|

市場調查報告書

商品編碼

1524206

叫車:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Ride-Hailing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

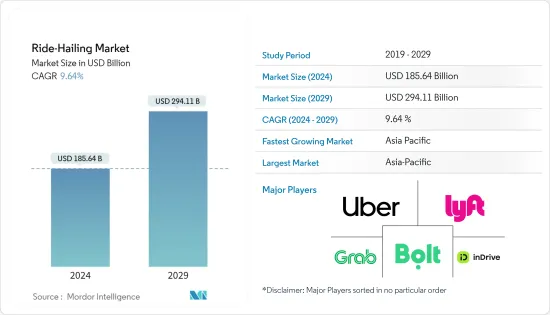

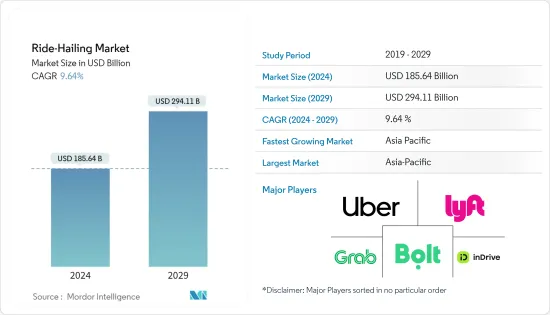

預計到 2024 年,叫車市場規模將達到 1,856.4 億美元,預計到 2029 年將達到 2,941.1 億美元,在預測期內(2024-2029 年)複合年成長率為 9.64%。

從長遠來看,全球都市化上升、旅遊業成長以及都市區交通堵塞加劇可能是推動叫車市場成長的主要因素。

隨著都市化的加快,越來越多的人在都市區尋求更好的就業機會,增加了對叫車服務的需求。與擁有汽車相比,這些消費者更喜歡負擔得起的通勤選擇。此外,隨著交通堵塞的加劇,每天需要遠距旅行的人更願意避免自己開車,因為這可能會導致身體疲勞。

最近的趨勢表明,不僅在美國和歐洲等已開發地區,而且在印度、中國和越南等新興國家,人們對叫車服務的偏好也越來越高。為了應對這些趨勢,公司正在透過行動應用程式改進服務並擴展業務,幫助他們更有效地在市場上競爭。

叫車公司正在努力透過將汽油動力汽車轉換為電動車來減少全球汽車碳排放,以消除廢氣排放。車輛改裝具有直接的環境效益和其他市場的間接效益。電動車與叫車車隊的整合預計將推動市場的顯著成長。

叫車市場趨勢

汽車領域預計將在預測期內獲得牽引力

由於對個人出行便利性的需求不斷成長以及全球遊客數量的不斷增加,消費者越來越偏好使用私人交通工具進行旅行,這是汽車行業需求成長的主要決定因素。

為了方便起見,遊客開始轉向叫車服務。這些服務使您可以根據需要隨時使用交通工具,而無需預訂一整天或特定時段的汽車。

隨著對綠色交通途徑的呼籲,世界各地的政策制定者正在優先考慮改進交通解決方案,以應對汽車污染和應對氣候變遷。

世界各國政府都在提倡車輛電氣化,以盡量減少碳排放。市場新參與企業正在大力投資,將全電動汽車引入他們的叫車服務。我們積極建立合作關係,以提高我們的品牌影響力。

- 2023 年 12 月,電動出行新興企業BluSmart 宣佈在新一輪資金籌措中籌集了 2,400 萬美元,用於建造大型充電超級中心,從而擴展電動叫車服務。

此外,市場上的幾家公司正在積極地將「緊急按鈕」等先進功能整合到他們的汽車中,以提高客戶的安全。因此,該領域的需求預計將會成長。此外,由於旅遊業的成長和叫車平台的進步,預計乘用車市場在預測期內將顯著成長。

亞太地區將成為預測期內成長最快的市場

亞太地區叫車服務市場的成長是由於日益嚴重的交通堵塞以及與其他交通途徑相比較低的票價所推動的。此外,印度和中國等國家不斷成長的城市人口導致對高速交通解決方案的需求增加,對亞太地區叫車市場產生正面影響。

近年來,亞太叫車市場不斷湧現印度BluSmart、越南GSM等新進業者。印度和中國是世界上人口最多的國家,這些國家對叫車服務的需求不斷增加。

在該生態系統中營運的公司正在結盟和合作夥伴關係,擴大其機隊,並製定新舉措以提高其品牌在這個競爭激烈的市場中的影響力。例如,

- 2023 年 11 月,Uber 與印度西孟加拉邦政府運輸部IAS 秘書合作,在加爾各答推出巴士接送服務。此舉措旨在加強大眾交通工具服務,增加通勤選擇並簡化出行。

- 2023 年 5 月,Uber 宣布計劃與 Lithium、Everest 和 Move 等車隊提供商合作,為印度市場部署 25,000 輛電動車。該公司還與電動車新興企業Zaip Electric 合作,到年終在德里部署 10,000 輛電動二輪車。

由於城市人口的增加、新參與企業市場整合的加劇以及越來越多的消費者更喜歡個人交通的便利性,預計未來幾年亞太市場對乘車服務的需求將激增。

叫車產業概況

叫車市場由滴滴出行科技有限公司、Uber Technologies Inc.、Lyft Inc.、Grab Holdings Inc.、Cabify、Bolt、inDrive、Gett 和 Ani Technologies Pvt Ltd. (OLA) 等幾家主要企業主導。 。這些參與者積極參與併購、地理擴張以及在其叫車平台中引入先進功能,以提高客戶的便利性。例如,

- 2023 年 6 月,VCNC 營運的韓國叫車平台 TADA 在其應用程式中引入了英語服務,以簡化外國客戶的用戶體驗。當外國用戶不直接叫計程車,而是讓朋友或熟人使用「call for me」功能時,該英語功能也適用。

- 2023年12月,印度卡納塔克邦政府計劃推出一款類似Ola和Uber的叫車應用程式,預計將於2024年2月向公眾開放。這項決定是在計程車和汽車駕駛人於 2023 年 8 月表達對私人乘車平台的不滿後做出的。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 日益嚴重的交通堵塞和不斷成長的城市人口推動市場成長

- 市場限制因素

- 政府對叫車服務的嚴格監管和政策影響市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模:美元)

- 按車型分類

- 摩托車

- 車

- 貨車

- 公車

- 依推進類型

- 內燃機(ICE)

- 電

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Didi Chuxing Technology Co.

- Uber Technologies Inc.

- Lyft Inc.

- Grab Holdings Inc.

- Maxi Mobility SL(Cabify)

- BlaBla Car

- GoTo Group(GoJek)

- Xanh SM(GSM)

- Bolt Technology OU

- Gett Group

- Ani Technologies Pvt. Ltd(OLA)

- SUOL INNOVATIONS LTD(inDrive)

第7章 市場機會及未來趨勢

第8章 全球叫車產業的政府監管

The Ride-Hailing Market size is estimated at USD 185.64 billion in 2024, and is expected to reach USD 294.11 billion by 2029, growing at a CAGR of 9.64% during the forecast period (2024-2029).

Over the long term, the increasing urbanization rate worldwide, the growing tourism industry, and the rising traffic congestion in urban cities will be major factors driving the growth of the ride-hailing market.

The increasing urbanization has led to a higher demand for ride-hailing services as more people seek better job opportunities in cities. These consumers prefer affordable commuting options over owning a vehicle. In addition, with growing traffic congestion, people who need to travel long distances daily prefer to avoid having to drive themselves, as it can be physically exhausting.

In recent years, there has been a growing preference for ride-hailing services in developing countries like India, China, and Vietnam, as well as in developed regions such as the United States and Europe. This trend has prompted companies to improve their services and expand their operations through mobile applications to compete effectively in the market.

Ride-hailing companies are working to reduce vehicle carbon emissions globally by converting gasoline vehicles to electric, aiming to eliminate tailpipe emissions. Fleet conversion offers direct environmental benefits and indirect advantages for other markets. The integration of electric vehicles in ride-hailing fleets is expected to drive substantial market growth.

Ride-Hailing Market Trends

The Cars Segment is Expected to Gain Traction During the Forecast Period

The increasing preference of consumers toward using private transportation for traveling purposes, owing to the rising need for convenience in personal mobility and the growing number of tourists worldwide, serve as major determinants of the rising demand for the cars segment.

Tourists are increasingly turning to ride-hailing services due to their convenience. These services allow them to access transportation as and when they need it, without the need to book a car for an entire day or a specific period.

In the age of environmentally friendly transportation, policymakers across the world are prioritizing advancements in transportation solutions to combat environmental pollution from vehicles and address climate change issues.

Governments globally are advocating for the electrification of vehicle fleets to minimize carbon emissions. New players in the market are investing substantial amounts in introducing an all-electric vehicle fleet for their ride-hailing services. They are actively forming partnerships to strengthen their brand presence.

- In December 2023, electric mobility startup BluSmart announced that it had raised USD 24 million in a fresh round of funding to build large-scale charging superhubs that would enable the expansion of its electric ride-hailing services.

Additionally, several companies in the market are actively incorporating advanced features, such as the "emergency button," into their passenger car fleet to improve customer safety. This, in turn, is expected to drive demand for this segment. Furthermore, with the growing tourism industry and the advancement of ride-hailing platforms, the cars segment of the market is anticipated to experience significant growth during the forecast period.

Asia-Pacific to Become the Fastest-growing Market During the Forecast Period

The growth of the ride-hailing service market in Asia-Pacific is driven by increasing traffic congestion and low fares compared to other modes of transportation. In addition, the rising urban population in countries like India and China is leading to a higher demand for fast transportation solutions, which is positively impacting the ride-hailing market in Asia-Pacific.

In recent years, the ride-hailing market in Asia-Pacific has seen the emergence of new players such as BluSmart in India and GSM in Vietnam. With India and China being the world's most populous countries, the demand for ride-hailing services in these nations is on the rise.

Various companies operating in the ecosystem are forming collaborations and partnerships, expanding their fleets, and strategizing for new initiatives to enhance their brand's presence in this competitive market. For instance,

- In November 2023, Uber partnered with the IAS Secretary of the Transport Department, Government of West Bengal, India, to launch a bus shuttle service in Kolkata. This initiative aims to enhance public transport services and provide more commuting options to make travel easier.

- In May 2023, Uber announced its plan to introduce 25,000 electric cars in partnership with fleet providers such as Lithium, Everest, and Moove for the Indian market. In addition, the company stated that it would roll out 10,000 electric two-wheelers in Delhi by the end of 2024 in collaboration with Zypp Electric, another EV startup.

With the growing urban population, rising integration of new entrants in the market, and the consumers' increasing preference for convenience in personal mobility, the demand for ride-hailing services in the Asia-Pacific market is anticipated to surge rapidly over the coming years.

Ride-Hailing Industry Overview

The ride-hailing market is dominated by several key players, such as Didi Chuxing Technology Co., Uber Technologies Inc., Lyft Inc., Grab Holdings Inc., Cabify, Bolt, inDrive, Gett, and Ani Technologies Pvt. Ltd (OLA). These players are actively engaging in mergers and acquisitions, geographical expansions, and introducing advanced features in their ride-hailing platforms to enhance customers' convenience. For instance,

- In June 2023, the South Korean ride-hailing platform TADA, operated by VCNC, introduced an English-language service to its app to simplify the user experience for international customers. The English-language functionality also extends to situations where a foreign user is not directly hailing the taxi, but a friend or acquaintance uses the "call for me" feature on their behalf.

- In December 2023, the Karnataka government in India planned to launch its ride-hailing app, similar to Ola and Uber, which was expected to be open to the public by February 2024. This decision came after taxi and auto drivers voiced grievances against private ride-hailing platforms in August 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth

- 4.2 Market Restraints

- 4.2.1 Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Motorcycles

- 5.1.2 Cars

- 5.1.3 Vans

- 5.1.4 Buses

- 5.2 By Propulsion Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Electric

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Didi Chuxing Technology Co.

- 6.2.2 Uber Technologies Inc.

- 6.2.3 Lyft Inc.

- 6.2.4 Grab Holdings Inc.

- 6.2.5 Maxi Mobility SL (Cabify)

- 6.2.6 BlaBla Car

- 6.2.7 GoTo Group (GoJek)

- 6.2.8 Xanh SM (GSM)

- 6.2.9 Bolt Technology OU

- 6.2.10 Gett Group

- 6.2.11 Ani Technologies Pvt. Ltd (OLA)

- 6.2.12 SUOL INNOVATIONS LTD (inDrive)