|

市場調查報告書

商品編碼

1536883

汽車齒輪:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Automotive Gears - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

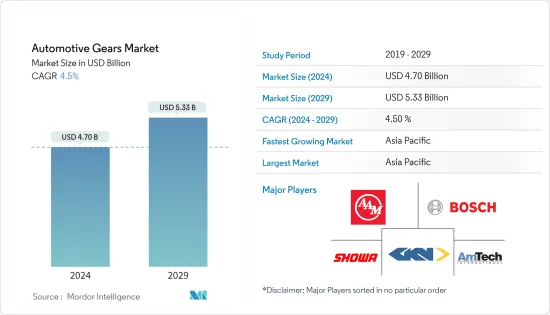

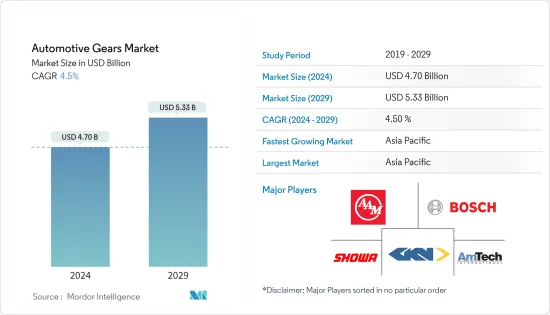

預計 2024 年汽車齒輪市場規模為 47 億美元,預計 2029 年將達到 53.3 億美元,在預測期內(2024-2029 年)複合年成長率為 4.5%。

2022 年汽車齒輪市場價值為 46.7 億美元,預計到 2027 年將達到 53.8 億美元。在預測期內(2023-2028年),汽車齒輪市場的複合年成長率預計將超過5.5%。

COVID-19大流行阻礙了市場成長。由於關門和旅行限制,汽車需求下降。受此影響,汽車產業的汽車零件成長近兩年也出現下滑。在與汽車行業相關的所有領域都觀察到了這一趨勢。

從長遠來看,無論是已開發國家或新興國家,汽車產量都在逐年增加。這將導致汽車齒輪市場的成長。汽車市場正日益轉向更增強的駕駛體驗,即更平穩的換檔和更高的加速性能。

然而,多種因素限制了齒輪市場的成長,包括由於排放法規的不斷提高對電動車的需求增加。電動車使用最少的齒輪。總體而言,齒輪數量顯著減少,因為傳動系統較少,使用的差速器較少,幾乎不需要變速箱。

由於其強勁的汽車生產,亞太地區可能會引領汽車齒輪市場,其次是歐洲和北美。這些地區的市場成長將受到乘用車和輕型商用車的需求以及現有齒輪製造商在研發方面的持續投資的支持,以在未來幾年提高車輛效率並減少碳足跡,這似乎將會發生。

汽車齒輪市場趨勢

預計平行齒輪軸將在預測期內主導市場

平行軸齒輪電機,也稱為平行軸齒輪箱,其特點是輸入軸和輸出軸平行但偏壓的設計。

與同心齒輪箱相比,這種設計可實現更高的扭力容量和更全面的齒輪比範圍,使其適合需要更高扭力和速度能力的應用。

平行軸齒輪馬達是指齒輪箱減速機輸出軸的位置。當馬達軸和減速機輸出軸位於平行平面上時,它們被視為“平行軸”。該位置與直列定位相結合,使齒輪馬達能夠在有限的空間內成功運作。緊湊的尺寸意味著更輕的重量、更低的噪音、更低的振動和客戶滿意度。

許多引擎系統使用平行軸在零件之間傳輸動力。例如,在內燃機中,一根軸連接到曲軸並傳輸來自活塞的動力。同時,另一根軸連接到凸輪軸並控制氣門正時和操作。

平行軸可用於引擎平衡。透過平行軸上兩個反向旋轉質量的旋轉,引擎能夠實現動態平衡,減少振動並提高整體運行的平穩性。這通常用於某些引擎配置,例如水平對臥引擎。

預計亞太地區將在預測期內主導市場

亞太地區可能會主導汽車齒輪市場,其中中國對市場成長做出了重大貢獻。亞太地區是汽車裝備的主要市場。隨著印度和中國等國家汽車產量的增加以及製造商注重提高產能,汽車齒輪的需求預計將大幅成長。例如,根據多份報告,預計未來幾年中國內燃機汽車的年銷量將達到8,000萬輛,因為這些內燃機汽車仍佔據主導地位。

此外,對省油車和輕型汽車零件的需求不斷成長正在推動市場成長。此外,在估計和預測期間,輕質耐用的鋁製和複合材料齒輪可能會獲得更高的受歡迎程度。例如,諾德推出SK 920072.1兩級斜齒輪錐齒輪馬達(配備諾德馬達)。它具有高強度和輕量化設計。

上述因素和亞太各國的市場開拓預計將在預測期內促進市場成長。

汽車齒輪產業概況

汽車齒輪市場的一些主要製造商包括 American Axle &Manufacturing Holdings Inc.、AmTech International、Bharat Gears Ltd、GKN PLC、Robert Bosch GmbH、Gleason Plastic Gears、Showa Corporation 和 Universal Auto Gears LLP。

- 2021年6月,加特可開發了適用於中大型前輪驅動車輛的新型無段變速箱CVT-X,提升了環保性能與便利性。據稱,它實現了CVT難以達到的90%以上的傳動效率。

- 採埃孚宣布將投資2億美元在北美生產商用車變速箱。採埃孚計劃於 2023 年在其位於南卡羅來納州格雷考特的最先進製造工廠生產 ZF Powerline 8 速自排變速箱。 2021 年 7 月,採埃孚獲得了一份價值約 60 億美元的車軸契約,到 2027 年在其密西根州馬里斯維爾工廠為皮卡交付梁軸和車軸驅動裝置。

- 2019年3月,德納公司宣布完成對歐瑞康集團驅動系統部門的收購。此次收購擴大了德納的技術組合,並專注於輕型商用車市場的精密斜齒輪。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 市場限制因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按職位

- 斜軸齒輪

- 準雙曲面齒輪

- 蝸輪

- 十字軸齒輪

- 直齒錐齒輪

- 螺旋錐齒輪

- 平行軸齒輪

- 正齒輪

- 齒條和小齒輪

- 夾腳齒輪

- 斜齒輪

- 斜軸齒輪

- 按材質

- 鐵

- 非鐵金屬

- 其他(複合材料/塑膠)

- 按用途

- 轉向系統

- 微分系統

- 傳輸系統

- 手動的

- 自動的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- American Axle & Manufacturing Holdings Inc.

- AmTech International

- Bharat Gears Ltd

- Cone Drive

- Dynamatic Technologies Limited

- Franz Morat Group

- GKN PLC

- Gleason Plastic Gears

- IMS Gear SE & Co. KGaA

- Robert Bosch GmbH

- RSB Global

- Showa Corporation

- Taiwan United Gear Co. Ltd

- Universal Auto Gears LLP

- ZF Friedrichshafen AG

第7章 市場機會及未來趨勢

The Automotive Gears Market size is estimated at USD 4.70 billion in 2024, and is expected to reach USD 5.33 billion by 2029, growing at a CAGR of 4.5% during the forecast period (2024-2029).

The automotive gears market was valued at USD 4.67 billion in 2022 and is expected to reach USD 5.38 billion by 2027. The automotive gears market is anticipated to register a CAGR of over 5.5% during the forecast period (2023-2028).

The COVID-19 pandemic disrupted market growth. With lockdowns and travel restrictions, the demand for vehicles had declined. As a result, the growth of automotive parts in the automotive industry also fell in the past two years. This trend was seen in all segments related to the automotive industry.

Over the long term, vehicle production has increased yearly in developed and developing countries. This will lead to growth in the automotive gear market. In the automotive market, a shift toward a more enhanced driving experience in terms of smooth gear shifting & improved acceleration has been increased.

However, various factors are restraining the growth of the gear market, such as the growing demand for electric vehicles due to rising emission regulations. Electric vehicles use minimal gear. The overall number of gears is significantly less due to fewer transmission systems, lesser use of differentials, and near elimination of gearboxes.

Asia-Pacific is likely to lead the automotive gears market, as the region is a significant vehicle producer, followed by Europe and North America. The market growth across these regions will likely be supported by demand for passenger cars and light commercial vehicles and continuous investments by established gear manufacturers in research and development to achieve improved vehicle efficiency and reduced carbon footprint in the coming years.

Automotive Gear Market Trends

Parallel Gear Shaft is Expected to Dominate the Market during Forecast Period

Parallel shaft gear motors, also called parallel shaft gearboxes, feature a design in which the input and output shafts are parallel but offset.

This design allows for higher torque capacity and a more comprehensive range of gear ratios than concentric gearboxes, making them suitable for applications that require higher torque and speed capabilities.

A parallel shaft gear motor refers to the position where the gearbox reducer's output shaft sits. If the motor shaft and the speed reducer output shaft are on parallel planes, it is considered a "parallel shaft." This position, coupled with the inline positioning, enables the gear motor to succeed in limited-space areas. Compact size leads to less weight, less sound, less vibration, and a happy customer experience.

In many engine systems, parallel shafts are used for power transmission between components. For example, in an internal combustion engine, one shaft may be connected to the crankshaft to transmit power from the pistons. In contrast, the other shaft may be connected to the camshaft to control valve timing and operation.

Parallel shafts can be utilized for balancing purposes in engines. By rotating two counter-rotating masses on parallel shafts, the engine can achieve dynamic balance, reducing vibrations and improving the overall smoothness of operation. This is commonly employed in specific engine configurations, such as boxer engines.

Asia-Pacific is Expected to Dominate the Market During the Forecast Period

Asia-Pacific is likely to dominate the automotive gears market, with China being a key contributor to the market's growth. Asia-Pacific is the leading market for automotive gear. With the increasing vehicle production in countries such as India and China and the manufacturers' focus on increasing production capacity, the demand for automotive gear is anticipated to grow significantly. For instance, according to several reports, China is expected to sell 80 million internal combustion engines annually in the coming years as these IC vehicles are still occupying the dominant share.

Additionally, the increasing need for fuel-efficient vehicles and lightweight automotive parts drive the market's growth. In addition, lightweight and highly durable aluminum and composite gears are estimated to gain higher popularity during the forecast period. For instance, NORD launched the SK 920072.1 two-stage helical bevel gear motor (mounted with a NORD motor), a drive solution for a wide range of light-duty conveying, processing, and manufacturing applications. It is identified by its high-strength and lightweight design.

The factors above and developments across various countries in Asia-Pacific are expected to enhance the market's growth during the forecast period.

Automotive Gears Industry Overview

Some of the major manufacturers in the automotive gear market include American Axle & Manufacturing Holdings Inc., AmTech International, Bharat Gears Ltd, GKN PLC, Robert Bosch GmbH, Gleason Plastic Gears, Showa Corporation, and Universal Auto Gears LLP.

- In June 2021, JATCO developed a new continuously variable transmission, "CVT-X," for medium and large FWD vehicles with improved environmental performance and drivability. It is said to have achieved more than 90% transmission efficiency, which was considered difficult for a CVT.

- ZF announced investing USD 200 million in commercial vehicle transmission manufacturing in North America. In 2023, ZF planned to produce the ZF Powerline 8-speed automatic transmission at the company's state-of-the-art manufacturing facility in Gray Court, SC. In July 2021, ZF secured a nearly USD 6 billion axle contract for the Marysville, Michigan, facility to deliver beam axles and axle drives for pick-up trucks until 2027.

- In March 2019, Dana Incorporated announced that it completed the acquisition of the Drive Systems segment of the Oerlikon Group. This acquisition has expanded Dana's technology portfolio, especially in high-precision helical gears for the light- and commercial-vehicle markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD billion)

- 5.1 By Position

- 5.1.1 Skew Shaft Gears

- 5.1.1.1 Hypoid Gears

- 5.1.1.2 Worm Gears

- 5.1.2 Intersecting Shaft Gears

- 5.1.2.1 Straight Bevel Gears

- 5.1.2.2 Spiral Bevel Gears

- 5.1.3 Parallel Shaft Gears

- 5.1.3.1 Spur Gears

- 5.1.3.2 Rack and Pinion Gears

- 5.1.3.3 Herringbone Gears

- 5.1.3.4 Helical Gears

- 5.1.1 Skew Shaft Gears

- 5.2 By Material

- 5.2.1 Ferrous Metals

- 5.2.2 Non-ferrous Metals

- 5.2.3 Other Materials (Composites and Plastics)

- 5.3 By Application

- 5.3.1 Steering Systems

- 5.3.2 Differential Systems

- 5.3.3 Transmission Systems

- 5.3.3.1 Manual

- 5.3.3.2 Automatic

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Mexico

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 American Axle & Manufacturing Holdings Inc.

- 6.2.2 AmTech International

- 6.2.3 Bharat Gears Ltd

- 6.2.4 Cone Drive

- 6.2.5 Dynamatic Technologies Limited

- 6.2.6 Franz Morat Group

- 6.2.7 GKN PLC

- 6.2.8 Gleason Plastic Gears

- 6.2.9 IMS Gear SE & Co. KGaA

- 6.2.10 Robert Bosch GmbH

- 6.2.11 RSB Global

- 6.2.12 Showa Corporation

- 6.2.13 Taiwan United Gear Co. Ltd

- 6.2.14 Universal Auto Gears LLP

- 6.2.15 ZF Friedrichshafen AG