|

市場調查報告書

商品編碼

1641870

壓縮機 -市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

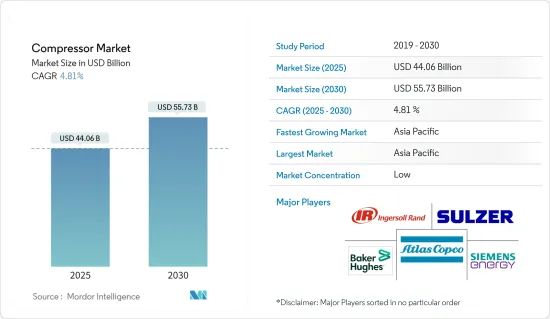

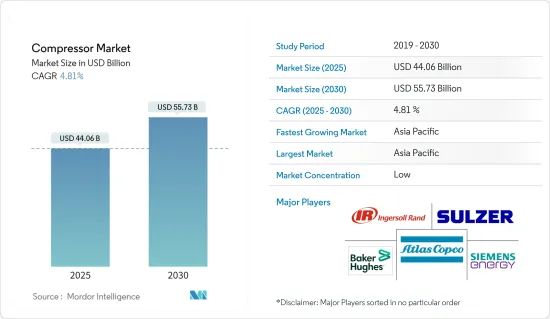

壓縮機市場規模預計在 2025 年為 440.6 億美元,預計到 2030 年將達到 557.3 億美元,預測期內(2025-2030 年)的複合年成長率為 4.81%。

關鍵亮點

- 從中期來看,天然氣需求成長導致天然氣管道網路擴張等因素預計將成為壓縮機市場最重要的促進因素之一。

- 另一方面,太陽能和風能的普及可望減少對煤炭和天然氣等石化燃料發電的依賴。這對預測期內的壓縮機市場構成了威脅。

- 隨著最終用戶需求的增加和能源效率標準的變化,一些壓縮機製造商正在努力開發更節能的產品。預計這一因素將在未來為市場創造許多機會。

- 亞太地區佔據市場主導地位,並可能在預測期內實現最高的複合年成長率。中國和印度由於其不斷成長的天然氣基礎設施而引領市場。

壓縮機市場趨勢

預計石油和天然氣產業將主導市場

- 正排量壓縮機和動態壓縮機廣泛應用於石油和天然氣產業,涵蓋上游、中游和下游領域。壓縮機在石油和天然氣領域有多種用途,包括天然氣輸送、注氣壓縮、天然氣收集和氣舉。

- 由於儲存壓力隨著時間的推移而降低,在天然氣田開發的後期階段使用動態壓縮機來維持或增加進入管道網路的氣體流量。氣體再注入用於提高採收率(EOR)以抵消油田產量的自然下降。

- 過去十年來,隨著人們環保意識的不斷增強,大多數國家都計劃透過從煤炭發電轉向天然氣發電來減少二氧化碳排放。預計石油和天然氣產業對壓縮機的需求將受到天然氣產量和發電消費量持續成長的潛力的支持。國際能源實驗室(EI)預測,2022年全球天然氣產量將達4.438兆立方米,較2015年成長15.3%。

- 印度正在擴大其天然氣管道基礎設施以滿足日益成長的需求。印度政府已宣布了多個州際管道計劃。例如,2024 年 1 月,政府宣布向印度石油公司 (IOCL) 投資 900 億印度盧比 (100 億印度盧比),其中包括一條 488 公里長的天然氣管道和一條 697 公里長的印度斯坦石油公司的石油管線(VDPL) Corporation 計劃(HPCL)。

- 同樣,中國政府也設定了2060年實現淨零排放的目標。根據該國的能源轉型策略,天然氣將在減少二氧化碳排放方面發揮關鍵作用,預計未來十年將成為該國的主要能源來源。

- 此外,美國能源資訊署(EIA)預測,由於國際天然氣需求預計將增加,2020年至2029年期間美國液化天然氣出口將增加一倍以上,這將進一步擴大壓縮機市場。 。

- 由於上述因素,石油和天然氣產業很可能在預測期內主導壓縮機市場。

亞太地區佔市場主導地位

- 全球最大的天然氣進口國和消費國均位於亞太地區。該地區的能源需求仍主要依賴煤炭和石油。然而,隨著人們對空氣污染的日益擔憂,近年來天然氣的使用越來越頻繁。

- 該地區天然氣的最大用戶是製造業和發電業。預計中國和印度等國家的能源消耗增加將推動天然氣市場的發展。

- 隨著亞太國家都市化和中階的不斷壯大,住宅天然氣消費量預計會增加。由於天然氣消費量的增加,預計電力部門、製造業和中游天然氣產業對天然氣壓縮機的需求將會增加。

- 此外,亞太地區的精製產業在過去十年中取得了長足的發展,離心式壓縮機等壓縮機在精製過程中發揮著不可或缺的作用。 《世界能源數據統計評論》預測,2022年亞太地區煉油能力將達到3,618.9萬桶/日,較2013年成長8.9%。由於未來幾年將啟動許多計劃,預計這一數字在預測期內將大幅成長。

- 中國計劃在未來十年擴大天然氣和石油管線,增加無污染燃料在其能源結構中的比重。根據國發改委預測,到2025年,我國石油天然氣管網規模將達24萬公里。預計天然氣管道總長24萬公里,其中12.3萬公里。壓縮機是動力來源遠距天然氣管道最常用的機器之一,因此,隨著管道網路的擴大,預計整個預測期內對壓縮機的需求將會增加。

- 同樣,印度正在對石化領域進行大規模投資,預計這將增加對壓縮機的需求。例如,2023年12月,印度政府在古吉拉突邦舉行的活力古吉拉特全球峰會會前活動上,為化工和石化行業簽署了11份價值6700億印度盧比(約合83億美元)的合作備忘錄。預計預測期內該地區石化產業的投資將呈指數級成長,從而大大增加整個產業對壓縮機的需求。

- 由於這些因素,預計亞太地區將在預測期內主導壓縮機市場。

壓縮機產業概況

壓縮機市場是細分的。該市場的主要企業(不分先後順序)包括阿特拉斯·科普柯公司、貝克休斯公司、英格索蘭公司、西門子能源股份公司和蘇爾壽有限公司。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究範圍

- 市場定義

- 調查前提

第 2 章執行摘要

第3章調查方法

第4章 市場概況

- 介紹

- 2029 年市場規模與需求預測(十億美元)

- 最新趨勢和發展

- 政府法規和政策

- 市場動態

- 市場促進因素

- 天然氣需求不斷增加

- 不斷增加的全球管道基礎設施

- 市場限制

- 太陽能和風力發電的利用日益廣泛

- 市場促進因素

- 供應鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅產品/服務

- 競爭對手之間的競爭

第5章 市場區隔

- 按最終用戶

- 石油和天然氣

- 電力業

- 製造業

- 化學和石化工業

- 其他

- 按類型

- 體積

- 動態的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 挪威

- 土耳其

- 俄羅斯

- 北歐的

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 馬來西亞

- 泰國

- 澳洲

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 卡達

- 埃及

- 其他中東和非洲地區

- 北美洲

第6章 競爭格局

- 併購、合資、合作與協議

- 主要企業策略

- 公司簡介

- Aerzener Maschinenfabrik GmbH

- Ariel Corporation

- Atlas Copco AB

- Baker Hughes Co.

- Bauer Compressors Inc.

- Burckhardt Compression Holding AG

- Ebara Corporation

- Ingersoll Rand Inc

- Siemens Energy AG

- Sulzer Ltd

- 市場排名/佔有率分析

第7章 市場機會與未來趨勢

- 壓縮機製造商大力開發更節能的產品

簡介目錄

Product Code: 61051

The Compressor Market size is estimated at USD 44.06 billion in 2025, and is expected to reach USD 55.73 billion by 2030, at a CAGR of 4.81% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as growing demand for natural gas, which, in turn, is leading to a growing gas pipeline network, are expected to be one of the most significant drivers for the compressor market.

- On the other hand, increasing solar and wind power installation is expected to decrease the countries' dependency on fossil fuel-fired power generation, such as coal and natural gas. This poses a threat to the compressor market during the forecast period.

- Nevertheless, several compressor manufacturers are making strides to develop more energy-efficient products amid rising end-user demands and changing energy efficiency standards. This factor is expected to create several opportunities for the market in the future.

- The Asia-Pacific region dominates the market and will likely register the highest CAGR during the forecast period. China and India drive it due to these countries' growing natural gas infrastructure.

Compressor Market Trends

Oil and Gas Segment Expected to Dominate the Market

- Positive displacement and dynamic compressors are widely used in the oil and gas industry, encompassing upstream, midstream, and downstream sectors. Compressors are used for various purposes in the oil and gas sector, including gas transportation, compression for gas injection, gas collection, and gas lift.

- As reservoir pressure tends to drop with time, dynamic compressors are utilized in later stages of gas field development to sustain or boost gas flow into pipeline networks. Gas reinjection is employed in enhanced oil recovery (EOR) to offset the oil fields' natural reduction in production.

- Most nations plan to reduce carbon emissions by switching from coal-based to gas-based electricity generation in response to the growing environmental consciousness during the past ten years. The demand for compressors from the oil and gas industry is anticipated to be supported by the potential for natural gas output and consumption for power generation to keep growing. The Energy Institute (EI) estimates that the world produced 4043.8 billion cubic meters of natural gas in 2022, an increase of 15.3% compared to 2015.

- India is expanding its gas pipeline infrastructure to accommodate rising demand. The Indian government announced a pipeline project across several states. For instance, in January 2024, the government launched a gas pipeline project of INR 9,000 crore (USD 1.1 billion) that includes Indian Oil Corporation Ltd's (IOCL) 488-km-long natural gas pipeline and Hindustan Petroleum Corporation Ltd's (HPCL) 697-km-long Petroleum Pipeline (VDPL).

- Similarly, China's government has set a target of net-zero emissions by 2060. Under the country's energy transition strategy, natural gas is intended to play a critical part in lowering CO2 emissions, and it is projected to be the country's major energy source within the next decade.

- Furthermore, the United States Energy Information Administration (EIA) predicts that due to anticipated rises in international demand for natural gas, the US LNG exports are expected to more than double between 2020 and 2029, which is likely to have a positive impact on the compressor market.

- As a result of the factors mentioned above, the oil and gas segment is likely to dominate the compressor market over the forecast period.

Asia-Pacific to Dominate the Market

- Some of the world's top importers and consumers of natural gas are located in the Asia-Pacific region. For energy needs, this region still primarily relies on coal and oil. However, due to increasing concerns about air pollution, there has been a recent trend toward using natural gas more frequently.

- The most significant users of natural gas in the region are the manufacturing and power generation sectors. It is anticipated that rising energy consumption in nations like China and India will propel the market for natural gas.

- Residential gas consumption is predicted to rise due to urbanization and the expansion of the middle class in Asia-Pacific nations. The need for gas compressors is anticipated to increase in the electricity and manufacturing sectors, as well as in the midstream gas industry, due to the rising gas consumption.

- Furthermore, the refinery sector of Asia-Pacific has risen significantly over the last ten years, and compressors like centrifugal compressors are vitally used during the refinery process. According to Statistical Review of World Energy Data, in 2022, the refinery capacity of the Asia-Pacific region was 36,189 thousand barrels daily, increased by 8.9% compared to 2013. The number is expected to rise significantly over the forecast period as serval projects are going to start in the upcoming years.

- China intends to increase the proportion of clean fuel in its energy mix by strengthening its network of natural gas and oil pipelines over the next ten years. The nation's network of gas and oil pipelines is anticipated to grow to 240,000 km by 2025, according to the National Development and Reform Commission. The natural gas pipes are anticipated to cover 123,000 km of the 240,000 km. Since compressors are among the most frequently utilized pieces of machinery that power long-distance natural gas pipelines, the demand for compressors is anticipated to rise throughout the projected period as the pipeline network expands

- Similarly, India is investing significantly in the petrochemical sector, which is anticipated to create a rising demand for compressors. For instance, in December 2023, the government of India signed 11 MoUs worth INR 67,000 crore (USD 8.3 billion) at a pre-Vibrant Gujarat Global Summit event in the state of Gujarat for the Chemical and Petrochemicals Industry. Investments in the petrochemical sector is anticipated to rise exponentially over the region during the forecast period and significantly raise the demand for compressors across the industry.

- Due to these factors, Asia-Pacific is expected to dominate the compressor market during the forecast period.

Compressor Industry Overview

The compressor market is fragmented. Some key players in this market (in no particular order) include Atlas Copco AB, Baker Hughes Co., Ingersoll-Rand Inc., Siemens Energy AG, and Sulzer Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Market Drivers

- 4.5.1.1 The Growing Demand for Natural Gas

- 4.5.1.2 Rising Pipeline Infrastructure across Globe

- 4.5.2 Market Restraints

- 4.5.2.1 Increasing Adoption of Solar and Wind Energies

- 4.5.1 Market Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By End-User

- 5.1.1 Oil and Gas Industry

- 5.1.2 Power Sector

- 5.1.3 Manufacturing Sector

- 5.1.4 Chemicals and Petrochemical Industry

- 5.1.5 Other End-Users

- 5.2 By Type

- 5.2.1 Positive Displacement

- 5.2.2 Dynamic

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Norway

- 5.3.2.6 Turkey

- 5.3.2.7 Russia

- 5.3.2.8 NORDIC

- 5.3.2.9 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Malaysia

- 5.3.3.4 Thailand

- 5.3.3.5 Australia

- 5.3.3.6 Indonesia

- 5.3.3.7 Vietnam

- 5.3.3.8 Rest of Asia Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Aerzener Maschinenfabrik GmbH

- 6.3.2 Ariel Corporation

- 6.3.3 Atlas Copco AB

- 6.3.4 Baker Hughes Co.

- 6.3.5 Bauer Compressors Inc.

- 6.3.6 Burckhardt Compression Holding AG

- 6.3.7 Ebara Corporation

- 6.3.8 Ingersoll Rand Inc

- 6.3.9 Siemens Energy AG

- 6.3.10 Sulzer Ltd

- 6.4 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Several Compressor Manufacturers are Making Strides to Develop More Energy-Efficient Products

02-2729-4219

+886-2-2729-4219