|

市場調查報告書

商品編碼

1549796

全球矽電容器市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Silicon Capacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

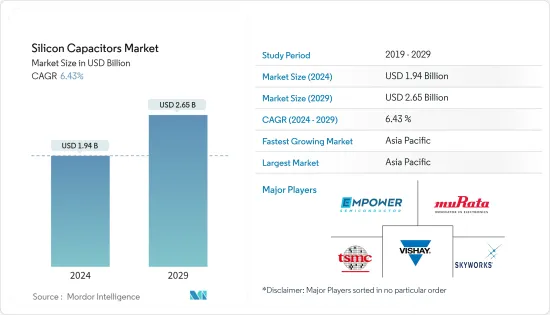

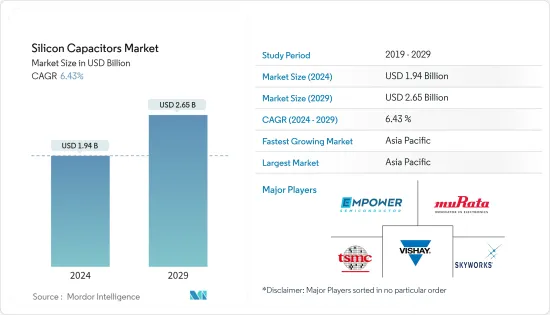

預計2024年全球矽電容器市場規模為19.4億美元,2029年達26.5億美元,預測期間(2024-2029年)複合年成長率為6.43%。

主要亮點

- 矽電容器採用半導體技術製造,主要採用單層或多層MIM結構。由二氧化矽和氮化矽組成的電介質穩定、可靠且耐溫,適合高密度應用。其強大的性能使這些電容器在苛刻的環境中效用。高密度型採用3D奈米形狀電極來增加表面積。

- 採用半導體製造方法製造的矽電容器具有出色的電容密度和增強穩定性的矽介電層,可提高可靠性,使其非常適合高頻應用。這些電容器表現出長達 10 年的顯著老化。在高溫和惡劣環境條件下運作的能力將支援矽電容器未來的市場滲透。

- 隨著全球5G甚至6G通訊的發展,矽電容器因其高頻率、緊湊設計通訊以及適用於超緊湊、薄型、高性能SoC封裝和模組變得越來越效用。

- 雖然矽電容器具有穩定性、高頻性能、尺寸小等多項優點,但它們也有缺點。與陶瓷和鉭等傳統電容器相比,它們有一些缺點,例如電容範圍更窄和電荷洩漏更多。這些限制正在阻礙全球矽電容器市場的擴張。

- 影響矽電容器需求的因素有很多,包括通膨率上升、最終用戶需求疲軟以及 COVID-19 危機期間消費者支出減少。俄羅斯-烏克蘭衝突美國中緊張局勢,包括技術限制,都將阻礙經濟成長。然而,家用電器需求的增加、電動車的廣泛採用以及疫情後全球半導體產業的製造業擴張可能會支持市場成長。

矽電容器市場趨勢

汽車產業實現顯著成長

- 推動全球矽電容器市場的因素之一是汽車產業對小型化的日益接受。自動駕駛系統、先進駕駛輔助系統和電動車 (EV) 等新興汽車技術依賴 ADAS 所需的較小、更經濟和更高性能的電子元件的趨勢。

- 眾所周知,矽電容器由於其等效串聯電阻 (ESR) 較低,因此非常節能。這對於依靠有效電源管理來延長電池壽命和續航里程的電動車和混合動力汽車至關重要。矽電容器可以有效工作的寬溫度範圍(-55°C 至 +150°C)對於暴露在惡劣氣候條件下的汽車應用至關重要。矽電容器的小尺寸使其更適合現代電動車有限的內部空間,從而實現節省空間的設計。

- IEA的數據顯示,新興國家的電動車銷量成長了一倍多,但銷量仍需成長。 2023 年第一季的銷量較 2022 年同期成長 25%。 2022年上半年銷售量將大幅成長,EIA預計2023年終全球電動車銷售佔有率將超過18%。因此,隨著產業朝向更小、更有效率的電力系統發展,矽電容器是需求量不斷增加的小型化組件之一,而這種需求與電動車製造的大幅成長密切相關。

- 訊號完整性和高速資料處理對於 ADAS 和自動駕駛車輛至關重要。矽電容器可提供先進雷達、LiDAR和攝影機系統所需的可靠性能,使其成為高頻應用的絕佳選擇。矽電容器優異的耐用性和可靠性可確保在整個車輛生命週期中保持穩定的性能,這對於自動駕駛中的安全相關應用至關重要。

- 英特爾預計,到 2030 年,註冊自動駕駛汽車的佔有率預計將達到 12% 左右。隨著自動駕駛系統日益普及,矽電容器等高可靠性的高頻元件的需求將會增加。

- 汽車產業正在推動小型化,對矽電容器的需求不斷增加。矽電容器等電氣元件對於可靠性、性能和小型化非常重要,隨著它們整合電力傳動系統、自動駕駛技術和智慧娛樂系統,在汽車中變得越來越重要。除了提高現代車輛的性能外,這項因素還推動了全球矽電容器產業的顯著成長。

亞太地區實現顯著成長

- 該地區,尤其是中國、日本、韓國和台灣等國家,處於技術創新的前沿。這些國家是半導體製造和電子產品的重要參與者,為矽電容器的採用和發展提供了堅實的基礎。

- 根據 Telenor 物聯網大趨勢報告,亞太地區物聯網的採用預計將以前所未有的速度成長,到 2030 年物聯網設備將超過 389 億台。該報告指出,蜂巢式物聯網連接的收益將持續成長。

- 2023 年 2 月,由於 COVID-19 後電子產品需求增加,印度政府向電子和資訊技術部撥款 1,654.9 億印度盧比(20.1177 億美元)。政府計劃向半導體使命投資 30 億印度盧比(3,647 萬美元),以促進半導體和顯示器製造業的發展。預計這將鼓勵家用電器的生產。

- 需求的增加,加上政府制定的支持性法規,使該國成為汽車製造中心,進一步推動了該地區汽車產業的成長。例如,《印度汽車使命計畫2026》是印度政府和印度汽車產業的共同計劃,為產業發展提供了藍圖。

- 汽車產業對能源供應的需求不斷成長是該產業成長的主要推動力。印度的排放法規變得越來越嚴格。

- 例如,為了加速混合動力汽車和電動車技術的製造,以在 2030 年實現電氣化,印度政府根據國家電動車任務計畫 (NEMMP)推出了「加快混合動力和電動車的採用和製造」。這些趨勢預計將支持所研究市場的成長。

矽電容器產業概況

矽電容器市場是半靜態的。鑑於他們的市場滲透率和投資新技術的能力,我們預計未來競爭對手之間的競爭將會加劇。這可能對買家有利,因為產品差異化將成為預測期內的決定因素。主要公司包括 Murata Manufacturing、Vishay Intertechnology Inc.、Skyworks Solutions Inc.、Empower Semiconductor 和 TSMC。

- 2024 年 5 月 - Empower Semiconductor 推出其 ECAP 系列中最大的矽電容器,用於高頻去耦。新型 EC1005P 是一款 16.6 微法拉 (μF) 單電容裝置,適用於高效能系統晶片(SoC) 中常見的最苛刻的電源完整性目標。它具有緊湊的外形,可插入任何 SoC基板或內插器,並提供高達 1 GHz 的超低電阻,使其適合高效能運算 (HPC) 和人工智慧 (AI) 應用。

- 2023 年 10 月 - Nexperia 宣布與全球先進電子元件製造商 Kyocera AVX Components(薩爾斯堡)建立策略合作夥伴關係。兩家公司將共同開發新型650V、20A碳化矽(SiC)整流模組。此模組專為 3-11kW 電源組範圍內的高頻電源應用而設計。目標應用包括工業電源、電動車充電站和車輛充電器。此次合作標誌著兩家公司之間的長期合作關係向前邁出了重要一步。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 科技趨勢

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 技術簡介

- 評估 COVID-19 和宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 小型化在汽車產業日益普及

- 增加技術進步

- 市場挑戰

- 矽電容器的高電荷洩漏和低電容範圍

第6章 市場細分

- 依技術

- MOS電容

- 金屬絕緣體電容器

- 深溝槽矽電容器

- 按最終用戶使用情況

- 車

- 家電

- 資訊科技/通訊

- 航太/國防

- 衛生保健

- 其他最終用戶用途

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Murata Manufacturing Co. Ltd

- Vishay Intertechnology Inc.

- Skyworks Solutions Inc.

- Empower Semiconductor

- TSMC

- KYOCERA AVX Components Corporation

- Microchip Technology Inc.

- ELOHIM Inc.

- Massachusetts Bay Technologies

- MACOM Technology Solutions Holdings Inc.

第8章市場的未來

The Silicon Capacitors Market size is estimated at USD 1.94 billion in 2024, and is expected to reach USD 2.65 billion by 2029, growing at a CAGR of 6.43% during the forecast period (2024-2029).

Key Highlights

- Silicon capacitors, predominantly single or multiple MIM structures, are crafted using semiconductor technologies. Their dielectrics, composed of silicon dioxide or silicon nitride, are favored for high-density applications, offering stability, reliability, and temperature resilience. These capacitors, with their robust performance, find utility in demanding environments. High-density variants employ 3D nano-shaped electrodes to enhance surface area.

- Silicon capacitors, crafted through semiconductor manufacturing methods, feature silicon dielectric layers for enhanced stability to enhance superior capacitance density and reliability and excel in high-frequency applications. These capacitors exhibit a significant aging time of up to a decade. They can operate at high temperatures and in harsh environmental conditions, driving the future market adoption of silicon capacitors.

- Due to their high frequency, ultra-small and thin for miniaturized design compatibility, and application in high-performance SoC package modules, silicon capacitors are finding increased utility in communication devices and consumer electronics, in line with the growth of 5G and even 6G communications worldwide.

- Although silicon capacitors have several benefits, including stability, high-frequency performance, and miniaturization, they also have some drawbacks. There are several drawbacks, including smaller capacitance ranges and higher charge leakages compared to more conventional capacitors like ceramic or tantalum. These limitations impede the expansion of the global silicon capacitor market.

- Various factors, including rising inflation, weak end-user demand, and reduced consumer spending during the COVID-19 crisis, impacted the demand for silicon capacitors. The Russo-Ukraine conflict and US-China tensions, including technology restrictions, are poised to hinder growth. However, the increasing demand for consumer electronic products, the emergence usage of electric vehicles, and the manufacturing expansion of semiconductor industries worldwide in the post-pandemic period would support the market's growth.

Silicon Capacitors Market Trends

Automotive Sector to Witness Major Growth

- One factor propelling the global silicon capacitor market is the growing acceptance of miniaturization in the automotive sector. Modern automotive technologies, such as autonomous driving systems, enhanced driver assistance systems, and electric cars (EVs), depend on the trend toward smaller, more economical, and higher-performing electronic components required in ADAS.

- Due to the low equivalent series resistance (ESR) of silicon capacitors, they are well known for being extremely energy efficient. This is crucial for EVs and HEVs, which depend on effective power management to increase battery life and driving range. The broad temperature range (-55 °C to +150 °C) over which silicon capacitors may function effectively makes them essential for automotive applications subjected to harsh climatic conditions. Silicon capacitor's small dimensions enable more adaptable and space-efficient designs to fit into the constrained interior of contemporary EV automotives.

- According to IEA, Electric car sales in emerging nations have more than doubled, but sales volumes still need to grow. In the first quarter of 2023, sales increased by 25% compared to the same period in 2022. Sales climbed significantly in the first half of 2022, and EIA implies that the global EV sales share was over 18% by the end of 2023. Therefore, silicon capacitors are among the miniaturized components in high demand as the industry moves toward smaller and more efficient power systems, and their demand is closely correlated with the significant increase in EV manufacturing.

- Signal integrity and high-speed data processing are critical to ADAS and autonomous cars. Silicon capacitors are strong candidates for high-frequency applications since they offer the reliable performance needed for sophisticated radar, LIDAR, and camera systems. Silicon capacitors' exceptional endurance and dependability guarantee steady performance throughout the car's life cycle, which is essential for safety-related applications in autonomous driving.

- According to Intel, the share of registered autonomous vehicles is expected to reach about 12% by 2030. The increasing prevalence of autonomous driving systems will drive demand for dependable high-frequency components such as silicon capacitors.

- The automotive industry's push for miniaturization drives the need for silicon capacitors. Reliability, performance, and compactness are critical for electrical components such as silicon capacitors, which are becoming more important in cars by integrating electric drivetrains, autonomous driving technologies, and intelligent entertainment systems. In addition to increasing the capabilities of modern cars, this factor is driving significant growth in the global silicon capacitor industry.

Asia-Pacific to Witness Significant Growth

- The region, particularly countries like China, Japan, South Korea, and Taiwan, is at the forefront of technological innovation. These countries are significant semiconductor manufacturing and electronics players, providing a solid foundation for adopting and developing silicon capacitors.

- According to the Telenor IoT Megatrends Report, the adoption of IoT in Asia-Pacific is expected to grow at an unprecedented rate, and more than 38.9 billion IoT devices will be there by 2030. The report stated that the revenue from cellular IoT connections would grow continuously.

- In February 2023, the Government of India allocated INR 16,549 crore (USD 2011.77 million) to the Ministry of Electronics and Information Technology, owing to the growing demand for electronics post-COVID-19. The government aims to invest INR 300 crore (USD 36.47 million) in the semiconductor mission to boost the semiconductor manufacturing and display manufacturing industry. This is expected to fuel the production of consumer electronics.

- Increasing demand, along with supportive government regulations to make the country an automotive manufacturing hub, is further driving the growth of the automotive sector in the region. For instance, India's Automotive Mission Plan 2026 is a mutual initiative by the Government of India and the Indian automotive industry to lay down the roadmap for the industry's evolution.

- The rise in demand for energy supply in the automobile industry has been a significant driver for growth in this sector. Exhaust emission control norms have become even more stringent in the country.

- For instance, to promote the manufacturing of hybrid and electric vehicle technologies to achieve electrification by 2030 ultimately, the government has even launched the Faster Adoption and Manufacturing of Hybrid & Electric Vehicles in India Under the National Electric Mobility Mission Plan (NEMMP) as silicon capacitors are increasingly used in the electronics and subsystems of electric vehicles. Such trends are expected to support the growth of the market studied.

Silicon Capacitors Industry Overview

The silicon capacitor market is semi-consolidated. Considering the market penetration and ability to invest in new technologies, the competitive rivalry is expected to grow in the future. This may be termed beneficial for the buyers, as product differentiation would be a determinate factor during the forecast period. Some of the key players include Murata Manufacturing Co. Ltd, Vishay Intertechnology Inc., Skyworks Solutions Inc., Empower Semiconductor, and TSMC.

- May 2024 - Empower Semiconductor revealed the largest silicon capacitor in its ECAP product range for high-frequency decoupling. The new EC1005P is a single 16.6-microfarad (μF) capacitance device suitable for the most demanding power integrity goals typically found in high-performance systems-on-chip (SoCs). It offers ultra-low impedance up to 1 GHz in a compact form that may be inserted into the substrate or interposer of any SoC, making it well-suited for high-performance computing (HPC) and artificial intelligence (AI) applications.

- October 2023 - Nexperia announced a strategic partnership with KYOCERA AVX Components (Salzburg) GmbH, a global manufacturer of advanced electronic components. Together, they will develop a new 650 V, 20 A silicon carbide (SiC) rectifier module. This module is designed for high-frequency power applications within the 3 kW to 11 kW power stack range. Target applications include industrial power supplies, EV charging stations, and on-board chargers. This collaboration signifies a significant advancement in the longstanding partnership between the two companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technology Trends

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Technology Snapshot

- 4.6 Assessment of the Impact of COVID-19 and the Impact of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Popularity of Miniaturization in the Automotive Industries

- 5.1.2 Growing Technological Advancements

- 5.2 Market Challenges

- 5.2.1 High Charge Leakages and Lower Capacitance Range of Silicone Capacitors

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 MOS Capacitors

- 6.1.2 MIS Capacitors

- 6.1.3 Deep-trench Silicon Capacitors

- 6.2 By End-user Applications

- 6.2.1 Automotive

- 6.2.2 Consumer electronics

- 6.2.3 IT and Telecommunications

- 6.2.4 Aerospace and defense

- 6.2.5 Healthcare

- 6.2.6 Other End-user Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co. Ltd

- 7.1.2 Vishay Intertechnology Inc.

- 7.1.3 Skyworks Solutions Inc.

- 7.1.4 Empower Semiconductor

- 7.1.5 TSMC

- 7.1.6 KYOCERA AVX Components Corporation

- 7.1.7 Microchip Technology Inc.

- 7.1.8 ELOHIM Inc.

- 7.1.9 Massachusetts Bay Technologies

- 7.1.10 MACOM Technology Solutions Holdings Inc.