|

市場調查報告書

商品編碼

1686220

奈米陶瓷粉末-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Nanoceramic Powder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

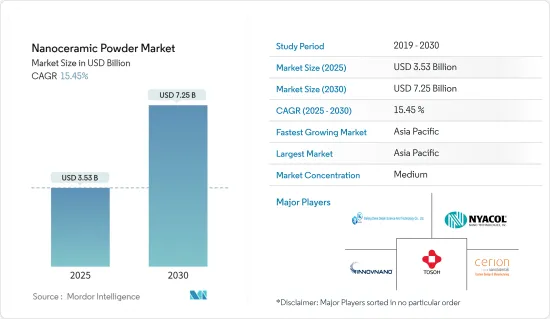

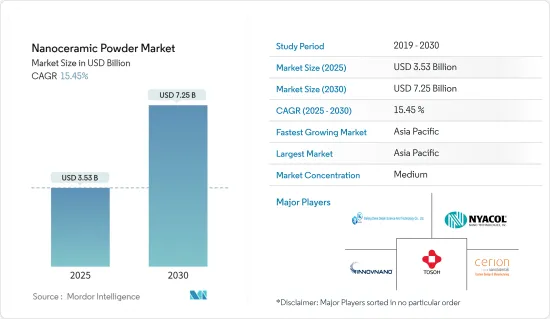

奈米陶瓷粉末市場規模預計在 2025 年為 35.3 億美元,預計到 2030 年將達到 72.5 億美元,預測期內(2025-2030 年)的複合年成長率為 15.45%。

主要亮點

- 新冠疫情影響了各行各業,嚴重影響了對奈米陶瓷粉末的需求。需求波動是由於供應鏈中斷、經濟活動減少和消費行為改變所造成的。對奈米陶瓷粉末的需求受到運輸、化學和工業領域衰退趨勢的影響。然而,自從限制解除以來,該行業已經復甦。

- 推動市場研究的關鍵因素是其在電子產業的廣泛應用。此外,對醫療保健領域和高性能陶瓷塗層的需求不斷成長,推動了奈米陶瓷粉末市場的發展。

- 奈米陶瓷粉末的高加工成本以及健康安全問題預計將對2024-2029年期間奈米陶瓷粉末的成長產生負面影響。

- 碳化矽和氮化鎵的應用日益增多以及太空探勘和太陽能電池等先進技術領域的機會預計將為市場提供新的成長機會。

- 預計亞太地區將在 2024 年至 2029 年期間佔據市場主導地位。電氣和電子產業受到不斷增加的投資和出口機會的支持,從而推動成長。

奈米陶瓷粉體市場趨勢

電氣和電子產業需求增加

- 近二十年來,人們對奈米陶瓷進行了大量研究,為學術界和工業界帶來了許多積極的成果。因此,這些先進材料在電子領域有廣泛的應用。

- 奈米陶瓷粉末的介電、鐵磁、壓電、磁阻和超導性特性使其成為電力傳輸裝置、工業電容器和高能能源儲存裝置等應用的理想選擇。

- 奈米陶瓷粉末用於電子工業,傳統上用於製造行動電話、可攜式電腦、遊戲系統和其他個人電子設備中的高速計算晶片。

- 奈米陶瓷氧化鋁在電子產品中應用最為廣泛,因為它可以承受更高的電壓,並且其形狀可以根據設備的尺寸量身定做。

- 由於對行動電話、可攜式電腦、遊戲系統和其他個人電子設備的需求不斷成長,全球消費性電子產業多年來一直經歷快速成長。根據日本電子情報技術產業協會統計,2023年1-8月電子產品總生產值為69,372.33億日圓。

- 根據國家統計局資料,2023年4月中國積體電路產量達281億塊。中國智慧型手機用戶數量快速成長。預計到2023年底,該國智慧型手機用戶數將達到8.682億。

- 東協是亞太地區消費性電子領域成長最快的地區。電氣和電子製造業是東協最突出的產業之一。該行業約佔該地區出口總額的30-35%。世界上大多數消費性電子產品,包括收音機、電腦和行動電話,都是在東南亞國協生產和組裝的。

- 在北美,尤其是美國,電子產業預計將經歷溫和成長。預計未來對採用新技術的產品的需求不斷增加將推動市場擴張。

- 由於最新科技產品的日益普及,全球消費性電子產品市場在過去幾年中取得了顯著成長。家庭自動化和個人輔助設備的整合正在推動市場顯著成長。

- 根據電子情報技術產業協會的數據,2023 年 1 月至 9 月電子產品產值為 7,891,720 百萬日圓(約 52,864,900,000 美元)。

- 所有上述因素都可能增加 2024 年至 2029 年的市場需求。

亞太地區可望主導市場

- 亞太地區佔全球需求的50%以上,是奈米陶瓷粉體材料最具前景的市場,並有可能在不久的將來佔據市場主導地位。這種主導地位歸因於該地區電子和醫療行業日益成長的需求。

- 中國佔該地區奈米陶瓷粉末需求的33%以上。中國也是全球奈米陶瓷粉末的主要市場之一。電子、航太和國防(A&D)產業蓬勃發展,對奈米陶瓷粉末的需求持續成長。

- 中國是全球最大的電子產品製造基地之一,對韓國、新加坡和台灣等現有的上游製造商構成了激烈的競爭。從需求來看,智慧型手機、OLED電視、平板電腦等電子產品在消費性電子市場中成長率最高。根據中國國家統計局的數據,2023 年 4 月中國家電及消費性電子產品零售額達到近 610 億元人民幣(85.2 億美元)。

- 此外,根據印度品牌股權基金會(IBEF)的數據,預計到2025年,印度電子製造業的產值將達到5,200億美元。此外,預計到2025年,印度將成為世界第五大家電和電子產業國。由於印度製造、國家電子政策、電子產品淨零進口和零缺陷零效應等政府舉措,印度電氣和電子設備產量預計將快速成長,這些舉措促進了國內製造業的成長,減少了進口依賴,促進了出口並致力於製造業。

- 該地區也是最大的汽車製造地,中國和印度為最大限度提高生產能力做出了貢獻,東南亞國協也加入了市場擴張的行列。中國是全球最大的汽車市場,在全球汽車領域中發揮著至關重要的作用。 2022年,中國汽車產量預計將達到2,702萬輛,比上年(2,609萬輛)增加3%。中國產量高顯示對汽車材料(包括奈米陶瓷粉末)的需求強勁,這支撐了這個蓬勃發展的產業。

- 此外,中國是最大的飛機製造商之一,也是最大的國內航空客運市場之一。此外,該國的飛機零件和組裝製造業正在快速發展,擁有超過 200 家小型飛機零件製造商。

- 預計 2024 年至 2029 年期間該地區的奈米陶瓷粉末市場前景廣闊,因為其在軍用飛機、引擎和戰鬥機的高級設備和部件中的應用至關重要。

- 中國政府每年都會公佈國防支出。中國宣布,2023 年 3 月的國防預算為 1.55 兆元(2,248 億美元)。這比 2022 年的 1.45 兆元(2,296 億美元)預算名義上增加了 7.2%。

- 總體而言,由於中國和印度的持續成長,預計未來幾年全部區域對奈米陶瓷粉末的需求將以更快的速度成長。亞太地區的巨大成長為全球奈米陶瓷粉末市場的擴張做出了巨大貢獻。

奈米陶瓷粉體產業概況

全球奈米陶瓷粉體市場呈現寡占和部分整合的格局,少數幾家公司佔據主導地位。主要企業包括東曹株式會社、北京大科奈米技術有限公司、NYACOL Nano Technologies Inc.、Innovnano-Materiais Avancados SA 和 Cerion LLC。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 電子業普及

- 醫療保健產業需求增加

- 對高性能陶瓷塗層的需求不斷增加

- 限制因素

- 加工成本高

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 專利分析

- 原料分析

第5章市場區隔

- 類型

- 氧化物粉末

- 碳化物粉末

- 氮化物粉末

- 硼粉

- 其他類型

- 最終用戶產業

- 電氣和電子

- 工業的

- 運輸

- 醫療保健

- 化學

- 防禦

- 其他最終用戶產業

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 世界其他地區

- 亞太地區

第6章競爭格局

- 市場排名分析

- 主要企業策略

- 公司簡介

- ABM Advance Ball Mill Inc.

- Beijing DK Nano Technology Co. Ltd

- Cerion LLC

- Inframat Advanced Materials LLC

- Innovnano-materiais Avancados SA

- Nanophase Technologies Corporation

- NYACOL Nano Technologies Inc.

- Tosoh Corporation

- Trunnano

第7章 市場機會與未來趨勢

- 太空探勘和太陽能電池等尖端技術領域的商機

- 碳化矽和氮化鎵的應用範圍不斷擴大

簡介目錄

Product Code: 50700

The Nanoceramic Powder Market size is estimated at USD 3.53 billion in 2025, and is expected to reach USD 7.25 billion by 2030, at a CAGR of 15.45% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic had a diverse effect on different industries, significantly impacting the demand for nanoceramics powder. The demand fluctuations were due to disruption in supply chains, reduced economic activity, and changed consumer behavior. The demand for nanoceramics powder was affected as the transportation, chemical, and industrial sectors witnessed a decreasing trend. However, since restrictions were removed, the industry has been recovering.

- A significant factor driving the market study is widespread use in the electronics industry. Additionally, increasing demand in the healthcare sector and high-performance ceramic coatings drive the nanoceramics powder market.

- The high processing costs of nanoceramic powder and health and safety issues are expected to negatively affect the growth of the nanoceramic powder between 2024 and 2029.

- Increasing applications of silicon carbide and gallium nitride and opportunities in advanced technologies, like space exploration and photovoltaic solar cells, are expected to provide new growth opportunities for the market.

- Asia-Pacific is expected to dominate the market from 2024 to 2029. The electrical and electronics sector is supported by increasing investments and export opportunities, which drive this growth.

Nanoceramic Powder Market Trends

Increasing Demand from the Electrical and Electronics Industry

- Over the last 20 years, there has been a huge amount of study into nanoceramics that has resulted in some positive outcomes for academia and industry. As a result, these advanced materials have a wide range of uses in electronics.

- Nanoceramic powders with properties like dielectricity, ferromagnetism, piezoelectricity, magnetoresistance, and superconductivity make them a perfect fit for applications in power transmission devices, industrial capacitors, high-energy storage devices, and others.

- Nanoceramic powders are used in the electronics industry, and they are traditionally used during the production of high-speed computing chips in cellular phones, portable computing devices, gaming systems, and other personal electronic devices.

- Nanoceramic alumina is most commonly used in electronics, as it can withstand a much higher voltage, so its shape can be customized based on the device size.

- The global consumer electronics industry has been growing rapidly across the world over the years due to the consistently increasing demand for cellular phones, portable computing devices, gaming systems, and other personal electronic devices. According to the Japan Electronics and Information Technology Industries Association, the total production of electronic products accounted for JPY 6,937,233 million in the first 8 months of 2023.

- According to data from the National Bureau of Statistics, China's integrated circuit production volume reached 28.1 billion units in April 2023. The number of smartphone users in China is growing rapidly. The number of smartphone users in the country is expected to reach 868.2 million by the end of 2023.

- ASEAN has the fastest-growing consumer electronics segment in Asia-Pacific. Electrical and electronics manufacturing is one of the most prominent sectors in ASEAN. The sector accounts for about 30-35% of the total exports from the region. Most global consumer electronic products, such as radio, computers, and cellular phones, are manufactured and assembled in ASEAN countries.

- In North America, especially in the United States, the electronics industry is expected to grow at a moderate rate. An increase in the demand for new technological products is expected to help the market expansion in the future.

- The global consumer electronics market has witnessed notable growth in the past few years as the latest technological gadgets are gaining popularity. Home automation and integrating devices with personal assistance have provided noteworthy growth to the market.

- According to the Japan Electronics and Information Technology Industries Association, the production of electronic products accounted for JPY 7,891,720 million (~USD 52,864.9 million) in the first nine months (i.e., January- September) of 2023.

- All the aforementioned factors are likely to increase the demand for the market between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market

- With over 50% of the global demand, Asia-Pacific is the most promising market for nanoceramic powder materials, which is likely to dominate the market in the near future. This domination can be attributed to the rising demand from the electronics and medical industries in the region.

- China accounts for over 33% of the demand for nanoceramic powder in this region. The country is also one of the major global markets for nanoceramic powder. Sustained demand for nanoceramic powder is witnessed here through its robust electronics, aerospace, and defense (A&D) sectors.

- China has one of the world's largest electronics production bases and offers tough competition to the existing upstream producers, such as South Korea, Singapore, and Taiwan. Electronic products, such as smartphones, OLED TVs, and tablets, have the highest growth rates in the consumer electronics segment of the market in terms of demand. According to the National Bureau of Statistics of China, retail sales of household appliances and consumer electronics in China amounted to almost CNY 61 billion (USD 8.52 billion) in April 2023.

- Moreover, according to the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025. Additionally, India is expected to become the world's fifth-largest consumer electronics and appliances industry by 2025. Electrical and electronics production in India is expected to increase rapidly due to government initiatives with policies, such as Make in India, National Policy of Electronics, Net Zero Imports in Electronics, and Zero Defect Zero Effect, which offer a commitment to growth in domestic manufacturing, lowering import dependence, energizing exports, and manufacturing.

- The region is also the largest manufacturer of automobiles, with China and India contributing to maximum production capacity and ASEAN countries joining the expanding market. China is the largest automobile market globally and plays a pivotal role in the global automotive sector. In 2022, vehicle production in China reached a notable total of 27.02 million units, marking a 3% increase compared to the previous year (26.09 million units). The substantial production volume in China signifies a robust demand for automotive materials, including nanoceramic powder, to support this thriving industry.

- Moreover, China is one of the largest aircraft manufacturers and one of the largest markets for domestic air passengers. Moreover, the country's aircraft parts and assembly manufacturing sector has been growing rapidly, with the presence of over 200 small aircraft parts manufacturers.

- Since the use of nanoceramic powder is important in high-grade military equipment and parts of military aircraft, engines, and fighter jets, the market for nanoceramic powder looks promising from 2024 to 2029 in the region.

- The Chinese government announces defense expenditure information annually. China announced a defense budget of CNY 1.55 trillion (USD 224.8 billion) in March 2023. This represents a nominal 7.2% increase from the CNY 1.45 trillion (USD 229.6 billion) budget in 2022.

- Overall, with the consistent growth in China and India, the demand for nanoceramics powder is expected to increase at a faster pace in the overall region in the coming years. The huge growth of Asia-Pacific is quite instrumental in the expansion of the global nanoceramics powder market.

Nanoceramic Powder Industry Overvview

The global nanoceramic powder market is oligopolistic and partially consolidated, with few players dominating the market. The major companies include Tosoh Corporation, Beijing DK Nano Technology Co. Ltd, NYACOL Nano Technologies Inc., Innovnano-Materiais Avancados SA, and Cerion LLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Widespread Use in the Electronics Industry

- 4.1.2 Increasing Demand from the Healthcare Sector

- 4.1.3 Increasing Demand for High-performance Ceramic Coatings

- 4.2 Restraints

- 4.2.1 High Processing Cost

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

- 4.6 Raw Material Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Oxide Powder

- 5.1.2 Carbide Powder

- 5.1.3 Nitride Powder

- 5.1.4 Boron Powder

- 5.1.5 Other Types

- 5.2 End-user Industry

- 5.2.1 Electrical and Electronics

- 5.2.2 Industrial

- 5.2.3 Transportation

- 5.2.4 Medical

- 5.2.5 Chemical

- 5.2.6 Defense

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 North America

- 5.3.3.1 United States

- 5.3.3.2 Canada

- 5.3.3.3 Mexico

- 5.3.4 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABM Advance Ball Mill Inc.

- 6.3.2 Beijing DK Nano Technology Co. Ltd

- 6.3.3 Cerion LLC

- 6.3.4 Inframat Advanced Materials LLC

- 6.3.5 Innovnano-materiais Avancados SA

- 6.3.6 Nanophase Technologies Corporation

- 6.3.7 NYACOL Nano Technologies Inc.

- 6.3.8 Tosoh Corporation

- 6.3.9 Trunnano

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Opportunities in Advanced Technologies, Like Space Exploration and Photovoltaic Solar Cell

- 7.2 Increasing Applications of Silicon Carbide and Gallium Nitride

02-2729-4219

+886-2-2729-4219