|

市場調查報告書

商品編碼

1641993

電容器 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Capacitor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

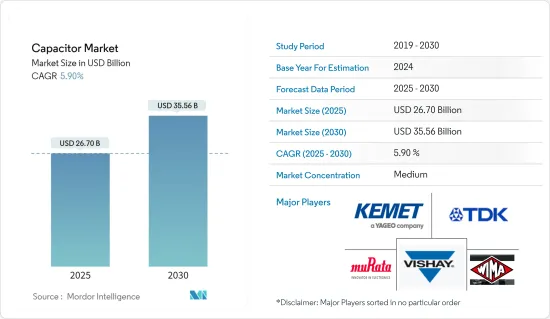

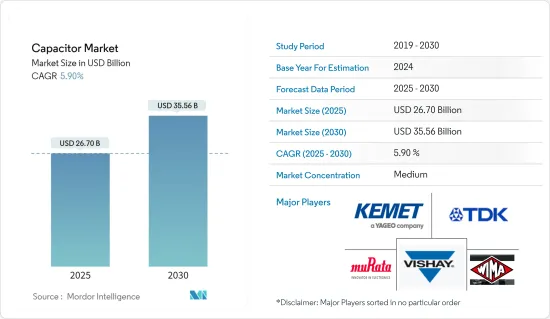

電容器市場規模預計在 2025 年為 267 億美元,預計到 2030 年將達到 355.6 億美元,預測期內(2025-2030 年)的複合年成長率為 5.9%。

關鍵亮點

- 印刷電路板 (PCB) 的小型化以及半導體和電路架構的進步為包括智慧型手機在內的各種應用對電容器的需求增加鋪平了道路。

- 隨著通訊基地台變得越來越小並使用更高的頻帶,由於基板可安裝的元件數量以及元件尺寸和動作溫度的限制,設計變得更加困難。電容器等被動元件由於成本低、體積小而越來越受到此類應用的青睞。

- 5G智慧型手機的普及及其日益增強的功能正在刺激對進一步小型化和更高密度電子電路的需求。例如,高通、聯發科等多家製造商已宣布推出支援 5G 的晶片組,並且已被多家智慧型手機製造商所使用。此前,只有旗艦手機才支援 5G,但現在,隨著更便宜的晶片組上市,甚至中階智慧型手機也支援 5G。這些努力增加了對陶瓷電容器的需求

- 其中,積層陶瓷電容(MLCC)是許多電子設備中必不可少的元件,廣泛應用於穿戴式裝置和智慧型手機(一部智慧型手機大約有900到1100個積層陶瓷電容)。此外,物聯網、5G 和電動車等新技術高度依賴 MLCC 的可用性來滿足更高的效率需求。這迫使製造商調整其產品線和生產能力以滿足這些技術的要求。

- 可再生應用的興起,尤其是依賴太陽能的手錶和顯示燈等小型設備,正在為 EDLC 創造許多應用領域。此外,電雙層電容器還可與小型電池一起使用,作為電腦記憶體的備用電源。由於成本高且可擴展性有限,製造商正在提供基於奈米碳管或石墨烯的電容器。不斷發展的綠色能源應用、提具成本效益以及拓展多個行業的新應用正在推動雙層電容器的進步。

- 為了縮小電容器的尺寸,製造商採用不同組合的電壓範圍和最佳電介質分佈來滿足快速成長的需求。物聯網、家用電子電器和電動車( 前置作業時間 )等領域的重大產品發展推動了對電容器的需求,因此這些行業的新進步受到電容器供不應求的限制。等。

電容器市場趨勢

陶瓷電容器佔最大市場佔有率

- 陶瓷電容器是大多數電氣設備中最常用的電容器,因為它們可靠性高,而且製造成本低。這些電容器用於多個行業,主要由非極化陶瓷或瓷盤構成。陶瓷材料也是良好的電介質,因為它們具有低電導率並能有效地支持靜電場。

- 向自動駕駛汽車和 ADAS(高級駕駛輔助系統)等先進汽車的轉變正在推動每輛車對 MLCC 的使用。因此,為了應對這一趨勢,製造商正致力於與增加陶瓷電容器電容相關的產品創新。

- 例如,2022年2月,村田製作所宣布推出具有三個端子、電容為4.3F的MLCC「NFM15HC435D0E3」。此電容器專為汽車應用而設計,可提供 ADAS(高級駕駛輔助系統)和自動駕駛功能中使用的高性能處理器所需的雜訊抑制和出色的去耦性能。這表明汽車行業對陶瓷電容器的需求正在成長。然而,COVID-19 疫情的持續影響預計將對供應鏈造成一些小中斷。

- 此外,電動車對MLCC的需求也在增加。這是因為,隨著駕駛輔助功能和全自動駕駛系統等功能的增加,大多數電動車都使用近 10,000 個 MLCC。根據國際能源總署 (IEA) 的數據,到 2022 年全球電動車 (EV) 銷量預計將成長 60%。這項里程碑式的成就意味著銷量首次突破 1,000 萬台,較 2021 年的 660 萬台有顯著成長。此外,電動車的高普及率和各國政府設定的全面淘汰內燃機的時間可能會推動汽車領域 MLCC 的成長。

- 此外,數位化、小型化的快速發展將大幅增加MLCC的需求,為廠商最佳化生產帶來困難。此外,由於 1825、1206 和 0805 的供應量越來越少,最終用戶正專注於採用尺寸較小的 MLCC,例如 0201 和 0402 尺寸。

亞太地區將在整個預測期內佔據市場主導地位

- 亞太地區是電容器最突出的市場之一。中國汽車工業正在崛起,並在全球汽車市場中發揮越來越重要的作用。政府將汽車產業(包括汽車零件產業)視為國家的支柱產業之一。中國政府預測,2025年中國汽車產量將達3,500萬輛。因此,預計全部區域的電容器需求將進一步成長。

- 電動車越來越受歡迎,中國被視為採用電動車的領先國家之一。中國的「十三五」規劃推動混合動力汽車汽車和電動車等環保型交通解決方案的發展,預計將加速中國交通運輸業的發展。

- 到 2022 年,中國的電動車市場將擴大,比中國政府 2025 年的預測要早得多,因為數十家競爭對手的新車型吸引了新買家,並鼓勵車主轉換電動車。年的目標% 全國普及率。

- 根據中國乘用車資訊聯席會(CPCA)預測,2023年中國乘用車銷售量預計將達到2,350萬輛。其中,新能源汽車約850萬輛,預計新能源汽車滲透率為36%。中國是世界上最大的汽車市場。預計此舉將促進該國電容器的採用。

- 該地區的市場投資也在增加。例如,2022年1月,領先的被動元件和子系統設計商和製造商Exxelia宣布已完成對Alcon Electronics的多數股權收購。 Alcon Electronics 是一家印度目錄和自訂設計的薄膜和電解電容器設計和製造商,主要服務於可再生能源、醫學影像處理、感應加熱、發電和鐵路等終端市場。 Alcon Electronics 為電力電子應用提供各種薄膜電容器和螺絲端子電解電容器。

電容器產業概況

電容器市場是一個半固定市場。市場競爭激烈,全球有許多主要製造商。電容器市場是已經進行了大量投資的老字型大小企業的聚集地。這些公司正在利用策略合作措施來增加市場佔有率和盈利。市場上的知名供應商包括村田製造公司、TDK 公司、KEMET 公司、Vishay Intertechnology, Inc. 和 WIMA GmbH &Co.KG。

- 2023年11月,ROHM開發了新型矽電容器BTD1RVFL系列。這些設備在智慧型手機和穿戴式裝置行業中越來越受歡迎。我們在處理矽半導體方面的豐富經驗使我們能夠實現更小的尺寸和更高的性能。透過利用薄膜技術,與目前市場上的積層陶瓷電容(MLCC) 相比,該公司的矽電容器能夠以更薄的尺寸提供更大的電容。

- 2023年4月,京瓷公司宣布其電子元件部門開發了新型EIA0201尺寸電容器(MLCC)。電容器尺寸為 0.6 毫米 x 0.3 毫米。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 價值鏈分析

- 產業吸引力-波特五力分析

- 買家的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 市場宏觀經濟分析

第5章 市場動態

- 市場促進因素

- 電動車的普及將增加電容器的需求

- 電訊和電子產業中電容器的使用日益增多

- 市場限制

- 先進電容器研發的技術力要求

第6章 市場細分

- 按類型

- 陶瓷電容器

- 鉭電容器

- 電解電容器

- 紙塑膜電容器

- 超級電容/EDLC

- 按最終用戶產業

- 車

- 工業的

- 航太和國防

- 能源

- 通訊/伺服器/資料存儲

- 消費性電子產品

- 醫療

- 按地區

- 美洲

- 歐洲、中東和非洲

- 亞太地區(日本和韓國除外)

- 日本和韓國

第7章 競爭格局

- 公司簡介

- Murata Manufacturing Co., Ltd.

- KEMET Corporation

- TDK Corporation

- Vishay Intertechnology, Inc.

- WIMA GmbH & Co. KG

- Panasonic Corporation

- KYOCERA AVX Components Corporation

- WIMA GmbH & Co. KG

- Cornell Dubilier Electronics Inc.

- Yageo Corporation

- Lelon Electronics Corp

- United Chemi-Con(Nippon Chemi-Con Corporation)

- Wurth Elektronik eiSos GmbH & Co. KG

- Eaton Corporation PLC

- Honeywell International Inc.

第8章 市場機會與未來趨勢

The Capacitor Market size is estimated at USD 26.70 billion in 2025, and is expected to reach USD 35.56 billion by 2030, at a CAGR of 5.9% during the forecast period (2025-2030).

Key Highlights

- PCB miniaturization and advancements in semiconductor and circuit architectures paved the way for the rise in demand for capacitors in various applications, including smartphones.

- As communication base stations become increasingly smaller and use higher frequency bands, designing is becoming more difficult owing to the limited number of components mounted on the substrate and restrictions on the size and operating temperature of components. Due to their lower cost and small size, passive components like capacitors are increasingly preferred for these applications.

- The widespread adoption of 5G smartphones and their increasing functionality stoke demand for further miniaturization and higher electronic circuitry density. For instance, several manufacturers, such as Qualcomm and MediaTek, are introducing chipsets that support 5G, which multiple smartphone manufacturers use. Previously, 5G support was confined to only flagship mobiles; now, mid-level smartphones also support 5G to introduce cheaper chipsets in the market. Such initiatives are increasing the need for ceramic capacitors.

- Among the applications, multilayer ceramic capacitors (MLCC) are essential components of many electronic devices and are widely used in wearable devices and smartphones (approximately 900 to 1100 multilayer ceramic capacitors are installed in smartphones). Moreover, new technologies, like IoT, 5G, and EVs, are highly dependent on the availability of MLCCs, as these fulfill higher efficiency needs. This has driven manufacturers to align their product lines and production capacities to meet the requirements of these technologies.

- Renewable applications such as solar energy-dependent watches and display lights, among other small devices, have increased and have created many application areas for EDLC. In addition, electric double-layer capacitors are used as backup sources of memory in computers and are used together with small batteries. Manufacturers provide these capacitors based on carbon nanotubes and graphene due to the high costs and their limited scalability. Due to evolving green energy applications, improving price-performance ratios, and growing new applications across several industries, there are advancements in double-layer capacitors.

- To reduce the size of the capacitors, the manufacturers are adopting and using various combinations, such as voltage range and optimal dielectric spread, to fulfill the surging needs. As the demand for capacitors is fueled by significant product development in the IoT, consumer electronics, and electric vehicles (EV), any new advancements in these industries have become limited by the capacitor's availability during the shortage, with lead times extending from several months to a year in some cases.

Capacitor Market Trends

Ceramic Capacitors to Hold the Largest Market Share

- Ceramic capacitors are one of the most commonly used in most electrical instruments, as they offer reliability and are cheaper to manufacture. These capacitors are used in multiple industries and primarily consist of ceramic or porcelain discs that exist in a non-polarized form. The ceramic material is also an excellent dielectric due to its poor conductivity and its efficient support of electrostatic fields.

- The shift towards sophisticated vehicles, such as self-driving vehicles and ADAS (Advanced Driver Assistance Systems), is driving the use of MLCCs per vehicle. Therefore, manufacturers are involved in product innovation related to higher capacitance for ceramic capacitors to cater to such a trend.

- For instance, in February 2022, Murata Manufacturing Co., Ltd. announced the launch of the NFM15HC435D0E3 MLCC, designed with 3 terminals to provide a capacitance of 4.3 F. The capacitor is designed for automotive applications to attain results on noise removal and superior decoupling that are required for high-performance processors employed in advanced driver assistance systems and autonomous driving functions. This indicates the growing demand for ceramic capacitors in the automotive industry. However, with the impact of the constant COVID-19 pandemic, the supply chain is expected to be disrupted on a small scale.

- Moreover, the demand for MLCC in electric vehicles is also increasing, as most of the EVs use close to 10,000 MLCC due to increased features like driver assistance functions and fully autonomous systems. As per the International Energy Agency (IEA), there has been a noteworthy 60% surge in global electric vehicle (EV) sales in 2022. This milestone achievement marks the first time sales have exceeded 10 million units, showing remarkable growth from the 6.6 million units sold in 2021. Further, the high adoption of EVs and the complete phase-out dates of ICE engines set by various governments will drive the growth of MLCC in the automotive sector.

- The demand for MLCCs is also going to increase considerably due to rapid digitalization and miniaturization, and the manufacturers are going to find it hard to optimize their production. Moreover, end users are focusing on incorporating smaller formats of MLCCs, such as the 0201 or 0402 sizes, to make them future-proof, as the availability of 1825, 1206, and 0805 is becoming limited, and the use of smaller formats is expected to insulate the end users from supply chain difficulties.

Asia-Pacific Region will Dominate the Market Throughout the Forecast Period

- The Asia-Pacific region is one of the most prominent markets for capacitors. The automotive industry is increasing in China, and the country plays an increasingly important role in the global automotive market. The government views its automotive industry, including the auto parts sector, as one of the country's pillar industries. The government of China estimates that China's automobile output is expected to reach 35 million units by 2025. Consequently, the demand for capacitors is anticipated to increase further across the region.

- The popularity of EVs is growing, and China is regarded as one of the dominant adopters of electric vehicles. The country's 13th Five-Year Plan promotes the development of green transportation solutions, such as hybrid and electric cars, for advancements in the country's transportation sector.

- China's electric cars are on their way to reaching the 20% nationwide penetration goal in 2022, well ahead of the Chinese government's 2025 forecast, due to new models by dozens of competitors attracting new buyers and encouraging owners to switch to electric vehicles.

- According to the China Passenger Car Association (CPCA), sIt is anticipated that China's passenger car sales will amount to 23.5 million units in 2023. Among these, approximately 8.5 million units are projected to be NEVs, with an expected NEV penetration rate of 36%. China is the leading world's largest vehicle market. This is anticipated to boost the adoption of capacitors in the country.

- The region is also witnessing increasing investments in the market. For instance, in January 2022, Exxelia, a leading designer and manufacturer of passive components and subsystems, announced that it completed the majority acquisition of Alcon Electronics. Alcon Electronics is an Indian designer and manufacturer of catalog and custom-designed film and aluminum electrolytic capacitors, primarily serving the renewable energy, medical imaging, induction heating equipment, power generation, and railway end markets. Alcon Electronics provides a wide range of film and screw-terminal aluminum electrolytic capacitors for power electronic applications.

Capacitor Industry Overview

The capacitor market is a semi-consolidated market. The market is competitive with the presence of various large-scale manufacturers in the market across the globe. The capacitor market has long-standing established players who have made significant investments. These companies leverage strategic collaborative initiatives to increase their market share and profitability. Some of the prominent vendors in the market include Murata Manufacturing Co., Ltd., TDK Corporation, KEMET Corporation, Vishay Intertechnology, Inc., and WIMA GmbH & Co. KG, among others.

- November 2023: ROHM has developed the BTD1RVFL series, a new line of silicon capacitors. These devices are gaining popularity in the smartphone and wearable device industries. Due to their extensive experience in silicon semiconductor processing, the company has achieved higher performance in a more compact design. By utilizing thin-film technology, their silicon capacitors offer a greater capacitance in a thinner form compared to the current multilayer ceramic capacitors (MLCCs) available in the market.

- April 2023: Kyocera Corporation announced that the company's Electronic Components Division developed a new capacitor (MLCC) with EIA 0201 size, with a capacitance of 10 microfarads, which the company claims to be the industry's highest among MLCCs in the 0201 case size. The dimensions of the capacitor are 0.6 mm x 0.3 mm.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Macro-Economic Analysis of the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of EVs to Boost the Demand for Capacitors

- 5.1.2 Increasing Adoption of Capacitors in the Telecom and Electronics Industry

- 5.2 Market Restraints

- 5.2.1 Requirement of Technical Competence for Developing Advanced Capacitors

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Ceramic Capacitors

- 6.1.2 Tantalum Capacitors

- 6.1.3 Aluminum Electrolytic Capacitors

- 6.1.4 Paper and Plastic Film Capacitors

- 6.1.5 Supercapacitors/EDLCs

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Industrial

- 6.2.3 Aerospace and Defense

- 6.2.4 Energy

- 6.2.5 Communications/Servers/Data Storage

- 6.2.6 Consumer Electronics

- 6.2.7 Medical

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe, Middle East and Africa

- 6.3.3 Asia Pacific (Excl. Japan and South Korea)

- 6.3.4 Japan and South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co., Ltd.

- 7.1.2 KEMET Corporation

- 7.1.3 TDK Corporation

- 7.1.4 Vishay Intertechnology, Inc.

- 7.1.5 WIMA GmbH & Co. KG

- 7.1.6 Panasonic Corporation

- 7.1.7 KYOCERA AVX Components Corporation

- 7.1.8 WIMA GmbH & Co. KG

- 7.1.9 Cornell Dubilier Electronics Inc.

- 7.1.10 Yageo Corporation

- 7.1.11 Lelon Electronics Corp

- 7.1.12 United Chemi-Con (Nippon Chemi-Con Corporation)

- 7.1.13 Wurth Elektronik eiSos GmbH & Co. KG

- 7.1.14 Eaton Corporation PLC

- 7.1.15 Honeywell International Inc.