|

市場調查報告書

商品編碼

1548910

會計中的人工智慧:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)AI In Accounting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

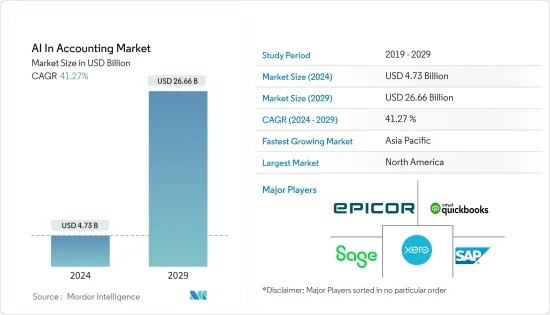

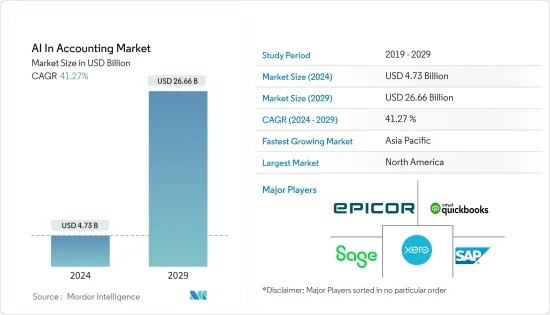

會計領域的人工智慧市場規模預計到2024年為47.3億美元,預計到2029年將達到266.6億美元,在預測期內(2024-2029年)複合年成長率預計為41.27%。

主要亮點

- 人工智慧將徹底改變會計專業,推動成長,釋放潛力,並為專業人士和組織增加價值。透過自動化手動任務並減少錯誤,人工智慧使會計師能夠騰出時間進行策略性財務規劃,最終為企業主節省成本並提高效率。將人工智慧整合到會計業務中可以提高生產力,並實現更準確、更及時的財務報告,這對於做出明智的決策至關重要。

- 雲端服務的日益普及極大地支持了全球經濟成長。這種快速成長導致政府政策有利於雲端供應商,刺激雲端公司創新並爭奪市場佔有率。因此,會計師事務所擴大轉向雲端解決方案來增強其服務。整合雲端技術使會計師事務所能夠簡化業務,提高資料安全性,並為客戶提供更有效率、更可靠的服務。

- 在自然語言處理(NLP)應用程式激增的推動下,所研究的市場有望成長。 NLP 擴大在聊天機器人和合約智慧中實施,其中人工智慧解釋合約中的自由文字並識別違規。

- 人工智慧在會計領域的變革力量正在為準確性和效率設定新標準。人工智慧驅動的解決方案為企業提供更深入的財務洞察,並使核算部門能夠比以往更快、更明智地做出決策。這項技術進步提高了業務效率,使企業能夠利用資料主導的洞察力進行策略決策,為企業帶來競爭優勢。

- 儘管越來越多的公司採用人工智慧,但許多中小型企業在利用先進的人工智慧功能方面面臨障礙。即使是基本的人工智慧系統也依賴資源彙整演算法,並且需要傳統辦公室設置中通常不具備的軟體和硬體層級。建立人工智慧基礎設施對於小型會計師事務所來說是一個挑戰。它需要高效的資料管理、強大的處理能力、敏捷性、擴充性以及處理不同數量資料的能力。隨著小型企業越來越容易接觸到人工智慧,對熟練人工智慧專業人員的需求將會激增。

- 2024年1月,管理會計師協會(IMA)發布了《人工智慧對會計和金融的影響:全球觀點》。本報告深入探討了組織可能遇到的挑戰以及成功整合人工智慧的先決條件,並提供了擁抱人工智慧主導的未來的藍圖。本報告提供的全面分析對於組織應對會計和財務領域人工智慧實施的複雜性來說是寶貴的資源。

會計人工智慧的市場趨勢

建築業的成長推動了對家具產品的需求

- 人工智慧技術在各個領域變得越來越重要,並具有廣泛的好處,包括創建新策略和提供即時回饋,可以提高小型企業(例如我們提供的小型企業)的生產力和準確性。人工智慧資源和大量資料的進步使小企業主能夠將時間投入到更重要的職責上,而不是從事平凡的業務。中小型企業擴大使用尖端會計工具預計將推動該領域的擴張。

- 人工智慧透過自動化重複且耗時的任務來提高小型企業簿記流程的效率。這不僅有助於減少錯誤,還可以提高整體生產力。利用人工智慧的會計軟體可以偵測重複交易等錯誤。中小企業擴大使用雲端會計技術預計將推動市場擴張。雲端會計軟體旨在為尋求簡化財務活動的中小型企業消除障礙。會計中的人工智慧提供了對各種功能的訪問,讓您可以看到人工智慧驅動的會計的實際好處。

- 一些公司正在大力投資實施先進的會計技術。例如,2024年5月,AI ACCOUNT PTE.LTD加大力度支援亞太地區中小企業,提供先進的雲端基礎的會計解決方案。透過利用人工智慧技術,該公司確保快速遵守當地法規,並為中小企業提供客製化且易於使用的平台。在中小企業是經濟成長主要推動力的地區,AI ACCOUNT PTE.LTD 引進了創新的財務管理方法。

- 根據AI ACCOUNT PTE.LTD的數據,中小企業佔亞太和歐洲業務的97%以上,而根據歐盟委員會的聲明,中小企業構成了歐洲經濟的支柱。據估計,到 2023 年,歐盟將有約 2,440 萬家中小企業,這突顯了對有效會計解決方案的巨大需求。

亞太地區預計將佔據主要市場佔有率

- 在日常業務自動化需求不斷成長的推動下,亞太地區有望實現顯著成長。隨著對準確會計和及時付款處理的需求不斷成長,該地區的企業正在轉向應收帳款自動化來加強應收帳款催收。

- 由於對安全和自動化支付處理的需求不斷成長,該地區的應收帳款自動化市場正在蓬勃發展。透過實施自動化解決方案,公司可以克服手動和紙本流程帶來的障礙,並有效實現應收帳款部門的現代化。

- 在亞太地區,中國處於金融服務進步的前沿,特別關注新技術。相反,在其他一些區域市場,金融服務主要集中在另類貸款、行動支付和機器人諮詢服務。

- 印度處於數位銀行革命的先鋒地位,特別是透過聯合支付介面(UPI),該介面旨在簡化P2P交易,以便於發送文字訊息,並強調互通性。

- 數位化成為 2023 年聯邦預算的中心議題。財政部長尼爾馬拉·西塔拉曼概述了政府利用數位工具和平台將印度經濟轉變為技術主導、知識密集型密集型的願景。她宣佈建立三個人工智慧卓越中心,並強調政府致力於加速人工智慧發展並最大限度地發揮印度人工智慧的潛力。

- 在該地區,人工智慧與區塊鏈、雲端運算和巨量資料一樣,成為會計行業的關鍵驅動力。 Nasscom資料顯示,印度 35% 的人工智慧計畫是專門為銀行服務量身定做的。

人工智慧在會計行業的概述

會計AI市場分散化,多家主要企業競相擴大市場佔有率。這些擁有大量市場佔有率的主要企業致力於擴大其國際客戶群。我們還提供新鮮和創造性的想法,並致力於商業交易和合併,以提高市場佔有率和盈利。主要參與者包括 Xero Limited、Intuit Inc. (QuickBooks)、Sage Group PLC、SAP SE 和 Epicor Software Corporation。

2024 年 4 月 - Cognizant 和 Microsoft 宣布擴大合作夥伴關係,旨在利用 Microsoft 的生成式 AI 和 Copilots 使數百萬用戶受益。此次合作將改變公司的業務運作、改善員工體驗並推動跨產業創新。

2024 年 3 月-印度軟體公司 Zoho 宣佈在拉丁美洲進行 2,000 萬美元策略投資。這項投資將持續三年,旨在擴大我們在該地區的影響力。作為該計劃的一部分,Zoho 計劃開設新辦事處並建立一兩個資料中心。該公司的首個資料中心容量為1兆瓦,將位於兩個地點,預計在2024年底或2025年第一季投入營運。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 宏觀經濟因素對市場的影響 COVID-19 影響

第5章市場動態

- 市場促進因素

- 自然語言處理技術推動市場成長

- 市場限制因素

- 缺乏專業技能和專業知識

- 技術簡介

- 自然語言處理(NLP)

- 機器學習和深度學習

第6章 人工智慧在會計中的應用/使用案例

- 詐欺和風險管理

- 申請分類與核准

- 彙報

- 自動記帳

- 其他用途

第7章 市場區隔

- 按成分

- 軟體

- 按服務

- 按配置

- 本地

- 雲

- 按組織規模

- 中小企業 (SME)

- 主要企業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第8章 日本會計的人工智慧市場

- 市場概況 - 日本

- 市場促進因素與機遇

- 市場挑戰

- 市場區隔

- 依成分分析 - 日本

- 軟體

- 服務

- 按配置分析 - 日本

- 本地

- 雲

- 按組織規模分析 - 日本

- 中小企業 (SME)

- 主要企業

- 主要供應商名單-日本

- 依成分分析 - 日本

第9章 競爭格局

- 公司簡介

- Xero Limited

- Intuit Inc.(QuickBooks)

- Sage Group PLC

- SAP SE

- Epicor Software Corporation

- Oracle Corporation(Netsuite)

- Zoho Corporation

- Google LLC

- Microsoft Corporation

- IBM Corporation

- SMACC GmbH

- Botkeeper Inc.

- VIC.ai Inc.

第10章投資分析

第11章投資分析市場的未來

The AI In Accounting Market size is estimated at USD 4.73 billion in 2024, and is expected to reach USD 26.66 billion by 2029, growing at a CAGR of 41.27% during the forecast period (2024-2029).

Key Highlights

- AI is set to revolutionize the accounting profession, driving growth, unlocking potential, and boosting the value of professionals and organizations. By automating manual tasks and reducing errors, AI frees up accountants for strategic financial planning, ultimately leading to increased cost savings and efficiency for business owners. The integration of AI into accounting practices enhances productivity and allows for more accurate and timely financial reporting, which is crucial for informed decision-making.

- The increasing adoption of cloud services is significantly bolstering global economic growth. This surge is prompting the government to craft policies favoring cloud providers, thereby incentivizing these firms to innovate and compete for market share. Consequently, accounting firms are increasingly turning to cloud solutions to enhance their service offerings. The integration of cloud technology allows these firms to streamline their operations, improve data security, and offer more efficient and reliable services to their clients.

- The market under study is poised for growth, driven by the surge in natural language processing (NLP) applications. NLP is increasingly finding its way into chatbots and contract intelligence, where AI interprets free text in contracts and identifies non-compliance.

- The transformative power of AI in accounting is setting new standards for accuracy and efficiency. With AI-enabled solutions, companies are gaining deeper financial insights, enabling their accounting departments to make quicker, more informed decisions than ever before. This technological advancement is improving operational efficiency and providing a competitive edge to businesses by allowing them to leverage data-driven insights for strategic decision-making.

- While businesses increasingly adopt AI, many small firms face hurdles in accessing advanced AI capabilities. Even basic AI systems rely on resource-intensive algorithms, demanding a level of software and hardware not typically found in older office setups. For smaller accounting businesses, crafting an AI-ready infrastructure is a challenge. It necessitates efficient data management, robust processing power, agility, scalability, and the ability to handle varying data volumes. As AI becomes more accessible to small and medium-sized enterprises, the demand for skilled AI professionals surges.

- In January 2024, the Institute of Management Accountants (IMA) unveiled "The Impact of Artificial Intelligence on Accounting and Finance: A Global Perspective." This report delves into the challenges organizations might encounter and the prerequisites for a successful AI integration, offering a roadmap for embracing an AI-driven future. The comprehensive analysis provided in the report serves as a valuable resource for organizations looking to navigate the complexities of AI adoption in the accounting and finance sectors.

AI In Accounting Market Trends

Growth in the Construction Sector Boosting the Demand for Furniture Products

- AI technology is increasingly crucial in various sectors and offers a wide range of advantages, such as creating new tactics and delivering immediate feedback that can enhance the productivity and precision of small enterprises like SMEs. Due to the advancement of AI resources and the vast amount of data ready for examination, entrepreneurs of small businesses can allocate their time to more significant responsibilities instead of mundane duties. The rise in the utilization of cutting-edge accounting tools within SMEs is projected to propel the segment's expansion.

- AI enhances the efficiency of small businesses' bookkeeping processes by automating tasks that are repetitive and time-consuming. This not only helps in reducing errors but also improves overall productivity. Accounting software that utilizes AI can detect mistakes such as duplicate transactions. The increasing use of cloud accounting technologies in small and medium enterprises is expected to boost the market's expansion. Cloud accounting software aims to remove obstacles for SMEs seeking to streamline their financial activities. By providing access to a variety of features, AI Account allows them to witness the benefits of AI-driven accounting in action.

- Several companies are significantly investing in introducing advanced technologies for accounting purposes. For instance, in May 2024, AI ACCOUNT PTE. LTD increased its efforts to assist SMEs in the Asia-Pacific region by offering advanced cloud-based accounting solutions. Through the use of AI technology, the company ensured prompt compliance with local regulations, providing SMEs with a tailored and user-friendly platform. In a region where SMEs are key drivers of economic growth, AI ACCOUNT PTE. LTD introduced an innovative approach to financial management.

- According to AI Account company, small and medium-sized enterprises (SMEs) make up more than 97% of businesses in the Asia-Pacific and European region; small and medium-sized enterprises (SMEs) form the backbone of the European economy as of the European Commission There were estimated to be approximately 24.4 million (SMEs) in the European Union in 2023 highlighting the crucial demand for effective accounting solutions.

Asia-Pacific is Expected to Hold Significant Market Share

- Asia-Pacific is poised for significant growth, driven by a rising imperative to automate daily operations. With a mounting call for precise accounting and timely payment processing, enterprises in the region are turning to receivable automation to enhance their collections.

- The regional accounts receivable automation market is surging, propelled by a heightened appetite for secure and automated payable processes. By embracing automated solutions, organizations can effectively modernize their accounts receivable departments, surmounting the hurdles posed by manual and paper-centric processes.

- Within the Asia-Pacific landscape, China stands at the forefront of financial services advancements, particularly emphasizing new technologies. Conversely, in several other regional markets, financial services primarily revolve around alternative lending, mobile payments, and robo-advisory services.

- India is spearheading the digital banking revolution, notably through the United Payments Interface (UPI), which aims to streamline peer-to-peer transactions to the simplicity of sending a text message, with a strong emphasis on interoperability.

- In the Union Budget of 2023, digitization took center stage. Finance Minister Nirmala Sitharaman outlined the government's vision, which was to transform the Indian economy into a technology-driven, knowledge-based powerhouse, harnessing digital tools and platforms. She announced the setup of three AI centers of excellence, underscoring the government's commitment to fostering AI development and maximizing its potential for India.

- In this region, AI, alongside blockchain, cloud computing, and Big Data, stands out as a pivotal driver for the accounting sector. Data from Nasscom reveals that 35% of AI initiatives in India were specifically tailored for banking services.

AI In Accounting Industry Overview

The Artificial Intelligence in the accounting market is fragmented and comprises multiple influential players competing for greater market share. These main firms, which have significant market shares, are concentrating on growing their clientele internationally. To improve their market shares and profitability, they are also offering fresh, creative ideas and engaging in business transactions and mergers. Xero Limited, Intuit Inc. (QuickBooks), Sage Group PLC, SAP SE, Epicor Software Corporation, etc., are important participants.

April 2024 - Cognizant and Microsoft Corp. announced an expanded partnership aimed at leveraging Microsoft's generative AI and Copilots to benefit millions of users. This collaboration intends to transform enterprise business operations, enhance employee experiences, and drive innovation across various industries.

March 2024 - Zoho, an Indian software company, announced a strategic investment of USD 20 million in Latin America. The investment, spread over three years, aims to enhance its market presence in the region. As part of this initiative, Zoho plans to establish new offices and set up one or two data centers. The company's inaugural data center, with a capacity of 1MW and two locations, is scheduled to commence operations either by the end of 2024 or in the first quarter of 2025.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of Macroeconomic Factors on the Market COVID-19 Impact

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Natural Language Processing Technology to Drive the Market Growth

- 5.2 Market Restraint

- 5.2.1 Lack of Specialized Skills and Expertise

- 5.3 Technology Snapshot

- 5.3.1 Natural Language Processing (NLP)

- 5.3.2 Machine Learning and Deep Learning

6 AI IN ACCOUNTING APPLICATION/USE-CASES

- 6.1 Fraud and Risk Management

- 6.2 Invoice Classification and Approvals

- 6.3 Reporting

- 6.4 Automated Bookkeeping

- 6.5 Other Applications

7 MARKET SEGMENTATION

- 7.1 By Component

- 7.1.1 Software

- 7.1.2 Services

- 7.2 By Deployment

- 7.2.1 On-Premise

- 7.2.2 Cloud

- 7.3 By Organization Size

- 7.3.1 Small to Medium-sized Enterprises (SMEs)

- 7.3.2 Large Enterprises

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia

- 7.4.4 Australia and New Zealand

- 7.4.5 Latin America

- 7.4.6 Middle East and Africa

8 JAPAN AI IN ACCOUNTING MARKET

- 8.1 Market Overview - Japan

- 8.2 Market Drivers and Opportunities

- 8.3 Market Challenges

- 8.4 Market Segmentation

- 8.4.1 By Component Analysis - Japan

- 8.4.1.1 Software

- 8.4.1.2 Service

- 8.4.2 By Deployment Analysis - Japan

- 8.4.2.1 On-Premise

- 8.4.2.2 Cloud

- 8.4.3 By Organization Size Analysis - Japan

- 8.4.3.1 Small to Medium-sized Enterprises (SMEs)

- 8.4.3.2 Large Enterprise

- 8.4.4 List of Key Vendors - Japan

- 8.4.1 By Component Analysis - Japan

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Xero Limited

- 9.1.2 Intuit Inc. (QuickBooks)

- 9.1.3 Sage Group PLC

- 9.1.4 SAP SE

- 9.1.5 Epicor Software Corporation

- 9.1.6 Oracle Corporation (Netsuite)

- 9.1.7 Zoho Corporation

- 9.1.8 Google LLC

- 9.1.9 Microsoft Corporation

- 9.1.10 IBM Corporation

- 9.1.11 SMACC GmbH

- 9.1.12 Botkeeper Inc.

- 9.1.13 VIC.ai Inc.