|

市場調查報告書

商品編碼

1536909

針狀焦:市場佔有率分析、產業趨勢、成長預測(2024-2029)Needle Coke - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

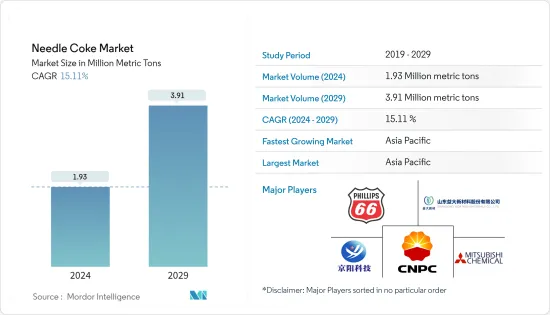

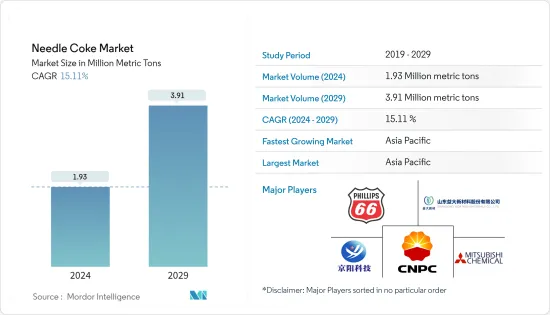

2024年針狀焦市場規模預估為193萬噸,預估2029年將達391萬噸,預測期(2024-2029年)複合年成長率為15.11%。

COVID-19 大流行對針狀焦市場產生了負面影響。疫情期間,鋼廠需求減少,導致針狀焦消耗減少,石墨電極生產受到較大影響。但由於鋰離子電池和石墨電極需求回升,限購解除後市場大幅成長。

*從中期來看,電弧爐鋼鐵製造投資的增加和廢鋼消費量增加的政府優惠政策是推動所研究市場成長的關鍵因素。

*然而,與石油焦相關的健康危害可能會阻礙所研究市場的成長。

*在預測期內,全球鋰離子電池產量的增加可能是研究市場的一個機會。

*亞太地區已成為主導市場。由於印度、中國和日本等國家的高需求,預計 2024 年至 2029 年將維持最高複合年成長率。

針狀焦市場趨勢

石墨電極領域佔據市場主導地位

*針狀焦是電爐石墨電極的主要原料。一種高品位、高價值的石油焦,用於生產熱膨脹係數 (CTE) 極低的石墨電極。

*石墨電極廣泛應用於鋼鐵等金屬產業所使用的電弧爐,因此石墨電極用針狀焦的應用佔針狀焦最大的應用。

*石墨具有高導熱性,耐熱、耐衝擊。它還具有低電阻,需要承載熔化鐵所需的大電流。因此,它可以承受EAF(電爐)產生的極高熱量。製造電極需要經過燒製和重新烘烤焦炭以將其變成石墨的過程,該過程大約需要六個月的時間。

*石墨電極分為四種:RP石墨電極、HP石墨電極、SHP石墨電極、UHP石墨電極。

*石墨電極主要用於電爐鋼、合金鋼、各種合金、非金屬的生產。這些電極可以產生高熱,也用於鋼鐵提煉和類似的冶煉過程。鐵屑在電爐中可在1600度C左右熔化。

*根據Sanergy Group Limited的資料,預計2023年全球石墨電極產量將達到878.5萬噸,2024年將達到79.54萬噸。

*2023 年 12 月,Graphite India Limited (GIL) 投資 5 億印度盧比(約 600 萬美元)購買 Godi India Private Limited 的強制可轉換優先股。透過本次投資,GIL將持有Godi India 31%的股份。 Godi India 致力於先進的研發,支援電動車 (EV)永續電池和基於超級電容器的能源儲存系統的生產。 Godi India 的環保和碳中和製程包括水性電極處理TM、活性乾式塗層TM 和Pranic BinderTM。這項投資符合 GIL 進軍先進電池和能源儲存技術的多元化策略。

*2023年11月,海格集團成功將印度中央邦石墨電極年產能從80噸擴大至100噸。該公司巨額投資120億印度盧比(143,741,000美元)來擴大產能。海格也因此成為歐美第三大石墨電極製造商。

*預計上述因素將影響預測期內石墨電極應用的針狀焦需求。

亞太地區主導市場

*亞太地區預計將主導針狀焦市場,因為它包括中國(也是最大的針狀焦生產國和消費國)和日本等國家。

*中國石墨電極消費量和產能佔全球最大佔有率。我國石墨電極生產公司有40多家。在電動車產業成長的推動下,中國市場對石墨電極的需求以及鋰離子電池負極的進一步多元化,都推動了針狀焦需求的復甦。在可預見的未來,這種需求預計將穩定成長,價格也將相應上漲。

*除此之外,中國政府也致力於發展環保鋼鐵生產方式。因此,中國當局正積極推廣電弧爐(EAF)技術,以此作為遏制碳排放和促進鋼鐵業永續性的手段。電弧爐技術主要以廢鐵為原料,利用電力將其熔化。在國家政策支持的推動下,電弧爐技術的採用將成為中國的普遍趨勢,從而帶動石墨電極的需求。

*日本是石油、煤炭和焦油針狀焦的主要生產國和出口國之一。日本公司是世界上最大的石墨電極生產商之一。石墨電極的市場領導者包括 Showa Denko、Nippon Carbon、SEC Carbon 和 Tokai Carbon。

*印度鋼鐵業正在加大脫碳力度,積極致力於減少碳排放。作為其中的一部分,在鋼鐵生產中採用電爐(EAF)技術的運動日益盛行。電弧爐依靠電力和廢鋼,使其成為比傳統方法更永續的選擇。

*隨著電弧爐的採用進展,對石墨電極的需求預計將急劇增加。印度政府取消廢鋼進口關稅的措施將直接使電爐鋼鐵製造商受益。再加上有利的國家政策,這些將進一步推動電爐煉鋼的轉變,並帶動對石墨電極的需求。

*日本第二大鋼鐵製造商 JFE 鋼鐵公司宣布建設計畫一座大型電爐 (EAF)。電弧爐計劃於 2027 年左右取代倉敷工廠現有的高爐。這項策略性舉措突顯了該公司根據全球氣候變遷計劃遏制碳排放的承諾。新高爐將主要供應汽車和其他產業,預計每年減少排放260萬噸。

*石墨電極在電爐(EAF)製程中發揮重要作用,電爐是鋼鐵生產的主要方法。韓國鋼鐵業非常重要,透過服務汽車、建築和造船等行業來推動該國的經濟成長。根據韓國鋼鐵協會報告,鋼鐵產業佔韓國GDP的1.5%,佔製造業的4.9%。特別是韓國是世界第六大鋼鐵生產國。

*因此,鑑於上述情況,亞太地區可能主導全球針狀焦市場。

針狀焦產業概況

針狀焦市場部分整合。該市場的主要企業(排名不分先後)包括飛利浦66、中國石油天然氣集團公司(CNPC)、山東億達融貿易有限公司、山東陽科技和三菱化學。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 加大對電爐鋼生產的投資

- 政府政策增加廢鐵消耗

- 抑制因素

- 與石油焦相關的健康危害

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 定價概覽

第5章市場區隔

- 產品類型

- 石油基

- 煤焦油瀝青基質

- 目的

- 石墨電極

- 鋰離子電池

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- Baosteel Group

- China National Petroleum Corporation(CNPC)

- China Petroleum & Chemical Corporation(Sinopec)

- Indian Oil Corporation

- Liaoning Baolai Bioenergy Co., Ltd.

- Mitsubishi Chemical Corporation

- Nippon Steel Corporation

- Phillips 66

- Posco Mc Materials

- Seadrift Coke LP(Graftech International)

- Shandong Dongyang Technology Co. Ltd

- Shandong Yida New Materials Co. Ltd

- Shanxi Hongte Coal Chemical Co. Ltd

第7章 市場機會及未來趨勢

- 鋰離子電池提振針狀焦需求

The Needle Coke Market size is estimated at 1.93 Million metric tons in 2024, and is expected to reach 3.91 Million metric tons by 2029, growing at a CAGR of 15.11% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the needle coke market. During the pandemic, the manufacturing of graphite electrodes was heavily affected due to less demand from the steel manufacturing plants, which reduced the consumption of needle coke. However, the market registered a significant growth rate after the restrictions were lifted due to the recovering demand for lithium-ion batteries and graphite electrodes.

* Over the medium term, increasing investments in EAF steel manufacturing and favorable government policies to increase scrap steel consumption are significant factors driving the growth of the studied market.

* However, health hazards associated with petroleum coke are likely to hinder the growth of the studied market.

* The increase in lithium-ion battery production globally is likely to act as an opportunity for the market studied during the forecast period.

* Asia-Pacific emerged as the dominant market. It is also expected to register the highest CAGR from 2024 to 2029 due to the high demand from countries such as India, China, Japan, and others.

Needle Coke Market Trends

Graphite Electrodes Segment to Dominate the Market

* Needle coke is a primary raw material for graphite electrodes in electric furnaces. It is a premium-grade, high-value petroleum coke used to manufacture graphite electrodes with a very low coefficient of thermal expansion (CTE).

* Owing to the wide application of graphite electrodes in electric arc furnaces, which are used in steel and other metal industries, the application of needle coke for graphite electrodes accounts for the largest application of needle coke.

* Graphite has high thermal conductivity and is resistant to heat and any impact. Also, it has low electrical resistance, which is needed to conduct large electrical currents necessary to melt iron. Thus, it can sustain extremely high heat levels generated by EAF (electric arc furnace). Making the electrodes requires processing coke, including baking and rebaking, to convert it into graphite, which can take up to six months.

* Graphite electrodes are divided into four types: RP graphite electrodes, HP graphite electrodes, SHP graphite electrodes, and UHP graphite electrodes.

* Graphite electrodes are primarily used to manufacture electric arc furnace steel, alloy steel, various alloys, and nonmetals. These electrodes can generate high levels of heat and are also used in refining steel and similar smelting processes. They can melt iron scrap in an electric arc furnace at about 1,600°C.

* According to data from Sanergy Group Limited, the production volume of graphite electrodes worldwide was 8785 thousand metric tons in 2023 and is projected to reach 795.4 thousand metric tons in 2024.

* In December 2023, Graphite India Limited (GIL) invested INR 50 crore (approximately USD 6 million) in compulsorily convertible preference shares of Godi India Private Ltd. This investment provides GIL with a 31% equity shareholding in Godi India. Godi India is engaged in advanced Research and development to support the production of sustainable batteries for electric vehicles (EVs) and supercapacitor-based energy storage systems. Godi India's environment-friendly and carbon-neutral processes include Aqueous Electrode ProcessingTM, Active Dry CoatingTM, and Pranic BinderTM. This investment aligns with GIL's strategy to diversify into advanced battery and energy storage technologies.

* In November 2023, HEG Limited successfully expanded its graphite electrode capacity in Madhya Pradesh, India, from 80 kilotons per annum to 100 kilotons per annum. The company made a substantial investment of INR 1,200 crore (USD 143.741 million) for this capacity expansion. As a result, HEG is the third-largest graphite electrode company in the Western world.

* The factors mentioned above are expected to affect the demand for needle coke for graphite electrode application during the forecast period.

Asia-Pacific to Dominate the Market

* Asia-Pacific is expected to dominate the needle coke market, as it includes countries such as China (the biggest producer and consumer of needle coke) and Japan.

* China holds the largest share of graphite electrode consumption and production capacity in the global scenario. There are over 40 official graphite electrode manufacturers in China. The Chinese market's demand for graphite electrodes and further diversification into lithium-ion battery anodes, fueled by the EV industry's growth, are both driving a comeback in the demand for needle coke. For the foreseeable future, this demand is expected to continue to increase steadily, with corresponding pricing support.

* In addition to this, the Chinese government is also focusing on developing eco-friendly means of producing steel. Hence, Chinese authorities are actively promoting Electric Arc Furnace (EAF) technology as a means to curb carbon emissions and foster sustainability in the steel industry. EAF technology relies primarily on steel scrap as its raw material, with electricity used to melt it. Driven by supportive national policies, the adoption of EAF technology is poised to become a prevailing trend in China, consequently bolstering the demand for graphite electrodes.

* Japan is one of the leading producers and exporters of petroleum, coal, and tar-based pitch needle coke. Japanese companies are one of the largest producers of graphite electrodes in the world. The market giants of graphite electrodes include Showa Denko, Nippon Carbon, SEC Carbon, and Tokai Carbon.

* The Indian steel industry is actively working to reduce carbon emissions through intensified efforts to decarbonize. As part of this push, there is a rising trend in adopting electric arc furnace (EAF) technology for steel production. EAFs rely on electricity and steel scrap, making them a more sustainable choice than traditional methods.

* With the growing adoption of EAFs, there is a significant expected surge in demand for graphite electrodes. The Indian government's move to eliminate customs duty on scrap imports directly benefits EAF steel manufacturers. Coupled with favorable national policies, these further fuel the shift toward EAFs and drive the demand for graphite electrodes.

* JFE Steel, Japan's second-largest steelmaker, announced in November 2023 its plans to construct a large-scale electric arc furnace (EAF). The EAF is slated to replace an existing blast furnace at its Kurashiki plant by around 2027. This strategic move underscored the company's commitment to curbing carbon emissions, which is in line with global climate change initiatives. The new EAF will primarily cater to automotive and other sectors, with an anticipated annual emissions reduction of 2.6 million tons.

* Graphite electrodes play an important role in the electric arc furnace (EAF) process, a key method for steel production. The steel sector in South Korea is significant, driving the nation's economic growth by catering to industries like automotive, construction, and shipbuilding. The steel industry accounts for 1.5% of the nation's GDP and 4.9% of its manufacturing sector, as reported by the Korean Iron & Steel Association. Notably, South Korea ranks as the sixth-largest steel producer globally.

* Hence, Asia-Pacific is likely to dominate the global needle-coke market based on the aspects mentioned above.

Needle Coke Industry Overview

The needle coke market is partially consolidated. Some of the major players in the market (not in any particular order) include Phillips 66 Company, China National Petroleum Corporation (CNPC), Shandong Yida Rongtong Trading Co., Shandong Jing Yang Technology Co. Ltd, and Mitsubishi Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Investments in EAF Steel Manufacturing

- 4.1.2 Government Policies to Increase Scrap Steel Consumption

- 4.2 Restraints

- 4.2.1 Health Hazards Associated with Petroleum Coke

- 4.3 Industry Value-Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Overview

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Petroleum Based

- 5.1.2 Coal-tar Pitch Based

- 5.2 Application

- 5.2.1 Graphite Electrodes

- 5.2.2 Lithium-ion Batteries

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Baosteel Group

- 6.4.2 China National Petroleum Corporation (CNPC)

- 6.4.3 China Petroleum & Chemical Corporation (Sinopec)

- 6.4.4 Indian Oil Corporation

- 6.4.5 Liaoning Baolai Bioenergy Co., Ltd.

- 6.4.6 Mitsubishi Chemical Corporation

- 6.4.7 Nippon Steel Corporation

- 6.4.8 Phillips 66

- 6.4.9 Posco Mc Materials

- 6.4.10 Seadrift Coke LP (Graftech International)

- 6.4.11 Shandong Dongyang Technology Co. Ltd

- 6.4.12 Shandong Yida New Materials Co. Ltd

- 6.4.13 Shanxi Hongte Coal Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Lithium-ion Batteries to Boost the Demand for Needle Coke