|

市場調查報告書

商品編碼

1548909

固態繼電器:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Solid-state Relay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

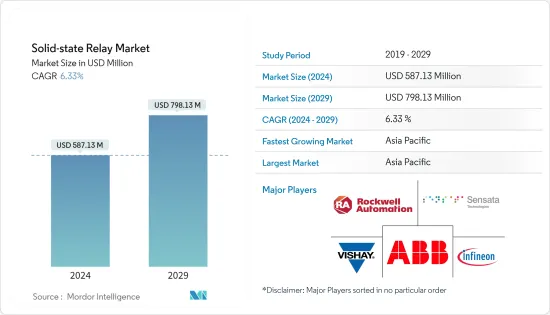

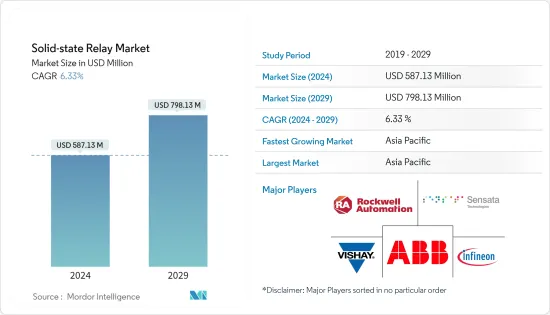

固態繼電器(SSR)市場規模預計到2024年為5.8713億美元,預計到2029年將達到7.9813億美元,在預測期內(2024-2029年)複合年成長率為6.33%。

儘管固態繼電器(SSR) 和電子機械繼電器(EMR) 具有通用的功能,但它們的實現和性能卻截然不同。 SSR 相當於 EMR 的機械等效物,無需移動部件即可管理電力負載。與依賴機械常開觸點的 EMR 不同,SSR 利用 TRIAC、SCR 和開關電晶體等組件來處理交流和直流電流。

一個重要的區別是,在 SSR 中,低電壓輸入和負載開關輸出是電隔離的。另一方面,EMR的特徵是接點壽命有限、尺寸大、開關速度慢,特別是在高功率繼電器和接觸器中,這是SSR所不具備的限制。

世界向太陽能和風能等清潔可再生能源來源的轉變產生了對高效能電力轉換和控制系統的需求。太陽能逆變器、風力發電機和能源儲存系統的日益普及預計將推動可再生能源領域對功率半導體的需求。 SSR在太陽能逆變器中很重要,它可以有效地將太陽能轉換為電能。

智慧型家電、HVAC 系統以及筆記型電腦和智慧型手機等電子設備的激增正在增加電力消耗。此外,隨著科技的進步,LED照明也逐漸成為消費者喜愛的照明產品。 LED燈銷量的激增為固態繼電器開闢了巨大的市場前景。這些繼電器在智慧照明系統中發揮著至關重要的作用,可實現 LED 照明的高效控制和調光,最終減少功耗。

SSR的初始成本高於EMR,長期來看SSR更划算。這主要是因為EMR維護成本高、功耗大、壽命短。

考慮到綜合使用壽命、檢查和維護成本等附加成本,使用固態繼電器的平均成本明顯低於使用電磁繼電器的平均成本,並且由於繼電器而導致的低效率較低。此外,根據應用的不同,可能需要額外的成本來防止觸點振動並確保機械繼電器的可靠接觸。

經濟成長、通貨膨脹、政府支出、全球貿易和地緣政治動態等全球趨勢影響不同國家的製造業生態系統。俄羅斯-烏克蘭衝突和美國緊張局勢等事件造成的供應鏈中斷正在對製造業產生重大影響。例如,中國國家統計局的數據顯示,2023年中國電子製造業付加價值成長率達3.4%,為同期最高。這一成長在 2019 年和 2020 年有所下降,並於 2021 年恢復。

固態繼電器市場趨勢

汽車和運輸業成為成長最快的應用

- 固態繼電器在汽車系統中用於配電和馬達控制功能。為方向燈、雨刷和冷卻風扇等組件提供可靠的開關。這些繼電器可以處理高電流並具有快速開關速度,使其適合汽車應用。

- 固態繼電器在電動車電力電子系統中發揮重要作用。此繼電器用於電池管理系統、馬達控制單元和充電系統。這些繼電器能夠有效率且可靠地切換電動車中的高電壓、高電流電路。

- 隨著電動車市場尤其是動力傳動系統市場的成長,固態繼電器的需求預計將進一步增加。汽車產業的電子元件對於安全至關重要,並且暴露在極端電壓和環境條件下。這迫使製造商開發新的汽車固態繼電器產品線。

- 推動SSR成長的因素包括汽車產量的增加和電動車需求的增加。此外,物聯網的引入以及對自動駕駛汽車、聯網汽車和低排放氣體生產的有利政府標準等多項技術進步將進一步推動馬蘇固態繼電器市場的成長。

- 例如,2024 年 5 月,NOVOSENSE 宣布推出工業級和汽車級新型 NSI7258 系列電容隔離固態繼電器。 NSI7258專為高電壓測量和絕緣監測而設計,提供業界領先的耐壓和EMI性能,使其適用於工業BMS、光伏、能源儲存、充電樁、新能源汽車BMS和OBC等,有助於提高高電壓系統的可靠性和穩定性。

- 根據IEA《2024年全球電動車展望》,2024年美國電動車銷量預計將比與前一年同期比較成長20%,比2023年成長約50萬輛。鑑於最近的事態發展以及嚴格的二氧化碳排放目標只計劃到 2025 年這一事實,歐洲電動車銷量成長預計將成為三大市場中最慢的。預計2024年銷量將達到約350萬輛,與前一年同期比較適度成長10%以內。這些趨勢在預測期內創造了對固態繼電器的需求。

亞太地區預計將出現顯著成長

- 近年來,固態繼電器的應用領域顯著擴大。固態繼電器沒有移動部件,這意味著磨損更少,可靠性更高,使用壽命更長。這在汽車行業尤其重要,因為汽車行業的部件經常暴露在振動和惡劣的條件下。固態繼電器比電子機械繼電器具有更快的開關速度,可提高各種汽車系統的性能,包括 ADAS、配電裝置和電動車電池管理系統。

- 中國市場的成長將主要由汽車產業推動。汽車製造業對固態繼電器的需求激增是快速成長的主要動力。例如,2024年1月,中國工業協會宣布,我國汽車工業取得年產銷量突破3,000萬輛的重大成就,顯示成長機會龐大。

- 此外,中國已成為混合動力汽車和電動車市場的主要參與者,其雄心勃勃的目標是到 2030 年將電動車佔汽車總銷量的佔有率提高到 40%。

- 日本汽車工業,包括不斷成長的電動車 (EV) 市場,是固態繼電器的重要推動力。這些繼電器具有高可靠性和高效率,用於電池管理系統、配電和各種車輛控制系統。

- 歷史上對日本GDP貢獻率超過89%的日本汽車產業正處於重大轉折點。日本雄心勃勃的目標是到 2050 年實現淨零排放,到 2030 年將排放量減少 46%,這推動了電動車 (EV) 的普及。政府為此訂定了明確的目標。目標是到 2030 年電動車和插電式混合動力汽車(PHEV) 佔乘用車銷量的 20-30%,其中燃料電池汽車 (FCV) 佔 3%。

- 在印度,智慧城市、現代化交通系統等基礎建設發展進展迅速,對固態繼電器(SSR)的需求不斷增加。 SSR 的可靠性和管理高電壓應用的能力對於這些計劃至關重要。例如,2024 年 2 月,印度議會委員會強調啟動政府旗艦智慧城市使命的後續階段的重要性,並專注於邦首府半徑 100 公里範圍內的二線城市。

固態繼電器產業概況

固態繼電器市場正朝向半固體發展,羅克韋爾自動化公司、ABB 有限公司、英飛凌科技股份公司、森薩塔科技公司和 Vishay Intertechnology Inc. 等主要公司紛紛進入該市場。市場上的公司正在採取合作和收購等策略來增強其產品陣容並獲得永續的競爭優勢。

2024 年 6 月 - 英飛凌科技推出專為汽車電源管理設計的 600V CoolMOS S7TA超接面MOSFET。這種創新產品為對現代車輛的安全性和效率至關重要的各種關鍵應用提供了增強的解決方案。這些應用包括關鍵組件,例如電路斷流器、高電壓電池隔離開關、直流和交流低頻開關以及高電壓電子熔斷器。

2024 年 3 月 - 奧托尼克斯在大阪開設新辦事處,瞄準日本西部地區。此舉旨在改善客戶服務和訪問。大阪辦事處是日本東部東京辦事處的補充,奧托尼克斯的目標是在全國範圍內拓展市場。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 增加對再生能源來源的投資

- 住宅和工業領域對節能的需求不斷成長

- 市場限制因素

- 與電子機械繼電器相比,固態繼電器的高成本

第6章 市場細分

- 按安裝

- 面板安裝

- PCB安裝

- DIN 導軌安裝

- 按產量

- 繼電器固態繼電器

- 直流固態繼電器

- 繼電器直流輸出繼電器

- 按用途

- 能源和基礎設施

- 工業OEM

- 建築設備

- 飲食

- 汽車/運輸設備

- 工業自動化

- 衛生保健

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Rockwell Automation Inc.

- ABB Ltd

- Infineon Technologies AG

- Sensata Technologies Inc.

- Vishay Intertechnology Inc.

- Omron Corporation

- Fujitsu Limited

- Broadcom Inc.

- Omega Engineering Inc.

- TE Connectivity Ltd

- Celduc Relais.

- Littelfuse

- Schneider Electric SE

- Autonics Corporation

- Toshiba Corporation

第8章 市場機會及未來趨勢

The Solid-state Relay Market size is estimated at USD 587.13 million in 2024, and is expected to reach USD 798.13 million by 2029, growing at a CAGR of 6.33% during the forecast period (2024-2029).

Solid State Relays (SSRs) and electromechanical relays (EMRs) share a common functionality, but their implementation and performance diverge significantly. SSRs, acting as the mechanical counterparts of EMRs, can manage electrical loads sans moving parts. Unlike EMRs that rely on mechanical NO contacts, SSRs leverage components like TRIACs, SCRs, or switching transistors to handle both AC and DC currents.

One key distinction lies in the electrical isolation of the low voltage input from the load-switching output in SSRs, a feature absent in EMRs. EMRs, on the other hand, are characterized by a finite contact life, bulkier dimensions, and slower switching speeds, particularly evident in larger power relays and contactors-limitations not shared by SSRs.

The global shift toward clean and renewable energy sources, such as solar and wind, has created a need for efficient power conversion and control systems. The increasing deployment of solar inverters, wind turbines, and energy storage systems is anticipated to drive the demand for power semiconductors in the renewable energy sector. SSRs are crucial in solar inverters, allowing efficient solar energy conversion into electricity.

The rising uptake of smart home appliances, HVAC systems, and electronic devices, including laptops and smartphones, is driving up power consumption. In addition, with technological advancements, LED lighting has emerged as a favorite lighting among consumers. The surge in LED lamp sales is opening substantial market prospects for solid-state relays. These relays play a pivotal role in smart lighting systems, enabling efficient control and dimming of LED lights, ultimately curbing power usage.

The upfront cost of SSR surpasses that of EMR, and SSR proves more cost-effective in the long term. This is primarily because EMR entails higher maintenance costs, consumes more power, and boasts a shorter lifespan.

Considering additional costs, such as comprehensive service life, inspection and maintenance expenses, and inefficiencies due to unstable or faulty relays, the average cost of using solid-state relays is significantly lower than that of electromagnetic relays. Furthermore, some applications require extra costs to prevent contact vibration and ensure reliable contact in mechanical relays.

Macroeconomic trends like economic growth, inflation, government spending, global trade, and geopolitical dynamics influence various countries' manufacturing ecosystems. Disruptions in supply chains, triggered by events such as the Russia-Ukraine conflict and tensions between the US and China, have significantly impacted the manufacturing sector. For example, the electronics manufacturing industry in China saw a 3.4% growth in value added in 2023, marking the highest point in the given period, as China's National Bureau of Statistics reported. This growth had dipped in 2019 and 2020, only to rebound in 2021.

Solid-state Relay Market Trends

Automotive and Transportation Segment to be the Fastest Growing Application

- Solid-state relays are employed in automotive systems for power distribution and motor control functions. They provide reliable switching for components like turn signals, windshield wipers, and cooling fans. These relays can handle high currents and offer fast switching, making them suitable for automotive applications.

- Solid-state relays play a crucial role in the power electronics systems of electric vehicles. They are used on battery management systems, motor control units, and charging systems. These relays enable efficient and reliable switching of high-voltage and high-current circuits in EVs.

- The growth in the electric vehicle markets, especially power trains, is further expected to increase the demand for solid-state relays. Electronic components in the automotive industry are critical for safety and are subjected to extreme voltages and environmental conditions. This has driven the manufacturers to develop a new line of solid-state relays for automotive applications.

- The factors driving the growth of the SSRs include increased vehicle production and rising demand for electric vehicles. In addition, several technological advancements, such as the implementation of IoT and favorable government standards for the production of autonomous, connected, and low-emission vehicles, are further fueling the market's growth of solid-state relays during the forecast period.

- For instance, in May 2024, NOVOSENSE announced the launch of its new NSI7258 series of capacitive isolation-based solid-state relays, available in both industrial and automotive grades. Designed specifically for high-voltage measurement and insulation monitoring, NSI7258 provides industry-leading voltage withstand capability and EMI performance to help improve the reliability and stability of high-voltage systems such as industrial BMS, PV, energy storage, charging piles, and BMS and OBCs for new energy vehicles.

- According to IEA's Global EV Outlook 2024, in 2024, electric car sales in the United States are projected to rise by 20% compared to the previous year, translating to almost half a million more sales relative to 2023. Based on recent trends and considering that tightening CO2 targets are due to come in only in 2025, the growth in electric car sales in Europe is expected to be the lowest of the three largest markets. Sales are projected to reach around 3.5 million units in 2024, reflecting modest growth of less than 10% compared to the previous year. Such trends are creating a demand for solid-state relays over the forecast period.

Asia Pacific Expected to Witness Significant Growth

- The application field for solid-state relays has significantly broadened recently. Solid-state relays have no moving parts, reducing wear and tear and increasing reliability and longevity. This is particularly important in the automotive sector, where components are subjected to constant vibrations and harsh conditions. Solid-state relays offer faster switching speeds than electromechanical relays, improving the performance of various automotive systems, including ADAS, power distribution units, and battery management systems in EVs.

- China's market growth is poised to be significantly driven by the automotive sector. The surging demand for solid-state relays within automotive manufacturing primarily fuels this surge. For instance, in January 2024, the China Association of Automobile Manufacturers announced a significant achievement for the country's auto industry: production and sales have surpassed 30 million units annually, highlighting the immense growth opportunities in the sector.

- In addition, China emerged as a significant player in the hybrid and electric vehicle market, propelled by its ambitious target: achieving a 40% share of electric vehicles in total car sales by 2030.

- Japan's automotive industry, including the growing electric vehicle (EV) market, is a significant driver of solid-state relays. These relays offer high reliability and efficiency and are used in battery management systems, power distribution, and various vehicle control systems.

- Japan's automotive sector, which historically contributes to over 89% of the nation's GDP, is undergoing a significant shift. Driven by Japan's ambitious targets of achieving net-zero emissions by 2050 and a 46% reduction by 2030, electric vehicles (EVs) are gaining traction. In line with this, the national government has outlined clear targets: aiming for EVs and plug-in hybrid electric vehicles (PHEVs) to constitute 20-30% of passenger car sales by 2030, with fuel cell vehicles (FCVs) targeted at 3%.

- India's rapid infrastructure development, including smart cities and modern transportation systems, boosts the demand for solid-state relays (SSRs). The SSR's reliability and ability to manage high-voltage applications are essential in these projects. For instance, in February 2024, the Indian parliamentary committee underscored the importance of initiating the subsequent phase of the government's primary Smart Cities Mission, focusing on tier-2 cities within a 100-kilometer radius of state capitals.

Solid-state Relay Industry Overview

The solid state relay market is semi-consolidated, with major players like Rockwell Automation Inc., ABB Ltd, Infineon Technologies AG, Sensata Technologies Inc., and Vishay Intertechnology Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantages.

June 2024 - Infineon Technologies unveiled the 600 V CoolMOS S7TA superjunction MOSFET designed for automotive power management. This innovative product offers an enhanced solution for various important applications crucial to the safety and efficiency of contemporary vehicles. These applications encompass vital components like circuit breakers, high-voltage battery disconnect switches, low-frequency switches for DC and AC, and high-voltage electronic fuses.

March 2024 - Autonics opened a new sales office in Osaka, Japan, targeting the western Japan region. This move aims to improve customer service and accessibility. With the Osaka office complementing the Tokyo office in eastern Japan, Autonics seeks nationwide market expansion.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Investment in Renewable Energy Sources

- 5.1.2 Elevated Requirement of Power Savings in the Residential and Industrial Sectors

- 5.2 Market Restraints

- 5.2.1 High Cost of the Solid-state Relay Compared to Electromechanical Relay

6 MARKET SEGMENTATION

- 6.1 By Mounting

- 6.1.1 Panel Mount

- 6.1.2 PCB Mount

- 6.1.3 DIN Rail Mount

- 6.2 By Output

- 6.2.1 AC Solid State Relay

- 6.2.2 DC Solid State Relay

- 6.2.3 AC/DC Output Relay

- 6.3 By Application

- 6.3.1 Energy and Infrastructure

- 6.3.2 Industrial OEM

- 6.3.3 Building Equipment

- 6.3.4 Food and Beverages

- 6.3.5 Automotive and Transportation

- 6.3.6 Industrial Automation

- 6.3.7 Healthcare

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 France

- 6.4.2.3 United Kingdom

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Rockwell Automation Inc.

- 7.1.2 ABB Ltd

- 7.1.3 Infineon Technologies AG

- 7.1.4 Sensata Technologies Inc.

- 7.1.5 Vishay Intertechnology Inc.

- 7.1.6 Omron Corporation

- 7.1.7 Fujitsu Limited

- 7.1.8 Broadcom Inc.

- 7.1.9 Omega Engineering Inc.

- 7.1.10 TE Connectivity Ltd

- 7.1.11 Celduc Relais.

- 7.1.12 Littelfuse

- 7.1.13 Schneider Electric SE

- 7.1.14 Autonics Corporation

- 7.1.15 Toshiba Corporation