|

市場調查報告書

商品編碼

1687350

離散半導體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Discrete Semiconductor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

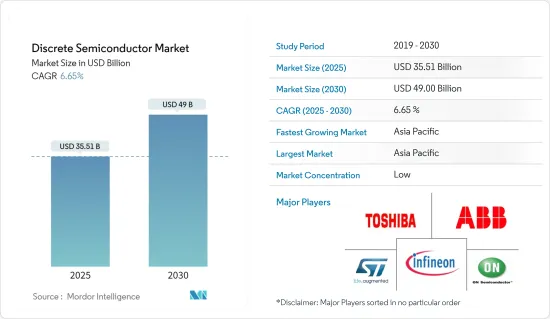

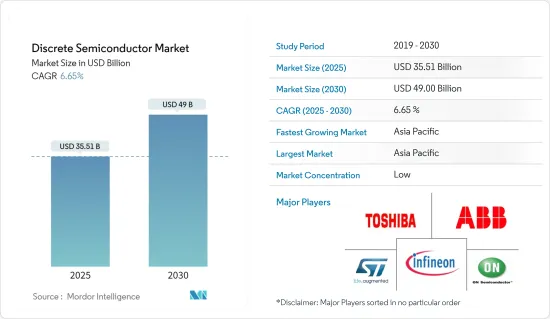

預計2025年離散半導體市場規模為355.1億美元,預計2030年將達到490億美元,預測期內(2025-2030年)的複合年成長率為6.65%。

從出貨量來看,預計將從 2025 年的 4,272.1 億台成長到 2030 年的 5,449.9 億台,預測期內(2025-2030 年)的複合年成長率為 4.99%。

主要亮點

- 隨著新應用的出現和現有技術的發展,對更先進、更有效率的半導體的需求日益成長。小型化、功率效率和性能的提高為將半導體整合到各種設備和系統中開闢了新的可能性。物聯網 (IoT)、人工智慧 (AI) 和自動駕駛汽車等領域的創新正在推動對離散半導體的需求。

- 此外,汽車和電子產業對節能、省電設備的需求不斷成長,以及對綠色能源發電的需求不斷增加,也正在推動市場的發展。

- 此外,受可支配收入增加、生活方式改變和技術進步等因素的推動,全球消費性電子產品市場持續快速成長。智慧型手機、平板電腦、穿戴式裝置和家用電器等消費性電子產品嚴重依賴離散半導體。這些設備的需求不斷增加,導致對離散半導體的需求也增加,進而推動了市場成長。

- 然而,市場面臨著影響其成長和發展的幾個限制因素。積體電路(IC)競爭日益激烈,對市場的成長構成了重大挑戰。 IC 提供了緊湊且經濟高效的解決方案,減少了對離散半導體的需求。這些市場偏好的轉變對離散半導體產業提出了重大挑戰。

- 持續的俄烏衝突和中國的「零容忍政策」導致全球通貨膨脹大幅上升,影響到包括電子元件產業在內的多個產業,導致邏輯、線性、分立、先進模擬和被動元件價格上漲,從而對研究市場的成長產生不利影響。

離散半導體市場趨勢

汽車產業可望大幅成長

- 這些系統利用二極體和電晶體等離散半導體來管理電流並有效地減少能量損失。因此,汽車產業對離散半導體的需求受到對汽車電氣化日益關注的推動。

- 自動駕駛和 ADAS 技術正在徹底改變汽車產業,需要先進的電子和離散半導體來實現即時資料處理、感測器融合和車輛控制。這些系統嚴重依賴節能、省電的設備來確保準確可靠的運作。

- 離散半導體對於實現主動式車距維持定速系統、車道維持輔助和防撞等自動駕駛功能至關重要。自動駕駛和 ADAS 技術的需求激增,導致汽車產業對節能、省電設備的需求增加。

- 此外,隨著向電動車的轉變,過去幾年中製造基於 SiC 的逆變器原型的汽車公司數量迅速成長。在這一領域,SiC 功率 MOSFET、二極體和模組的主要應用是車載電動車 (EV) 充電器、DC/DC 轉換器和動力傳動系統逆變器。插電式混合動力電動車或純電動車使用家中或公共充電站的車用充電器為車用電池充電。

- 此外,正如國際能源總署所強調的那樣,全球汽車產業正在經歷重大變革時期期,其影響也可能對能源產業產生影響。預測表明,到 2030 年,電氣化將減少每天 500 萬桶石油的需求。

中國可望引領市場

- 由於中國工業數量不斷增加,並且與自動化相結合以提高投資收益,中國的離散半導體市場正在經歷顯著成長。中國擁有全球最大的製造業,對市場需求貢獻巨大。中國製造商優先採用4.0解決方案來最佳化和改進業務,從而促進市場擴張。

- 政府不斷採取措施加強該國的半導體生態系統,以及該國成為全球汽車和家用電子電器生產國,這些都可能支持市場的成長。

- 在該國,由於汽車製造對離散半導體裝置的需求不斷增加,預計市場成長將受到汽車產業的巨大影響。例如,2024年1月,中國工業協會宣布,中國汽車產業年產銷售量突破3,000萬輛,並取得了顯著的里程碑。這清楚地表明了汽車市場巨大的成長潛力。

- 中國汽車產業取得了長足的發展,鞏固了在全球汽車市場主要企業的地位。中國政府認為汽車工業及其零件產業是國民經濟的重要支柱。

- 電動車在世界各地越來越受歡迎。中國是全球採用電動車的領先國家。中國的「十三五」規劃提倡發展混合動力汽車汽車和電動車等環保型交通解決方案,以促進國家交通運輸業的發展。

- 政府計劃在 2060 年實現碳中和,預計將推動對離散半導體的需求,並促進包括電動車市場在內的各個領域的成長。根據中國新能源汽車產業發展計畫(2021-2035),到2025年電動車將佔25%的市場佔有率。

- 因此,中國正在實施更積極的政策來鼓勵電動車的普及,這反過來又加速了電動車中廣泛使用的離散半導體的採用。 2023 年 8 月,中國汽車工業協會報告稱,中國已生產了 589,000 輛純電動車 (BEV)。此外,同月中國生產了25.4萬輛插電式混合動力汽車(PHEV),其中25.3萬輛為搭乘用PHEV,1000輛為商用PHEV。

離散半導體產業概況

離散半導體市場較為分散,主要企業包括 ABB 有限公司、安森美半導體公司、英飛凌科技股份公司、意法半導體公司、東芝電子設備及儲存公司和恩智浦半導體公司(將被高通收購)。市場上的公司正在努力創新先進、全面的產品,以滿足消費者複雜且不斷變化的需求。

- 2024 年 3 月:英飛凌推出其全新先進 MOSFET 技術 OptiMOS 7 80 V 的首批產品。 IAUCN08S7N013 顯著提高了功率密度,並採用多功能、堅固、高電流 SSO8 5 x 6 mm2 SMD 封裝。 OptiMOS 780 V 非常適合即將推出的 48 V 板網應用。這些產品專為滿足電動車車載 DC-DC 轉換器、48 V馬達控制等嚴苛的汽車應用所需的高性能、高品質和穩健性而設計。電動方向盤(EPS)、48 V 電池開關以及電動二輪車和三輪車。

- 2024 年 2 月:安森美半導體推出 1200V SPM31 智慧功率模組 (IPM),採用尖端的場截止 7 (FS7)絕緣柵雙極電晶體(IGBT) 技術。這些 IPM 以其卓越的效率和緊湊的設計而聞名,具有更高的功率密度,最終意味著與競爭對手相比更低的整體系統成本。透過利用這些最佳化的 IGBT,SPM31 IPM 找到了它的最佳應用點,尤其是在熱泵、商務用HVAC 系統、伺服馬達以及各種工業泵浦和風扇的三相逆變器驅動器等應用中。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈/供應鏈分析

- COVID-19 的副作用和其他宏觀經濟因素將如何影響市場

第5章 市場動態

- 市場促進因素

- 汽車和電子領域對高節能設備的需求不斷增加

- 綠色能源發電需求不斷成長推動市場

- 市場限制

- 積體電路需求不斷成長

第6章 市場細分

- 依設備類型

- 二極體

- 小訊號電晶體

- 功率電晶體

- MOSFET 功率電晶體

- IGBT 功率電晶體

- 其他功率電晶體

- 整流器

- 閘流體

- 按行業

- 車

- 消費性電子產品

- 通訊設備

- 產業

- 其他行業

- 按地區

- 美國

- 歐洲

- 日本

- 中國

- 韓國

- 台灣

第7章 競爭格局

- 公司簡介

- ABB Ltd

- On Semiconductor Corporation

- Infineon Technologies AG

- STMicroelectronics NV

- Toshiba Electronic Devices and Storage Corporation

- NXP Semiconductors NV

- Diodes Incorporated

- Nexperia BV

- Semikron Danfoss Holding A/S(Danfoss A/S)

- Eaton Corporation PLC

- Hitachi Energy Ltd(Hitachi Ltd)

- Mitsubishi Electric Corporation

- Fuji Electric Co Ltd

- Analog Devices Inc.

- Vishay Intertechnology Inc.

- Renesas Electronics Corporation

- Rohm Co. Ltd

- Microchip Technology

- Qorvo Inc.

- Wolfspeed Inc.

- Texas Instrument Inc.

- Littelfuse Inc

- WeEn Semiconductors

第8章投資分析

第9章 市場機會與未來趨勢

The Discrete Semiconductor Market size is estimated at USD 35.51 billion in 2025, and is expected to reach USD 49.00 billion by 2030, at a CAGR of 6.65% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 427.21 billion units in 2025 to 544.99 billion units by 2030, at a CAGR of 4.99% during the forecast period (2025-2030).

Key Highlights

- As new applications emerge and existing technologies evolve, the demand for more advanced and efficient semiconductors increases. Advancements such as miniaturization, increased power efficiency, and improved performance open new possibilities for integrating semiconductors into various devices and systems. Innovations in areas like the Internet of Things (IoT), artificial intelligence (AI), and autonomous vehicles drive the demand for discrete semiconductors.

- Additionally, the rising demand for high-energy and power-efficient devices in the automotive and electronics segment and the increasing demand for green energy power generation drive the market.

- Furthermore, the global consumer electronics market continues to experience rapid growth, fueled by factors such as rising disposable incomes, changing lifestyles, and technological advancements. Consumer electronics, including smartphones, tablets, wearables, and home appliances, heavily rely on discrete semiconductors. The increasing demand for these devices translates into a higher demand for discrete semiconductors, driving the market's growth.

- However, the market faces several restraints that impact its growth and development. The increasing competition from integrated circuits (ICs) is a significant challenge for the market's growth. ICs offer a compact and cost-effective solution, which led to a decline in the demand for discrete semiconductors. This shift in the market preference poses a significant challenge for the discrete semiconductors industry.

- Continuous Russia-Ukraine conflict, as well as China's "Zero Tolerance Policy," has led to a significant increase in global inflation, impacting multiple sectors, including the electronic components industry, leading to climbing prices of logic, linear, discrete, advanced analog, and passive component, thus negatively impacting the growth of the market studied.

Discrete Semiconductor Market Trends

Automotive Segment Is Expected to Witness Major Growth

- Discrete semiconductors, such as diodes and transistors, are utilized in these systems to manage power flow and minimize energy losses efficiently. The demand for discrete semiconductors in the automotive industry is thus driven by the growing emphasis on vehicle electrification.

- Autonomous driving and ADAS technologies are revolutionizing the automotive industry, requiring sophisticated electronics and discrete semiconductors to enable real-time data processing, sensor fusion, and vehicle control. These systems heavily rely on high energy and power-efficient devices to ensure precise and reliable operation.

- Discrete semiconductors are crucial in enabling autonomous driving functions like adaptive cruise control, lane-keeping assist, and collision avoidance. The surge in demand for autonomous driving and ADAS technologies has consequently driven the need for high-energy and power-efficient devices in the automotive industry.

- Furthermore, with the transition to EVs, the number of car companies building SiC-based inverter prototypes has rapidly increased in the past few years. In the sector, the primary applications for SiC power MOSFETs, diodes, and modules are onboard electric vehicle (EV) chargers, DC/DC converters, and drivetrain inverters. Plug-in hybrid EVs and BEVs use onboard chargers to refuel the vehicle battery either at home or at a public charging station.

- Moreover, the global automotive industry is undergoing a significant transformation, as highlighted by the IEA, with potentially far-reaching implications for the energy sector. According to projections, the rise of electrification is anticipated to result in a daily elimination of the need for 5 million barrels of oil by 2030.

China is Expected to Lead the Market

- The discrete semiconductor market in China is experiencing substantial growth due to the increasing number of industries in the country and their integration with automation to enhance return on investment. China has the largest manufacturing industry globally, contributing significantly to market demand. Manufacturing companies in China prioritize adopting 4.0 solutions to optimize and elevate their operations, thereby propelling market expansion.

- The growth of governmental initiatives in strengthening the country's semiconductor ecosystem and the country's emergence as a global producer of automotive and consumer electronic sectors would support the market's growth.

- The market's growth in the country is expected to be greatly influenced by the automotive segment, as there is a rising demand for discrete semiconductor devices in automotive manufacturing. For instance, in January 2024, the China Association of Automobile Manufacturers announced that China's automobile industry achieved a remarkable milestone, with production and sales surpassing 30 million units annually. This clearly indicates the immense growth potential of the automobile market.

- China's automotive sector experienced significant growth, solidifying the country's position as a key player in the worldwide automotive market. The Chinese government considers the automotive industry, along with its auto parts segment, to be crucial pillars of the nation's economy.

- The popularity of EVs is rising globally. China is a dominant adopter of electric vehicles worldwide. The country's 13th Five-Year Plan promotes the development of green transportation solutions, such as hybrid and electric vehicles, to advance the country's transportation sector.

- The government's efforts to attain carbon neutrality objectives by 2060 are projected to enhance the need for discrete semiconductors by leveraging the growth of various sectors, including the electric vehicle market. According to China's Development Plan for the New Energy Automobile Industry (2021-2035), electric vehicles could capture a 25% market share by 2025.

- Consequently, China is implementing more assertive measures to incentivize the adoption of electric vehicles, thereby expediting the adoption of discrete semiconductors for their extensive utilization in EVs. In August 2023, CAAM reported that China manufactured 589,000 battery electric vehicles (BEVs), comprising 551,000 passenger BEVs and 38,000 commercial BEVs. Additionally, 254,000 plug-in hybrid electric vehicles (PHEVs) were produced in China during the same month, with 253,000 being passenger PHEVs and 1,000 being commercial PHEVs.

Discrete Semiconductor Industry Overview

The discrete semiconductor market is fragmented, with several prominent players, such as ABB Ltd, ON Semiconductor Corporation, Infineon Technologies AG, STMicroelectronics NV, Toshiba Electronic Devices & Storage Corporation, and NXP Semiconductors NV (to be acquired by Qualcomm). The market players strive to innovate advanced and comprehensive products to cater to consumers' complex and evolving requirements.

- March 2024: Infineon introduced the first product in its new advanced MOSFET technology OptiMOS 7 80 V. The IAUCN08S7N013 features a significantly increased power density and is available in the versatile, robust, and high-current SSO8 5 x 6 mm2 SMD package. The OptiMOS 780 V offering perfectly matches the upcoming 48 V board net applications. It is designed specifically for the high performance, high quality, and robustness needed for demanding automotive applications like automotive DC-DC converters in EVs, 48 V motor control, for instance, electric power steering (EPS), 48 V battery switches, and electric two- and three-wheelers.

- February 2024: Onsemi unveiled its 1200 V SPM31 Intelligent Power Modules (IPMs), showcasing the cutting-edge Field Stop 7 (FS7) Insulated Gate Bipolar Transistor (IGBT) technology. These IPMs, known for their superior efficiency and compact design, boast a higher power density, ultimately translating to a reduced overall system cost compared to their industry counterparts. Leveraging these optimized IGBTs, the SPM31 IPMs find their sweet spot in applications like three-phase inverter drives, notably in heat pumps, commercial HVAC systems, servo motors, and various industrial pumps and fans.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain / Supply Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment

- 5.1.2 Increasing Demand for Green Energy Power Generation Drives the Market

- 5.2 Market Restraints

- 5.2.1 Rising Demand for Integrated Circuits

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Diode

- 6.1.2 Small Signal Transistor

- 6.1.3 Power Transistor

- 6.1.3.1 MOSFET Power Transistor

- 6.1.3.2 IGBT Power Transistor

- 6.1.3.3 Other Power Transistor

- 6.1.4 Rectifier

- 6.1.5 Thyristor

- 6.2 By End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Communication

- 6.2.4 Industrial

- 6.2.5 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 South Korea

- 6.3.6 Taiwan

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 On Semiconductor Corporation

- 7.1.3 Infineon Technologies AG

- 7.1.4 STMicroelectronics NV

- 7.1.5 Toshiba Electronic Devices and Storage Corporation

- 7.1.6 NXP Semiconductors NV

- 7.1.7 Diodes Incorporated

- 7.1.8 Nexperia BV

- 7.1.9 Semikron Danfoss Holding A/S (Danfoss A/S)

- 7.1.10 Eaton Corporation PLC

- 7.1.11 Hitachi Energy Ltd (Hitachi Ltd)

- 7.1.12 Mitsubishi Electric Corporation

- 7.1.13 Fuji Electric Co Ltd

- 7.1.14 Analog Devices Inc.

- 7.1.15 Vishay Intertechnology Inc.

- 7.1.16 Renesas Electronics Corporation

- 7.1.17 Rohm Co. Ltd

- 7.1.18 Microchip Technology

- 7.1.19 Qorvo Inc.

- 7.1.20 Wolfspeed Inc.

- 7.1.21 Texas Instrument Inc.

- 7.1.22 Littelfuse Inc

- 7.1.23 WeEn Semiconductors