|

市場調查報告書

商品編碼

1641965

自助倉儲:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Self Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

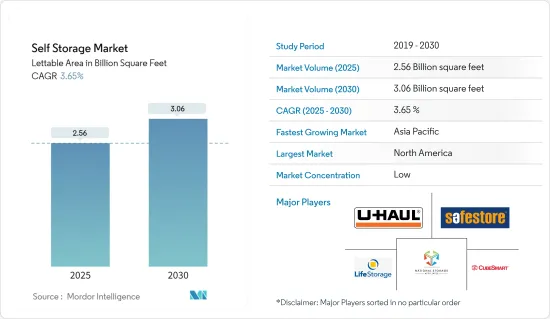

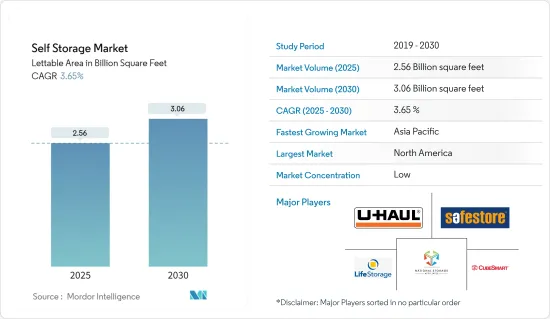

預計自助倉儲市場將從 2025 年的 25.6 億可出租平方英尺成長到 2030 年的 30.6 億可出租平方英尺,預測期內(2025-2030 年)的複合年成長率為 3.65%。

主要亮點

- 自助倉儲產業是商業房地產的一個分支,在都市化和經濟改善的推動下,該產業有望實現強勁成長。雖然美國和西歐等成熟市場擁有完善的自助倉儲基礎設施,但中國和印度等地區仍處於起步階段。

- 都市化,伴隨城市人口的增加,是主要的成長要素。隨著城市人口變得越來越稠密,房地產價格上漲,對自助倉儲的需求,尤其是租賃住宅的需求正在成長。例如,預計2024年倫敦人口將達到970萬,2030年將達到1000萬。

- 企業越來越關注儲存成本並且擴大轉向自助倉儲解決方案。與傳統倉儲業不同,自助倉儲為企業提供多種空間大小和費率方案。市場在氣候控制和數位安全自助倉儲設施的開發方面取得了重大進展,為居住者提供遠離溫度和濕度等環境因素的安全儲存設施,尤其是氣候控制自助倉儲設施。基於功能的自助倉儲設施。

- 為了支持這一趨勢,2023 年 12 月,專門從事自助倉儲的房地產投資公司 VanWest Partners 宣布了在科羅拉多丹佛市計劃的計劃。該計劃將由其子公司 ClearHome Self Storage 管理,將在五層樓、93,000 平方英尺的建築內配備氣候控制的 A 級自助倉儲單位。此舉是為了滿足美國對氣候控制儲存日益成長的需求。在預測期內,它代表了對商業和住宅客戶對氣候中性儲存解決方案日益成長的需求的策略性回應。

- 然而,該產業面臨政府監管的挑戰。國防安全保障部警告營運商,他們的設施可能被濫用來儲存可能帶來安全風險的材料。

自助倉儲市場趨勢

個人儲存領域預計將佔據大部分市場佔有率

- 在住宅領域,對額外存儲空間的需求主要由家庭的成長所推動,家庭財產的增加對自助倉儲性能的性能產生了重大影響。此外,隨著嬰兒潮世代的減少,對儲存單元的需求預計也會增加。

- 城市人口的增加導致居住空間越來越小,價格越來越高,尤其是在都市區,導致了更多的流動住宅。聯合國預測,2050年全球都市化將達68%。北美是一個高度都市化的地區,超過80%的人口居住在都市區。

- 在都市化威脅著景氣衰退且可能因新冠肺炎疫情而加劇的背景下,個人儲存產業正在蓬勃發展。面臨空間限制的租戶在縮小住房規模、搬去與家人同住或採用更變化無常的生活方式時,都會轉向儲存設施。這項變更為個人儲存產業帶來了巨大的推動。

- 千禧世代佔據了自助倉儲用戶的大多數,他們的期望也不斷改變。千禧世代喜歡透過智慧型手機、應用程式和行動網站進行互動,並要求企業提供技術先進的解決方案。虛擬旅遊、線上預訂、非接觸式付款和自動化存取正在成為行業標準,與該行業的技術進步保持一致。隨著傳統的實體位置優勢逐漸消失,這些數位管道為新興儲存參與者顛覆市場提供了巨大的機會。

北美有望成為最大市場

- 北美,主要是美國和加拿大,可能會主導自助倉儲市場。對儲存解決方案和工業自動化的不斷成長的需求推動了這一成長。北美的主要市場促進因素包括降低基礎設施成本、日益成長的商業洞察力需求以及即時資料可用性需求。自 36 年前誕生以來,自助倉儲業一直是成長最快的商業房地產市場之一。根據SpareFoot.com報道,截至2023年1月,自助倉儲業的年銷售額將達到290億美元,目前美國運作的自助倉儲設施估計有51,206個。

- 此外,由於美國企業和個人客戶擴大採用自助倉儲設施,美國自助倉儲領域的投資正在顯著成長。該國自助倉儲市場較低的租金價格優勢可能會推動美國的運轉率,從而在預測期內促進市場成長。

- 例如,2023 年 6 月,全球房地產公司 Ivanhoe Cambridge 宣布計劃透過與 Safely Store Self Storage 建立策略合作夥伴關係,擴大其在美國的自助倉儲組合。該計劃旨在增加美國自助倉儲設施的可用性並幫助市場成長。

- SecureSpace 也在 2023 年 6 月收購了位於西雅圖林伍德社區的 North Lynn Mini Storage。租賃的辦公室將採用 SecureSpace 的現代設計和該公司專有的高安全平台進行升級,並由國家安全團隊進行管理。

- 穩定的就業機會和不斷上漲的工資正在刺激家庭的形成和消費者的支出,從而推動自助倉儲的需求。此外,年輕一代和老一代的生活方式節奏越來越快,收集紀念品的愛好也進一步推動了未來對自助倉儲空間的需求。

- 此外,2023 年 11 月,專注於國際學生交流和推廣、外交事務以及國際和平與安全的國際教育協會將宣布加州、紐約州和德克薩斯州將舉辦國際學生交流計畫。最大貢獻者。這可能會推動美國不斷成長的移民人口的需求,增加這些美國城市的人口密度,從而支持預測期內對外部儲存空間的需求。

自助倉儲產業概況

自助倉儲市場競爭激烈,主要企業包括 U-Haul International Inc.、Life Storage Inc.、CubeSmart LP、National Storage Affiliates Trust 和 Safestore Holdings PLC。市場的主要企業也參與合作、合併、收購、投資、業務擴張和技術創新,以保持其在市場中的地位。

- 2024年6月,房地產投資公司新加坡政府投資公司(GIC)與澳洲國家倉儲房地產投資信託基金(National Storage REIT)合作推出全國倉儲創投基金(National Storage Ventures Fund)。該基金旨在在澳洲各地開發自助倉儲設施。該夥伴關係將在未來 12 到 18 個月內投資 2.7 億澳元(1.795 億美元),以完成 NSR 早期開發組合中的 10 個計劃。

- 2024年2月,Talonvest Capital Inc.與Metro Self Storage合作並簽訂了一項融資協議,向包括美國東南部四處房產在內的投資組合投資2,250萬美元。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估宏觀經濟因素對市場的影響

- 主要市場基本面分析

- 平均居住面積

- 自助倉儲設施運轉率

- 辦公室租金價格

第5章 市場動態

- 市場促進因素

- 都市化進程加快,生活空間縮小

- 商業慣例的變化和新冠肺炎疫情下的消費行為

- 市場限制

- 政府對儲存的監管阻礙因素了市場成長

第6章 市場細分

- 依使用者類型

- 個人

- 商業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比利時

- 荷蘭

- 盧森堡

- 丹麥

- 芬蘭

- 挪威

- 瑞典

- 冰島

- 亞洲

- 中國

- 日本

- 台灣

- 韓國

- 馬來西亞

- 香港

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- U-Haul International Inc.

- Life Storage Inc.

- CubeSmart LP

- National Storage Affiliates

- Safestore Holdings PLC

- Simply Self Storage Management LLC

- StorageMart

- Prime Storage Group

- WP Carey Inc.

- Metro Storage LLC

- SmartStop Asset Management LLC

- (Great Value Storage)World Class Capital Group LLC

- All Storage

- Amsdell Cos./Compass Self Storage

- Urban Self Storage Inc.

- Global Self Storage Inc.

第8章投資分析

第9章 市場機會與未來趨勢

The Self Storage Market size in terms of lettable area is expected to grow from 2.56 billion square feet in 2025 to 3.06 billion square feet by 2030, at a CAGR of 3.65% during the forecast period (2025-2030).

Key Highlights

- The self-storage sector, a segment within commercial real estate, is set for robust growth driven by urbanization and improving economies. While established markets like the United States and Western Europe boast well-developed self-storage infrastructures, regions such as China and India are witnessing the nascent stages of this concept.

- Urbanization, accompanied by increasing urban populations, is a primary growth factor. As cities grow with denser populations and rising real estate prices, the demand for self-storage, particularly among renters, is rising. For instance, London's population hit 9.7 million in 2024, which is projected to reach the 10 million mark by 2030.

- Businesses are aware of storage costs and are increasingly turning to self-storage solutions. Unlike traditional warehousing, self-storage offers businesses a wider array of space sizes and pricing plans. The market has been registering a significant advancement in the development of climate control and digital security-managed self-storage facilities to provide tenants with safe storage facilities for their belongings against environmental factors, including temperature and humidity, among others, supporting the growth of the market by creating an opportunity for the climate control feature based self-storage facilities.

- Highlighting this trend, in December 2023, VanWest Partners, a real estate investment firm specializing in self-storage, unveiled plans for a project in Denver, Colorado. The project, to be managed by their subsidiary, ClearHome Self Storage, will feature a 5-story, 93,000-square-foot building of Class A, climate-controlled self-storage units. This move addresses the surging demand for climate-controlled storage in the United States. During the forecast period, it signals a strategic response to the growing need for climate-neutral storage solutions catering to business and personal clientele.

- However, the industry faces challenges from government regulations. The Department of Homeland Security has cautioned operators about potential misuse of their facilities for storing materials that could pose security risks.

Self Storage Market Trends

Personal Storage Segment is Expected to Hold Major Market Share

- In the personal sector, the demand for additional storage space is majorly driven by growing families, and their increasing material possessions significantly influence the performance of self-storage properties. Additionally, as baby boomers downsize, the need for storage units is anticipated to rise.

- Rising urban populations are leading to smaller and more expensive living spaces, particularly in cities, with a growing number of mobile renters. The United Nations projects global urbanization to reach 68% by 2050. North America is notably the most urbanized region, with over 80% of its population living in urban areas.

- Amid concerns of a recession, potentially driven by urbanization and exacerbated by the COVID-19 pandemic, the personal storage sector is experiencing a surge. Renters, facing space constraints, are turning to storage facilities as they downsize, move in with family, or adopt a more transient lifestyle. This shift is significantly boosting the personal-storage industry.

- With millennials comprising a significant portion of the self-storage user base, their expectations are evolving. They increasingly seek technologically advanced solutions from operators, preferring interactions through smartphones, apps, and mobile websites. Virtual tours, online bookings, contactless payments, and automated access are becoming industry standards, aligning with the sector's technological advancements. As the traditional advantage of physical location diminishes, these digital channels present a significant opportunity for emerging storage players to disrupt the market.

North America is Expected to be the Largest Market

- North America, led by the United States and Canada, is set to dominate the self-storage market. The increasing demand for storage solutions and industrial automation is driving this growth. Key market drivers in North America include a focus on reducing infrastructure costs, a growing need for business insights, and the necessity for real-time data availability. The self-storage industry has been one of the fastest-growing commercial real estate market segments since its debut 36 years ago. According to SpareFoot.com, the storage industry recorded USD 29 billion in annual revenue as of January 2023, and the United States currently has an estimated 51,206 storage facilities in service.

- Furthermore, investments in the self-storage sector in the US have witnessed significant growth supported by the increasing adoption of self-storage facilities among businesses and individual customers in the country, which would increase the number of self-storage facilities in the US and can decrease rent prices in the market. This advantage of lower renting prices in the country's self-storage market would fuel the occupancy rate in the United States and can drive market growth during the forecast period.

- For instance, in June 2023, Ivanhoe Cambridge, a global real estate company, announced plans to expand its self-storage portfolio in the United States through a strategic partnership with Safely Store Self Storage. This initiative aims to enhance the availability of self-storage facilities in the United States, supporting market growth.

- Also, in June 2023, SecureSpace acquired Northlynn Mini Storage in the Lynnwood area of Seattle. The leasing office will be upgraded with SecureSpace's modern design, and their proprietary high-security platform, managed by a national security team, will be installed.

- The demand for self-storage units is rising due to steady job creation and wage growth, which boost household formation and consumer spending. Additionally, the faster-paced lifestyles and the tendency to collect memorabilia among younger and older generations further strengthen the future need for self-storage space.

- Additionally, in November 2023, the Institute of International Education, which focuses on international student exchange and aid, foreign affairs, and international peace and security, stated that California, New York, and Texas have contributed the highest enrollment of international students, which would fuel the demand for migrant population growth in the country and can increase of population densities in these cities of the US, supporting the demand for external storage spaces during the forecast period.

Self Storage Industry Overview

The self-storage market is highly competitive, with significant players like U-Haul International Inc., Life Storage Inc., CubeSmart LP, National Storage Affiliates Trust, and Safestore Holdings PLC. The key players in the market are also making partnerships, mergers, acquisitions, investments, expansions, and innovations to retain their market position.

- In June 2024, Singapore's GIC, a real estate investor, partnered with Australia's National Storage REIT to launch the National Storage Ventures Fund. This fund aims to develop self-storage facilities across Australia. The partnership will invest AUD 270 million (USD 179.5 million) over the next 12 to 18 months to complete ten projects within NSR's initial development portfolio.

- In February 2024, Talonvest Capital Inc. partnered with Metro Self Storage to invest USD 22.5 million in a financing agreement for a portfolio including four properties across the southeastern United States, which would enhance Metro Self Storage's presence in suburban areas of Nashville, Tampa, Orlando, and Atlanta with a total of 2,382 units and 282,396 net rentable square feet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of Macro Economic Factors on the Market

- 4.5 Analysis of Key Base Indicators of the Market

- 4.5.1 Average Living Spaces

- 4.5.2 Occupancy Rates of Self-storage Facilities

- 4.5.3 Office Rental Prices

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Urbanization Coupled with Smaller Living Spaces

- 5.1.2 Changing Business Practices and COVID-19 Consumer Behavior

- 5.2 Market Restraints

- 5.2.1 Government Regulations on Storage are Hindering the Market Growth

6 MARKET SEGMENTATION

- 6.1 By User Type

- 6.1.1 Personal

- 6.1.2 Business

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Spain

- 6.2.2.5 Italy

- 6.2.2.6 Belgium

- 6.2.2.7 Netherlands

- 6.2.2.8 Luxembourg

- 6.2.2.9 Denmark

- 6.2.2.10 Finland

- 6.2.2.11 Norway

- 6.2.2.12 Sweden

- 6.2.2.13 Iceland

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 Taiwan

- 6.2.3.4 South Korea

- 6.2.3.5 Malaysia

- 6.2.3.6 Hong Kong

- 6.2.3.7 Australia and New Zealand

- 6.2.4 Latin America

- 6.2.5 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 U-Haul International Inc.

- 7.1.2 Life Storage Inc.

- 7.1.3 CubeSmart LP

- 7.1.4 National Storage Affiliates

- 7.1.5 Safestore Holdings PLC

- 7.1.6 Simply Self Storage Management LLC

- 7.1.7 StorageMart

- 7.1.8 Prime Storage Group

- 7.1.9 WP Carey Inc.

- 7.1.10 Metro Storage LLC

- 7.1.11 SmartStop Asset Management LLC

- 7.1.12 (Great Value Storage) World Class Capital Group LLC

- 7.1.13 All Storage

- 7.1.14 Amsdell Cos./Compass Self Storage

- 7.1.15 Urban Self Storage Inc.

- 7.1.16 Global Self Storage Inc.