|

市場調查報告書

商品編碼

1548926

計劃合管理:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Project Portfolio Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

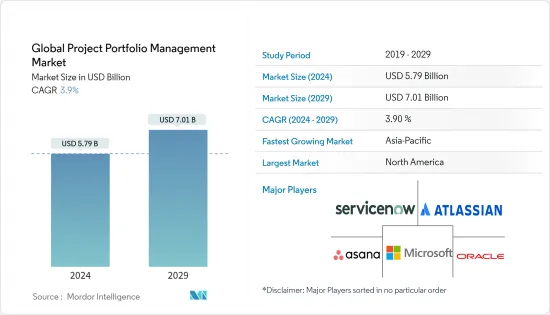

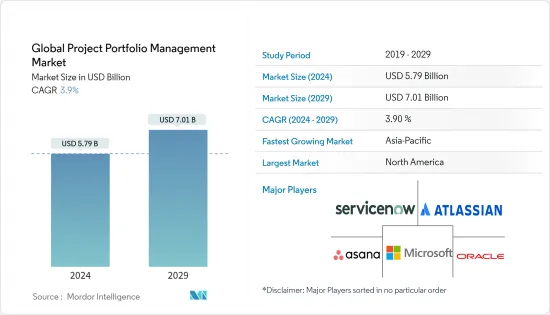

預計2024年全球計劃合管理(PPM)市場規模為57.9億美元,預計2029年將達到70.1億美元,複合年成長率預計為3.9%。

計劃合管理是對組織的計劃合的集中管理。然而,即使計劃彼此沒有鏈接,或者根本沒有鏈接,計劃可以透過專案組合進行集中管理,這為監控和管理競爭資源提供了顯著的好處。

主要亮點

- 為了最大限度地提高組織績效,計劃合管理在分配資金、人員和截止日期之前根據潛在計劃的成功可能性和相關風險對其進行評估。還包括高層控制和監控,以確保當前舉措與公司的整體策略和目標密切相關。

- 工作文化的變化和向遠端團隊的轉變正在推動 PPM 市場的成長。新興企業和大型企業的不斷變化允許員工在家工作或以混合模式工作,提高了生產力,提高了員工士氣,並減輕了大多數員工的壓力水平,從而節省了營運成本。隨著這種做法變得越來越普遍,許多人將其稱為“工作的未來”,但即使是參與混合模式的公司也常常認為遠距員工是理所當然的。因此,實施計劃合管理解決方案可以為公司帶來多種好處。

- 雲端基礎的計劃合管理市場包括雲端 PPM 解決方案的銷售,用於管理組織的各種計劃和流程,經過選擇和管理以提高計劃投資的投資回報。專案組合實現組織目標,計劃管理管理整體風險。由於對雲端基礎的解決方案和服務的需求不斷成長,對 PPM 的需求也在不斷成長。

- 此外,組織花費大量時間和金錢來留住合適的人才。因此,如果充分利用所有資源的技能和能力,整體效率和盈利將會提高。基於計劃的業務專注於提高資源利用率,從而專注於透過指標、政府和管理進行最佳化。

- 過去幾十年來,遠距工作趨勢不斷擴大。然而,COVID-19 的影響在短期內顯著加速了這一趨勢,導致各種規模的企業必須迅速適應世界各國政府建議的自我隔離措施。 COVID-19 爆發後,計劃合管理軟體已成為企業的重要工具,因為它可以幫助他們管理遠端工作環境並有效執行計劃。

計劃合管理市場趨勢

最近工作文化的變化和向遠端團隊的轉變推動了市場

- 隨著我們越來越擁抱工作的未來和工作文化的變化,辦公室的想法正在逐漸消失。雖然持續變革的概念受到企業家和新企業的普遍擁護,但世界各地的大公司也面臨著這一現實。

- COVID-19 大流行正在對職場文化產生重大且迅速的影響。人們已經認知到他們的大部分工作可以遠端完成。

- Twitter、Facebook、Square 和 Shopify 等公司已經宣布了永久的在家工作政策。許多其他公司提供混合模式。職場的溝通模式正在改變。人們越來越關注主要的數位方法,例如 Slack(聊天)、電子郵件和 Workday 等共用計劃管理工具。

- 組織內的多重職責受到不同部門課責新推動的影響,通常需要跨地域不同的團隊和辦公室進行協作和溝通。

- 為了有效地利用有限的資源,讓管理階層承擔課責非常重要。相關人員還要求提高透明度,以了解重大計劃和正在進行的服務所提供的價值。曾經對計劃計劃和預算感到滿意的業務部門現在期望獲得顯示實際績效的最新資訊和指標。

北美將佔據很大佔有率

- 與其他區域市場相比,北美佔據了很大的收益佔有率。鑑於該地區的預算狀況,可以提供技術和資源來有效實施計劃。此外,微軟公司、甲骨文公司和Workfront等成熟的計劃合管理解決方案供應商的存在預計將顯著推動該地區的市場成長。

- 由於基礎設施的重大進步和新公司的出現,預計北美將在本研究的預測期內保持其主導地位。在該地區營運的各種工業公司正在實施在推動市場成長方面發揮關鍵作用的商業智慧和分析解決方案和策略。

- 一家公司開發了計劃合管理工具。目前,整合技術和工具最有效地用於識別關鍵最終用戶(例如 BFSI 和政府措施)之間的資料同步模式。

- 此外,在該地區,擁有數位基礎設施的公司開始使用 PPM 解決方案進行集體決策,以提高計劃成功率。在美國,醫療保健、製造、BFSI 和建設業等各種最終用途行業都採用計劃合管理服務來管理其整個業務營運並有效消除超額成本。

計劃合管理產業概述

全球計劃合管理市場較為分散,幾家大公司爭奪市場佔有率。工作環境的變化也加劇了競爭公司之間的競爭。

- 2024 年 3 月,惠普公司發布了人工智慧 PC 產品組合 1,該產品利用人工智慧的力量來提高混合工作環境中的生產力、創造力和使用者體驗。在不斷發展的混合工作環境中,工人們繼續與斷網和數位疲勞作鬥爭。大多數員工認為人工智慧將帶來新的享受機會並使工作變得更輕鬆,但這需要正確的工具和技術。

- 2023 年 12 月,Planisware 與 OnePagerare 合作,首次實現了兩家公司產品之間的直接整合。這項備受期待的合作是響應兩家公司客戶要求向前邁出的重要一步。 OnePager 的使命是透過將複雜的資料轉換為易於理解的視覺表示來簡化計劃和專案組合管理。這種合作關係匯集了兩家公司在提供無縫體驗方面的獨特優勢。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 最近工作文化的變化和向遠端團隊的轉變使得集中任務管理和資源利用變得至關重要。

- 再加上對雲端基礎的PPM 的需求不斷成長,及時使用規劃和調度工具可帶來長期成本效益

- 多個連結模組的整合和協作擴展了 PPM 的範圍,以涵蓋與工作區相關的任務的整個範圍

- 市場挑戰

- 最新的進展正在解決整合和安全挑戰。

第6章 市場細分

- 依部署類型

- 雲

- 本地

- 按類型

- 解決方案

- 服務

- 按行業分類

- 資訊科技和電信

- 醫療保健/生命科學

- 製造業

- 建造

- 零售/消費品

- BFSI

- 其他行業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 拉丁美洲

- 中東/非洲

- 澳洲和紐西蘭

第7章 競爭格局

- 公司簡介

- Oracle Corporation

- Servicenow Inc.

- Microsoft Corporation

- Atlassian Corporation PLC

- Asana Inc.

- SAP SE

- Wrike(citrix Systems Inc.)

- Monday.com

- Workday Inc.

- Planview Inc.(changepoint)

- Smartsheet Inc.

- Upland Software Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Global Project Portfolio Management Market size is estimated at USD 5.79 billion in 2024, and is expected to reach USD 7.01 billion by 2029, growing at a CAGR of 3.9% during the forecast period (2024-2029).

Project portfolio management is the centralized management of an organization's project portfolios. However, even if they are not linked to each other or have no connection at all, the projects shall be administered centrally through a portfolio, which confers considerable advantages in monitoring and managing rival resources.

Key Highlights

- In order to maximize organizational performance, project portfolio management will assess possible projects on the basis of their likelihood of success and associated risks before assigning funds, staff, or time limits. In order to ensure that the current initiatives are closely linked with the overall strategy and objectives of the company, high-level controls and monitoring shall also be included.

- The change in work culture and the move toward remote teams drive the growth of the PPM Market. The constant changes in startups and large enterprises allow employees to work from home or a hybrid model, which enhances productivity, raises employee morale, lowers stress levels for most workers, and saves operating expenses. As the practice grows in popularity, many have called it the future of work, and yet, businesses often take remote workers for granted, even those participating in hybrid models. Thus, implementing project portfolio management solutions provides various benefits to businesses.

- The cloud-based project portfolio management market comprises the sale of cloud PPM solutions that manage an organization's range of projects and processes, which are chosen and managed to deliver better returns on investment in project investments. The portfolio shall meet the organization's objectives and allow project management to take care of overall risk. The need for PPM is driven by a growing demand for cloud-based solutions and services.

- Furthermore, organizations spend a lot of time and money creating the right talent pool. Hence, when all the resources' skills and competencies are tapped to their maximum potential, it enhances overall efficiency and profitability. Improved resource utilization is a growing concern in project-focused businesses, resulting in an increased focus on optimization through metrics, government, and management.

- The trend toward remote work has been continuously growing for the past decades. However, the effect of COVID-19 has significantly accelerated this trend in a brief time, thereby forcing companies, irrespective of their size, to adapt speedily to the self-isolation measures governments worldwide were recommending. After the COVID-19 pandemic, project portfolio management software has become a vital tool for companies as it can help manage the remote working environment and deliver projects efficiently.

Project Portfolio Management Market Trends

Recent Changes in Work Culture and Move Toward Remote Teams Driving the Market

- There is a growing acceptance of change in the future of work and work culture, and the idea of an office is gradually fading. Although the concept of constant change is generally supported by entrepreneurs and new companies, large enterprises around the world are also faced with this reality.

- The COVID-19 pandemic has had a profound and rapid impact on workplace culture. People have come to realize that they can do most of their work remotely.

- Companies like Twitter, Facebook, Square, Shopify, and others announced a permanent work-from-home policy. Hybrid models are offered by a lot of other companies. The mode of communication is changing in the workplace. The focus on primarily digital approaches, including Slack, e-mail, and shared project management tools like workdays, has been intensified.

- Multiple responsibilities within an organization are affected by the new drive for accountability in different sectors, and it is usually necessary to cooperate and communicate between teams and offices on a geographical basis.

- With limited resources, holding managers accountable for their efficient use is crucial. Stakeholders are also demanding greater transparency to understand the value delivered by major projects and ongoing services. Business units, once satisfied with project plans and budgets, now expect updates and metrics that demonstrate actual performance.

North America to Account for a Significant Share

- Compared to the rest of the regional markets, North America holds a significant revenue share. In view of the region's budgetary situation, technology and resources for the effective implementation of projects may be provided. In addition, the market's growth in this region is expected to be driven substantially by a strong presence of some well-established project portfolio management solution providers such as Microsoft Corporation, Oracle Corporation, and Workfront.

- As a result of the significant progress in infrastructure and the emergence of new companies, North America is expected to retain its dominance throughout the forecast period of the study. The implementation of business intelligence and analytics solutions and strategies, which play a key role in driving the market's growth, are carried out by various industrial companies active in the region.

- Companies are developing project portfolio management tools. In order to identify data synchronization patterns in critical end users such as BFSI or government initiatives, integration techniques and tools are currently being used most effectively.

- In addition, to increase the success rate of their projects in the region, companies with digital infrastructures are using PPM solutions to initiate collective decision-making. In the United States, various end-use sectors such as healthcare, manufacturing, BFSI, and construction are adopting project portfolio management services to manage overall business operations and eliminate extra costs efficiently.

Project Portfolio Management Industry Overview

The global project portfolio management market is fragmented, with several major players vying for more market share. The shift in the work environment has also led to an increase in competition among the players.

- In March 2024, HP Inc. launched a portfolio of AI PCs1 leveraging the power of AI to enhance productivity, creativity, and user experiences in hybrid work settings. Workers continue to struggle with disconnection and digital fatigue in an ever-evolving hybrid work environment. Most employees believe that AI will open up new opportunities for enjoying their jobs and making them easier, but they need the right tools and technology to do so.

- In December 2023, Planisware collaborated with OnePagerare to allow the two of their products to be directly integrated for the first time. In response to the requests of customers from both companies, this very anticipated collaboration is a major step forward. By transforming complex data into visual representations that are easily understandable, OnePager's mission is to simplify project and portfolio management. This partnership brings together their unique strengths in offering a seamless experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Recent Changes in Work Culture and Move toward Remote Teams has Made It Imperative to Develop a Centralized View of Task Management and Resource Utilization

- 5.1.2 Long-term Cost Benefits Enabled by Timely Use of Planning & Scheduling Tools, Coupled with Growing Demand for Cloud-based PPM

- 5.1.3 Integration of Several Allied Modules and Collaborations Have Increased the Span of PPM to Cover the Entire Workspace Related Tasks

- 5.2 Market Challengess

- 5.2.1 Challenges Pertaining to Integration and Security Albeit Being Addressed by Recent Advancements

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Type

- 6.2.1 Solution

- 6.2.2 Services

- 6.3 By End-user Verticals

- 6.3.1 IT And Telecom

- 6.3.2 Healthcare And Lifesciences

- 6.3.3 Manufacturing

- 6.3.4 Construction

- 6.3.5 Retail And Consumer Goods

- 6.3.6 BFSI

- 6.3.7 Other End-user Verticals

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.6 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 Servicenow Inc.

- 7.1.3 Microsoft Corporation

- 7.1.4 Atlassian Corporation PLC

- 7.1.5 Asana Inc.

- 7.1.6 SAP SE

- 7.1.7 Wrike (citrix Systems Inc.)

- 7.1.8 Monday.com

- 7.1.9 Workday Inc.

- 7.1.10 Planview Inc. (changepoint)

- 7.1.11 Smartsheet Inc.

- 7.1.12 Upland Software Inc.