|

市場調查報告書

商品編碼

1686309

無損檢測 (NDT):市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)NDT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

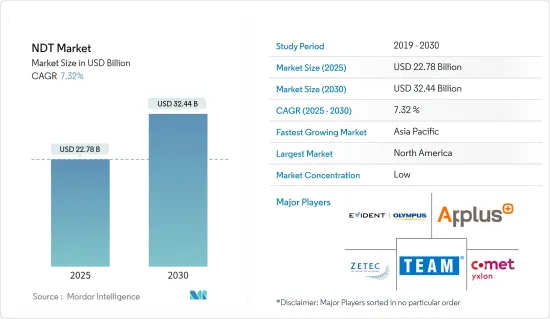

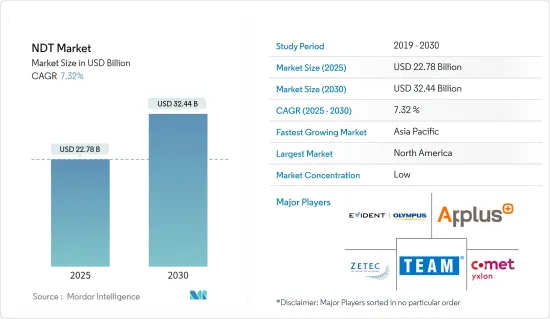

預計 2025 年無損檢測 (NDT) 市場規模為 227.8 億美元,到 2030 年將達到 324.4 億美元,預測期內(2025-2030 年)的複合年成長率為 7.32%。

主要亮點

- 預計無損檢測 (NDT) 市場將見證強勁成長,原因包括對安全性、完整性和可靠性的日益重視、發電行業的擴張、AL、ML、工業 4.0 和工業IoT等技術進步以及製造業活動的激增。

- 此外,石油和天然氣、建築計劃以及各國不斷增加的國防支出都對無損檢測 (NDT) 設備和服務產生了巨大的需求。此外,電動和自動駕駛汽車銷售的不斷成長也推動了汽車行業對無損檢測設備和服務的需求。

- 在汽車工業中,無損檢測 (NDT) 被廣泛用於檢查鍛造、熱處理和機械加工後的汽車零件,以確保它們符合既定的標準。無損檢測 (NDT) 對於檢查車身板和部件的焊接也很重要,以確保它們具有足夠的滲透力、無夾雜物和其他可能影響車輛安全性或可靠性的缺陷。電動和自動駕駛汽車的需求不斷成長,對無損檢測 (NDT) 的需求巨大。

- 缺乏熟練人力和培訓設施嚴重限制了該市場的成長。無損檢測 (NDT) 市場面臨的主要挑戰之一是熟練人才的短缺。有效使用無損檢測 (NDT) 需要高度的技術專業知識和解釋和分析測試結果的熟練程度。

- 俄羅斯入侵烏克蘭、美國競爭、選舉以及以色列戰爭等地緣政治挑戰對全球供應鏈產生重大影響,尤其是對傳統工業、國防、高科技領域、航太和綠色能源至關重要的關鍵原料。

- 俄烏戰爭和經濟放緩給無損檢測行業造成了重大衝擊。通貨膨脹和利率上升減少了消費者支出,阻礙了行業需求並導致市場成長放緩。此外,美國貿易戰也進一步擾亂了全球供應鏈。美國對華半導體設備進出口實施嚴格限制,阻礙了中國石油和天然氣、電力和能源、建築和汽車產業的生產。

無損檢測市場趨勢

預計可伸縮安全注射器市場在預測期內將出現顯著成長

- 無損檢測 (NDT) 技術在國防工業中至關重要,可確保從製造到組裝的材料和連接製程的最高品質水準。即使是由於腐蝕或磨損造成的輕微缺陷也可能導致災難性的故障,危及大筆投資。

- 透過無損檢測(NDT)進行品管在軍事裝備製造中至關重要,並直接影響其可靠性。在戰鬥場景中,這些系統的有效性取決於細緻的超音波和渦流無損檢測 (NDT) 測試,以確保組件符合規格並且更換或維修完美無缺。

- 儲存槽在安全和防禦領域廣泛使用,主要用於儲存航空和船用燃料,有時也用於儲存標準車輛燃料。這些儲罐具有多種配置,包括地上儲罐、埋地儲罐、半埋地儲罐、臥式儲罐和立式儲罐。無損檢測(NDT)技術被廣泛用於這些油箱的檢查,以避免將來出現缺陷。

- 飛機、飛彈和防禦系統的製造、維護和修理過程中對品質保證和控制的需求推動了對無損檢測 (NDT) 技術的需求。全球軍事航空的興起推動了對延長飛機壽命至關重要的例行檢查、維護和無損檢測 (NDT) 測試的需求不斷成長。

- 例如,2024年7月,美國宣布計劃部署數十架先進戰鬥機,以加強在日本的存在。該計劃是價值 100 億美元的維修的一部分,旨在加強美日聯盟、增強地區阻礙力並促進印度-太平洋地區的和平。具體來說,三澤空軍基地的36架F-16將被48架最先進的F-35A戰鬥機取代。此外,36架新型F-15EX戰機將部署到沖繩嘉手納空軍基地,取代將於2023年逐步淘汰的48架舊款F-15C/D戰機。

- 歐洲北約盟國將在國防上投入總合3,800 億美元,這是該支出案例達到總合GDP 的 2%。 2024年,美國國防支出預計將達到9,677億美元,鞏固其北約國家最大國防開支國地位。排名第二的是德國,總額為977億美元,排名第三的是英國。

預計北美將在預測期內佔據主要市場佔有率

- 美國由於國內市場龐大且廣泛採用大規模生產方式,在汽車市場中佔有關鍵地位。美國汽車業是製造業的重要組成部分,多家汽車製造商在全國各地設有組裝廠。該國是福特、雪佛蘭和特斯拉等主要企業的所在地,在汽車創新,特別是自動化領域發揮主導作用,這支持了該國對無損檢測服務的需求。

- 無損檢測 (NDT) 在該國的汽車產業中至關重要,因為它可以在鍛造、熱處理和機械加工後檢查零件,以確保符合規定。它們也用於評估連接車身板和部件的焊接質量,以確保正確的滲透、無夾雜物、無可能危及車輛安全性和可靠性的缺陷。

- 汽車電氣化的日益普及和政府鼓勵使用更清潔能源來源的法規也將推動市場成長。白宮宣布了一項公私聯合承諾,支持拜登總統在 2030 年實現 50% 新車購買為電動車的目標。這些推動電動車普及的努力預計將對市場產生重大影響。

- 根據汽車創新聯盟的報告,電動車(EV)將佔 2024 年第一季新輕型車銷量的 9.3%,略低於 2023 年第四季的 10.2%,但高於 2023 年第一季的 8.6%。在美國,2024 年第一季的電動車銷量與 2023 年第一季相比成長了 13%,達到 344,000 多輛。

- 由於加拿大石油和天然氣工業的成長,加拿大無損檢測市場的需求正在增加。石油和天然氣產業透過資本投資和出口主導加拿大的GDP。有吸引力的省級激勵措施鼓勵鑽探、更多採用長水平井和頁岩資源的多級壓裂是加強加拿大石油和天然氣工業的關鍵驅動力。

- 加拿大的石油和天然氣產業遍及 13 個省和地區中的 12 個。根據加拿大統計局的數據,2023年9月至10月,原油產量增加了3.62%。

無損檢測產業概況

無損檢測(NDT)市場高度分散,既有全球參與者,也有中小型企業。該市場的主要參與者包括 Evident Corporation(Olympus Corporation)、Zetec Inc.(Eddyfi Technologies)、YXLON International GMBH(COMET Group)、Team Inc. 和 Applus Services SA。市場參與者正在採取合作和收購等策略來加強其產品供應並獲得永續的競爭優勢。

2024 年 6 月-TUV 萊茵北美宣佈在麻薩諸塞州博克斯伯勒開設酵母技術與研發中心。這座現代化的設施體現了德國萊茵 TUV 集團的一項重大承諾。這個佔地 65,000 平方英尺的最先進的設施包括電氣安全、無線技術、EMC 測試、環境評估和醫療設備測試的基礎設施。

2024 年 1 月 - Intertek Group PLC 推出 Intertek Inform,這是一項提供標準和法規以促進更快進入市場的服務。對品質、安全和永續性的日益成長的需求使得獲取標準對於在現有和新興市場中競爭和提供產品和服務的公司至關重要。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 產業價值鏈分析

第5章 市場動態

- 市場促進因素

- 嚴格規定安全標準

- 缺陷檢測需求不斷增加,以降低維修成本

- 市場限制

- 缺乏熟練勞動力和培訓設施

第6章 市場細分

- 按類型

- 裝置

- 服務

- 按檢驗技術

- 放射線攝影

- 超音波檢查

- 磁粉檢測

- 液體液體滲透探傷

- 目視檢查

- 渦流檢測

- 其他測試技術

- 按最終用戶產業

- 石油和天然氣

- 電力和能源

- 建造

- 汽車與運輸

- 航太

- 防禦

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Evident Corporation(Olympus Corporation)

- Zetec Inc.(Eddyfi Technologies)

- YXLON International GMBH(COMET Group)

- Team Inc.

- Applus Services SA

- Mistras Group Inc.

- SGS SA

- Fujifilm Corporation(Fujifilm Holdings Corporation)

- Bureau Veritas

- Nikon Metrology NV(Nikon Corporation)

- Intertek Group PLC

- TUV Rheinland AG

- Magnaflux Corp.(Illinois Tool Works Inc.)

第8章投資分析

第9章:市場的未來

The NDT Market size is estimated at USD 22.78 billion in 2025, and is expected to reach USD 32.44 billion by 2030, at a CAGR of 7.32% during the forecast period (2025-2030).

Key Highlights

- The non-destructive testing (NDT) market is anticipated to witness robust growth owing to several factors, such as increased emphasis on safety, integrity, and reliability, expansion of the power generation sector, technological advancements like AL, ML, industry 4.0, industrial IoT, and an upsurge in manufacturing activities.

- Furthermore, increased oil and gas, construction projects, and rising defense expenditures of various countries create significant demand for NDT equipment and services. Further, rising sales of electric vehicles and autonomous cars fuel demand for non-destructive testing equipment and services in the automotive sector.

- In the automotive industry, non-destructive testing (NDT) is widely adopted to inspect automotive components after forging, heat treatment, and machining to ensure they meet established standards. NDT is also critical for examining welds that join body panels and components, ensuring they have adequate penetration, are free of inclusions, and are devoid of defects that could compromise vehicle safety or reliability. The growing demand for electric and autonomous vehicles creates a huge demand for the NDT.

- The lack of skilled personnel and training facilities significantly restrains the growth of this market. One of the primary challenges faced by the NDT market is the shortage of skilled personnel. The effective utilization of NDT requires a high level of technical expertise and proficiency in interpreting and analyzing test results.

- Geopolitical challenges, including the Russian invasion of Ukraine, China-US competition, elections, and the war in Israel, significantly impact the global supply chain, especially critical raw materials vital for traditional industries, defense, high-tech sectors, aerospace, and green energy.

- The Russia-Ukraine war and economic slowdown caused significant disruption in the NDT industry. The increased inflation and interest rates reduced consumer spending, hampered the industry's demand, and led to slow growth in the market. Furthermore, the trade war between the United States and China further disturbed the global supply chain. Owing to strict export and import controls on China by the United States for semiconductor equipment hampers the production of oil and gas, power and energy, construction, and the automotive sector in China.

Non-Destructive Testing Market Trends

Retractable Safety Syringes Segment Expected to Witness Significant Growth During the Forecast Period

- Non-destructive testing (NDT) technology is pivotal in the defense industry, guaranteeing top-tier quality in materials and joining processes, from fabrication to erection. It's instrumental in ensuring military forces are combat-ready, as even a minor flaw from corrosion or wear could lead to catastrophic failures, jeopardizing significant investments.

- Quality control through NDT is paramount in manufacturing military equipment, directly impacting its reliability. In combat scenarios, the efficacy of these systems hinges on meticulous ultrasonic and eddy current NDT testing, ensuring components meet specifications and any replacements or repairs are flawless.

- Storage tanks are prevalent in the security and defense sector, primarily housing aviation or ship fuel and, sometimes, standard vehicle fuel. These tanks come in various forms: above-ground, buried, or semi-buried, in both horizontal and vertical configurations. NDT technology is widely used to inspect these tanks to avoid future defects.

- The imperative for quality assurance and control in the manufacturing, maintenance, and repairing of aircraft, missiles, and defense systems propels the demand for NDT technologies. The global growth in military aircraft fleets underscores the rising demand for routine inspections, maintenance, and NDT testing, which is crucial for prolonging aircraft lifespans.

- For instance, in July 2024, the US military announced that it planned to deploy dozens of its latest fighter jets to bolster its presence in Japan. This initiative, part of a USD 10 billion upgrade, aims to fortify the US-Japan Alliance, heighten regional deterrence, and promote peace in the Indo-Pacific. Specifically, the plan entails replacing 36 F-16s at Misawa Air Base with 48 advanced F-35A fighters. Additionally, 36 new F-15EX jets will be stationed at Kadena Air Base in Okinawa, replacing 48 older F-15C/D models phased out in 2023.

- European NATO Allies are set to collectively invest USD 380 billion in defense, marking the first instance where this expenditure reaches 2% of their combined GDP. In 2024, the United States allocated an estimated USD 967.7 billion to defense, solidifying its position as the largest defense spender among all NATO nations. Germany trailed as the second-largest spender, allocating USD 97.7 billion, with the UK ranking third.

North America Expected to Hold Significant Market Share During the Forecast Period

- The United States holds a prominent position in the automotive market thanks to its large domestic market and widespread adoption of mass production methods. The automotive industry in the United States is a crucial part of the manufacturing sector, with multiple car manufacturers running assembly plants nationwide. Notable companies such as Ford, Chevrolet, and Tesla are based in the country, which has played a leading role in automotive innovation, particularly in automation, which supports the demand for non-destructive testing services in the country.

- Non-destructive testing (NDT) is essential in the country's automotive sector as it examines components post-forging, heat treating, and machining to verify compliance with regulations. It is also utilized to assess the quality of welds connecting body panels and components, ensuring proper penetration, the absence of inclusions, and the absence of defects that may jeopardize the safety and dependability of a vehicle.

- The market's growth is also driven by the increasing popularity of vehicle electrification and government regulations, which encourage cleaner energy sources. The White House announced a combination of public and private pledges that support President Biden's goal of having 50% of all new vehicle purchases be electric by 2030. These efforts, designed to promote the adoption of electric vehicles, are expected to influence the market significantly.

- According to the Alliance for Automotive Innovation Report, in the first quarter of 2024, electric vehicles (EVs) made up 9.3% of new sales of light-duty vehicles, a slight decrease from 10.2% in the fourth quarter of 2023 but an increase from 8.6% in the first quarter of 2023. The United States witnessed a 13% increase in EV sales in the first quarter of 2024, with over 344,000 EVs sold compared to Q1 2023.

- The demand for the non-destructive testing market in Canada is increasing due to the country's growing oil and gas industry. The oil and gas sector dominates the Canadian GDP, with capital investments and exports. Attractive provincial incentives to encourage drilling, increased implementation of long horizontal wells, and multistage fracturing in shale resources are the major drivers in enhancing the Canadian oil and gas industry.

- The oil and natural gas sector in Canada operates within 12 out of the 13 provinces and territories. Large companies are ramping up their spending to pump more oil out of the ground; there was a 3.62% increase in crude oil production between September and October 2023, according to Statistics Canada.

Non-Destructive Testing Industry Overview

The Non-Destructive Testing (NDT) market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Evident Corporation (Olympus Corporation), Zetec Inc. (Eddyfi Technologies), YXLON International GMBH (COMET Group), Team Inc., and Applus Services SA. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

June 2024 - TUV Rheinland North America announced the launch of its Northeast Technology and Innovation Center in Boxborough, MA. This modern facility signifies a substantial commitment for the prominent organization. Encompassing 65,000 square feet, this advanced facility has infrastructure for electrical safety, wireless technology, EMC testing, environmental assessments, medical device testing, and beyond.

January 2024 - Intertek Group PLC launched a service called Intertek Inform, which provides standards and regulations to facilitate quicker access to the market. Access to standards is becoming essential for companies wishing to compete and supply products and services in current and developing markets due to the growing demand for quality, safety, and sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Regulations Mandating Safety Standards

- 5.1.2 Increase in Demand for Flaw Detection to Reduce Repair Cost

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Personnel and Training Facilities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Equipment

- 6.1.2 Services

- 6.2 By Testing Technology

- 6.2.1 Radiography Testing

- 6.2.2 Ultrasonic Testing

- 6.2.3 Magnetic Particle Testing

- 6.2.4 Liquid Penetrant Testing

- 6.2.5 Visual Inspection Testing

- 6.2.6 Eddy Current Testing

- 6.2.7 Other Testing Technologies

- 6.3 By End-user Industry

- 6.3.1 Oil and Gas

- 6.3.2 Power and Energy

- 6.3.3 Construction

- 6.3.4 Automotive and Transportation

- 6.3.5 Aerospace

- 6.3.6 Defense

- 6.3.7 Other End User Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.6.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Evident Corporation (Olympus Corporation)

- 7.1.2 Zetec Inc. (Eddyfi Technologies)

- 7.1.3 YXLON International GMBH (COMET Group)

- 7.1.4 Team Inc.

- 7.1.5 Applus Services SA

- 7.1.6 Mistras Group Inc.

- 7.1.7 SGS SA

- 7.1.8 Fujifilm Corporation (Fujifilm Holdings Corporation)

- 7.1.9 Bureau Veritas

- 7.1.10 Nikon Metrology NV (Nikon Corporation)

- 7.1.11 Intertek Group PLC

- 7.1.12 TUV Rheinland AG

- 7.1.13 Magnaflux Corp. (Illinois Tool Works Inc.)