|

市場調查報告書

商品編碼

1630424

南美壓縮機:市場佔有率分析、產業趨勢、成長預測(2025-2030)South America Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

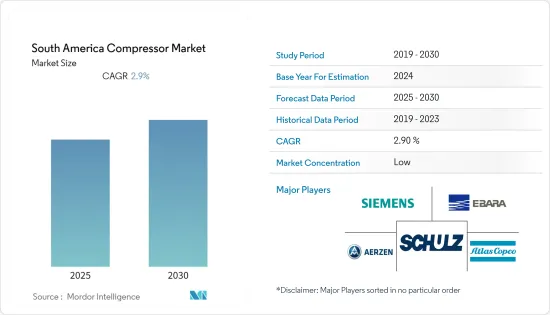

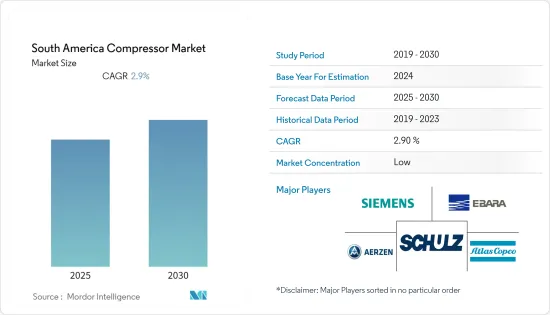

南美壓縮機市場預計在預測期內複合年成長率為 2.9%。

由於地區關閉和最終用戶行業放緩,市場受到了 COVID-19 爆發的負面影響。目前,市場已達到疫情前水準。

主要亮點

- 處理和加壓多種氣體的化肥和石化工廠對壓縮機的需求增加預計將推動美洲壓縮機市場的發展。

- 然而,增加再生能源來源的安裝以提供無壓縮機電力預計將抑制南美壓縮機市場。

- 壓縮機新技術比現有技術更有效率,預計未來將為南美洲壓縮機市場創造多個機會。

- 阿根廷是該地區最大的天然氣生產國,預計將成為南美洲壓縮機市場成長最快的國家。

南美洲壓縮機市場趨勢

石油和天然氣產業預計將主導市場

- 壓縮機是一種減少氣體體積並增加其壓力的機械裝置。廣泛應用於石油和天然氣產業。石油和天然氣產業的上游、中游和下游領域的許多應用都需要壓縮,包括傳輸、儲存、集氣、氣舉、注氣、閃蒸氣壓縮和冷凍。

- 此外,如果在該地區發現氣儲存,壓縮機很可能被用作天然氣運輸基礎設施的組成部分。因此,天然氣管網的擴張預計將成為預測期內研究的市場成長的最重要促進因素之一。

- 2021年,南美洲總發電量的約20.4%由天然氣發電。作為能源生產來源,天然氣是該地區僅次於水力發電的第二大能源,2021年佔該地區能源總量約660.1太瓦時。

- 提案的巴西和阿根廷之間 1,430 公里的管道將把 Vaca Muerte 頁岩的生產連接到巴西的內烏肯州。該計畫談判於2021年8月開始,計劃成本預計為49計劃美元。

- Gasoducto del Noreste (GNEA) 是阿根廷即將建成的另一條主要天然氣管道。 GNEA 是一條正在建造的管道(總長 1,500 公里),用於將天然氣從玻利維亞輸送到阿根廷各地。隨著GNEA計劃的發展,政府也聚焦在國內天然氣運輸基礎設施的發展。

- 鑑於上述情況,石油和天然氣產業可能在預測期內主導南美壓縮機市場。

快速成長的阿根廷市場

- 由於能源需求的不斷成長以及商業和工業營運的不斷增加,阿根廷很可能成為南美洲成長最快的壓縮機市場。此外,該國天然氣在發電中的佔有率不斷增加,這可能會推動壓縮機市場的發展。

- 2021年,該國頁岩氣產量將成長約90%。預計這將為從事壓縮機業務的公司提供新的途徑。

- 阿根廷2021年天然氣產量為386億立方公尺(bcm),超過2020年的383 bcm。該國用於發電的天然氣使用量正在增加,這可能會推動發電和煉油廠等各個領域的壓縮機市場。

- Gasoductodel Noreste (GNEA) 是阿根廷的另一個主要天然氣管道。 GNEA 是一條正在建造的管道(長 1,500 公里),用於將天然氣從玻利維亞輸送到阿根廷各個地區。隨著GNEA計劃的發展,政府也聚焦在國內天然氣運輸基礎設施的發展。

- 綜上所述,預計阿根廷將成為預測期內南美洲成長最快的壓縮機市場。

南美洲壓縮機產業概況

南美壓縮機市場適度細分。該市場的主要企業(排名不分先後)包括 Atlas Copco AB、Siemens AG、Schulz SA、Ebara Corporation 和 Aerzener Maschinenfabrik GmbH。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 類型

- 正位移

- 動態型

- 最終用戶

- 石油和天然氣工業

- 電力部門

- 製造業

- 化學和石化行業

- 其他

- 地區

- 巴西

- 阿根廷

- 南美洲其他地區

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- 公司簡介

- Siemens AG

- Baker Hughes Co

- Trane Technologies PLC

- Atlas Copco AB

- Schulz SA

- General Electric Company

- Ebara Corporation

- Aerzener Maschinenfabrik GmbH

- ELGI Equipments Ltd

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 71347

The South America Compressor Market is expected to register a CAGR of 2.9% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to regional lockdowns and a slowdown in end-user industries. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factor such as increasing demand for compressors from fertilizers and petrochemical plants to process and pressurize multiple gases is likely going to drive the SAmericanerica compressor market.

- However, increasing the installation of renewable energy sources to provide power that does not use compressors is expected to restrain the South American compressor market.

- New technologies in compressors have more efficiency than the present ones and are expected to create several opportunities for the South American compressor market in the future.

- Due to its highest gas production in the region, Argentina is expected to be the fastest-growing country in the SAmericanerica compressor market.

South America Compressor Market Trends

Oil and Gas Industry Segment Expected to Dominate the Market

- Compressors are mechanical devices that increase the pressure of a gas by reducing its volume. They are widely used throughout the oil and gas industry. The upstream, midstream, and downstream sectors of the oil and gas business require compression for numerous applications, such as transmission, storage, gas gathering, gas lift, gas injection, flash gas compression, and refrigeration.

- Moreover, discoveries of gas reservoirs in the region are likely going to use the compressor as an integral part of the gas transportation infrastructure. Hence, the expanding gas pipeline networks are expected to be one of the most significant drivers for the growth of the market studied during the forecast period.

- In 2021, the total electricity generated in South America, approximately 20.4%, was from natural gas in the region. As the energy generation source, natural gas comes second after hydropower in the region, which is 2021 accounted for approximately 660.1 TWh of the energy in the area.

- The 1430-km long proposed Brazil-Argentina pipeline will allow production from the Vaca Muerte shale to connect to Neuquen province in Brazil. Negotiations over the project started in August 2021, and the estimated cost of the project is USD 4.9 billion.

- Gasoducto del Noreste (GNEA) is another major upcoming gas pipeline in Argentina. GNEA is a pipeline (1,500km long) that is being constructed to transport gas from Bolivia to different areas in Argentina. The government is also focusing on the development of the gas transportation infrastructure in the country, along with the development of this GNEA project.

- Hence, owing to the above points, the oil and gas industry segment is likely going to dominate the South American compressor market during the forecast period.

Argentina Expected to be the Fastest Growing Market

- Argentina, due to the constant increase in energy demand and an increasing number of commercial and industrial operations, the country is likely to be the fastest-growing market for compressors in South America. Moreover, the growth in the share of natural gas in power generation in the country is likely to drive the compressor market.

- The production of shale gas in the country will increase by about 90% in 2021. This is expected to provide new avenues for the companies engaged in the compressor business.

- In 2021, the production of gas in Argentina was 38.6 billion cubic meters (bcm), which was higher than the production in 2020, 38.3 bcm. The increasing usage of gas in the country to generate electricity is likely to drive the compressor market in various sectors such as power generation, refineries, etc.

- GasoductodelNoreste (GNEA) is another major upcoming gas pipeline in Argentina. GNEA is a pipeline (1,500km long) that is being constructed to transport gas from Bolivia to different areas in Argentina. The government is also focusing on the development of the gas transportation infrastructure in the country, along with the development of this GNEA project.

- Hence, owing to the above points, Argentina is expected to be the fastest-growing market for compressors in South America during the forecast period.

South America Compressor Industry Overview

The South America compressor market is moderately fragmented. Some of the key players in this market (in no particular order) include Atlas Copco AB, Siemens AG, Schulz S.A., Ebara Corporation, and Aerzener Maschinenfabrik GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Positive Diplacement

- 5.1.2 Dynamic

- 5.2 End User

- 5.2.1 Oil and Gas Industry

- 5.2.2 Power Sector

- 5.2.3 Manufacturing Sector

- 5.2.4 Chemicals and Petrochemical Industry

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Baker Hughes Co

- 6.3.3 Trane Technologies PLC

- 6.3.4 Atlas Copco AB

- 6.3.5 Schulz S.A.

- 6.3.6 General Electric Company

- 6.3.7 Ebara Corporation

- 6.3.8 Aerzener Maschinenfabrik GmbH

- 6.3.9 ELGI Equipments Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219