|

市場調查報告書

商品編碼

1549956

汽車保固管理:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Warranty Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

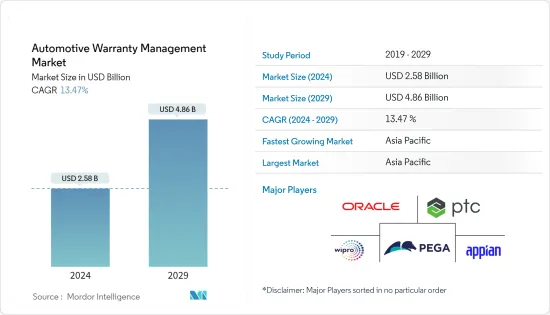

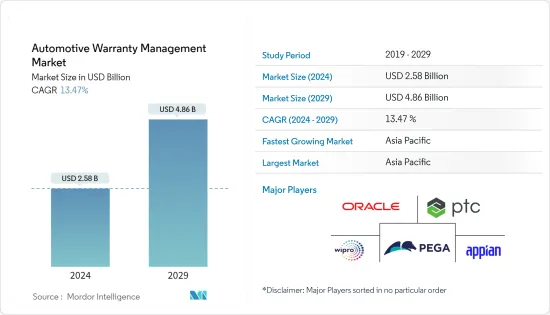

汽車保固管理市場規模預計到 2024 年為 25.8 億美元,預計到 2029 年將達到 48.6 億美元,在預測期內(2024-2029 年)複合年成長率為 13.47%。

汽車產業產量的增加是推動市場的關鍵因素,因為汽車和供應鏈產業在保證軟體的採用中佔據最大佔有率。此外,消費者採用連網型汽車的趨勢也預計將影響全球汽車需求並推動市場。

如今,OEM在保固管理方面的主要關注點是遵守其政策和程序,確保按時進行維修,並保持車輛品質和可靠性。但實現成本節約同樣重要。因此,OEM擴大採用保固管理解決方案,以提高盈利、提高客戶滿意度並保持競爭優勢。

汽車公司不斷努力提高產品質量,以降低保固成本、提高客戶滿意度並增強財務績效。然而,品質往往受到新產品需求快速成長、競爭加劇、技術進步和供應鏈中斷等因素的影響。平均而言,汽車和工業公司的保固索賠成本佔年銷售額的 1.5% 至 2.5%,導致收益大幅損失並降低客戶滿意度。公司經常加快保固服務和零件更換,以緩解這些挑戰,從而保持客戶忠誠度。考慮到這些挑戰,汽車製造商必須將人工智慧 (AI) 和機器學習 (ML) 等技術整合到傳統的保固管理系統中。

作為回應,一些市場參與者正在實施基於人工智慧和機器學習的解決方案。例如,2023 年 8 月,總部位於加利福尼亞州、為汽車行業提供人工智慧和決策分析解決方案的軟體公司 FrogData 推出了一家旨在最佳化經銷商保固申請流程的軟體公司,並宣布推出 WarrantyMind AI。到端的遠端保固管理服務。

然而,這些解決方案處理敏感的客戶和車輛資料,使得安全漏洞對於品牌聲譽和客戶信任至關重要。因此,資料和身分盜竊挑戰正在阻礙市場成長,需要投資網路安全措施來保護資料。

COVID-19 大流行期間,全球汽車保固管理市場面臨挑戰與機會。封鎖和供應鏈中斷導致零件短缺和維修延誤,造成保固申請積壓,並使保固管理系統緊張。此外,這場危機凸顯了資料主導決策的價值,以及對具有資料分析功能的汽車保固系統的需求,以識別趨勢並提高服務中心效率。

汽車保固管理市場趨勢

雲端基礎的保固管理系統預計將顯著推動市場成長

由於 COVID-19 大流行,雲端基礎的保固管理解決方案促進了遠端工作,並確保保固團隊在鎖定期間持續存取資料。這些雲端採用趨勢預計將在疫情後繼續下去,推動汽車產業採用雲端基礎的保固管理解決方案。

汽車行業擴大採用雲端技術有很多好處,包括可擴展性、節省成本以及改善全球團隊、設計師和製造部門的協作,以即時存取和共用資料。開發。這些優勢預計將進一步推動雲端基礎的保固管理解決方案的採用。

汽車產業的產業雲採用率正在上升,為企業提供了重組價值鏈的機會。一個著名的例子是德國汽車製造商大眾汽車,它與 AWS 和保時捷旗下的 IT 顧問 MHP 合作,於 2023 年 6 月建立了專門針對汽車製造的產業雲。雲端採用的成長預計將在未來幾年推動對雲端基礎的汽車保固管理解決方案的需求。

此外,包括汽車在內的整個製造業快速採用雲端服務,預計將推動採用已建立的雲端基礎設施的雲端基礎的保固管理解決方案。例如,根據內務部,日本製造企業使用雲端服務的比例將從 2022 年的 71.6% 上升到 2023 年的 79.2%。

亞太地區預計將創下最高成長率

亞太地區正在推動全球汽車產業的成長,中國、印度、日本和韓國等國家的汽車銷售量大幅成長。這種快速成長,尤其是配備先進功能和電子設備的新型車輛,需要更複雜的保固管理和複雜的系統來處理日益複雜的保固申請。

根據國際汽車工業協會(OICA)統計,2023年包括中東在內的亞太地區乘用車銷量約4,260萬輛,其中中國銷量超過2,600萬輛。同時,2022 年亞太地區乘用車銷量約 3,750 萬輛。汽車銷售的成長給製造商和經銷商帶來了維護保固記錄和改善客戶體驗的挑戰。

不斷變化的客戶期望和更長的保固期正在推動市場成長。該地區的消費者越來越精通技術,並要求無縫的保固體驗。這包括高效的索賠處理、透明的溝通以及線上查詢保固資訊。因此,汽車製造商正在推出延長保固選項以保持競爭力,從而推動對支援更長索賠期限的高級保固管理解決方案的需求。

此外,由於維修成本和零件價格上漲,汽車製造商和經銷商正面臨售後服務利潤的壓力。實施保固管理系統有助於簡化流程、降低管理成本並識別詐欺索賠。因此,汽車製造商和經銷商越來越注重降低成本和提高業務效率,從而擴大採用汽車保固管理解決方案。

汽車保固管理產業概述

汽車保固管理市場的整合程度較低,只有少數市場參與者擁有較大的市場佔有率。擁有重要市場佔有率的領先公司正致力於透過合作、擴張和併購等策略措施擴大其全球基本客群,以獲得有競爭力的市場佔有率。

2024 年 6 月 - 服務生命週期管理解決方案提供商 Tavant 與北美重型卡車製造商和中型卡車和特種商用車生產商戴姆勒卡車北美有限責任公司合作,共同改善客戶體驗和經銷商生產力。建立合作夥伴關係,以改造戴姆勒卡車的服務業務。此次合作是戴姆勒卡車集團與 Tavant 長期全球技術合作關係的延伸。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業相關人員分析

- 宏觀經濟趨勢的影響(經濟衰退、俄羅斯-烏克蘭戰爭等)

第5章市場動態

- 市場促進因素

- 引進人工智慧、機器學習、物聯網和巨量資料等技術

- 市場整合與訂閱模式

- 保險申請管理自動化和節省時間的需求日益增加

- 市場挑戰

- 資料和身份盜竊/資料洩露

第6章 市場細分

- 按服務

- 軟體

- 服務

- 按配置

- 本地

- 雲端基礎

- 按組織規模

- 中小企業 (SME)

- 主要企業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Oracle Corporation

- PTC Inc.

- Wipro Limited

- Appian Corporation

- Pegasystems Inc.

- MSX International

- Annata

- SKYLYZE

- IFS Americas Inc.

- SYNCRON HOLDING AB

第8章投資分析

第9章 市場未來展望

The Automotive Warranty Management Market size is estimated at USD 2.58 billion in 2024, and is expected to reach USD 4.86 billion by 2029, growing at a CAGR of 13.47% during the forecast period (2024-2029).

The growing production in the automotive sector is a significant factor driving the market, as the automotive and supply chain industries account for the largest share in the adoption of warranty software. Moreover, the consumer propensity toward adopting connected vehicles is also expected to influence the global demand for automobiles, thereby driving the market.

Nowadays, the primary focus of OEMs when it comes to warranty management is compliance with their policies and procedures, ensuring repairs are performed as prescribed and maintaining the quality and reliability of their vehicles. However, achieving cost savings is equally important for them. Thus, the adoption of warranty management solutions among OEMs is growing to improve profitability, enhance customer satisfaction, and remain competitive.

Automotive companies are constantly striving to boost product quality, aiming to reduce warranty costs, elevate customer satisfaction, and bolster financial performance. However, the quality is frequently hampered by factors like surging new product demands, heightened competition, technological advancements, and disruptions in the supply chain. On average, automotive and industrial firms witness warranty claims expenses between 1.5-2.5% of their annual revenue, translating to significant revenue losses and poor customer satisfaction. Companies frequently expedite warranty services and part replacements to mitigate these challenges to uphold customer loyalty. Given these challenges, it becomes imperative for automakers to integrate technologies like artificial intelligence (AI) and machine learning (ML) into their traditional warranty management systems.

In response, some market players are introducing AI- and ML-based solutions. For instance, in August 2023, FrogData, a software company based in California that offers artificial intelligence and decision analytics solutions to the automotive industry, introduced WarrantyMind AI, an end-to-end remote warranty administration service designed to optimize the warranty claims process for dealerships.

However, as these solutions handle sensitive customer and vehicle data, security breaches become essential to brand reputation and customer trust. Thus, data and identity theft challenges are hampering market growth, necessitating investment in cybersecurity measures to protect data.

The global automotive warranty management market faced challenges as well as opportunities amid the COVID-19 pandemic. Lockdowns and supply chain disruptions led to a shortage of parts and delays in repair, creating a backlog of warranty claims that strained warranty management systems. Moreover, the crisis underscored the value of data-driven decisions, highlighting the demand for automotive warranty systems equipped with data analytics capabilities to identify trends and enhance service center efficiency.

Automotive Warranty Management Market Trends

Cloud-based Warranty Management Systems is Expected to Drive Market Growth Significantly

As a result of the COVID-19 pandemic, the cloud-based warranty management solutions facilitated remote work and ensured continued access to data for warranty teams during lockdowns. This trend toward cloud adoption is expected to continue post-pandemic, driving the adoption of cloud-based warranty management solutions in the automotive industry.

The growing adoption of the cloud in the automotive industry, owing to several benefits such as scalability, reduced costs, and improved collaboration between globally located teams, designers, and manufacturing units to access and share data in real time, is driving innovation and faster product development cycles. Such advantages are further expected to drive the adoption of cloud-based warranty management solutions.

The adoption of industry cloud in the automotive sector is on the rise, offering enterprises an opportunity to reconstruct their value chains. A notable example is Volkswagen, the German automaker that collaborated with AWS and MHP, an IT consultant under Porsche, to establish its industry cloud tailored for automobile manufacturing in June 2023. These advancements in cloud adoption are anticipated to drive the demand for cloud-based automotive warranty management solutions in the coming years.

Furthermore, the rapidly growing adoption of cloud services across the manufacturing industries, including automotive, is expected to support the adoption of cloud-based warranty management solutions with established cloud infrastructure. For instance, according to the Ministry of Internal Affairs and Communications Japan, the share of manufacturing companies in Japan that use cloud services reached 79.2% in 2023 from 71.6% in 2022.

Asia-Pacific is Expected to Register the Highest Growth Rate

Asia-Pacific leads the global automobile industry in growth, driven by countries such as China, India, Japan, and South Korea, witnessing a significant surge in vehicle sales. This surge has resulted in a larger pool of vehicles, particularly modern cars equipped with advanced features and electronics, necessitating more intricate warranty management and sophisticated systems to handle the rising complexity of warranty claims.

According to the International Organization of Motor Vehicle Manufacturers (OICA), in 2023, about 42.6 million passenger cars were sold within Asia-Pacific, including the Middle East, of which over 26 million were sold in China. Comparatively, approximately 37.5 million passenger cars were sold in Asia-Pacific in 2022. This rise in vehicle sales challenges manufacturers and dealers to maintain warranty records and enhance customer experience.

Evolving customer expectations and longer warranty durations are bolstering market growth. Consumers in the region are becoming increasingly tech-savvy, so they now demand a seamless warranty experience. This includes efficient claim processing, transparent communication, and online access to warranty information. Consequently, automakers are rolling out extended warranty options to stay competitive, driving the demand for advanced warranty management solutions to handle these longer claim lifespans.

In addition, automakers and dealers are experiencing pressure on after-sales margins due to rising repair costs and parts prices. Implementing warranty management systems is helping them streamline processes, reduce administrative costs, and identify fraudulent claims. Thus, automakers and dealers are increasingly focusing on cost reduction and operational efficiency, leading to increased adoption of automotive warranty management solutions.

Automotive Warranty Management Industry Overview

The automotive warranty management market is moderately consolidated, with few market players holding significant market share. The major players with prominent shares in the market are focusing on expanding their global customer base through strategic initiatives such as collaboration, expansion, mergers & acquisitions, and others to gain competitive market share.

June 2024 - Tavant, a provider of Service Lifecycle Management solutions, and Daimler Truck North America LLC, the heavy-duty truck manufacturer in North America and a producer of medium-duty trucks and specialized commercial vehicles, formed a partnership to transform Daimler Truck's service operations to enhance customer experience and dealer productivity. This partnership marks the expansion of a longer global technology partnership between Daimler Truck Group and Tavant.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Stakeholder Analysis

- 4.4 Impact of Macroeconomic Trends (Recession, Russia-Ukraine war, etc.)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Implementation of Technologies Such as AI, ML, IoT and Big Data

- 5.1.2 Market Consolidation and Subscription-based Model

- 5.1.3 Rising Automation and Need for Hassle-free Claim Management

- 5.2 Market Challenges

- 5.2.1 Data and Identity Theft/Data Breaches

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Software

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On Premise

- 6.2.2 Cloud-based

- 6.3 By Organization Size

- 6.3.1 Small and Medium Enterprises (SMEs)

- 6.3.2 Large Enterprises

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Oracle Corporation

- 7.1.2 PTC Inc.

- 7.1.3 Wipro Limited

- 7.1.4 Appian Corporation

- 7.1.5 Pegasystems Inc.

- 7.1.6 MSX International

- 7.1.7 Annata

- 7.1.8 SKYLYZE

- 7.1.9 IFS Americas Inc.

- 7.1.10 SYNCRON HOLDING AB