|

市場調查報告書

商品編碼

1549710

包裝檢定:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Package Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

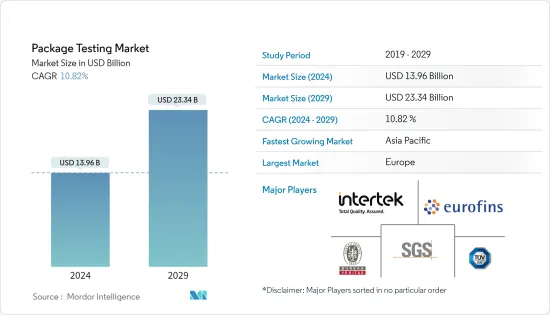

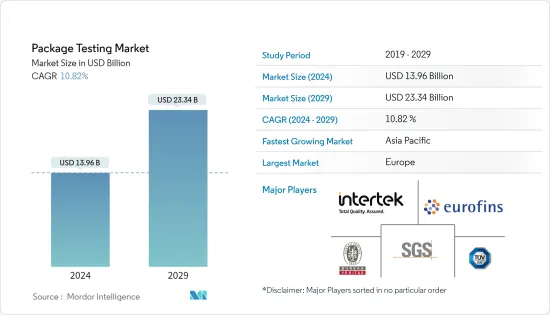

包裝檢測市場規模預計到2024年為139.6億美元,預計到2029年將達到233.4億美元,在預測期內(2024-2029年)複合年成長率為10.82%,預計將會成長。

包裝檢測在幾乎每個供應鏈中都發揮著至關重要的作用。包裝測試可確保您企業的包裝符合規格,避免代價高昂的產品損壞、法律問題和不良的使用者體驗。包裝測試發現了多個領域的機會,包括包裝成本節省、現實環境條件和運輸場景中的包裝材料性能、品管見解和包裝擴充性。它還包括認證、規範和法規等合規性問題。

主要亮點

- 貿易自由化、交通基礎設施和通訊技術的改善以及食品零售領域跨國公司的成長導致了全球化的加劇。因此,乳製品、水果和蔬菜等生鮮食品的國際貿易活性化。

- 由於損壞的產品會增加零售商和製造商的成本並導致客戶不滿意,因此包裝檢查變得更加重要。按照美國材料與試驗協會 (ASTM) 和國際種子測試協會 (ISTA) 等標準組織的指導,透過進行跌落、振動和衝擊測試等多項測試檢驗包裝可靠性。

- 然而,與包裝測試相關的成本相當高,使得小型製造商和行業很難投資於這一過程,從而阻礙了該市場的成長。

- 此外,全球和當地經濟的健康狀況極大地影響了對包裝產品的需求,從而推動了對包裝測試的需求。消費者消費的轉變和購買習慣直接改變包裝的數量和複雜性,進而塑造包裝測試格局。

- 包裝測試產業的命運與食品和飲料、消費品、藥品和電子產品等關鍵產業密切相關。工業產出和製造業的波動直接影響包裝檢測服務的需求。

包裝檢測市場趨勢

食品和飲料佔據很大的市場佔有率

- 智慧包裝、活性包裝、智慧包裝、調氣包裝等先進包裝方法正在取代傳統方法,增加了對這些包裝產品進行有效測試的需求。

- 由於產品以包裝狀態到達客戶手中,因此其安全性是一個重要問題。有毒或有害污染物的存在可能會影響產品本身,這凸顯了市場上包裝檢查的重要性。

- 包裝食品的成長在美國、西班牙、法國和俄羅斯等新興經濟體最為明顯。這種重視催生了市場對有效包裝檢測的強烈需求。

- 由於方便、節省時間和易於準備,美國包裝食品消費者正在增加消費量,而減少浪費被認為是關鍵原因。 Census.gov 報告稱,非店面零售數量比前一年增加了 6.8% (+1.4%)。相較之下,食品和飲料服務業較 2023 年 5 月成長了 3.8%(+2.3%)。

- 人們對環保食品包裝(例如紙質包裝解決方案)的認知不斷增強,增加了對包裝檢查以確保包裝完整性完好無損的需求。包裝和加工食品和飲料越來越受歡迎。隨著包裝食品和消費品的消費更加廣泛,該行業預計將成長。

- 據有機貿易協會稱,美國包裝有機食品的消費額預計將從 2021 年的 212.6 億美元增加到 2025 年的超過 250 億美元。包裝檢驗的需求預計將隨著包裝有機食品消費的成長而成長。有機食品通常必須遵守嚴格的規則和規定,以保持其完整性並確保其有機。包裝檢查可確保包裝組件和佈局滿足您的需求,以避免污染、保持新鮮度並延長保存期限。對包裝有機食品不斷成長的需求可能需要強大的包裝檢測技術。

歐洲預計將佔據較大市場佔有率

- 歐洲是過去幾十年來包裝檢驗產業顯著成長的關鍵地區之一。包裝企業意識的增強、行業法規的嚴格以及包裝產品消費的增加是包裝檢驗行業成長的主要驅動力。

- 例如,歐盟包裝和包裝廢棄物指令的主要目標是支持歐盟內部市場的正常運行,並不斷提高包裝的環保績效。成員國已製定國家法律來實施該法律,允許企業對包裝材料和產品進行認證、測試和認證。

- 包裝的製造必須能夠根據特定要求進行回收或再利用。為了維持包裝產品和消費者的衛生、安全和可接受性,必須最大限度地減少包裝內有害物質透過焚燒或掩埋的數量。強制遵守多項行業包裝標準,例如國際標準化組織 (ISO) 和國際安全運輸協會 (ISTA) 制定的標準,進一步鼓勵了多個行業採用包裝測試。

- 隨著各個最終用戶領域的供應商更頻繁地發布新產品,對封裝和相關測試解決方案的需求預計將進一步增加。例如,雀巢國際旅遊零售 (NITR) 計劃於 2024 年 3 月推出 Breaks for Good KitKat。這項創新產品不僅將旅行者和農民與雀巢新的收入加速器計畫聯繫起來,而且還強調了酒吧所用可可的永續性。值得注意的是,這標誌著 KitKat 的首次亮相,它是用專門從參與該計劃的農民那裡採購的可可豆製成的。

包裝檢測產業概況

由於公司集中度適中,包裝偵測市場處於半靜態狀態,預計未來幾年將經歷更多的整合。競爭公司之間的敵意預計將進一步加劇。在市場競爭中,Intertek Group PLC、Eurofins Scientific SE、SGS SA、Bureau Veritas SA等老字型大小企業紛紛進入市場,並透過提供創新的包裝測試解決方案服務保持市場優勢並保持市場領先地位。

- 2023 年 9 月 Eurofins 醫療器材測試有限公司開設了新的包裝測試實驗室。我們於 2023 年在芬蘭開始業務。 Eurofins 醫療器材測試有限公司是一個實驗室網路,提供科學服務以最佳化產品發布和生命週期管理。

- 2023 年 8 月,SGS 在 Centurion 開設了一個新的微生物實驗室。這將提高南非的食品安全檢測能力,並補充 SGS 位於開普敦梅特蘭的現有農業和食品實驗室 (AFL) 提供的服務。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 包裝完整性測試

- 包裝強度測試

- 包裝有效期限研究

- 包驗證

- 市場宏觀經濟因素評估

- 產業政策

- ASTM標準

- ISO標準

- STA標準

第5章市場動態

- 市場促進因素

- 嚴格的管理規定和管理/資格要求

- 產品在各種條件下長期儲存的要求以及對包裝永續產品的需求不斷增加

- 市場限制因素

- 與包裹檢查相關的高成本

第6章 市場細分

- 按主要材料分類

- 玻璃

- 紙

- 塑膠

- 金屬

- 按類型

- 跌落測試

- 振動測試

- 衝擊試驗

- 溫度測試

- 其他類型(壓縮測試、保存期限測試、大氣溫度測試)

- 按最終用途行業

- 食品/飲料

- 工業的

- 衛生保健

- 居家及個人保健產品

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Intertek Group PLC

- Eurofins Scientific SE

- SGS SA

- Bureau Veritas SA

- TUV SUD AG

- Campden BRI

- IFP Institute for Product Quality GmbH

- DDL Inc.(Integreon Global)

- Turner Packaging Limited

- Nefab Group

第8章投資分析

第9章市場的未來

The Package Testing Market size is estimated at USD 13.96 billion in 2024, and is expected to reach USD 23.34 billion by 2029, growing at a CAGR of 10.82% during the forecast period (2024-2029).

Package testing plays a prominent role in almost every supply chain. Package testing ensures the business's packaging meets specifications and avoids costly product damage, legal situations, and poor user experiences. Package testing identifies opportunities in several areas, such as savings on packaging costs, the performance of packaging materials in realistic environmental conditions and transportation scenarios, quality control insights, and scalability of packaging. It also includes compliance issues like certifications, specifications, and regulations.

Key Highlights

- Globalization increased owing to trade liberalization, improvements in transport infrastructure and communication technologies, and the growth of multinational companies in the food retail sector. It boosted international trade in perishable foods like dairy, fruits, and vegetables.

- It made package testing even more important, as damaged products increase costs for retailers and manufacturers and lead to customer dissatisfaction. The reliability of the package is tested by performing numerous tests, such as drop, vibration, and shock tests, directed by standard institutions, such as the American Society for Testing and Materials (ASTM) and the International Seed Testing Association (ISTA).

- However, the costs associated with packaging testing are quite high, making it harder for small-scale manufacturers and industries to invest in this process, thereby hindering the growth of this market.

- Moreover, global and regional economic health significantly shapes the demand for packaged products, thereby fueling the necessity for packaging testing. Consumer spending shifts and buying habits directly alter the volume and intricacy of packaging, molding the packaging testing landscape.

- The packaging testing sector's fortunes are intricately linked to key industries like food and beverage, consumer goods, pharmaceuticals, and electronics. Swings in industrial output and manufacturing directly sway the appetite for packaging testing services.

Package Testing Market Trends

Food and Beverage Accounts for a Significant Share of the Market

- Advanced packaging methods, such as intelligent packaging, active, smart packaging, and modified atmosphere packaging, are replacing traditional methods, driving the need to test these packaged goods effectively.

- Products' safety is an important concern as they reach customers in the packaged form. Any toxic or damaging contaminant could affect the product itself, emphasizing the importance of package testing in the market.

- Packaged food's growth is more prominent in the developed economies of the United States and major European countries like Spain, France, and Russia. This emphasis created a robust demand for effective package testing in the market.

- Packaged food consumers in the United States increased their consumption due to convenience, saved time, and easy prep, with minimal wastage indicated as the primary reason. Nonstore retailers saw a 6.8% (+-1.4%) increase from the previous year, as reported by Census.gov. In comparison, food services and drinking establishments experienced a 3.8% (+-2.3%) uptick from May 2023.

- The need for package testing to ensure that the integrity of the package is not compromised increased in response to the growing awareness of environmentally friendly food packaging, such as paper-based packaging solutions. Foods and drinks that are packaged and processed are becoming increasingly popular. The sector is anticipated to grow as packaged food and consumer items are consumed more widely.

- According to the Organic Trade Association, the consumption of packaged organic food in the United States is anticipated to increase to over USD 25 billion by 2025 from USD 21.26 billion in 2021. The demand for package testing will expand in tandem with the growth in the consumption of packaged organic food. Organic food items frequently need to adhere to strict rules and regulations to retain their integrity and guarantee that they stay organic. Package testing ensures that the packaging's components and layout adhere to needs like avoiding contamination, preserving freshness, and prolonging shelf life. Strong package testing techniques will be required due to the rising demand for packaged organic foods.

Europe is Expected to Hold a Significant Market Share

- Europe is one of the key locations where the package testing sector has grown significantly over the previous few decades. The increased awareness among packaging firms, strict industry rules, and rising packaged product consumption are the main drivers of the package testing sector's growth.

- For instance, the EU Packaging and Packaging Waste Directive's main goals are to support the proper operation of the EU internal market and continuously enhance the environmental performance of packaging. Member states created national laws to execute the act, allowing businesses to certify, test, and certify the packaging materials and commodities.

- The packaging must be manufactured to allow recovery or reuse following specific requirements. The number of hazardous materials inside the packaging must be kept to a minimum in terms of emissions from incineration or landfills to maintain hygiene, safety, and acceptance for the packed product and the consumer. The requirement to follow several sector-specific packaging standards, such as those set out by the International Organisation for Standardisation (ISO) and the International Safe Transit Association (ISTA), further encourages the adoption of package testing across multiple business verticals.

- The need for packaging and related testing solutions is anticipated to increase further as vendors across various end-user sectors increase the frequency of new product releases. For instance, in March 2024, Nestle International Travel Retail (NITR) is gearing up to introduce the Breaks for Good KitKat. This innovative offering not only links travelers with farmers in Nestle's new Income Accelerator Program but also highlights the sustainability of the cocoa utilized in these bars. Notably, this will mark the debut of a KitKat crafted from cocoa beans exclusively sourced from farmers participating in the program.

Package Testing Industry Overview

The packaging testing market is semi-consolidated as the firm concentration ratio is moderate, and consolidation is expected over the next few years. The competitive rivalry is expected to increase further. The presence of longstanding companies in the market studied, such as Intertek Group PLC, Eurofins Scientific SE, SGS SA, and Bureau Veritas SA, is expected to maintain their market dominance by offering innovative package testing solutions services to intensify the market competition.

- September 2023: Eurofins Medical Device Testing launched a new Package Testing Lab. The operation started operations in Finland in 2023. Eurofins Medical Device Testing is a network of laboratories providing scientific services to ensure optimized product launch and lifecycle management.

- August 2023: SGS opens a new microbiological testing laboratory in Centurion. This increases food safety testing capabilities in South Africa, complementing the services provided by SGS's existing agriculture and food laboratory (AFL) in Maitland, Cape Town.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.3.1 Package Integrity Testing

- 4.3.2 Package Strength Testing

- 4.3.3 Package Shelf-Life Studies

- 4.3.4 Package Validation

- 4.4 Assessment of Macroeconomic Factors on the Market

- 4.5 Industry Policies

- 4.5.1 ASTM Standards

- 4.5.2 ISO Standards

- 4.5.3 STA Standards

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rigorous Control Regulations and Administration and Qualification Demands

- 5.1.2 Demand for Longer Shelf Life of Products Under Varying Conditions and Growing Demand for Packaged and Sustainable Products

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Package Testing

6 MARKET SEGMENTATION

- 6.1 By Primary Material

- 6.1.1 Glass

- 6.1.2 Paper

- 6.1.3 Plastic

- 6.1.4 Metal

- 6.2 By Type

- 6.2.1 Drop Test

- 6.2.2 Vibration Test

- 6.2.3 Shock Test

- 6.2.4 Temperature Testing

- 6.2.5 Other Types (Compression Testing, Shelf Life Testing, Atmospheric Temperature Testing)

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Industrial

- 6.3.3 Healthcare

- 6.3.4 Household and Personal Care Products

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Intertek Group PLC

- 7.1.2 Eurofins Scientific SE

- 7.1.3 SGS SA

- 7.1.4 Bureau Veritas SA

- 7.1.5 TUV SUD AG

- 7.1.6 Campden BRI

- 7.1.7 IFP Institute for Product Quality GmbH

- 7.1.8 DDL Inc. (Integreon Global)

- 7.1.9 Turner Packaging Limited

- 7.1.10 Nefab Group