|

市場調查報告書

商品編碼

1536897

折疊式紙盒包裝:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Folding Carton Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

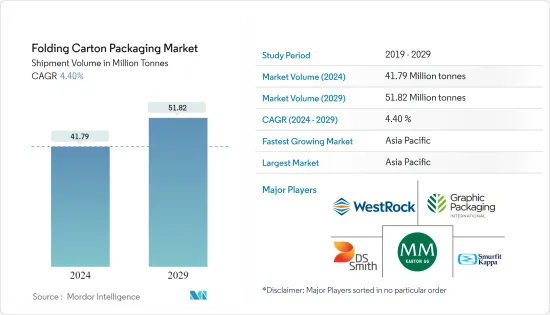

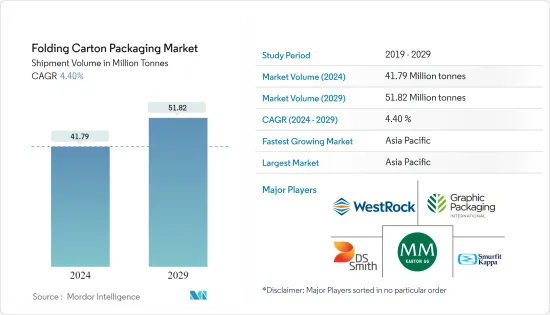

以出貨量為準,全球折疊式紙盒包裝市場規模預計將在2024年達到4179萬噸,在2024-2029年預測期內複合年成長率為4.40%,並在2029年達到5182萬噸。

由紙箱紙板製成的折疊式紙盒用於包裝各種產品,包括乾食品、冷凍食品、簡便食品、個人保健產品、家庭用品、藥品和家用電器。折疊式紙盒市場主要受到電子商務行業成長的推動。此外,消費者更喜歡更環保的產品,隨著紙板獲得更快的市場接受度,消費者自願轉向永續包裝。折疊式紙盒還可以多次回收,從而減少整體環境廢棄物,並迅速被積極致力於減少環境廢棄物的政府所採用。

折疊式紙盒由多層化學漿和機械漿組成,兼具輕盈性和出色的剛性。紙板的外層由優質化學漿製成,中階由漂白化學熱機械漿(BCTMP)組成。這種策略成分使產品在強度和重量上取得了平衡。其輕質特性有助於降低運輸成本和環境影響,符合包裝產業對永續性和成本最佳化的整體關注。

世界各地的消費者越來越意識到包裝的環境風險,並正在將他們的購買習慣轉向更環保的選擇。消費者、政府和媒體正在向製造商施加壓力,要求其工藝和產品更加環保。個人願意為環保包裝支付更多費用。由於這些趨勢,折疊式紙盒包裝行業預計將擴大。

由於對環保包裝選擇的高需求,北美和歐洲等地區預計將在未來幾年引領折疊式紙盒市場。根據 Pro Carton 對歐洲消費者包裝認知的研究,平均 90% 的歐洲客戶選擇紙質或紙板包裝,因為他們意識到其環境效益。

全球範圍內個人護理市場的擴張、市場及其下游行業技術創新的不斷提升進一步推動了折疊式紙盒市場的擴張。藥品包裝中對折疊式紙盒的需求不斷成長預計將推動未來幾年的市場擴張。

折疊成型設備的技術進步提高了折疊式紙盒包裝的生產效率和精確度。自動折疊式和塗膠機可實現精確、快速的折疊式操作,從而提高生產率並降低製造成本。表面處理和裝飾的創新提高了折疊式紙盒包裝的視覺吸引力和功能性。壓花、燙金、清漆等特殊處理為包裝增添質感、光澤和保護,使其對消費者更具吸引力和吸引力。

折疊式紙盒包裝市場趨勢

對輕質材料的需求不斷成長以及印刷創新的潛力推動市場成長

- 輕量化和永續性正在成為吸引消費者的重要包裝舉措。永續性正在成為一個重要的發展議題,許多消費者和企業都開始遵守零廢棄物。包裝製造商不斷投資於設計和材料創新,以適應不斷變化的人口結構和生活方式。因此,對紙質包裝的需求不斷增加,對折疊式紙盒的需求也在增加。

- 折疊式紙盒產業的主要產品趨勢和創新包括減輕重量,這極大地有助於降低貨運成本。此外,創新和客製化設計透過卓越的印刷和有效的體積利用率節省成本,推動市場成長。

- 消費市場的電氣產品和消費性設備更喜歡折疊式紙盒包裝其產品。另外,這些包裝產品僅覆蓋部分存放空間並且可以折疊。折疊式紙盒提供相同等級的保護,同時從物流角度來看更便宜且更具成本效益。

- 消費者希望從他們收到的包裝中尋找一些興奮點。帶有黑色文字塊的普通棕色盒子被彩色自訂印刷包裝所取代,創造了一種情感上的“拆箱”體驗,旨在讓收件人感到高興。展示包裝和二次包裝之間的界線也變得模糊。現在它們是銷售和行銷組合的一部分,應該包括吸引消費者註意力所需的訊息、形象和品質。

- 多年來,印刷一直是包裝的突出特點。數位印刷透過內部印刷加固包裝的內表面,幫助創建折疊式紙盒包裝的外罩。具有環保設計和紙板印刷的個人護理品牌和包裝供應商在這一領域越來越受歡迎。許多公司都專注於印刷創新,以使產品品質可見。

- 全球個人護理和化妝品市場的成長預計將推動輕質、永續和引人注目的包裝解決方案的銷售,包括用於各種化妝品的折疊紙盒。根據化妝品、盥洗用品和香水協會 (CTPA) 發布的一份報告,全球化妝品行業的零售將從 2022 年的 87.3 億歐元(91.8 億美元)增至 2023 年的 95.7 億歐元(103.6 億美元)。 )。

亞太地區佔最大市場佔有率

- 亞太地區折疊式紙盒市場的成長是由各種快速消費品、藥品、紡織品、有組織的零售、蓬勃發展的電子商務和其他行業對紙板包裝的持續需求所推動的。由於輕質、生物分解性和可回收的特點,折疊式紙盒市場的主要趨勢是提高回收率和提高物流效率。由於其剛度、剛度和韌性,折疊式紙盒提供抗壓強度,可在運輸過程中保護產品。

- 由於該地區電子商務包裝行業的發展、紙漿價格下降以及人們對使用環保包裝的意識不斷增強,紙箱紙板包裝市場預計將成長。此外,紙箱紙板產能和產量的增加以及技術突破是該領域的主要趨勢和發展。

- 據印度造紙工業商協會(IPMA)稱,印度的紙張消費量預計每年成長6-7%。預計 2026-27 年產量將達到 3000 萬噸,這主要是由於教育和識字率的提高以及有組織零售的增加。此外,印度的人均消費量是世界上最低的國家之一,因此造紙業具有巨大的成長潛力。印度紙張消費量的預期成長可能會對折疊式紙盒市場產生正面影響。對經濟高效的硬包裝的需求不斷成長,以及向永續材料的轉變,為折疊式紙盒產業的發展和適應印度市場不斷變化的需求創造了機會。

- 過去幾年,該地區的電子商務行業線上訂單大幅增加。該地區的人們擴大在網上購買雜貨、膳食和其他必需品。這些趨勢預計將增加對永續包裝解決方案的需求,因為電子商務和零售業是折疊式紙盒解決方案的主要用戶之一。電子商務的繁榮主要帶動了印度折疊式紙盒包裝的成長。預計到 2026 年,電子商務產業將產生 2,000 億美元的收益。

- 中國也保持著全球最大網路購物市場的地位。越來越多的中國消費者從網路零售商購買產品,這增加了對折疊式紙盒等包裝解決方案的需求。網路購物平台必須使用堅固可靠的包裝,以在運輸和交付過程中保護產品。由於其強度、耐用性和靈活性,折疊式紙盒通常用於包裝。

折疊式紙盒包裝產業概況

折疊式紙盒市場較為分散,主要參與者包括 Westrock Company、Smurfit Kappa Group、Graphic Packaging International LLC、DS Smith PLC 和 Seaboard Folding Box Company Inc. (Vidya Brands Group)。這些公司致力於透過贏得新契約和開拓新市場來提高市場佔有率。

- 2024年3月,DS Smith PLC宣布收購塞爾維亞包裝公司Bosis doo。透過此次收購策略,公司將增強自身實力,增強為歐洲客戶提供優質產品的能力。

- 2023年11月,WestRock公司在紙板包裝委員會(PPC)主辦的第80屆北美紙板包裝大賽上因出色的包裝設計而獲得獎勵。本公司各類折疊式紙盒產品榮獲10項獎項。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 評估地緣政治情境對產業的影響

第5章市場動態

- 市場促進因素

- 對尖端包裝設計服務和永續性的需求推動市場成長

- 電商領域需求旺盛

- 市場限制因素

- 木漿需求波動和供需缺口抑制市場成長

第6章 市場細分

- 按最終用戶產業

- 食品/飲料

- 家庭使用

- 個人護理和化妝品

- 醫療保健/製藥

- 菸草

- 電力/硬體

- 按地區: 北美

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 埃及

- 北美洲

第7章 競爭格局

- 公司簡介

- WestRock Company

- Graphic Packaging International LLC

- Mayr-Melnhof Karton AG

- Smurfit Kappa Group

- Seaboard Folding Box Company Inc.(Vidya Brands Group)

- American Carton Company

- All Packaging Company

- DS Smith PLC

- Edelmann GmbH

- CCL Healthcare(A Division of CCL Industries Inc.)

第8章投資分析

第9章 市場的未來

The Folding Carton Packaging Market size in terms of shipment volume is expected to grow from 41.79 Million tonnes in 2024 to 51.82 Million tonnes by 2029, at a CAGR of 4.40% during the forecast period (2024-2029).

Folding cartons made using carton board material are used for packaging various products such as dry and frozen food, convenience food, personal care products, household products, pharmaceuticals, consumer electronics, and more. The folding carton market is mainly driven by the growth of the e-commerce industry. In addition, consumers prefer more environmentally friendly products, leading to a voluntary shift to sustainable packaging as paperboard gains market acceptance faster. Also, folding cartons can be recycled multiple times, reducing overall environmental waste and leading to more rapid adoption by governments that are actively taking action to reduce environmental waste.

A folding carton comprises multiple chemical and mechanical pulp layers to combine lightness with exceptional stiffness. The outer layers of the board are crafted using high-quality chemical pulp, while the middle layer consists of bleached chemical-thermomechanical pulp (BCTMP). This strategic composition allows the product to achieve a balance of strength and weight. The lightweight property helps reduce transportation costs and environmental impact and aligns with the overall focus on sustainability and cost optimization in the packaging industry.

Consumers worldwide are becoming more aware of the environmental hazards of packaging and are shifting their purchasing habits to greener choices. Consumers, governments, and the media are pressuring manufacturers to make the processes and products environmentally friendly. Individuals are willing to pay more for eco-friendly packaging. Due to these trends, the folding carton packaging industry is expected to expand.

The high demand for green packaging options in regions such as North America and Europe is anticipated to lead the folding carton market in the upcoming years. According to the study on consumer perceptions of packaging in Europe by Pro Carton, 90% of customers in Europe, on average, choose paper or cardboard packaging because they recognize its environmental benefits.

The expansion of the folding carton market is further fueled by the expansion of the personal care market on a global scale and rising innovation in the market and its downstream industries. In the upcoming years, the market expansion is anticipated to be driven by the increased demand for folding cartons in pharmaceutical product packaging.

Technological advancements in folding and forming equipment have improved the efficiency and accuracy of folding carton packaging production. Automated folding and gluing machines enable precise and faster folding operations, increasing productivity and reducing manufacturing costs. Innovations in surface finishes and embellishments have enhanced folding cartons' visual appeal and functionality. Special finishes like embossing, foiling, or varnishing add texture, shine, and protection to the packaging, making it more visually appealing and engaging for consumers.

Folding Carton Packaging Market Trends

Increasing Demand for Lightweight Materials and Scope for Printing Innovations Propelling the Growth of the Market Studied

- Lightweight and sustainability are becoming more essential packaging initiatives to engage consumers. Sustainability is becoming the critical development agenda, with many consumers and companies becoming more zero-waste compliant. Packaging manufacturers are continuously investing in innovation in design and materials, considering demographic and lifestyle changes. This has increased the demand for paper-based packaging, supporting the need for folding cartons.

- The folding carton industry's primary product trends and innovations include lightweight offerings, which significantly help reduce freight costs. Additionally, innovative and customized design, which provides superior printing and cost savings through effective volume utilization, has driven the market growth.

- Electrical products and consumer equipment meant for consumer markets prefer folding carton packaging for their products. Moreover, these packaging products only cover a portion of the storage space and can be folded. The folding cartons are cheaper and cost-effective from a logistics point of view while offering a similar level of protection.

- Consumers want some excitement in the package they receive. Plain brown boxes with blocks of black text are replaced with colorful custom print packaging that creates an emotional "unpacking" experience designed to please the recipient. The line between display and secondary packaging, including ready-to-market packaging, is also blurring. They are now part of the sales and marketing mix and should contain the necessary message, imagery, and quality to capture consumer attention.

- Printing has been a prominent feature in packaging for a few years. Digital printing can enhance the inside surface of packaging with internal printing and helps create a pleasing external cover for a folding carton packaging unit. Personal care brands and packaging suppliers with eco-friendly designs and printing using paperboard for cartons are witnessing popularity in the segment. Various companies are focused on printing innovations to make the quality of the product visible.

- The growing personal care and cosmetic market worldwide is expected to push the sales of lightweight, sustainable, and eye-catching packaging solutions, including folding cartons for various cosmetic products. According to the report published by the Cosmetic, Toiletry, and Perfumery Association (CTPA), the retail sales value of the global cosmetic industry reached EUR 9.57 billion (USD 10.36 billion) in 2023 from EUR 8.73 billion (USD 9.18 billion) in 2022.

Asia-Pacific to Hold the Largest Market Share

- The growth of the folding carton market in Asia-Pacific is driven by continued demand for paperboard packaging from various FMCG products, pharmaceuticals, textiles, organized retail, booming e-commerce, and other segments. Due to its lightweight, biodegradable, and recyclable characteristics, the folding carton market's primary trends are increasing recycling rates and boosting logistical efficiency. Due to their stiffness, rigidity, and toughness, folding cartons provide compression strength to protect products during transportation.

- The market for carton board packaging is projected to grow due to an evolving e-commerce package industry in the region, declining pulp prices, and improved awareness of the use of eco-friendly packaging. Moreover, the increasing capacity and production of carton boards and technological breakthroughs are key trends and developments in the sector.

- According to the Indian Paper Manufacturers Association (IPMA), paper consumption in India is likely to witness 6-7% annual growth. It is projected to reach 30 million tonnes by FY 2026-27, primarily driven by the growing emphasis on education and literacy and the increased organized retail. Furthermore, the paper industry holds immense potential for growth in India as the per capita consumption globally is one of the lowest. The expected growth of paper consumption in India may positively impact the folding carton market. The growing demand for cost-effective rigid packaging and a shift to sustainable materials create an opportunity for the folding carton industry to grow and adapt to changing needs in the Indian market.

- The e-commerce industry witnessed a considerable increase in online orders in the region in the past few years. People throughout the region are increasingly buying groceries, meals, and other necessities online. As the e-commerce and retail industries are among the primary users of folding carton solutions, such trends are projected to increase demand for sustainable packaging solutions. The e-commerce boom primarily leads to the growth in folding carton packaging in India. According to the India Brand Equity Foundation (IBEF), a foundation run by the Ministry of Commerce, the e-commerce industry is expected to generate a revenue of USD 200 billion by 2026.

- China also maintained its position as the world's largest online shopping market. The increasing number of Chinese consumers buying from internet retailers is raising demand for packaging solutions such as folding cartons. Online shopping platforms must use sturdy and reliable packaging to protect products during transport and delivery. Due to their strength, durability, and flexibility, folding cartons are often used in packaging.

Folding Carton Packaging Industry Overview

The folding carton market is fragmented, with several major players, such as Westrock Company, Smurfit Kappa Group, Graphic Packaging International LLC, DS Smith PLC, and Seaboard Folding Box Company Inc. (Vidya Brands Group). These players are focusing on increasing their market presence by securing new contracts and tapping new markets.

- In March 2024, DS Smith PLC announced the acquisition of Bosis doo, a packaging company in Serbia. The acquisition strategy will help the company enhance its capabilities and strengthen its ability to offer quality products to European customers.

- In November 2023, WestRock Company was awarded for packaging design excellence during the 80th annual North American Paperboard Packaging Competition sponsored by the Paperboard Packaging Council (PPC). The company received 10 awards for its different folding carton products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Geopolitical Scenario Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Leading-edge Packaging Design Services and Sustainability Demand to Drive the Market Growth

- 5.1.2 Strong Demand from the E-commerce Sector

- 5.2 Market Restraint

- 5.2.1 Fluctuations in Wood Pulp Demand and Gap between Supply and Demand to Hinder the Market Growth

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Food and Beverages

- 6.1.2 Household

- 6.1.3 Personal Care and Cosmetics

- 6.1.4 Healthcare and Pharmaceuticals

- 6.1.5 Tobacco

- 6.1.6 Electrical and Hardware

- 6.2 Geography***

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.3.4 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.4.1 Brazil

- 6.2.4.2 Argentina

- 6.2.4.3 Mexico

- 6.2.5 Middle East and Africa

- 6.2.5.1 Saudi Arabia

- 6.2.5.2 South Africa

- 6.2.5.3 Egypt

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 WestRock Company

- 7.1.2 Graphic Packaging International LLC

- 7.1.3 Mayr-Melnhof Karton AG

- 7.1.4 Smurfit Kappa Group

- 7.1.5 Seaboard Folding Box Company Inc. (Vidya Brands Group)

- 7.1.6 American Carton Company

- 7.1.7 All Packaging Company

- 7.1.8 DS Smith PLC

- 7.1.9 Edelmann GmbH

- 7.1.10 CCL Healthcare (A Division of CCL Industries Inc.)