|

市場調查報告書

商品編碼

1549845

可重複使用食品服務包裝的全球市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Reusable Foodservice Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

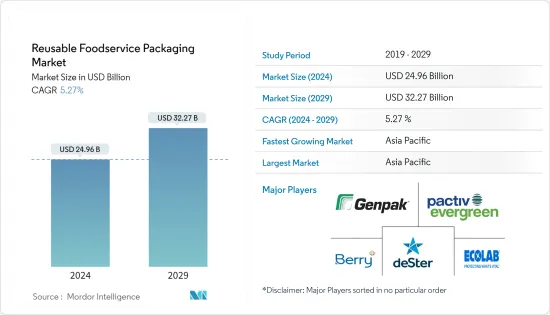

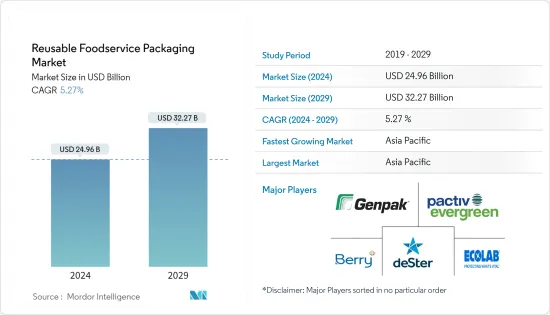

全球可重複使用食品服務包裝市場規模預計到 2024 年為 249.6 億美元,到 2029 年達到 322.7 億美元,在預測期內(2024-2029 年)複合年成長率為 5.27%。

由於對耐用和永續物料輸送解決方案的需求不斷成長,全球可重複使用包裝市場有望顯著成長。可回收包裝在永續性中發揮著至關重要的作用,並透過減少通常最終進入垃圾掩埋場的包裝廢棄物量而脫穎而出。

主要亮點

- 多樣化的城市景觀正在推動該國對方便、便攜和輕質食品的需求。近年來,即食食品和簡便食品已發展成為全球食品服務中最多樣化的領域之一。隨著環境問題的增加和垃圾掩埋場的掩埋廢物迅速增加,飯店、全方位服務餐廳 (FSR) 和快餐餐廳 (QSR) 正在使用可重複使用的食品服務包裝。

- 世界各地的多個政府機構對跨行業使用可重複使用包裝制定了嚴格的指導方針。例如,SUP指令要求歐盟成員國積極減少一次性塑膠廢棄物,並在地方和國家層級設定具體的減少目標。除了監管之外,這些國家還提倡使用可重複使用的食品包裝來實現這些目標。

- 在法國,最近的立法要求店內的所有餐點和輕食都採用可重複使用的包裝和餐具。

- 過去幾年,線上食品訂購和餐廳外送產業成長了 20%。隨著線上食品配送系統變得越來越流行,對永續食品服務包裝的需求也迅速增加。根據中國網際網路絡資訊中心2024年3月公佈的數據顯示,中國線上外送用戶數量將從2020年的41883萬增加到2023年的54454萬。這種成長促使製造商將注意力轉向環保、可重複使用的包裝解決方案。

- 然而,工業食品應用中塑膠包裝從一次性到可重複使用模式的轉變可能會帶來不可預見的挑戰,特別是在衛生和感知方面。重複使用塑膠包裝會帶來增加化學污染和食品中存在微塑膠顆粒的風險。此外,包裝產品的衛生標準和感知一致性可能會受到影響。

- 在全球範圍內,大公司正在擺脫傳統的「捕獲、包裝、丟棄」模式,轉向零廢棄物的生活方式。我們透過使其可重複使用來永續延長食品服務包裝的生命週期來實現這一目標。這種轉變不僅降低了與包裝相關的營運成本,而且還消除了不斷購買新包裝的需要。

可重複使用食品服務包裝的市場趨勢

對快餐店 (QSR) 的需求不斷成長推動市場發展

- 快餐店 (QSR) 注重服務速度並提供低成本的餐飲選擇。它們與傳統餐廳的不同之處在於,它們將餐桌服務降至最低限度並強調自助服務。在 QSR,您在享用食物和飲料之前先付款。在過去的十年中,多家國際快餐連鎖店以及提供各種美食以滿足不斷變化的消費者偏好的本土品牌不斷發展,特別是在這些國家的區域食品服務市場。

- 隨著環境永續性意識的不斷增強,一些主要的快餐連鎖店越來越關注可回收性、可堆肥性和可重複使用的包裝。漢堡王、麥當勞和溫蒂等知名公司都宣布了對可重複使用包裝的承諾。

- 例如,法國的麥當勞為用餐的顧客提供了21種可重複使用的容器。其中包括裝炸薯條的紅色塑膠容器、透明塑膠飲水杯和裝雞塊的白色塑膠杯。

- 專利權模式對於快餐連鎖店的崛起至關重要,預計將推動全球未來市場的成長。國際專利權協會公佈的資料顯示,截至 2024 年 4 月,美國快餐店數量在過去幾年中穩步成長,在 COVID-19 大流行期間略有下降後,2020 年門市數量有所增加。人增至2023 年195,510 人。值得注意的是,估計表明,在預測期內,美國各地的快餐店數量預計將進一步增加。

- 此外,由於人們越來越偏好外出用餐,導致食品成本不斷上漲,這推動了對快餐的需求,並推動了對可重複使用的食品服務包裝的需求。根據英國國家統計局的數據,在疫情後時期,英國餐廳和咖啡館的消費者支出激增至 1,328.9 億英鎊(1,695 億美元)。預計支出的增加將對市場產生正面影響。

- 千禧世代,尤其是 Z 世代現在正在積極尋找與其核心價值產生共鳴的品牌和場所。整體而言,速食店可以透過積極宣傳消費者的價值觀來滿足消費者對透明度和信任的需求。這可以透過籌款活動和促銷活動等以永續來源的成分和可回收和可重複使用的包裝為特色的舉措來實現。

預計亞太地區在預測期內將佔據主要市場佔有率

- 亞太地區是中國和印度等人口稠密的新興經濟體的所在地,這些國家對食品服務的需求正在迅速成長。市場受到對便利性需求激增的推動,轉向更健康的飲食選擇,導致永續包裝的採用顯著增加,預計在預測期內將達到頂峰。這些趨勢有望將該地區轉變為技術創新和業務成長的中心。

- 該地區對行動食品服務站的需求正在迅速成長。這一成長的主要驅動力是都市化的加速、生活方式的日益忙碌以及人們對外出就餐的渴望不斷成長。

- 例如,2023 年 6 月,香港一家由學生主導的食品服務新興企業推出了可重複使用碗的環保租賃服務。 11 家餐廳和 300 名註冊用戶參與了這項創新舉措。這些區域性運動預計將提高餐飲業對可重複使用產品包裝的認知。

- 亞太地區塑膠污染的迅速上升正促使該地區各國政府實施旨在減少塑膠廢棄物和推廣永續包裝解決方案的政策。 2022年,印度政府在包括食品服務業在內的多個行業禁止使用一次性塑膠,加速了全國對多用途包裝產品的需求。

- 此外,隨著勞動力的成長和忙碌的生活方式,日本、中國、印度和印尼等國家的消費者外出用餐支出正在增加。例如,根據內務部/統計局 2024 年 2 月發布的報告,日本家庭每年平均外出用餐支出將從 2021 年的 8,110 日圓(51 美元)增加到 2023 年,僅用三年時間幾年來,它迅速上漲至11,110 日圓(70 美元)。

可重複使用的食品服務包裝產業概述

研究的市場是分散的,大型供應商控制著大部分市場佔有率。市場上許多公司的存在會影響服務的定價,並且是一個直接的競爭因素,特別是對於較小的供應商。受調查的市場中的供應商可能會專注於提供一站式服務,以獲得競爭優勢。該市場的主要參與者包括 Berry Global Inc.、Ecolab Services、Genpak LLC 和 Enpak Enterprise。

- 2024 年 2 月:Berry Global 推出一系列可重複使用的餐具,以滿足食品服務業對永續包裝不斷成長的需求。這項措施訂定之際,立法和消費者需求正在推動該產業轉向更環保的包裝解決方案。根據該公司食品服務副總裁介紹,新系列可重複使用餐具旨在減少廢棄物、減少對新資源的依賴,並在滿足法律標準的同時確保功能性和耐用性。

- 2024 年 5 月:服務用品和食品包裝開發商 deSter 與特種材料公司 Eastman 合作,向航空公司推出可重複使用的機上飲料器具。包裝採用 Tritan Renew,這是一種由回收分子共聚酯製成的特殊塑膠。該材料在部署過程中將塑膠廢棄物分解為其基本化學成分,從而實現多次回收循環。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估近期地緣政治情境對產業的影響

- 在當前場景下可重複使用和一次性使用的安全解決方案

第5章市場動態

- 市場促進因素

- 對線上食品宅配服務的需求不斷成長

- 人們對環境永續性的認知不斷增強,對一次性塑膠包裝的嚴格規定

- 市場限制因素

- 重複使用塑膠包裝的意外後果和健康問題

第6章 市場細分

- 依材料類型

- 金屬

- 塑膠

- 玻璃

- 其他材料類型

- 依產品類型

- 紙板和紙箱

- 瓶子和玻璃

- 托盤、盤子、食品容器、碗

- 杯子和蓋子

- 翻蓋式

- 其他產品類型

- 按最終用戶產業

- 速食店 (QSR)

- 全方位服務餐廳 (FSR)

- 機構

- 款待

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Berry Global Inc.

- Ecolab services

- deSter Corporation

- Genpak LLC

- Pactiv Evergreen Inc.

- Limepack

- Re:Dish Co.

- Verive

- Evergreen Packaging

- Enpak Enterprise Co. Ltd

第8章投資分析

第9章 市場機會及未來趨勢

The Reusable Foodservice Packaging Market size is estimated at USD 24.96 billion in 2024, and is expected to reach USD 32.27 billion by 2029, growing at a CAGR of 5.27% during the forecast period (2024-2029).

The global reusable packaging market is set for significant growth, fueled by a rising need for durable and sustainable material handling solutions. Returnable packaging stands out for its pivotal role in sustainability, curbing the volume of packaging waste that typically ends up in landfills.

Key Highlights

- A diverse urban landscape drives the country's demand for convenient, on-the-go, lightweight foods. In recent years, ready-to-eat and convenient food has evolved into one of the most diverse segments of the global food service, with rising concern about the environment and the escalation in packaging landfills, reusable food service packaging in hotels, full-service restaurants (FSRs), and quick-service restaurants (QSRs).

- Several government bodies worldwide impose strict guidelines for using reusable packaging across sectors. For instance, the SUP Directive mandates that EU Member States actively reduce single-use plastic waste, setting specific reduction targets at local and national levels. In tandem with restrictions, these states are advocating for reusable food packaging to achieve these goals.

- In France, recent legislation mandates that all on-site meals or snacks be consumed using reusable packaging or crockery.

- Over the past few years, the online food ordering and restaurant delivery sector has grown by 20%. As the online food delivery system gains traction, there is a corresponding surge in demand for sustainable food service packaging. As per the China Internet Network Information Center publication in March 2024, the number of online food delivery users in China rose from 418.83 million in 2020 to a whopping 544.54 million in 2023. This uptick is prompting manufacturers to pivot toward eco-friendly reusable packaging solutions.

- However, transitioning from a single-use to a reuse model for plastic packaging in industrial food applications can introduce unforeseen challenges, particularly in hygiene and sensory perception. Reusing plastic packaging carries the risk of heightening chemical contamination and the presence of microplastic particles in food products. Additionally, it may compromise the packaged goods' hygienic standards and sensory consistency.

- Globally, large companies are shifting from the traditional 'catch, fill, and waste' model to a zero-waste lifestyle. They achieve this by making foodservice packaging reusable, thus extending its lifecycle sustainably. This shift not only cuts down on operational costs tied to packaging but also eliminates the need for continual new packaging purchases.

Key Highlights

Reusable Foodservice Packaging Market Trends

Growing Demand From Quick-service Restaurants (QSR) Aids the Market

- Quick-service restaurants (QSRs) offer low-cost food options, focusing on speed of service. Minimal table service and an emphasis on self-service distinguish this group from traditional restaurants. Food and beverages are paid for before consumption at QSRs. Over the last decade, the regional foodservice market, specifically for these countries, has witnessed the growth of several international QSR chains and home-grown brands offering varied cuisines suiting changing consumer preferences.

- With rising awareness of environmental sustainability, several major QSR chains are increasingly focusing on recyclability, compostability, and reusable packaging. Notable players, including Burger King, McDonald's, and Wendy's, have pledged to adopt reusable packaging.

- For instance, McDonald's in France offers 21 reusable containers for dine-in customers. These include red plastic containers for fries, clear plastic beverage glasses, and white plastic cups designed for chicken nuggets.

- The franchise model will be crucial to the rise of QSR chains, which is expected to fuel market growth across the globe in the upcoming period. According to the data published by the International Franchise Association, in April 2024, after a slight downfall during the COVID-19 pandemic, the number of QSR in the United States rose steadily in the past few years from 183.54 thousand in 2020 to 195.51 thousand in 2023. Notably, as per the estimates, the number of QSRs across the country is expected to further improve during the forecast period.

- Further, increased spending on food, driven by a rising preference for on-the-go eating, has bolstered the demand for QSRs, fueling the need for reusable food service packaging. As per the Office for National Statistics (United Kingdom), consumer spending on restaurants and cafes in the United Kingdom skyrocketed in the post-pandemic period to GBP 132.89 billion (USD 169.50 billion). This bolstered spending is expected to consequently impact the market positively.

- Presently, millennials and Gen Z, in particular, actively seek out brands and places that resonate with their core values. Overall, QSRs can align with consumer demands for transparency and authenticity by actively showcasing their values. This can be achieved through initiatives like fundraisers and promotions, which feature sustainably sourced ingredients and recyclable and reusable packaging.

Asia-Pacific is Expected to Hold a Significant Market Share During the Forecast Period

- Asia-Pacific is home to densely populated and emerging economies such as China and India, and the demand for food services is surging. The market is propelled by a surge in demand for convenience, a pivot toward healthier dietary choices, and consequently, a notable uptick in adopting sustainable packaging is projected to peak during the forecast period. These trends transform the region into a technological innovation and business growth center.

- The region is witnessing a rapid surge in the demand for mobile food service stations. This uptick is primarily driven by escalating urbanization, increasingly busy lifestyles, and a heightened appetite for on-the-go dining.

- For instance, in June 2023, a Hong Kong student-led food service start-up introduced an eco-friendly rental service for reusable bowls. Eleven restaurants with 300 registered users have joined this innovative initiative. Such regional developments would bolster the awareness of reusable product packaging in the foodservice sector.

- The surge in plastic pollution in Asia-Pacific has prompted governments across the region to implement policies that aim to reduce plastic waste and promote sustainable packaging solutions. In 2022, the Government of India introduced a ban on single-use plastic in several sectors, including food service, thereby accelerating the demand for multiple-use packaging products across the country.

- Further, with the growing working population and busy lifestyles, consumer spending on eating outside is also increasing in countries like Japan, China, India, and Indonesia. For instance, according to the Ministry of Internal Affairs and Communications (Japan) and Statistics Bureau of Japan's report published in February 2024, the annual average household expenditure on dining out in Japan increased rapidly from JPY 8.11 thousand (USD 0.051 thousand) in 2021 to JPY 11.11 (USD 0.070 thousand) in just three years ending 2023.

Reusable Foodservice Packaging Industry Overview

The market studied is fragmented, with major vendors accounting for most of the market share. The presence of many players in the market impacts the pricing of services, making it a direct competing factor, especially for small-scale vendors. The vendors in the market studied are expected to focus on providing one-stop-shop services, giving them a competitive advantage. Some of the major players in the market are Berry Global Inc., Ecolab Services, Genpak LLC, and Enpak Enterprise Co. Ltd.

- February 2024: Berry Global launched its Reusable Tableware Range to address the incremental demand for sustainable packaging across the food service industry. This move comes as legislation and consumer demands push the sector towards more eco-friendly packaging solutions. According to the company's Vice President of Food Service division, the new range of reusable tableware aims to cut waste, lessen reliance on new resources, and ensure functionality and durability while meeting legislative standards.

- May 2024: deSter, a developer of serviceware and food packaging, and Eastman, a specialty materials company, collaborated to introduce reusable in-flight drinkware to the airline sector. The packaging utilizes Tritan Renew, a specialty plastic crafted from recycled molecular copolyester. During its development, plastic waste is broken down into its fundamental chemical components, enabling the material to undergo multiple recycling cycles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of Recent Geopolitical Scenario on the Industry

- 4.5 Reusable vs Single-user Safer Solution in Current Scenario

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand In Online Food Delivery Service

- 5.1.2 Incremental Awareness For Environmental Sustainability and Stringent Regulations Against Single-Use Plastic Packaging

- 5.2 Market Restraints

- 5.2.1 Unforeseen Consequences of Reusing Plastic Packaging and Health Related Concerns

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.1.3 Glass

- 6.1.4 Other Material Types

- 6.2 By Product Type

- 6.2.1 Corrugated Boxes And Cartons

- 6.2.2 Bottles and Glasses

- 6.2.3 Trays, Plates, Food Containers, and Bowls

- 6.2.4 Cups And Lids

- 6.2.5 Clamshells

- 6.2.6 Other Product Types

- 6.3 By End-user Industry

- 6.3.1 Quick-service Restaurants (QSR)

- 6.3.2 Full-service Restaurants (FSR)

- 6.3.3 Institutional

- 6.3.4 Hospitality

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 Saudi Arabia

- 6.4.5.2 United Arab Emirates

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Berry Global Inc.

- 7.1.2 Ecolab services

- 7.1.3 deSter Corporation

- 7.1.4 Genpak LLC

- 7.1.5 Pactiv Evergreen Inc.

- 7.1.6 Limepack

- 7.1.7 Re:Dish Co.

- 7.1.8 Verive

- 7.1.9 Evergreen Packaging

- 7.1.10 Enpak Enterprise Co. Ltd