|

市場調查報告書

商品編碼

1548566

資料中心服務:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Data Center Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

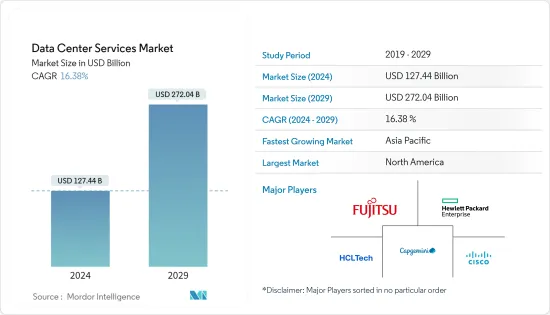

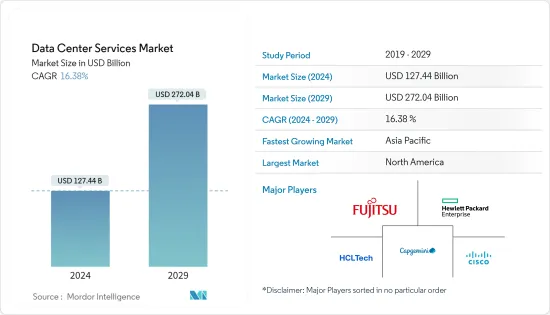

資料中心服務市場規模預計到2024年為1,274.4億美元,預計到2029年將達到2,720.4億美元,在預測期間(2024-2029年)複合年成長率預計為16.38%。

資料中心服務需求激增的主要因素是雲端處理的普及。企業和企業正在轉向雲端服務來滿足其儲存、運算和應用程式需求,而快速成長的資料量需要增加資料中心容量。

各行業對數位轉型舉措的需求不斷成長,推動了對強大資料中心基礎設施的需求。企業擴大利用數位技術來簡化業務、改善客戶體驗並促進創新。組織越來越依賴巨量資料和分析來收集和分析大量資料集以進行決策。這一趨勢凸顯了對強大的資料儲存和資料處理基礎設施日益成長的需求。

2024 年 1 月,全球雲端和營運商中立資料中心服務供應商 Digital Realty 在印度推出了第一個資料中心。佔地 10 英畝的園區位於清奈的工業中心,能夠支援高達 100 MW 的關鍵 IT 負載。這是對公司全球資料中心平台的重要擴展,滿足了全球主要市場對數位轉型日益成長的需求。

此外,物聯網 (IoT) 的興起正在創造新的需求,無數連網裝置產生大量必須儲存、處理和分析的資料。人工智慧和機器學習的日益複雜化需要大量的運算能力和存儲,從而推動了對資料中心服務的需求。

COVID-19 大流行引發的遠距工作和數位服務激增凸顯了資料中心的重要性。資料中心現在是安全可靠地存取資訊和應用程式的關鍵樞紐。此外,嚴格的資料保護條例正在促使企業增加對資料中心服務的投資,以滿足合規標準。節能設計和增強型冷卻解決方案等技術進步使資料中心更具吸引力和成本效益,從而推動市場成長。

2024 年 4 月,美國鐵塔子公司、混合IT 解決方案供應商 Coresight 宣布取得 NVIDIA DGX-Ready資料中心計畫認證。透過此認證,Coresight 可以提供可擴展的高效能基礎設施,專為希望利用人工智慧 (AI)、機器學習 (ML) 和其他高密度應用程式不斷成長的需求的組織而構建。選擇在其核心站點託管 NVIDIA DGX 基礎設施的客戶可以訪問洛杉磯、矽谷、芝加哥和北維吉尼亞州等關鍵地點為 NVIDIA AI 和高效能運算量身定做的高密度資料中心和園區網路。

然而,市場成長受到高營運成本、能源消耗問題和熟練專業人員有限的限制。此外,資料安全和隱私挑戰以及監管合規要求是市場擴張的主要障礙。

資料中心服務市場趨勢

雲端和託管預計將佔據資料中心服務市場的主要佔有率

- 對雲端和託管服務的需求不斷成長正在推動資料中心服務市場的發展。這種快速成長是由對高度擴充性的基礎設施的需求所推動的。隨著企業因其靈活性、擴充性和成本效益而轉向雲,對支援這些服務的可靠資料中心設施的需求正在迅速增加。

- 不斷成長的需求正在推動資料中心建設和擴建的投資。這種擴散不僅刺激了技術進步,而且增加了對高效能運算、儲存和網路解決方案的需求。此外,向雲端基礎的服務的轉變正在推動資料中心領域的創新和競爭。競爭的加劇帶來了更強大的服務組合併提高了營運效率。

- 根據 Cloudscene 的數據,截至 2024 年 3 月,美國擁有全球最多的資料中心,據報告數量為 5,381 個。德國以 521 名緊隨其後,英國以 514 名緊隨其後。

- 目前運作十億台設備連接到網際網路正在運行,而且這個數字還在不斷增加。這些設備通常會產生大量必須進行記錄、處理、儲存、評估和搜尋的資料。隨著物聯網和工業 4.0 的進步,製造商擴大利用巨量資料和分析來提高生產力、降低成本、增強安全性並簡化營運。

- 隨著資料生成的加速,及時獲得洞察變得越來越困難。智慧城市、智慧建築等新的數位領域提供了大量易於存取的資料。此外,公有雲正在迅速普及,因為它們具有成本效益且需要較少的維護。此外,雲端服務可存取性的提高使中小型企業能夠根據其需求調整基礎設施成本,從而有效地擴展規模。

- 2024 年 5 月,專門從事比特幣挖礦和集中計算綠色資料中心的 Soluna Holdings 宣佈建立新的合作夥伴關係。我們宣布計劃與世界各地的企業 GPU 伺服器OEM和 AI 基礎設施即服務供應商合作。 Soluna Cloud 計劃利用策略合作夥伴提供的可再生能源運作的高效能資料中心推出其服務。此外,透過此次合作,Soluna Cloud的服務可望從基礎基礎設施擴展到一整套策略合作夥伴AI管道軟體解決方案。

北美佔有很大的市場佔有率

- 北美是眾多科技創新者的聚集地,對雲端運算、物聯網等尖端技術的需求不斷成長。鑑於這些技術的複雜性,對彈性資料中心設施的需求日益成長。因此,該地區對資料中心服務的需求預計將激增。

- 美國作為全球經濟的中心,有能力引領公有雲資料中心的擴張。 IT 產業是該國主要的私人雇主,資料中心的激增進一步推動了市場成長。此外,隨著超大規模平台的激增,該國擴大滿足超大規模平台資料中心的需求。

- 該地區的公司越來越喜歡主機代管資料中心,而不是建立自己的資料中心。這種轉變是由於實現了主機代管設施租賃帶來的許多好處而推動的。由於網路和連接設備等技術的快速整合,基礎設施變得越來越複雜。

- 市場正在見證老牌和新興企業競爭對手之間的激烈競爭。這些市場參與企業正在部署有機和無機策略相結合的策略,以增強競爭力並推動市場成長。例如,2024 年 6 月, Oracle和 Google Cloud 宣佈建立策略合作夥伴關係,為客戶提供整合Oracle Cloud Infrastructure (OCI) 和 Google Cloud 技術的彈性。此次合作旨在加速用戶的應用程式遷移和升級。 Oracle Interconnect for Google Cloud 最初預計將在全球 11 個地區推出,讓客戶能夠無縫部署通用工作負載,而無需在雲端之間產生資料傳輸費用。

- 2023 年 10 月,安全、可擴展的資料中心解決方案供應商 Flexential 宣布,專注於大規模 GPU 加速工作負載的專業雲端供應商 CoreWeave 將擴大其資料中心業務。 CoreWeave 的擴張意味著遷至位於奧勒岡州州希爾斯伯勒和喬治亞道格拉斯維爾的兩個策略性主機代管設施。這兩個設施均由 Flexential 擁有和營運。 CoreWeave 的基礎設施專為滿足機器學習、人工智慧、視覺特效、渲染和像素串流等計劃不斷變化的需求而量身定做,並展示了先進的運算框架。

資料中心服務產業概述

資料中心服務市場高度分散,競爭公司之間的競爭非常激烈。主要市場參與者包括富士通有限公司、思科系統公司、凱捷公司、HCL 技術有限公司和惠普企業公司。市場參與企業正在加強其產品組合,並透過策略合作夥伴關係和產品創新尋求持久的競爭優勢。

- 2024 年 5 月 北美網路中立互連和超大規模邊緣資料中心供應商 Corogix 宣布成功推出在該地區的第四個也是最大的資料中心。此次擴張標誌著 Cologix 在滿足俄亥俄州哥倫布市日益成長的主機代管和互連服務需求方面邁出了重要一步。

- 2024 年 2 月 全球基礎設施平台即服務公司 MOD Mission Critical (MOD) 宣布擴大與以網路為中心的主機代管、雲端和託管服務供應商 365 Data Centers (365) 的合作夥伴關係。此次合作將使 MOD 能夠提供部分主機代管和連接解決方案,使客戶能夠存取 20 個市場的 365 個以網路為中心的資料中心提供的服務和資源。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對市場的影響

- 市場促進因素

- 增加資料中心技術支出

- 由於擴充性,資料中心的複雜性增加

- 市場限制因素

- 資料隱私問題

第5章市場區隔

- 按服務類型

- 託管服務

- 主機代管服務

- 依資料中心類型

- 第一層級和第二層級

- 層級

- IV層級

- 按最終用戶產業

- BFSI

- 衛生保健

- 零售

- 製造業

- 資訊科技/通訊

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Fujitsu Limited

- IBM Corporation

- Singapore Telecommunications Limited(Singtel)

- Digital Realty Trust Inc.

- Cisco Systems Inc.

- Equinix Inc.

- Hewlett Packard Enterprise Company

- Vertiv Co.

- Dell Inc.

- NTT Communications

- Capgemini SE

第7章 投資分析

第8章市場的未來

The Data Center Services Market size is estimated at USD 127.44 billion in 2024, and is expected to reach USD 272.04 billion by 2029, growing at a CAGR of 16.38% during the forecast period (2024-2029).

The primary driver behind the surge in demand for data center services is the widespread adoption of cloud computing. Businesses and firms are turning to cloud services for their storage, computing, and application requirements, leading to a surge in data volumes that necessitates expanded data center capacity.

The rising demand for digital transformation initiatives in multiple industries is driving the need for robust data center infrastructure. Firms are increasingly turning to digital technologies to boost operations, elevate customer experiences, and foster innovation. Organizations are progressively relying on big data and analytics, collecting and analyzing extensive data sets for decision-making. This trend underscores the growing need for robust data storage and processing infrastructure.

In January 2024, Digital Realty, a global provider of cloud- and carrier-neutral data center services, unveiled its inaugural data center in India. Situated in Chennai's industrial hub, the 10-acre campus boasts the capacity to support up to 100 megawatts of critical IT load. This marks a pivotal expansion for the company's global data center platform, addressing the escalating digital transformation demands in significant global markets.

Moreover, the increase of the Internet of Things (IoT) adds another layer of demand, with countless connected devices generating massive amounts of data that need to be stored, processed, and analyzed. The expanding sophistication of artificial intelligence and machine learning necessitates substantial computational power and storage, thereby driving up the demand for data center services.

The surge in remote work and digital services, catalyzed by the COVID-19 pandemic, underscored the importance of data centers. They now serve as crucial hubs for secure and reliable access to information and applications. Additionally, stringent data protection regulations are nudging businesses to bolster their investments in data center services to meet compliance standards. Technological advancements, including energy-efficient designs and enhanced cooling solutions, are enhancing the appeal and cost-effectiveness of data centers, thereby fuelling market growth.

In April 2024, CoreSite, a subsidiary of American Tower Corporation and a provider of hybrid IT solutions, revealed its certification under the NVIDIA DGX-Ready Data Center program. This certification equips CoreSite to offer scalable, high-performance infrastructure, catering specifically to organizations seeking to leverage the growing appetite for artificial intelligence (AI), machine learning (ML), and other high-density applications. Customers opting to host their NVIDIA DGX infrastructure with CoreSite can gain access to a network of high-density data center campuses in key locations, such as Los Angeles, Silicon Valley, Chicago, and Northern Virginia, tailored for NVIDIA AI and high-performance computing.

However, the growth of the market is restricted by high operational costs, energy consumption concerns, and limited availability of skilled professionals. Additionally, data security and privacy challenges, along with regulatory compliance requirements, pose significant barriers to expansion.

Data Center Services Market Trends

Cloud and Hosting is Expected to Capture a Major Share in the Data Center Services Market

- The growing demand for cloud and hosting services is propelling the data center services market. This surge is fuelled by the necessity for enhanced, scalable infrastructure. With businesses increasingly shifting to the cloud for its flexibility, scalability, and cost-effectiveness, the demand for reliable data center facilities has surged to support these services.

- The rising demand is driving investments in data center construction and expansion. This surge is not only spurring technological advancements but also amplifying the necessity for high-performance computing, storage, and networking solutions. Furthermore, the transition to cloud-based services is fuelling innovation and competition in the data center sphere. This heightened competition is resulting in more robust service portfolios and greater operational efficiencies.

- According to Cloudscene, as of March 2024, the United States boasted the highest number of data centers globally, with a reported count of 5,381. Germany followed with 521, and the United Kingdom closely behind with 514.

- Billions of internet-connected devices are in operation today, a number that continues to climb. These devices often produce substantial data volumes, necessitating recording, processing, storage, assessment, and retrieval. As IoT and Industry 4.0 advance, manufacturers increasingly turn to big data and analytics to enhance productivity, cut costs, bolster security, and streamline operations.

- As data generation accelerates, capturing timely insights becomes increasingly challenging. Emerging digital arenas, like smart cities and intelligent buildings, provide a wealth of readily accessible data. Furthermore, the public cloud's popularity is surging due to its cost-effectiveness and minimal maintenance requirements. Moreover, the accessibility of cloud services is empowering small and medium enterprises to scale efficiently, as they can tailor their infrastructure expenses to match their requirements.

- In May 2024, Soluna Holdings Inc., a company specializing in green data centers for Bitcoin mining and intensive computing, revealed a new partnership. It announced its plan to collaborate with a global enterprise GPU-server OEM and an AI Infrastructure-as-a-Service provider. Soluna Cloud is set to launch its services, tapping into the renewable-powered, high-performance data centers of its strategic partner. Moreover, this partnership is expected to broaden Soluna Cloud's services from basic infrastructure to encompass its strategic partner's full suite of AI pipeline software solutions.

North America Holds a Substantial Share in the Market

- North America boasts a surplus of technological innovators, driving demand for advanced technologies such as cloud computing and IoT. Given the intricate nature of these technologies, there is a growing need for resilient data center facilities. Consequently, the region is poised to witness a surge in demand for data center services.

- The United States, a significant global economy, is poised to drive the expansion of public cloud-based data centers. With the IT industry governing as the nation's primary private employer, the widespread adoption of data centers further fuels market growth. Furthermore, with the surge in hyper-scale platforms, the country finds itself increasingly catering to the data center needs of its hyper-scale platforms.

- Businesses in the region are increasingly favoring colocation data centers over building their own. This shift is driven by the realization of the myriad benefits that come with leasing from a colocation facility. Infrastructure facilities are becoming increasingly complex due to the rapid integration of technologies such as networks and connectivity devices.

- The market is witnessing intense competitive rivalry driven by both established and emerging players. These industry participants are deploying a mix of organic and inorganic strategies to enhance their competitive edge and fuel market growth. For instance, in June 2024, Oracle and Google Cloud unveiled a strategic partnership, offering customers the flexibility to integrate Oracle Cloud Infrastructure (OCI) with Google Cloud technologies. This collaboration aims to expedite application migrations and upgrades for users. Oracle Interconnect for Google Cloud is projected to be initially available in 11 global regions for customer onboarding, enabling seamless deployment of general-purpose workloads without incurring cross-cloud data transfer fees.

- In October 2023, Flexential, a provider of secure and scalable data center solutions, announced that CoreWeave, a specialized cloud provider focusing on large-scale GPU-accelerated workloads, is set to broaden its data center presence. CoreWeave's expansion would see the company moving into two additional colocation facilities, strategically located in Hillsboro, Oregon, and Douglasville, GA. Notably, both these facilities are under the ownership and operation of Flexential. CoreWeave's infrastructure is tailored to cater to the evolving needs of projects spanning machine learning, AI, VFX, rendering, and pixel streaming, showcasing an advanced computing framework.

Data Center Services Industry Overview

The data center service market is highly fragmented, with high competitive rivalry. The major market players are Fujitsu Ltd, Cisco Systems Inc., Capgemini, HCL Technologies Limited, and Hewlett Packard Enterprise Company. Market players are bolstering their portfolios and pursuing enduring competitive edges through strategic partnerships and product innovations.

- May 2024: Cologix, the network-neutral interconnection and hyperscale edge data center provider in North America, announced the successful launch of its fourth and most extensive data center in the region. This expansion signifies a pivotal step in Cologix's dedication to addressing the escalating need for colocation and interconnection services in Columbus, Ohio.

- February 2024: Global infrastructure Platform-as-a-Service company MOD Mission Critical (MOD) announced an expansion of its partnership with 365 Data Centers (365), a provider of network-centric colocation, cloud, and managed services. Through this partnership, MOD can provide fractional colocation and connectivity solutions, allowing its clients to access the services and resources offered by 365's network-centric data centers across 20 markets, complemented by an additional 125 nationwide points of presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Impact of COVID-19 on the Market

- 4.5 Market Drivers

- 4.5.1 Increase in the Expenditure on Data Center Technology

- 4.5.2 Rising Data Center Complexities Due to Scalability

- 4.6 Market Restraint

- 4.6.1 Concerns Relating to Data Privacy

5 MARKET SEGMENTATION

- 5.1 By Type of Service

- 5.1.1 Managed Hosting Service

- 5.1.2 Colocation Service

- 5.2 By Data Center Type

- 5.2.1 Tier-I and -II

- 5.2.2 Tier-III

- 5.2.3 Tier-IV

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Retail

- 5.3.4 Manufacturing

- 5.3.5 IT and Telecom

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fujitsu Limited

- 6.1.2 IBM Corporation

- 6.1.3 Singapore Telecommunications Limited (Singtel)

- 6.1.4 Digital Realty Trust Inc.

- 6.1.5 Cisco Systems Inc.

- 6.1.6 Equinix Inc.

- 6.1.7 Hewlett Packard Enterprise Company

- 6.1.8 Vertiv Co.

- 6.1.9 Dell Inc.

- 6.1.10 NTT Communications

- 6.1.11 Capgemini SE