|

市場調查報告書

商品編碼

1644382

金融科技區塊鏈:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Fintech Blockchain - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

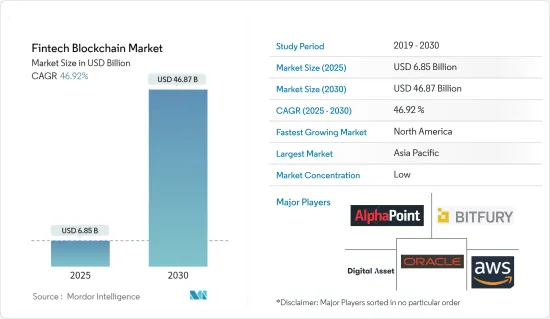

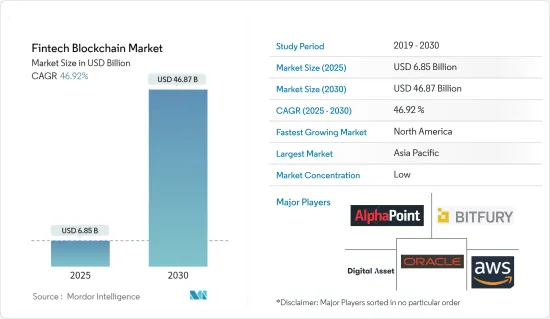

金融科技區塊鏈市場規模預計在 2025 年為 68.5 億美元,預計到 2030 年將達到 468.7 億美元,預測期內(2025-2030 年)的複合年成長率為 46.92%。

區塊鏈相關的金融科技產業正在成長,原因有很多,包括加密貨幣和 ICO 的市值不斷上升、對分散式帳本技術的需求不斷成長,以及金融機構採用先進的區塊鏈解決方案。金融業的數位轉型也促進了金融科技區塊鏈的發展,增加了對數位銀行技術和客戶服務自動聊天機器人的需求。

加密貨幣和數位代幣在付款中的應用日益增多,預計也將推動市場成長。此外,許多金融科技公司已開始採用區塊鏈技術來簡化業務流程、減少詐欺並改善客戶服務。 Ripple 和其他基於區塊鏈的平台正日益受到人們的關注,預計未來將獲得更廣泛的認可。穩定幣具有更高的流動性、成本節約和穩定性,也越來越受歡迎,成為 DeFi通訊協定系列的一個有吸引力的補充。

提高業務效率、加快交易速度、增強安全性、合規優勢、降低基礎設施成本、改善跨境貿易、金融包容性以及增強競爭和創新將推動金融科技區塊鏈市場整體擁有成本的降低。

各種組織都在其貿易和金融系統中採用區塊鏈,以在參與者之間創建智慧合約,提高效率和透明度並提供新的商機。區塊鏈的相同記錄特性使得現有的清算和付款流程變得多餘。銀行和其他金融機構正在採用區塊鏈身分證來識別人們。業績的改善歸功於該組織能夠預見金融區塊鏈應用的新興趨勢並開發區塊鏈能力。

缺乏明確一致的監管標準,使得金融科技區塊鏈公司難以確保遵守各法律公司的工作以適應不斷變化的監管環境。

新冠疫情為全球許多產業帶來了不利影響,其中也包括區塊鏈相關的金融科技產業。封鎖和供應鏈中斷使得業內相關人員難以預測金融科技區塊鏈產業的復甦。然而,危機帶來的系統性變化預計將對該市場產生重大影響。儘管面臨挑戰,金融科技區塊鏈市場預計仍將持續成長。

金融科技區塊鏈市場的趨勢

保險領域有望成為最大的終端用戶領域

- 區塊鏈技術正在透過改變業務並提供一系列好處(包括降低成本、改善客戶體驗、提高效率和提高透明度)來徹底改變保險業。對於準備接受這項轉變的金融科技公司和保險公司來說,這是一個巨大的機會。

- 區塊鏈的主要優勢之一是它能夠提供有關交易的透明和可信的資訊,使其成為檢驗保險索賠真實性的關鍵資料的理想存儲庫。這增強了人們對整個流程的信心,並允許保險提供者對可賠償索賠的百分比做出準確的決定。據瑞士再保險公司稱,2023年,美國和丹麥等國家的保險深度指數得分為1。

- 此外,隨著物聯網技術的興起,連網設備產生的資料量呈指數級成長。這需要能夠有效管理大量資料的技術。區塊鏈允許保險提供商透過允許設備進行P2P通訊和管理來安全地管理這些複雜的網路,而不是依賴昂貴的資料中心進行處理和儲存。這種方法更具成本效益,預計將在未來幾年推動市場成長。

- 雲端基礎的金融科技區塊鏈服務預計將更加安全,使企業能夠更快地應對安全威脅,專注於降低業務風險,確保合規性,並節省內部基礎設施投資。對於一些擁有嚴格監管的IT基礎設施的大型企業來說,將軟體和服務保留在本地的決定是明確的。這些內部伺服器部署的解決方案比雲端伺服器更易於訪問,並且由於它們處於公司的直接控制之下,因此更可靠。

- 隨著您的業務不斷成長,您的解決方案將需要擴展以支援您的關鍵業務。然而,對於多家公司來說,經營現有的內部部署解決方案來支援較新的應用程式、整合和更新可能會很困難。

北美可望實現強勁成長

- 包括銀行、金融服務和保險在內的金融業由於其多重優勢而轉向區塊鏈技術。例如在美國,摩根大通、美國銀行等大型銀行都在投資區塊鏈技術。

- 保險業從事各種活動,共用由多方修改和更新的資料。因此,區塊鏈技術可以使保險業受益。北美是區塊鏈技術的早期採用者,並且區塊鏈在保險業中廣泛應用。

- 智慧合約允許區塊鏈用戶透明地、無需中介地轉移價值。智慧合約與實體合約類似:它們定義雙方之間的規則。與傳統合約不同,智慧合約可以追蹤保險索賠並讓雙方承擔責任。

- 新冠肺炎疫情加速了銀行業數位轉型的需求。由於人們被迫使用線上服務並減少前往銀行的次數,許多銀行已與金融科技供應商合作,提供差異化和競爭性的服務。數位化客戶體驗是競爭優勢的關鍵領域,並將推動市場向前發展。

- 金融科技供應商提供的區塊鏈技術的最大好處之一是減少金融界的詐騙和網路攻擊。區塊鏈允許金融科技營運商透過分散網路共用或傳輸安全、未更改的訊息,有助於遏制資料外洩和其他詐欺活動。增強的安全性和透明度有助於建立金融機構和客戶之間的信任。

金融科技區塊鏈產業概覽

金融科技區塊鏈市場高度分散,主要參與者包括 AlphaPoint Corporation、Bitfury Group Limited、Oracle Corporation、Amazon Web Services Inc. 和 Digital Asset Holdings LLC。市場參與者正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2023 年 10 月,區塊鏈保護公司 Cponcover 與提供數位資產基礎設施的全球領先金融科技公司之一 AlphaPoint 合作,為 AlphaPoint 的客戶提供額外的保護。此次合作預計將為 AlphaPoint 的客戶提供 Coincover 先進的資產保護技術,使他們能夠簡單有效地減輕駭客攻擊、人為錯誤和詐騙等安全風險。當安全成為客戶的首要任務時,AlphaPoint 的最終用戶將受益於增強的安全性和公司作為注重安全的交易所的信譽。

- 2023 年 7 月,跨鏈通訊協定Axelar 與科技巨頭微軟宣布合作,連結公共和私人區塊鏈。此次合作將使 Axelar 加入微軟的 Azure 市場,使其成為第一個在開發者網路商店上架的跨鏈通訊協定。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第 2 章執行摘要

第3章調查方法

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 產業影響評估

第5章 市場動態

- 市場促進因素

- 活性化創新、高度智慧、可程式化的區塊鏈平台的研發活動

- 銀行業越來越多採用區塊鏈技術進行付款和智慧付款等應用

- 降低總擁有成本

- 市場挑戰

- 監管標準和框架不明確

- 市場機會

第6章 市場細分

- 按提供者

- 中介軟體提供者

- 應用解決方案提供商

- 基礎設施和通訊協定提供者

- 按應用

- 付款、清算和付款

- 兌換和匯款

- 智慧合約

- 身分管理

- 合規管理/KYC

- 其他用途

- 按組織規模

- 大型企業

- 中小型企業

- 按最終用戶產業

- 銀行

- 非銀行金融服務

- 保險

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章 競爭格局

- 供應商市場佔有率

- 合併和收購

- 公司簡介

- AlphaPoint Corporation

- Bitfury Group Limited

- Oracle Corporation

- Amazon Web Services Inc.

- Digital Asset Holdings LLC

- Cambridge Blockchain LLC

- Circle Internet Financial Limited

- Coinbase Inc.

- Accenture PLC

- Earthport Plc

- Factom Inc.

- GuardTime AS

- IBM Corporation

- Microsoft Corporation

- RecordesKeeper

- Ripple Lab Inc.

第8章:未來市場展望

The Fintech Blockchain Market size is estimated at USD 6.85 billion in 2025, and is expected to reach USD 46.87 billion by 2030, at a CAGR of 46.92% during the forecast period (2025-2030).

The blockchain-related fintech industry has been experiencing growth due to various factors, such as the rising market cap of cryptocurrencies and ICOs, increasing demand for distributed ledger technology, and adoption of advanced blockchain solutions in financial institutions. The financial industry's digital transformation is also contributing to the growth of the fintech blockchain, as digital banking technologies and automated chatbots for customer service are experiencing rising demand.

The adoption of cryptocurrencies and digital tokens for making payments is expected to boost the market growth. Many fintech organizations have also started adopting blockchain technology to simplify business procedures, reduce fraudulent activity, and enhance customer service quality. Ripple and other blockchain-based platforms are gaining interest, which is anticipated to lead to greater acceptance in the future. Stablecoins are also gaining popularity as they increase liquidity, cost savings, and stability, and they are a fascinating example of DeFi protocols.

Increased operational efficiency, faster transactions, enhanced security, compliance benefits, infrastructure cost savings, improved cross-border transactions, financial inclusion, and increased competition and innovation drive the reduced total cost of ownership in the fintech blockchain market.

Various organizations are adopting blockchain in trade and finance systems to build smart contracts between participants, increase efficiency and transparency, and offer newer revenue opportunities. Blockchain's identical recording capabilities make the existing clearing and settlement process redundant. Banks and other financial institutions are adopting blockchain-enabled IDs to identify people. Improved results are from organizations' capacity to foresee emerging trends in financial blockchain applications and develop blockchain functionality.

The lack of clear and consistent regulatory standards makes it difficult for fintech blockchain companies to ensure compliance with various legal companies' work to navigate the evolving regulatory landscape.

The COVID-19 pandemic negatively impacted many industries globally, including blockchain-related fintech industries. Lockdowns and supply chain disruptions made it difficult for industry participants to predict the resurgence of the fintech blockchain industry. However, systemic changes brought on by the crisis are anticipated to impact this market significantly. Despite the challenges, the fintech blockchain market is expected to continue its growth.

Fintech Blockchain Market Trends

Insurance Segment to be the Largest End-user Vertical

- Blockchain technology is revolutionizing the insurance industry by transforming operations and providing various benefits, such as cost reduction, enhanced customer experiences, increased efficiency, greater transparency, and more. This represents a significant opportunity for fintech companies and insurance providers ready to embrace this transformation.

- One of the critical advantages of blockchain is its ability to provide transparent and trustworthy information about transactions, making it an ideal repository for data that is crucial in verifying the authenticity of insurance claims. This instills trust in the process and enables insurance providers to make accurate decisions about the percentage of the claim that can be covered. According to Swiss Re, in 2023, countries like the United States and Denmark ranked with an index score of 1 in insurance penetration.

- Furthermore, with the rise of IoT technology, the amount of data generated by interconnected devices is increasing exponentially. This requires a technology that can efficiently manage large volumes of data. Blockchain enables insurance providers to manage these complex networks securely by allowing devices to communicate and manage each other peer-to-peer rather than relying on expensive data centers for processing and storage. This approach is much more cost-effective and is expected to drive the market's growth in the future.

- The cloud-based fintech blockchain services are expected to become more secure, thus enabling enterprises to respond faster to security threats, focus on mitigating business risks, become compliant, and save on-premise infrastructure investment. For multiple large enterprises with highly regulated IT infrastructure, the decision to house their software and services on-premise has been clear. The solutions deployed on these in-house servers are also more accessible and under the company's direct control, which provides reliability compared to cloud servers.

- As companies expand over time, it becomes necessary for them to scale their solutions to support crucial business operations. However, it is sometimes difficult for multiple companies to manipulate the existing on-premises solutions to support newer applications, integrations, and updates.

North America is Expected to Witness Significant Growth

- Due to the multiple benefits of blockchain technology, the financial industry, which includes banking, financial services, and insurance, is focused on it. For example, major banks in the United States are investing in blockchain technology, including JPMorgan and Bank of America.

- The insurance industry is involved in various activities, including sharing data that is modified or updated by multiple parties. As a result, blockchain technology can benefit the insurance industry. As early technological adaptors, North Americans have significantly embraced blockchain in the insurance industry.

- Smart contracts allow blockchain users to transfer anything of value transparently without the intervention of a middleman. Smart contracts, like physical contracts, define the rules between two parties. Unlike traditional contracts, smart contracts can track insurance claims and hold both parties accountable.

- The COVID-19 outbreak accelerated the demand for digital transformation in the banking industry. As people were forced to use online services and limit their bank visits, many banking companies collaborated with fintech vendors to offer differentiated and competitive services. Digital customer experience is the primary area of competitive advantage and is likely to drive the market in the future.

- One of the most significant benefits of blockchain technology offered by fintech vendors is the reduction of fraud and cyber-attacks in the financial world. Blockchain helps to curb data breaches and other fraudulent activities by enabling fintech businesses to share or transfer safe and unaltered information through a decentralized network. This added security and transparency could help build trust between financial institutions and their customers.

Fintech Blockchain Industry Overview

The fintech blockchain market is highly fragmented, with the presence of major players like AlphaPoint Corporation, Bitfury Group Limited, Oracle Corporation, Amazon Web Services Inc., and Digital Asset Holdings LLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In October 2023, Cponcover, a blockchain protection company, and AlphaPoint, one of the global financial technology companies providing digital asset infrastructure, partnered to offer an additional layer of protection for AlphaPoint's customers. The partnership is expected to allow AlphaPoint clients to access Coincover's leading asset protection technology, enabling them to mitigate security risks such as hacking, human error, and scams simply and effectively. AlphaPoint's end users will be provided with increased security, increasing the company's credibility as a safety-conscious exchange when security is its customers' top priority.

- In July 2023, cross-chain protocol Axelar and tech giant Microsoft announced a collaboration to bridge public and private blockchains. The partnership would see Axelar joining Microsoft's Azure marketplace, becoming the first cross-chain protocol listed on the developer's online store.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising R&D Activities for Transformative and Highly Intelligent Programmable Blockchain Platform

- 5.1.2 Increasing Adoption of Blockchain Technology for Applications in Banking Industry, such as Payments and Smart Contracts

- 5.1.3 Reduced Total Cost of Ownership

- 5.2 Market Challenges

- 5.2.1 Uncertain Regulatory Standards and Frameworks

- 5.3 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Provider

- 6.1.1 Middleware Providers

- 6.1.2 Application and Solution Providers

- 6.1.3 Infrastructure and Protocol Providers

- 6.2 By Application

- 6.2.1 Payments, Clearing, and Settlement

- 6.2.2 Exchanges and Remittance

- 6.2.3 Smart Contract

- 6.2.4 Identity Management

- 6.2.5 Compliance Management/ KYC

- 6.2.6 Other Applications

- 6.3 By Organization Size

- 6.3.1 Large Enterprises

- 6.3.2 Small and Medium-sized Enterprises

- 6.4 By End-user Verticals

- 6.4.1 Banking

- 6.4.2 Non-banking Financial Services

- 6.4.3 Insurance

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 Germany

- 6.5.2.2 United Kingdom

- 6.5.2.3 France

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Mergers and Acquisitions

- 7.3 Company Profiles

- 7.3.1 AlphaPoint Corporation

- 7.3.2 Bitfury Group Limited

- 7.3.3 Oracle Corporation

- 7.3.4 Amazon Web Services Inc.

- 7.3.5 Digital Asset Holdings LLC

- 7.3.6 Cambridge Blockchain LLC

- 7.3.7 Circle Internet Financial Limited

- 7.3.8 Coinbase Inc.

- 7.3.9 Accenture PLC

- 7.3.10 Earthport Plc

- 7.3.11 Factom Inc.

- 7.3.12 GuardTime AS

- 7.3.13 IBM Corporation

- 7.3.14 Microsoft Corporation

- 7.3.15 RecordesKeeper

- 7.3.16 Ripple Lab Inc.