|

市場調查報告書

商品編碼

1537591

全球加密貨幣市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Cryptocurrency - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

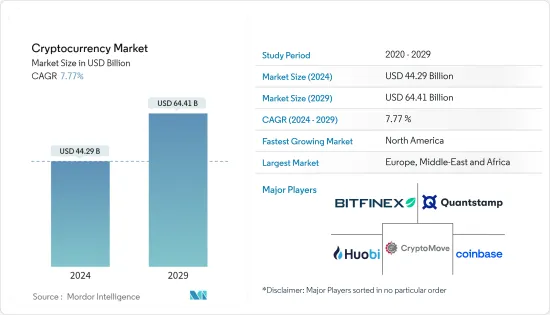

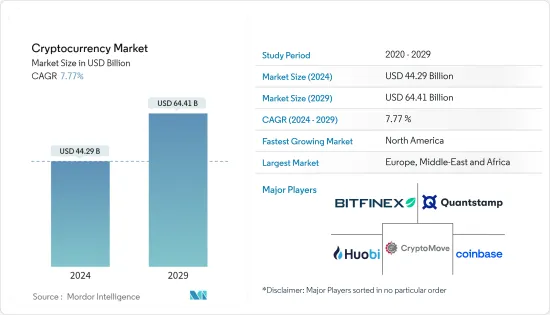

根據預測,2024 年全球加密貨幣市場規模預計為 442.9 億美元,2029 年達到 644.1 億美元,在預測期內(2024-2029 年)複合年成長率為 7.77%。

加密貨幣(虛擬貨幣)僅在數位領域運行,沒有監管機構監督。區塊鏈和加密貨幣等分散式帳本技術的使用可確保交易得到檢驗。由於分散式帳本技術的快速採用,加密貨幣市場預計將成長。此外,跨境匯款中加密貨幣的使用正在增加,預計透過降低消費者的費用和外匯成本來擴大市場。眾多加密貨幣的市值用於細分加密貨幣市場。這些數位貨幣與貨幣和金融體系的重要方面有交叉。它的快速擴張、複雜性、高波動性以及促進非法貿易的潛力促使世界各地的監管機構和政策制定者將其納入現有系統並相應地表達對性的擔憂。

加密貨幣最初是為了促進獨立於政府或央行監管的P2P交易而開發的,現在已成為一種尖端的金融創新。目前正在對這些數位資產檢驗,以評估其在金融業中的潛在風險和回報,以及其多樣化的設計目標。加密貨幣有很多種,每種都有特定的用途。有些旨在取代傳統貨幣(例如比特幣、門羅幣、比特幣現金),而有些則專注於支援具有成本效益的付款系統(例如 Ripple、Particle、公共事業付款幣)。此外,雖然某些加密貨幣透過創建代幣來實現P2P交易(例如RMG 和Maecenas),但其他加密貨幣則透過直接交易(例如Golem 和Filecoin)提供對商品和服務的安全訪問,從而允許底層的加密貨幣支援不同的加密通訊協定。重要的是要認知到這個設計目標清單是不完整的,因為新的加密貨幣正在不斷開發中。

加密貨幣市場趨勢

數位資產採用的增加預計將推動市場成長

數位資產採用的迅速成長正在推動加密貨幣市場向前發展。人們越來越認知到加密貨幣在安全、高效的交易和抵禦通貨膨脹方面的優勢,導致個人和企業迅速接受加密貨幣。此外,金融機構也加入了這個趨勢,整合加密貨幣服務,提高市場的合法性。這種接受範圍超越了比特幣和以太坊,擴展到了廣泛的Altcoin和代幣,提供了多樣化的投資機會。與傳統金融體系相比,加密貨幣的去中心化結構具有許多優勢,例如較低的交易成本和更高的金融服務可用性,尤其是在銀行業務有限的地區。隨著技術進步和監管情況變得更加清晰,這一趨勢預計將持續下去,加密貨幣在全球金融格局中的地位預計將變得更加強大。

北美地區佔據市場主導地位

預測期內,北美地區預計將為全球市場成長貢獻48%。由於該地區存在大量市場參與者以及不斷的技術創新,北美加密貨幣市場佔據最大佔有率。對數位付款不斷成長的需求進一步推動了北美加密貨幣市場的成長。美國處於數位貨幣技術進步的前沿,被認為是該地區的主要企業之一。供應商擴大北美業務的投資預計將在預測期內推動該地區加密貨幣市場的成長。

此外,加密貨幣在 NFT 中的使用以及加密貨幣作為價值儲存形式的日益接受也促進了該地區的市場成長。此外,對該地區專注於區塊鏈技術和加密貨幣挖礦系統創新解決方案的公司的投資顯著增加。這些投資旨在提供更高的算力並提高能源效率。

加密貨幣行業概況

加密貨幣市場也高度分散。加密貨幣有數千種,每種都有獨特的特徵、使用案例和社群。例如,比特幣是最著名和廣泛採用的加密貨幣,但還有許多其他加密貨幣,例如以太坊、瑞波幣和萊特幣。每種加密貨幣都是獨立運作的,並擁有用戶和開發人員網路。重要公司包括 Bitfinex、Quantstamp Inc.、CryptoMove Inc.、Coinbase 和 Huobi Global。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態與洞察

- 市場概況

- 市場促進因素

- 金融付款系統營運效率和透明度的需求不斷增加

- 新興國家匯款需求不斷增加

- 市場限制因素

- 各國政府法規的差異影響市場

- 由於市場價值波動,持有加密貨幣的風險增加

- 市場機會

- 為公司創造新數位資產的機會增加

- 加密貨幣正在成為投資報酬率更高的基金的機會

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 影響全球加密貨幣市場的趨勢

- 全球加密貨幣市場的技術創新

- COVID-19 對市場的影響

第5章市場區隔與分析

- 按市場資本

- 比特幣

- 以太坊

- 波紋

- 比特幣現金

- 卡爾達諾

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 南非

- 其他中東/非洲

第6章 競爭狀況

- 市場公司概況

- 公司簡介

- Bitfinex

- Quantstamp Inc.

- CryptoMove Inc.

- Coinbase

- Huobi Global

- CoinCheck

- Gemini

- Bitfury

- Binance

- Cannan Inc*

第7章 市場機會及未來趨勢

第8章 免責聲明

The Cryptocurrency Market size is estimated at USD 44.29 billion in 2024, and is expected to reach USD 64.41 billion by 2029, growing at a CAGR of 7.77% during the forecast period (2024-2029).

Cryptocurrency, or virtual currency, operates solely in the digital realm without any overseeing regulatory body. Utilizing distributed ledger technology like blockchain and cryptocurrency ensures transaction validation. The surge in distributed ledger technology adoption is forecasted to drive growth in the cryptocurrency market. Additionally, the rising use of cryptocurrencies for cross-border remittances is projected to expand the market by lowering consumer fees and exchange costs. The market capitalization of numerous cryptocurrencies is used to segment the cryptocurrency market. These digital currencies intersect with crucial aspects of the monetary and financial systems. Due to their rapid expansion, intricate nature, significant fluctuations, and potential for enabling unlawful transactions, regulators and policymakers worldwide express apprehension regarding their integration into the current system and the need to adapt the system accordingly.

Cryptocurrencies, developed initially to facilitate peer-to-peer transactions independent of government or central bank oversight, have emerged as a cutting-edge financial innovation. These digital assets are currently under examination to assess their potential risks and rewards within the financial industry and their diverse design objectives. There are numerous cryptocurrencies, each serving a specific purpose. Some seek an alternative to traditional currency (such as Bitcoin, Monero, and Bitcoin Cash), while others focus on supporting cost-effective payment systems (like Ripple, Particl, and Utility Settlement Coin). Additionally, specific cryptocurrencies enable peer-to-peer trading through token creation (such as RMG and Maecenas), while others provide secure access to goods or services in direct transactions (like Golem and Filecoin). Some cryptocurrencies support underlying platforms or protocols (such as Ether and NEO). It is essential to recognize that new cryptocurrencies are continually being developed, so this list of design objectives is incomplete.

Cryptocurrency Market Trends

Increasing Adoption of Digital Assets is Expected to Drive the Growth of this Market

The surge in the adoption of digital assets is propelling the cryptocurrency market forward. The growing recognition of the advantages of cryptocurrencies in terms of secure and efficient transactions and their ability to safeguard against inflation has resulted in a surge in their acceptance among individuals and enterprises. Moreover, financial institutions are joining the trend by integrating crypto services, thereby enhancing the legitimacy of the market. This acceptance is not limited to Bitcoin and Ethereum but also includes a wide range of altcoins and tokens, providing diverse investment opportunities. Cryptocurrencies' decentralized structure offers benefits compared to conventional financial systems, including reduced transaction costs and enhanced availability of financial services, especially in areas with limited banking access. This trend is expected to continue as technology advances and regulatory frameworks become more defined, further solidifying cryptocurrencies in the global financial landscape.

North America Region Dominates the Market

During the forecast period, North America is projected to contribute 48% to the global market growth. The cryptocurrency market in North America holds the largest share due to numerous market players and continuous innovations in the region. The growing demand for digital payments has further fueled the growth of the North American cryptocurrency market. The United States, being at the forefront of technological advancements in digital currencies, is considered one of the key players in the region. Investments by vendors to expand their operations in North America are expected to drive the growth of the cryptocurrency market in the area during the forecast period.

Additionally, the use of cryptocurrencies in NFTs and the increasing acceptance of cryptocurrencies as a form of value storage contribute to the regional market's expansion. Additionally, there has been a notable increase in regional investments towards companies focusing on blockchain technology and innovative solutions for cryptocurrency mining systems. These investments aim to provide higher hash rates and enhance power efficiency.

Cryptocurrency Industry Overview

The cryptocurrency market is also highly fragmented. Thousands of cryptocurrencies are available, each with unique features, use cases, and communities. Bitcoin, for example, is the most well-known and widely adopted cryptocurrency, but there are numerous others, such as Ethereum, Ripple, Litecoin, and many more. Each cryptocurrency operates independently and has a network of users and developers. Some significant players are Bitfinex, Quantstamp Inc., CryptoMove Inc., Coinbase, and Huobi Global.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Operational Efficiency and Transparency in Financial Payment Systems

- 4.2.2 Increasing Demand for Remittances in Developing Countries

- 4.3 Market Restraints

- 4.3.1 Varying Government Regulations in Different Countries Affecting the Market

- 4.3.2 Volatility in Market Value Increases the Risk of Holding Cryptocurrency

- 4.4 Market Opportunities

- 4.4.1 Rising Opportunities for Companies to Create New Digital Assets

- 4.4.2 Cryptocurrency Emerging as an Opportunity to Invest Money with Higher Returns

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Trends Influencing Global Cryptocurrency Market

- 4.7 Technological Innovations in Global Cryptocurrency Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION AND ANALYSIS

- 5.1 By Market Capitalization

- 5.1.1 Bitcoin

- 5.1.2 Ethereum

- 5.1.3 Ripple

- 5.1.4 Bitcoin Cash

- 5.1.5 Cardano

- 5.1.6 Others

- 5.2 Geography

- 5.3 North America

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

- 5.3.4 Rest of North America

- 5.4 Europe

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Russia

- 5.4.5 Italy

- 5.4.6 Spain

- 5.4.7 Rest of Europe

- 5.5 Asia-Pacific

- 5.5.1 India

- 5.5.2 China

- 5.5.3 Japan

- 5.5.4 Australia

- 5.5.5 Rest of Asia-Pacific

- 5.6 South America

- 5.6.1 Brazil

- 5.6.2 Argentina

- 5.6.3 Rest of South America

- 5.7 Middle East & Africa

- 5.7.1 United Arab Emirates

- 5.7.2 South Africa

- 5.7.3 Rest of Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Bitfinex

- 6.2.2 Quantstamp Inc.

- 6.2.3 CryptoMove Inc.

- 6.2.4 Coinbase

- 6.2.5 Huobi Global

- 6.2.6 CoinCheck

- 6.2.7 Gemini

- 6.2.8 Bitfury

- 6.2.9 Binance

- 6.2.10 Cannan Inc*