|

市場調查報告書

商品編碼

1536841

汽車塗料:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

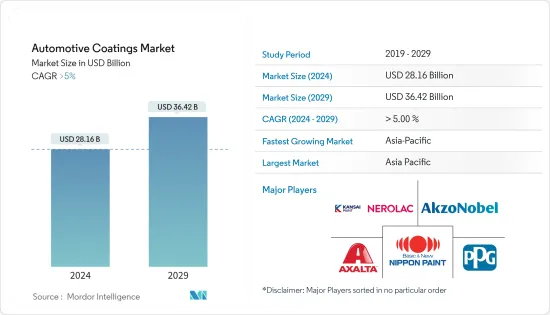

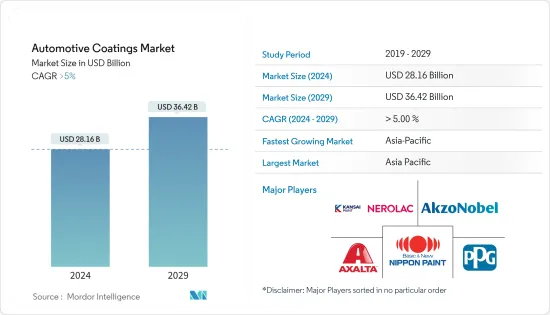

預計2024年全球汽車塗料市場規模將達到281.6億美元,並在2024-2029年預測期內以超過5%的複合年成長率成長,到2029年將達到364.2億美元。

主要亮點

- 汽車生產的擴張、投資的增加以及有利於汽車OEM的政府政策預計將推動汽車塗料市場的發展。

- 然而,嚴格的揮發性有機化合物法規預計將阻礙市場成長。

- 電動車市場的成長預計將在預測期內為市場創造機會。

- 亞太地區在市場上佔據主導地位,預計在預測期內仍將保持最高的複合年成長率。這是由於該地區汽車OEM和精煉行業對汽車塗料的需求不斷增加。

汽車塗料市場趨勢

OEM領域預計將顯著成長。

- 乘用車、輕型商用車等車輛暴露在溫度變化、酸雨、灰塵、水等各種惡劣環境下,導致其外觀和性能劣化。塗料可以透過減輕車輛重量和增加輪胎滾動阻力來幫助提高車輛整體效率。

- 基於聚氨酯的塗料可為汽車表面提供持久、改善的外觀和高光澤度。儘管聚氨酯樹脂系統的初始成本比環氧樹脂系統更高,但從長遠來看,它們具有成本效益,因為其使用壽命比環氧樹脂系統長約1.5至2倍。

- 丙烯酸基塗料和聚酯基塗料是汽車OEM應用中發現的其他類型的樹脂塗料。環氧樹脂是比丙烯酸樹脂更堅固的塑膠。因此,在汽車OEM應用中,可以更有效地完成精細細節,並且還具有優異的拋光性能。

- 溶劑在汽車OEM塗料中發揮重要作用。隨著消費者偏好轉向塗料和被覆劑中較低VOC含量,預計在預測期內水性塗料將更受青睞。然而,與水性塗料相比,溶劑表現出更好的性能。

- 全球汽車產量的增加可能會增加對汽車OEM塗料市場的需求。例如,根據歐洲汽車工業協會(ACEA)的預測,2022年全球汽車產量將達到8,540萬輛,較2021年成長5.7%。

- 由於這些因素,所研究市場的OEM應用領域可能會在預測期內呈現成長。

預計亞太地區成長率最高

- 亞太地區是最大的汽車塗料市場,其次是北美和歐洲。印度和東南亞國協的汽車生產預計將推動該地區汽車塗料的需求。

- 根據中國工業協會預測,2023年中國汽車產量將達3,016萬輛,與前一年同期比較增加11.6%。根據國際工業協會(OICA)預計,2022年中國汽車產量將達2,702萬輛,較2021年同期成長3%。

- 根據國際貿易管理局預測,到2025年,中國國內汽車產量預計將達到3,500萬輛。該國汽車產量的增加可能會導致汽車塗料消費量的增加。

- 印度汽車工業是印度經濟的重要指標,該產業在技術進步和宏觀經濟擴張中發揮關鍵作用。從產業趨勢來看,印度汽車產業近年來成長迅速。

- 由於汽車產量的增加,預計未來幾年對汽車塗料的需求將會增加。多家國內外製造商正在該國投資,以增加汽車產量並滿足該國的需求。例如,2023年5月,印度最大的汽車生產商馬魯蒂鈴木印度公司透露,計畫投資超過55億美元,到2030年將產能翻倍。

- 日本汽車工業是世界第三大汽車製造業,全國擁有78家工廠,僱用超過550萬名工人。汽車製造業佔日本第一大製造業(交通運輸設備工業)的89%,汽車零件製造商是日本經濟的重要組成部分。

- 日本工業協會(JAMA)公佈的新車登記資料顯示,2023年9月日本新車市場達437,493輛,較上月的395,163輛成長近11%。繼 8 月市場開拓後,9 月出現強勁成長。連續三個月放緩的日本市場在八月加速成長。

- 由於這些因素,預計該地區的汽車塗料市場在預測期內將穩定成長。

汽車塗裝業概況

汽車塗料市場分散。該市場的主要企業包括(排名不分先後)Akzo Nobel NV、Axalta Coating Systems Ltd、Kansai Nerolac Paints Limited、Nippon Paint Holdings 和 PPG Industries Inc。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 汽車產量的成長

- 汽車OEM加大投資和政府政策

- 其他司機

- 市場限制因素

- 嚴格的VOC法規

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:以金額為準)

- 按類型

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 其他樹脂類型

- 依技術

- 溶劑型

- 水性的

- 粉末

- 分層

- 電著底漆

- 底漆

- 底塗層

- 透明塗層

- 按用途

- OEM

- 修補漆

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲/紐西蘭

- 印尼

- 馬來西亞

- 泰國

- 其他東協國家

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Akzo Nobel NV

- Axalta Coating Systems Ltd

- BASF SE

- Beckers Group

- Cabot Corporation

- Eastman Chemical Company

- HMG Paints Limited

- Jotun

- Kansai Nerolac Paints Limited

- KCC Corporation

- Nippon Paint Holdings Co. Ltd

- Parker Hannifin Corp.

- PPG Industries Inc.

- RPM International Inc.

- Shanghai Kinlita Chemical Co. Ltd

- The Sherwin-Williams Company

第7章 市場機會及未來趨勢

- 電動車市場不斷成長的機會

- 其他機會

簡介目錄

Product Code: 51942

The Automotive Coatings Market size is estimated at USD 28.16 billion in 2024, and is expected to reach USD 36.42 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

Key Highlights

- The growing automotive production, increasing investments, and favorable government policies for automotive OEMs are expected to drive the market for automotive coatings.

- However, stringent VOC regulations are expected to hinder the market's growth.

- Growth in the electric vehicle market is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market, registering the highest CAGR during the forecast period. This is due to the rising demand for automotive coatings from automotive OEM and refinish industries in the region.

Automotive Coatings Market Trends

OEM Segment is Likely to Show Significant Growth

- Automotive vehicles such as passenger cars and light commercial vehicles are subjected to various harsh environments, such as changing temperatures, acid rains, dust, and water, which deteriorate the aesthetics and performance of the vehicle. Coatings help in increasing the vehicle's overall efficiency by making it lighter or enhancing the tires' rolling resistance.

- Polyurethane-based coatings deliver an improved appearance and high gloss for a longer period to automotive surfaces. While a polyurethane resin system will initially cost more compared to an epoxy resin system, it is more cost-effective in the long term as its lifespan is roughly one and a half to double that of the epoxy resin system.

- Acrylic-based coatings and polyester-based coatings are other types of resin coatings found in automotive OEM applications. Epoxy resin is a tougher plastic than acrylic resin. Hence, it provides minor details more effectively and also offers good polishing properties for automotive OEM applications.

- In automotive OEM coatings, solvents play a significant role. Consumer preferences are shifting toward lesser VOC in paints and coatings, and hence, water-borne coatings are expected to be more preferred during the forecast period. However, solvents offer greater properties when compared to water-borne coatings.

- Rising automotive production globally is likely to increase the demand for the automotive OEM coating market. For instance, according to the European Automotive Manufacturers Association (ACEA), global vehicle production reached 85.4 million in 2022, which increased by 5.7% compared to 2021.

- Owing to these factors, the OEM application segment of the market studied is likely to witness growth during the forecast period.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- Asia-Pacific is the largest market for automotive coatings, followed by North America and Europe. Automotive production in India and ASEAN countries is expected to boost the demand for automotive coatings in the region.

- According to the China Association of Automobile Manufacturers (CAAM), vehicle production in China reached 30.16 million units in 2023, witnessing a growth of 11.6% compared to the previous year. According to the International Organization of Motor Vehicle Manufacturers (OICA), vehicle production in China reached a total of 27.02 million units in 2022, which is an increase of 3% over 2021 for the same period.

- Domestic production in China is expected to reach 35 million units by 2025, according to the International Trade Administration. The growing production of automobiles in the country is likely to create a hike in the consumption of automotive coatings.

- The automotive industry in India is an essential indicator of the Indian economy, as this sector plays a vital role in both technological advancements and macroeconomic expansion. As per industry trends, the automotive industry in India has been growing on a huge scale in recent times.

- The rising vehicle production is projected to increase the demand for automobile coatings in the coming years. Several domestic and international manufacturers are investing in the country to increase vehicle production and meet the country's demand. For instance, in May 2023, Maruti Suzuki India, the largest vehicle producer in India, revealed its plans to invest over USD 5.5 billion to double capacity by 2030.

- Japan's automotive industry is the world's third-largest automotive manufacturing industry, with 78 factories spread across the country employing more than 5.5 million workers. Automotive manufacturing accounts for 89% of the largest manufacturing sector (transportation machinery industry) in the country, while auto parts suppliers have become a significant part of the Japanese economy.

- In September 2023, Japan's new vehicle market grew by nearly 11% to reach 437.493 units from 395.163 units in the previous month, according to new vehicle registration data published by the Japan Automotive Manufacturers Association (JAMA). The strong September growth followed a positive market development in August. After slowing for three consecutive months, the Japanese market picked up speed in August. The August sales rate reached an impressive 5,36 million units per year, a 28% increase from the weak July.

- Due to all these factors, the market for automotive coatings in the region is expected to show steady growth during the forecast period.

Automotive Coatings Industry Overview

The automotive coatings market is fragmented in nature. Some of the major players in the market include (not in any particular order) Akzo Nobel NV, Axalta Coating Systems Ltd, Kansai Nerolac Paints Limited, Nippon Paint Holdings Co. Ltd, and PPG Industries Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Automotive Production

- 4.1.2 Increasing Investments and Government Policies for Automotive OEM

- 4.1.3 Other Drivers

- 4.2 Market Restraints

- 4.2.1 Stringent VOC Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Other Resin Types

- 5.2 By Technology

- 5.2.1 Solvent-Borne

- 5.2.2 Water-Borne

- 5.2.3 Powder

- 5.3 By Layers

- 5.3.1 E-Coat

- 5.3.2 Primer

- 5.3.3 Base Coat

- 5.3.4 Clear Coat

- 5.4 By Application

- 5.4.1 OEM

- 5.4.2 Refinish

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Australia and New Zealand

- 5.5.1.6 Indonesia

- 5.5.1.7 Malaysia

- 5.5.1.8 Thailand

- 5.5.1.9 Rest of ASEAN

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Egypt

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Akzo Nobel NV

- 6.4.2 Axalta Coating Systems Ltd

- 6.4.3 BASF SE

- 6.4.4 Beckers Group

- 6.4.5 Cabot Corporation

- 6.4.6 Eastman Chemical Company

- 6.4.7 HMG Paints Limited

- 6.4.8 Jotun

- 6.4.9 Kansai Nerolac Paints Limited

- 6.4.10 KCC Corporation

- 6.4.11 Nippon Paint Holdings Co. Ltd

- 6.4.12 Parker Hannifin Corp.

- 6.4.13 PPG Industries Inc.

- 6.4.14 RPM International Inc.

- 6.4.15 Shanghai Kinlita Chemical Co. Ltd

- 6.4.16 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Opportunity in the Electric Vehicle Market

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219