|

市場調查報告書

商品編碼

1524205

智慧溫室:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Smart Greenhouse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

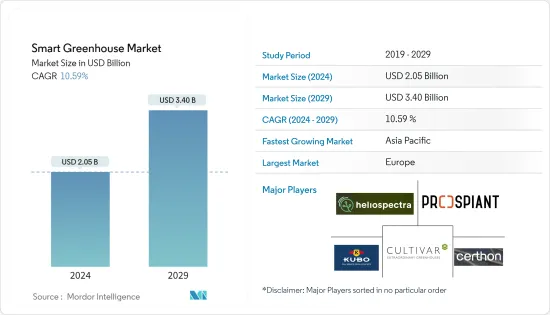

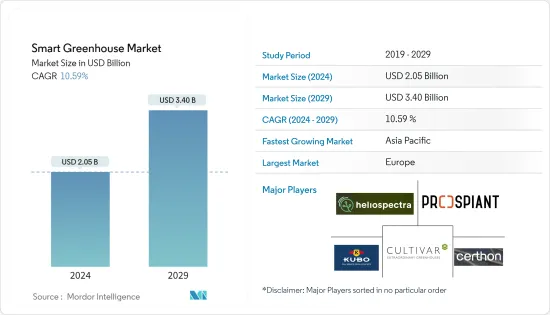

智慧溫室市場規模預計到2024年為20.5億美元,預計到2029年將達到34億美元,在預測期內(2024-2029年)複合年成長率為10.59%。

智慧農業技術正在取得重大進展。從灌溉系統的引進到精密農業農具的開發,技術徹底改變了農業部門。最近,人們開始強調將物聯網(IoT)和人工智慧(AI)融入溫室營運中。溫室和受控環境中的農業經營可以利用人工智慧和物聯網來提高作物產量、減少廢棄物並提高資源效率。

主要亮點

- 人工智慧技術的整合使農民和農業工人能夠改善工作流程、提高生產力、最佳化供應鏈並增加利潤率,同時消除浪費和節省資源。人工智慧使農民能夠更輕鬆地選擇作物、評估市場需求並確定哪些產品將產生最高收益。

- 借助智慧灌溉,人工智慧 (AI) 真正具有革命性,因為它改變了農民維護鬱鬱蔥蔥的景觀和管理水資源的方式。基於人工智慧 (AI) 的智慧灌溉系統為生產者提供了永續的解決方案,以滿足日益成長的節水需求,同時獲得更高的產量。

- 2023 年 4 月新興企業Housedigy Inc. 今天宣布推出最先進的智慧灌溉控制系統 GeoDrops。透過尖端人工智慧 (AI) 和業界領先的感測器陣列,GeoDrops 可以節省高達 70% 的戶外灌溉用水,同時打造出美麗的花園。

- 儘管智慧溫室設計可能為種植者帶來許多好處,但市場擴張受到實施昂貴技術所需的大量投資的限制。垂直農業技術是一種結合了巨量資料分析、機器人、物聯網和人工智慧等多種技術的能源密集型作物種植系統,正在全球擴展。因此,高昂的初始投資和維護成本預計將阻礙智慧溫室市場的成長。

- 然而,預計的成長和對永續農業解決方案的需求增加為尋求農業轉型的企業家提供了充滿希望的商機。

- COVID-19 的爆發導致感測器、燈泡、HVDC 系統、控制系統和 LED 照明等智慧溫室技術短暫關閉,導致全球供應鏈和多種產品的需求受到嚴重干擾。然而,消費者對健康食品日益成長的需求正在顯著推動市場成長。

智慧溫室市場趨勢

暖通空調領域佔據主要市場佔有率

- 暖通空調系統在智慧溫室中發揮著至關重要的作用,它可以維持植物生長所需的理想溫度,最大限度地減少外部溫度變化的負面影響,並促進全年種植。目前,暖通空調產業正逐漸將重點轉向能源效率。應對氣候變遷和減少溫室氣體排放的迫切需求迫使政府、企業和個人在許多領域積極尋求永續選擇,這是全球能源使用的最大貢獻者之一。

- 將人工智慧融入 HVAC 系統正在徹底改變定期測量溫度、濕度和二氧化碳水平並根據需要進行調整的整個概念。這可以透過智慧溫室內的感測器和監控系統來完成。最後,包括機器學習和人工智慧在內的先進技術可用於最佳化垂直農業的 HVAC 系統,透過使用開發的軟體解決方案,種植者可以分析資料、創建數位雙胞胎、執行預測性維護和性能管理,甚至應用高光譜遙測影像辨識。這些技術有助於根據植物的需求自動調整栽培環境,從而提高產量和有效的能源消耗。

- 最近,2023年10月,海康威視宣布創建創新的數位雙胞胎解決方案,以滿足對永續建築解決方案不斷成長的需求。海康威視融合了多種AIoT技術,這種融合涵蓋了照明、能源管理、環境監控、暖通空調等多個子系統。操作員可以查看數位雙胞胎上的熱圖,以了解站點關鍵區域的高峰時段和運轉率,AIoT 設備可以監控控制照明和 HVAC 系統的要求。

- 隨著物聯網在農業領域的廣泛滲透,人工智慧也正在向自己的領域鋪路。自動化系統在智慧溫室中發揮關鍵作用,可以精確控制和管理環境條件。透過利用致動器和控制演算法,這些系統可以調整通風、遮陽、灌溉和施肥等因素。

- 現在,最新版本的基於人工智慧的智慧溫室具有豐富的功能,可以讓農民高效種植作物並最大限度地提高農產品總量。明年,人工智慧預計將接管智慧溫室和整個農場的農業流程,成為能夠自行做出計算決策的獨立實體。這將農民與日常農場管理流程脫鉤,使他們能夠更好地利用時間並專注於發展業務,而不是犧牲 40-50% 的管理時間。微軟表示,到 2030 年,在環境應用中使用人工智慧預計將使北美的溫室氣體排放量比正常情況下減少 6.1%。

亞太地區將經歷顯著成長

- 在印度,消費者意識的提高以及對安全優質食品的需求正在推動智慧溫室的採用。印度快速的技術進步和數位化努力正在推動智慧農業解決方案的採用,包括智慧溫室。生產者擴大採用技術支援的耕作方法來提高生產力、降低生產成本並改善生計。智慧溫室提供利用感測器和自動化來最佳化作物生產的創新解決方案。

- COVID-19大流行的意外出現凸顯了中國溫室種植的成長趨勢。疫情對傳統耕作方式的破壞促使中國許多地區採用更先進的耕作方法,以加強糧食安全並維持安全和品質標準。

- 日本智慧農業的應用正在取得進展,人們越來越希望人工智慧(AI)能夠承擔更多集中任務,幫助解決該國嚴重的人手不足。經營大型智慧房屋的生產商處於利用日本新創公司開發的人工智慧機器人的最前線。人工智慧驅動的機器人有可能透過改善農產品的種植和收穫過程來顯著影響農業的未來。

- 智慧溫室支持多種作物的種植,包括蔬菜、水果、花卉和草藥。馬來西亞生產商正在採用智慧溫室來區分他們的產品,並向消費者提供優質、高價值的產品。

智慧溫室產業概況

由於全球參與者和中小企業的存在,智慧溫室市場高度分散。市場的主要參與者包括 Heliospectra AB、Prospiant Inc.、Cultivar Greenhouse Ltd、Kubo Greenhouse Projects BV 和 Certhon Group。市場參與者正在採取收購和合作等策略來增強其產品陣容並獲得永續的競爭優勢。

2024 年 3 月 - Heliospectra AB 是一家溫室和受控植物生長環境智慧照明技術提供商,收到了來自加拿大安大略省一家溫室種植商的重要訂單。該訂單價值 830 萬瑞典克朗,包括 Mitra X LED 栽培燈和 HelioCORE 控制系統,這將提高栽培的永續性和生產力。

2024 年 3 月 - KUBO Greenhouse Projects 宣布位於加拿大不列顛哥倫比亞省Delta的 WINDSET FARMS 一座佔地 24 英畝的新溫室設施竣工。該溫室是 BC 省最大的設施。 Windset Farms 利用可再生水力發電和生質能鍋爐等永續實踐,為加拿大西部、美國和亞洲市場全年生產優質番茄和黃瓜。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈/供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 農民和農業工人更常採用物聯網和人工智慧

- 由於世界人口的持續成長,糧食需求不斷增加

- 市場挑戰

- 智慧溫室系統實施成本高昂,投資成本高

第6章 市場細分

- 按類型

- 水耕

- 水耕栽培

- 依技術

- LED植物植物生長燈

- HVAC

- 物料輸送

- 控制系統

- 感光元件相機

- 閥門泵

- 灌溉系統

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Heliospectra AB

- Prospiant Inc.

- Cultivar Greenhouse Ltd

- Kubo Greenhouse Projects BV

- Certhon Group

- Argus Control Systems Ltd

- Netafim Irrigation Inc.

- Desert Growing

- Sensaphone

- Luiten Greenhouses

- Agra Tech Inc.

- Greenhouse Megastore(BFG Supply)

第8章 市場機會及未來趨勢

The Smart Greenhouse Market size is estimated at USD 2.05 billion in 2024, and is expected to reach USD 3.40 billion by 2029, growing at a CAGR of 10.59% during the forecast period (2024-2029).

Smart farming technology has advanced significantly. Technology has completely changed the farming sector, from introducing irrigation systems to developing tools for precision agriculture. These days, the emphasis is on incorporating the Internet of Things (IoT) and artificial intelligence (AI) into greenhouse operations. Greenhouse and controlled environment agriculture operations can boost crop yields, reduce waste, and enhance resource efficiency by utilizing AI and IoT.

Key Highlights

- With the integration of AI technology, farmers or agriculturists can improve their workflows, boost productivity, optimize their supply chains, and boost profit margins while reducing waste and conserving resources. AI enables farmers to choose crops more easily and assess market demand, enabling them to determine which produce will yield the highest returns.

- In smart irrigation, artificial intelligence (AI) is truly revolutionary because it transforms how farmers maintain lush landscapes and manage water resources. Artificial intelligence (AI)--based smart irrigation systems offer growers sustainable solutions to meet the growing demand for water conservation while yielding higher yields.

- In April 2023, Housedigy Inc., a high-tech startup, unveiled GeoDrops, a cutting-edge intelligent irrigation control system, today. With the help of cutting-edge artificial intelligence (AI) and industry-leading sensor arrays, GeoDrops can save up to 70% of water used for outdoor irrigation while also creating a garden that looks better.

- The smart greenhouse design may provide many benefits to the cultivator, but the large investment required due to the deployment of pricey technology limits market expansion. There is a global expansion in vertical farming technology, an energy-intensive crop cultivation system combining several technologies, such as big data analysis, robotics, the IoT, and AI. Hence, the high initial investment and maintenance expenses are anticipated to hinder the growth of the smart greenhouse market.

- However, the projected growth and the increasing demand for sustainable agricultural solutions present a promising business opportunity for entrepreneurs aiming to revolutionize the agriculture industry.

- Due to the outbreak of COVID-19, the global supply chain and demand for multiple products have majorly been disrupted, due to which sensors, valves, HVDC systems, control systems, LED lights, and other smart greenhouse technologies halted for a short period of time. However, the growing demand for healthy food by consumers has significantly promoted market growth.

Smart Greenhouse Market Trends

HVAC Segment to Hold Significant Market Share

- HVAC systems play an essential role in smart greenhouses by maintaining an ideal temperature needed for plant growth, minimizing the adverse impact of external temperature changes, and facilitating cultivation throughout the year. Currently, the HVAC industry is gradually shifting focus to energy efficiency. The urgency to tackle climate change and reduce greenhouse gas emissions has pressed governments, businesses, and individuals to actively pursue sustainable options in many areas, while greenhouses are among the most significant contributors to global energy usage.

- The incorporation of AI in HVAC systems has been revolutionizing the overall concept of regularly measuring and adjusting the temperature, humidity, and CO2 levels as needed. This can be done through sensors and monitoring systems in smart greenhouses. Finally, advanced technologies, including machine learning and AI, can be used to optimize HVAC systems for vertical farming, and with developed software solutions, growers can analyze all available data, make a digital twin, perform predictive maintenance as well as performance management, and also apply hyperspectral image recognition. These technologies can aid in automatically adjusting the growing environment to the requirements of the plants, which can lead to higher yields and efficient energy consumption.

- Recently, in October 2023, Hikvision announced the creation of an innovative digital twin solution to align with the growing demand for intelligent and sustainable construction solutions. Hikvision has integrated a diverse range of AIoT technologies, and This convergence encompasses multiple subsystems, including lighting, energy management, environmental monitoring, HVAC, and more. Operators can view heat maps in the digital twin to understand peak times and occupancy rates for key areas of the site, and with AIoT devices observing the requirement, lighting and HVAC systems can be controlled.

- With IoT presenting huge penetration rates in agriculture, AI has also been paving its way towards the respective sector. Automation systems play a crucial role in intelligent greenhouses, enabling precise control and management of environmental conditions. By leveraging actuators and control algorithms, these systems regulate factors like ventilation, shading, irrigation, and fertilization.

- Currently, the latest versions of AI-based smart greenhouses facilitate a vast plethora of features that allow farmers to grow crops and maximize the total amount of produce efficiently. In the coming year, AI is expected to take over the farming process of the smart greenhouse and the entire farm as a separate entity that can make calculated decisions by itself. This will help farmers separate themselves from the daily farm management processes and use their time better, focusing on expanding their business rather than sacrificing 40-50% for management. As per Microsoft, used for environmental applications, AI is expected to reduce GHGs in North America by 6.1% by 2030 compared to a business-as-usual scenario.

Asia-Pacific to Register Major Growth

- In India, increasing consumer awareness and demand for safe, high-quality food products is driving the adoption of smart greenhouses. India's rapid technological advancements and digitalization efforts are driving the adoption of smart agricultural solutions, including smart greenhouses. Growers are increasingly adopting technology-enabled farming practices to enhance productivity, reduce production costs, and improve livelihood. Smart greenhouses offer innovative solutions that leverage sensors and automation to optimize crop production.

- The unexpected emergence of the COVID-19 pandemic highlighted the growing trend of greenhouse farming in China. The disruptions to traditional farming methods resulting from the pandemic have prompted various regions in China to adopt more advanced agricultural practices to enhance food security and maintain standards of safety and quality.

- Japan is increasingly utilizing smart agriculture, raising expectations that artificial intelligence (AI) will be able to take on more labor-sensitive tasks to help alleviate the country's severe shortage of manpower. Growers who operate large-scale smart greenhouses are at the forefront of using AI-equipped robots developed by Japanese start-up companies. The AI-equipped robots have the potential to significantly impact the future of farming by improving the process of growing and harvesting agricultural products.

- Smart greenhouses support the cultivation of a wide range of crops, including vegetables, fruits, flowers, and herbs. Malaysian growers differentiate the produce by adopting smart greenhouses and offering premium and high-value products to consumers.

Smart Greenhouse Industry Overview

The smart greenhouse market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Heliospectra AB, Prospiant Inc., Cultivar Greenhouse Ltd, Kubo Greenhouse Projects BV, and Certhon Group. Players in the market are adopting strategies such as acquisitions and partnerships to enhance their product offerings and gain sustainable competitive advantage.

March 2024 - Heliospectra AB, a provider of smart lighting technology for greenhouse and controlled plant growth environments, has received a substantial order from a greenhouse grower in Ontario, Canada. The order,r worth SEK 8.3 million, consists of the Mitra X LED grow light and HelioCORE control system, which will improve sustainability and productivity in cultivation.

March 2024 - KUBO Greenhouse Projects announced the completion of a new 24-acre greenhouse facility for WINDSET FARMS, located in Delta, BC, Canada. The greenhouse is the largest facility in BC. Utilizing sustainable initiatives, including renewable hydroelectric power and biomass boilers, Windset Farms will produce high-quality tomatoes and cucumbers year-round for Western Canada, the US, and Asian markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of IoT and AI by Farmers and Agriculturists

- 5.1.2 Growing Demand for Food due to Continuously Increasing Global Population

- 5.2 Market Challenges

- 5.2.1 High Investment Cost Due to the Deployment of Expensive Systems in Smart Greenhouses

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hydroponic

- 6.1.2 Non-hydroponic

- 6.2 By Technology

- 6.2.1 LED Grow Light

- 6.2.2 HVAC

- 6.2.3 Material Handling

- 6.2.4 Control Systems

- 6.2.5 Sensors and Cameras

- 6.2.6 Valves and Pumps

- 6.2.7 Irrigation Systems

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Heliospectra AB

- 7.1.2 Prospiant Inc.

- 7.1.3 Cultivar Greenhouse Ltd

- 7.1.4 Kubo Greenhouse Projects BV

- 7.1.5 Certhon Group

- 7.1.6 Argus Control Systems Ltd

- 7.1.7 Netafim Irrigation Inc.

- 7.1.8 Desert Growing

- 7.1.9 Sensaphone

- 7.1.10 Luiten Greenhouses

- 7.1.11 Agra Tech Inc.

- 7.1.12 Greenhouse Megastore (BFG Supply)