|

市場調查報告書

商品編碼

1684040

消費性電子用 MLCC:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Consumer Electronics MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

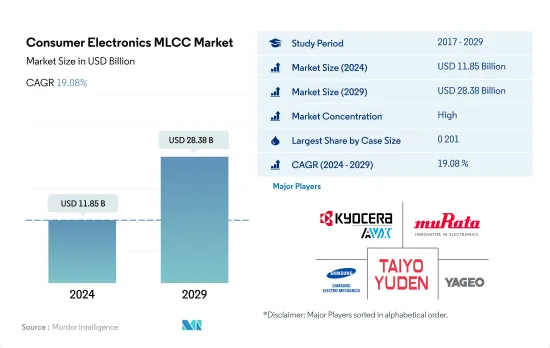

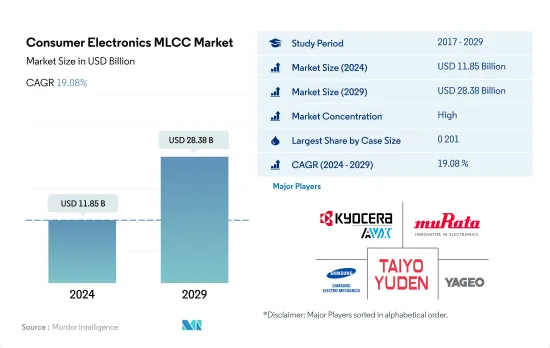

消費性電子 MLCC 市場規模預計在 2024 年為 118.5 億美元,預計到 2029 年將達到 283.8 億美元,預測期內(2024-2029 年)的複合年成長率為 19.08%。

外殼尺寸決定消費性電子產品的 MLCC 市場

- 在全球消費性電子MLCC市場中,0 201、0 402、0 603、1 005和1 210等各種外形尺寸在確保整體設備的最佳性能方面發揮著至關重要的作用。預計 0-201 尺寸外殼部分的銷售額在 2022 年將達到 26.3 億美元,這與高階智慧型手機小型化的趨勢完全一致。該領域的成長前景看好,2023-2028 年的複合年成長率為 19.07%,目標是到 2028 年實現 75.7 億美元的收入。外殼尺寸為 0 201 的 MLCC 是電容器製造中必不可少的微型組件,尤其是對於採用 4G 和 5G 技術的設備。

- 高階智慧型手機以高解析度顯示器、先進攝影機和 5G 連接等先進功能而聞名,依靠 0 201 MLCC 進行電源管理、雜訊抑制和訊號品質。雖然近年來高階智慧型手機的產量有所波動,但靈活的供應鏈至關重要,尤其是對於 0201 MLCC 等關鍵零件而言。消費性電子 MLCC 市場 0402 部分經歷強勁成長,反映了個人電腦、筆記型電腦和 Android 智慧型手機市場動態。 [3]

- 0 603 類別在個人電腦、筆記型電腦和智慧型手機中的電壓調節、濾波和訊號調節功能中起著至關重要的作用。適中的電容和尺寸使其適用於各種電子應用。該領域也與蘋果的 iOS 設備相吻合,後者以壽命長和品質優良而聞名。其他部分涵蓋的外殼尺寸包括 0 805、1 812、2 220、1 206、2 225 等。多功能電容器對於維持個人電腦、筆記型電腦和智慧型手機的系統穩定性以及提高設備效能至關重要。

亞太地區是成長最快的市場,複合年成長率為 16.09%

- 全球消費性電子MLCC市場分為四個主要區域:亞太地區、北美、歐洲和亞太其他地區。每個地區在塑造產業動態和成長前景方面都發揮關鍵作用。亞太地區是全球最大、成長最快的消費性電子產品市場,近年來經歷了顯著的成長。可支配收入增加、都市化快速發展和技術進步等因素正在推動對消費性電子產品的需求。中國、印度、日本和韓國等國家為該地區的市場擴張做出了重大貢獻。預計該地區在 2022 年至 2029 年期間的複合年成長率將達到驚人的 18.50%,顯示其具有持續擴張的潛力。

- 北美是一個成熟且成熟的消費性電子產品市場,具有普及率高、消費需求旺盛的特性。該地區的市場價值穩步成長,從 2017 年的 3.6209 億美元成長到 2029 年的 24.7 億美元。

- 歐洲是全球消費性電子產品領域的另一個重要參與者,其特點是擁有大量主要製造商和品牌。該地區的消費者傾向於選擇高品質、可靠的電子產品。此外,由於環境問題影響購買決策,人們對節能和永續產品的興趣日益濃厚。

- 世界其他地區包括各種新興市場,為消費性電子產品提供了巨大的未開發潛力。拉丁美洲、中東、非洲國家正逐步成為全球市場的主要企業。隨著這些地區經濟的發展和消費者收入的提高,對電子設備的需求顯著增加。

消費性電子學領域全球 MLCC 市場趨勢

由於個人可支配收入的增加,市場預計還會擴大。

- MLCC 因具有高電容值和高動作溫度能力而適合用於空調應用。它還可以提高您的空調系統的效率和可靠性。由於全球氣溫和濕度上升,以及空調作為實用產品而非奢侈品的接受度不斷提高,預計未來幾年空調產業將大幅成長。變頻空調、空調淨化技術等技術先進的空調也有望對空調市場產生正面影響。

- 空調(AC) 出貨量從 2021 年的 1.012 億台成長 3.46% 至 2022 年的 1.047 億台。住宅和商業領域對空調的需求增加可歸因於氣候變遷和全球氣溫上升的影響。生活水準的提高和可支配收入的增加使得個人和家庭越來越能負擔得起空調。

- 各個地區的都市化和人口成長也因對舒適度和改善室內空氣品質的需求而推動了對空調的需求。科技的進步帶來了節能、環保空調的出現,滿足了有環保意識的消費者的偏好。都市化導致高層建築建設的增加。這些建築需要空調來提供可接受的生活和工作條件,從而增加了對空調的需求。此外,政府鼓勵使用節能空調系統的措施也促進了市場的成長。

消費性電子產品用MLCC產業概況

消費性電子MLCC市場格局較為集中,前五大廠商合計佔65.31%的市佔率。市場的主要企業有:京瓷AVX元件株式會社(京瓷株式會社)、村田製作所、三星電機、太陽誘電和國巨株式會社(按字母順序排列)。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章執行摘要和主要發現

第2章 報告要約

第 3 章 簡介

- 研究假設和市場定義

- 研究範圍

- 調查方法

第4章 產業主要趨勢

- 消費性電子產品銷售

- 空調銷售

- 桌上型電腦銷售

- 遊戲機銷售

- HDD 和 SSD 銷售

- 筆記型電腦銷售

- 印表機銷售

- 冰箱銷售

- 智慧型手機銷量

- 智慧型手錶

- 平板電腦銷量

- 電視銷售

- 法律規範

- 價值鏈與通路分析

第5章 市場區隔

- 設備類型

- 空調

- 桌上型電腦

- 遊戲機

- HDD 和 SSD

- 筆記型電腦

- 印表機

- 冰箱

- 智慧型手機

- 智慧型手錶

- 藥片

- 電視機

- 其他

- 錶殼尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他

- 電壓

- 10V~30V

- 30V 或更高

- 小於10V

- 電容

- 10μF 至 100μF

- 小於10μF

- 100μF 以上

- 介電類型

- 1 類

- 2 級

- 地區

- 亞太地區

- 歐洲

- 北美洲

- 世界其他地區

第6章 競爭格局

- 主要策略趨勢

- 市場佔有率分析

- 業務狀況

- 公司簡介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第7章:執行長的關鍵策略問題

第 8 章 附錄

- 世界概況

- 概述

- 五力分析框架

- 全球價值鏈分析

- 市場動態(DRO)

- 資訊來源和進一步閱讀

- 圖片列表

- 關鍵見解

- 資料包

- 詞彙表

The Consumer Electronics MLCC Market size is estimated at 11.85 billion USD in 2024, and is expected to reach 28.38 billion USD by 2029, growing at a CAGR of 19.08% during the forecast period (2024-2029).

Case sizes are shaping the consumer electronics MLCC market

- In the global consumer electronics MLCC market, various case sizes, including 0 201, 0 402, 0 603, 1 005, and 1 210, play pivotal roles in ensuring optimal performance across devices. The 0 201 case size segment had revenue of USD 2.63 billion in 2022, which aligned perfectly with the trend of miniaturization in premium smartphones. The segment's growth prospects are promising, with a targeted revenue of USD 7.57 billion by 2028, registering a CAGR of 19.07% during 2023-2028. MLCC with case size 0 201 are compact components vital for capacitor manufacturing, especially in devices incorporating 4G and 5G technologies.

- Premium smartphones, known for their advanced features, including high-resolution displays, advanced cameras, and 5G connectivity, rely on 0 201 MLCCs for power management, noise suppression, and signal quality. Despite fluctuations in premium smartphone production in recent years, adaptable supply chains are essential, particularly for crucial components like 0 201 MLCCs. The 0 402 segment in the consumer electronics MLCC market experienced significant growth, reflecting changing dynamics in the PC, laptop, and Android smartphone markets. [3]

- The 0 603 category plays a crucial role in voltage regulation, filtering, and signal conditioning functions within PCs, laptops, and smartphones. Its moderate capacitance and size make it suitable for various electronic applications. This segment also aligns with Apple's iOS devices, known for their extended lifespans and premium quality. The others segment, encompassing case sizes such as 0 805, 1 812, 2 220, 1 206, and 2 225, and versatile capacitors are essential in maintaining system stability and enhancing device performance across PCs, laptops, and smartphones.

Asia-Pacific is the fastest-growing market with a CAGR of 16.09%

- The global consumer electronics MLCC market is segmented into four key regions: Asia-Pacific, North America, Europe, and the Rest of the World. Each region plays a significant role in shaping the industry's dynamics and growth prospects. Asia-Pacific is the largest and fastest-growing consumer electronics market, witnessing substantial growth in recent years. Factors such as rising disposable incomes, rapid urbanization, and technological advancements have fueled the demand for consumer electronics products. Countries like China, India, Japan, and South Korea are major contributors to the region's market expansion. The region's CAGR from 2022 to 2029 was recorded at an impressive 18.50%, showcasing the potential for sustained expansion.

- North America is a mature and well-established consumer electronics market characterized by high adoption rates and strong consumer demand. The region witnessed a steady increase in market value, starting at USD 362.09 million in 2017 and reaching USD 2.47 billion in 2029.

- Europe is another prominent player in the global consumer electronics landscape, featuring a robust presence of leading manufacturers and brands. The region's consumers show a preference for high-quality, reliable electronic devices. Moreover, there is a growing interest in energy-efficient and sustainable products, as environmental concerns influence purchasing decisions.

- The Rest of the World encompasses various emerging markets with significant untapped potential for consumer electronics. Countries in Latin America, the Middle East, and Africa are gradually becoming key players in the global market. As economies in these regions develop and consumer incomes rise, the demand for electronic devices is witnessing a notable increase.

Global Consumer Electronics MLCC Market Trends

The increasing disposable incomes of individuals are expected to encourage the uptake of the market

- MLCCs are suited for use in air conditioner applications because of their high capacitance values and high operating temperature capabilities. They can also lead to improving the AC system's efficiency and dependability. The AC industry is expected to grow significantly in the coming years due to the increasing global temperature and humidity levels and the growing acceptance of AC as a utility rather than a luxury product. Technologically advanced air conditioners such as AC with inverters and AC purification technologies are also expected to impact the air conditioner market positively.

- The air conditioner (AC) shipments increased by 3.46% from 101.20 million units in 2021 to 104.70 million units in 2022. The increasing demand for air conditioners in the residential and commercial sectors can be attributed to the impact of climate change and rising global temperatures. Improved living standards and higher disposable incomes have made air conditioners more affordable for individuals and families.

- Urbanization and population growth in various regions have also fueled the demand for air conditioners, driven by the need for improved comfort and indoor air quality. Technological advancements have resulted in the availability of energy-efficient and eco-friendly air conditioning options, catering to the preferences of environmentally conscious consumers. Urbanization has led to the construction of more high-rise buildings. As these buildings require air conditioning to provide acceptable living and working environments, this has increased demand for air conditioners. Additionally, government initiatives to encourage the usage of energy-efficient AC systems are contributing to the market's growth.

Consumer Electronics MLCC Industry Overview

The Consumer Electronics MLCC Market is fairly consolidated, with the top five companies occupying 65.31%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumer Electronics Sales

- 4.1.1 Air Conditioner Sales

- 4.1.2 Desktop PC's Sales

- 4.1.3 Gaming Console Sales

- 4.1.4 HDDs and SSDs Sales

- 4.1.5 Laptops Sales

- 4.1.6 Printers Sales

- 4.1.7 Refrigerator Sales

- 4.1.8 Smartphones Sales

- 4.1.9 Smartwatches Sales

- 4.1.10 Tablets Sales

- 4.1.11 Television Sales

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Device Type

- 5.1.1 Air Conditioner

- 5.1.2 Desktop PCs

- 5.1.3 Gaming Console

- 5.1.4 HDDs and SSDs

- 5.1.5 Laptops

- 5.1.6 Printers

- 5.1.7 Refrigerator

- 5.1.8 Smartphones

- 5.1.9 Smartwatches

- 5.1.10 Tablets

- 5.1.11 Television

- 5.1.12 Others

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 10V to 30V

- 5.3.2 Above 30V

- 5.3.3 Less than 10V

- 5.4 Capacitance

- 5.4.1 10 μF to 100 μF

- 5.4.2 Less than 10 μF

- 5.4.3 More than 100 μF

- 5.5 Dielectric Type

- 5.5.1 Class 1

- 5.5.2 Class 2

- 5.6 Region

- 5.6.1 Asia-Pacific

- 5.6.2 Europe

- 5.6.3 North America

- 5.6.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms