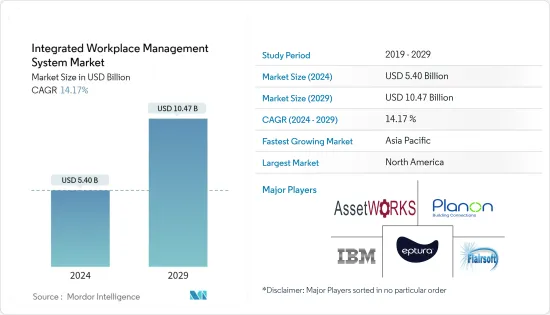

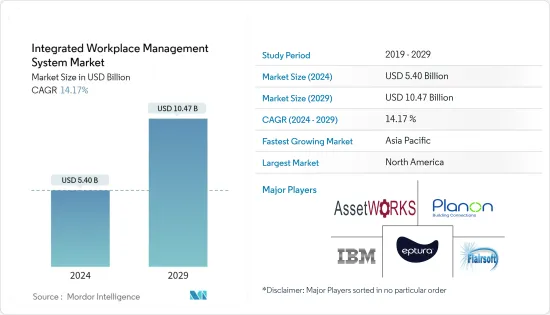

預計2024年整合工作場所管理系統市場規模為54億美元,預計2029年將達到104.7億美元,在預測期內(2024-2029年)複合年成長率為14.17%。

隨著房地產公司的崛起,擴大採用工作流程自動化解決方案,對提高生產力和降低成本的需求正在推動市場成長。

* 近年來,由於各種政府措施、都市化的加快以及已開發經濟體和新興經濟體商業建設計劃數量的增加,建設活動活性化,產生了對綜合設施管理服務的需求。

*對綠色和永續建築實踐以及建設活動恢復的日益重視正在推動綜合工作場所管理系統市場的成長。

*近年來,辦公和零售建築的增加以及對商業物業更有效率和更具成本效益的管理的需求不斷增加,推動了商業領域對綜合工作場所管理服務的需求。疫情發生以來,商辦的角色不斷改變。為商業部門創造更好的員工體驗、提高協作和生產力以及降低成本變得越來越重要。

*然而,專業人才的缺乏對全球綜合工作場所管理市場的成長構成了重大挑戰。由於該市場涵蓋從資產管理到設施管理的廣泛服務,人才短缺阻礙了服務供應商發揮其服務潛力,而在這些多個類別中尋找專家的困難正在抑制市場的成長。

*COVID-19 爆發對職場管理公司產生了重大經濟影響。對人員流動的限制減少了計劃工作並減少了一些客戶現場的活動。 COVID-19 後的未來將對轉型、創造性解決方案和獨特的規劃策略的需求不斷增加。隨著焦點轉向更高的衛生相關法規、更好的職場安全和清潔,以及數位化職場環境的發展至關重要,採購將在 COVID-19 後改變、恢復和重啟設施管理行業。

整合工作場所管理系統市場趨勢

環境永續性促進強勁成長

- IWMS 協助組織在努力實現環境永續性和法規遵循時監控和報告相關資料。 IWMS 有助於監控能源消耗、廢棄物管理、碳排放以及 LEED 和 ISO 等標準的遵守情況。這使用戶能夠確定需要改進的領域並展示組織對永續性的承諾。

- 隨著監管和宏觀環境的快速變化,主動的能源管理和永續性已成為組織長期成功的關鍵。由於越來越多的公司專注於永續性, IWMS 市場對環境永續性領域的需求正在增加。

- 公司正在採用 IWMS 平台來最佳化和追蹤資源使用、遵守法規、減少碳排放並提高其作為對環境負責的營業單位的聲譽,從而實現強大的永續性。

- 各國政府透過引入永續解決方案來持續收集、監控、基準測試和報告 ESG 績效,不斷擴大立法和企業永續發展目標 (SDG)。例如,在美國,EPAA已經推出了多項永續戰略計畫。因此,預計企業中的此類法律法規將推動對環境永續性解決方案的需求。

- 從地區來看,由於對環境友善企業實踐、環境合規監管要求以及對氣候變遷日益關注的關注,美國預計將出現成長。這些關鍵原因正在推動環境諮詢市場的發展。據全國房地產經紀人協會稱,人們期望商業建築更加節能和環保。

亞太地區將顯著成長

- 中國快速的都市化和基礎設施發展增加了對高效能職場管理解決方案的需求。隨著越來越多的商業和工業設施的新建或重建,對最佳化空間利用、設施維護和資源分配的整合工作場所管理系統的需求也在增加。

- 隨著中國工作場所的現代化,人們開始轉向技術更先進的解決方案來管理設施、資產和營運。整合的工作場所管理平台提供管理房地產投資組合、工作空間設計、能源消耗和環境永續性的整合功能,滿足現代工作場所的目標。

- 印度對資產和維護管理軟體的需求不斷成長。該國能源、製造業和公共工程等多個領域的基礎設施建設進展迅速。隨著基礎設施計劃投資的增加,對確保建築物高效運作和維護的資產和維護管理軟體的需求不斷成長。

- 為了滿足這項需求,許多公司正在推出新的解決方案。例如,2023年3月,索迪斯設施管理服務印度私人有限公司在蘭契的AHPI附屬醫療機構和診斷中心推出了用於診所維修和維護的軟體。位於蘭契的辦公室倉庫設有一個維修實驗室,用於存放對患者照護至關重要的設備的關鍵備件和配件。這些投資顯示對資產和維護管理軟體的需求不斷成長。

整合工作場所管理系統產業概述

由於對改善決策和確保業務成本效益的需求不斷增加,綜合職場管理市場變得支離破碎。主要市場參與者包括 Planon Group BV、AssetWorks Inc.、Eptura Inc.、IBM Corporation 和 Flairsoft Ltd.。

*2023 年 12 月,作為精簡數位技術、全球工程和專業服務營運的一部分,科進在其全球辦事處增加了 Causeway 排水設計解決方案。

*2023 年 11 月,德勤宣布與 IBM 合作,協助客戶將永續性計畫嵌入其組織的核心營運中,並加速實施排放策略。它還有助於監控資產監控、管理、預測性維護和可靠性規劃的績效目標和脫碳計劃,並與 IBM Maximo Application Suite(IBM 的永續發展軟體解決方案套件)中的其他產品整合。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 提高生產力和降低成本的需求推動市場成長

- 由於房地產公司的崛起,工作流程自動化解決方案的採用增加

- 市場限制因素

- 缺乏維護已安裝系統的專業知識阻礙了市場成長

第6章 市場細分

- 按服務

- 解決方案

- 房地產和租賃管理

- 設施/空間管理

- 資產/維護管理

- 計劃管理

- 環境永續性

- 其他解決方案

- 服務

- 專業的服務

- 管理服務

- 解決方案

- 按配置

- 雲

- 本地

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Planon Group BV

- AssetWorks Inc.

- Eptura Inc.

- IBM Corporation

- Flairsoft Ltd

- Trimble Inc.

- Causeway Technologies Limited

- FM:Systems(Johnson Controls International PLC)

- MRI Software LLC

- Accruent LLC(Fortive Corporation)

第8章投資分析

第9章市場的未來

The Integrated Workplace Management System Market size is estimated at USD 5.40 billion in 2024, and is expected to reach USD 10.47 billion by 2029, growing at a CAGR of 14.17% during the forecast period (2024-2029).

The demand for increased productivity and cost reduction are driving the market growth and the rise of real estate enterprises, increasing the adoption of workflow automation solutions.

* The growing construction activities due to various government initiatives, rising urbanization, and growing commercial construction projects in developed and developing economies have necessitated the demand for integrated facility management services in the past few years.

* Growing emphasis on Green and Sustainable Building Practices and rebounding construction activity are driving the growth of the integrated workplace management market.

* The growing construction of offices and retail outlets in the past few years and the increasing demand for more efficient and cost-effective management of commercial facilities are driving the demand for integrated workplace management services in the commercial sector. The role of commercial offices is constantly changing post-pandemic. It is becoming increasingly crucial to create a better employee experience, improve collaboration and productivity, and reduce costs in the commercial sector.

* However, the lack of specialized talents poses a significant challenge to the growth of the integrated workplace management market worldwide. The talent gap hinders the service providers from delivering the potential of their services as the market involves a broad range of services from asset management to facility management and the difficulty in finding professionals with expertise in these multiple categories is restraining the market's growth.

* The COVID-19 pandemic had a substantial economic impact on workplace management companies. People's mobility restrictions resulted in declining project work and decreased activity at several customer sites. In the post-COVID-19 future, there is an increased demand for transformation, creative solutions, and unique planning strategies. Since the emphasis shifted toward higher hygiene-related rules, better workplace safety and cleanliness, and developing a digitized work environment, sourcing and procurement are essential in the post-COVID-19 transformation, recovery, and restart of the facilities management industry.

Integrated Workplace Management System Market Trends

Environmental Sustainability to Witness Significant Growth

- IWMS helps an organization monitor and report relevant data if it is committed to environmental sustainability and legal compliance. They can help users monitor energy consumption, waste management, carbon dioxide emissions, and compliance with standards like LEED or ISO. It allows users to determine the areas of improvement and demonstrate the organization's commitment to sustainability.

- With a quickly changing regulatory and macro environment, active energy management and sustainability have become essential to long-term organizational success. The demand for the environmental sustainability segment in the IWMS market is increasing due to the rising corporate emphasis on sustainability initiatives.

- Businesses are adopting IWMS platforms to optimize and track resource usage, comply with regulations, reduce carbon footprint, and improve their reputation as environmentally responsible entities, thereby driving the demand for IWMS solutions with robust sustainability features and reporting capabilities.

- Governments continue to broaden laws and corporate sustainable development goals (SDGs) by deploying sustainable solutions that continuously collect, monitor, benchmark, and report ESG performance. In the United States, for example, several sustainable strategic plans have been launched by EPAA. Therefore, such laws and regulations in companies are expected to drive the demand for environmental sustainability solutions.

- By region, the United States is expected to grow due to the growing emphasis on environmentally friendly company practices, regulatory requirements for environmental compliance, and rising concerns about climate change. These key reasons are propelling the environmental consulting market. People expect commercial buildings to be more energy-efficient and eco-friendly, according to the National Association of Realtors.

Asia-Pacific to Witness Major Growth

- China's rapid urbanization and infrastructure development have increased the need for efficient workplace management solutions. As more commercial and industrial facilities are built or renovated, a demand for integrated workplace management systems to optimize space utilization, facility maintenance, and resource allocation is also growing.

- With the modernization of workplaces in China, there is a shift toward more technologically advanced solutions for managing facilities, assets, and operations. Integrated workplace management platforms offer integrated functionalities for managing real estate portfolios, workspace design, energy consumption, and environmental sustainability, aligning with the goals of modern workplaces.

- India is witnessing a growing demand for asset and maintenance management software. The country is undergoing rapid infrastructure development across various sectors, including energy, manufacturing, utility, and others. With increased investments in infrastructure projects, there is a growing need for asset and maintenance management software to ensure the efficient operation and maintenance of the buildings.

- Many companies are launching new solutions to cater to this demand. For instance, in March 2023, Sodexo Facilities Management Services India Private Limited launched its software at Ranchi's AHPI-affiliated healthcare providers and diagnostic centers to repair and maintain clinics. The office warehouse in Ranchi comprises a repair laboratory that houses vital spare parts and accessories for equipment crucial to patient care. These investments indicate the growing demand for asset and maintenance management software.

Integrated Workplace Management System Industry Overview

The integrated workplace management market is fragmented due to increasing demand for improved decision-making and ensuring cost-effective operations. Some key market players include Planon Group BV, AssetWorks Inc., Eptura Inc., IBM Corporation, and Flairsoft Ltd.

* In December 2023, as part of a drive to streamline its digital technologies, global engineering, and professional services business, WSP added a Causeway solution for drainage design across its global offices, showing the collaboration among the office building spaces and the company to increase its business in workplace management.

* In November 2023, Deloitte announced its collaboration with IBM to help clients make sustainability programs an embedded part of their organization's core business and accelerate emissions reduction strategies. It will also help monitor performance targets and decarbonization programs, which are integrated with other products from IBM's suite of Sustainability Software solutions, IBM Maximo Application Suite, for asset monitoring, management, predictive maintenance, and reliability planning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Competitive Rivalry Within the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Increased Productivity and Cost Reduction is Driving the Market Growth

- 5.1.2 Rise of Real Estate Enterprises Increasing in Adoption of Workflow Automation Solutions

- 5.2 Market Restraints

- 5.2.1 Lack of Expertise to Maintain the Deployed System is Discouraging the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Solution

- 6.1.1.1 Real Estate and Lease Management

- 6.1.1.2 Facilities and Space Management

- 6.1.1.3 Asset and Maintenance Management

- 6.1.1.4 Project Management

- 6.1.1.5 Environmental Sustainability

- 6.1.1.6 Other Solutions

- 6.1.2 Service

- 6.1.2.1 Professional Services

- 6.1.2.2 Managed Services

- 6.1.1 Solution

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Mexico

- 6.3.4.2 Brazil

- 6.3.4.3 Rest of Latin America

- 6.3.5 Middle East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Rest of Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Planon Group BV

- 7.1.2 AssetWorks Inc.

- 7.1.3 Eptura Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Flairsoft Ltd

- 7.1.6 Trimble Inc.

- 7.1.7 Causeway Technologies Limited

- 7.1.8 FM: Systems (Johnson Controls International PLC)

- 7.1.9 MRI Software LLC

- 7.1.10 Accruent LLC (Fortive Corporation)