|

市場調查報告書

商品編碼

1630205

保固管理系統:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Warranty Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

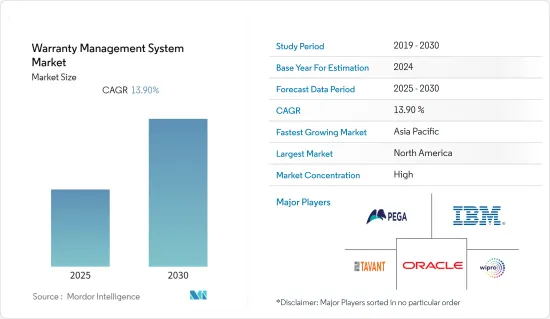

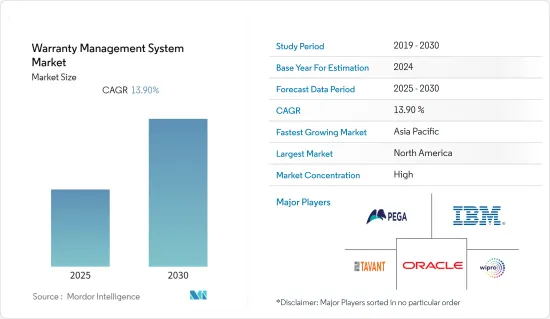

保固管理系統市場預計在預測期內複合年成長率為 13.9%。

主要亮點

- 保固管理系統透過自動化保固索賠處理和裝置量資產追蹤,幫助服務提供者在整個生命週期中設計、管理、追蹤和處理保固、索賠和資產。創新的保固管理系統 (WMS) 與人工智慧和機器學習功能相結合,確保客戶滿意度。

- 透過保固索賠處理和裝置量資產追蹤的自動化,保固管理解決方案主要使服務組織能夠在整個生命週期中建立、管理、追蹤和處理保固、索賠和資產。

- 因此,第三方可以提交有效的索賠並獲得積分。此外,客戶服務可以審查保固並啟動恢復,現場技術人員可以追蹤資產歷史記錄並更換保固期內的零件。這些解決方案最大限度地降低保固成本、自動化保固索賠、簡化保固管理系統並最大限度地提高業務收益。該軟體使所有相關人員受益,包括製造商、服務提供者、供應商、經銷商和最終用戶。因此,它們在世界各地的各個最終用戶產業中都有很大的需求。

- 現代保固管理系統 (WMS) 融合了先進技術、機器學習 (ML) 和人工智慧 (AI) 功能,可提高客戶滿意度。因此,由於人工智慧和機器學習的發展,保固生命週期管理系統在評估期間顯示出強勁的成長。基於人工智慧的系統採用影像識別來快速、經濟地識別詐欺索賠。機器學習演算法經過數萬張照片的訓練,可以從 Photoshop 圖像和舊投訴中識別出真正的問題。

- 汽車產業的產量擴張是推動市場成長的關鍵因素,因為汽車和供應鏈產業在保固軟體的採用中佔據最大佔有率。此外,消費者採用連網汽車的趨勢也預計將影響全球汽車需求並推動市場。

- COVID-19 大流行嚴重影響了保固管理系統市場的成長,因為許多國家的製造業務暫時停止以遏制病毒。結果,消費性電子產品的產量減少,而市場對保固管理系統的需求增加。然而,隨著新冠肺炎 (COVID-19) 的爆發,整個全部區域向自動化技術的轉變變得明顯。上述巨大的採用優勢正在吸引客戶廣泛採用由人工智慧和機器學習驅動的自動化保固管理系統,從而促進市場成長。

保固管理系統的市場趨勢

雲端業務預計將佔據很大佔有率

- 在雲端上實施保固管理系統可提供高擴充性、靈活性以及具有定義權限的共用功能。公司正在利用這個機會滲透市場,並分析市場在預測期內會擴大。

- 構成物聯網 (IoT) 的連接/智慧型裝置和感測器的激增,以及各種機器對機器 (M2M)通訊網路產生的元資料量,正在使保固索賠流程智慧更新和它有潛力為製造商提供交付客戶體驗所需的新層次的洞察力。

- 隨著工業 4.0 和物聯網 (IIoT) 等概念推動全球製造業的進步,服務供應商在預測期內擁有巨大的業務擴展機會。製造業中各種技術的融合,例如預測分析、巨量資料、雲端運算、數位雙胞胎和智慧工廠,也可能推動雲端基礎的保固管理系統的採用。

- 雲端基礎的物聯網平台可讓您根據收集的資料採取行動,包括預測建模、模擬、測試假設和彙報。該行業的領先企業正在提供雲端基礎的解決方案,這可能會促進預測期內的市場成長。

- 此外,公司正在積極投資各行業的雲端運算,預計這將對預測期內的市場成長產生積極影響。例如,根據Platform9的報告,到2022年,單一公共雲端(32.1%)、混合雲端(29.8%)和本地雲(14.1%)將成為企業運行工作負載的主要環境。

北美佔有很大的市場佔有率

- 就大規模最終用戶採用保固管理系統而言,北美是領先市場之一。由於中小型企業資料安全意識的增強,該地區也正在經歷健康成長。此外,該地區主要市場供應商的存在和持續的技術創新正在增加對保固管理系統的需求。

- 該地區保固管理系統市場成長的主要趨勢包括智慧型設備的興起和智慧住宅的採用增加,包括音訊和視訊設備、穿戴式裝置和智慧家庭設備,預計將促進保固管理的採用提供客戶體驗的解決方案。

- 因此,數位服務和技術進步的激增,加上雲端運算、人工智慧、物聯網和機器學習等新興技術在各個領域的早期採用,正在補充該地區的市場成長。該地區的保固管理公司還在整個保固流程中利用資料分析和人工智慧,透過識別缺陷模式、改善索賠審查和端到端管理供應商扣回爭議帳款來提高產品品質。

- 此外,該地區還在保固管理系統方面進行了大量投資和技術進步。零售業保固管理系統的引進也在取得進展。有組織的零售業正在發生巨大轉變,透過分析應用來改善客戶的行為體驗。

保固管理系統產業概況

保固管理系統市場適度整合,少數市場參與者佔了重要的市場佔有率。在這個市場上擁有大量佔有率的主要公司正在專注於擴大海外基本客群。公司正在利用戰略合作計劃來增加市場佔有率和盈利。

2022 年 11 月,數位產品和解決方案公司、服務生命週期管理的全球領導者之一 Tabant 將與全球最大的商用車製造商之一戴姆勒卡車股份公司 (DTAG) 合作開發其歐洲品牌。它將提供保固和索賠管理解決方案

2022 年 5 月,Opteven 將透過為 WMS 經銷商和維修商創建一個高度可訪問且市場領先的線上索賠平台,推動 WMS Group (UK) Ltd (WMS) 雄心勃勃的業務轉型和轉型策略。該平台旨在大幅簡化和加快保固索賠流程。新平台減少了管理時間,同時提供全面且卓越的客戶服務體驗。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 製造和汽車行業擴大採用保固管理系統

- 在下一代保固管理系統中更多地採用人工智慧和機器學習功能,以確保客戶滿意度

- 市場限制因素

- 價格敏感市場中獨立服務供應商之間的激烈競爭

第6章 市場細分

- 依部署類型

- 本地

- 雲

- 依軟體類型

- 保障情報

- 理賠管理

- 服務合約

- 合約管理

- 按成分

- 解決方案

- 服務(專業服務、主機服務)

- 按最終用戶產業

- 工業設備(重型機械/機器)

- 汽車/運輸設備

- 耐用消費品(主要住宅設備、空調系統)

- 建築/建築材料

- 其他最終用戶產業(醫療設備、航太和國防等)

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Pegasystems Inc.

- Oracle Corporation

- Wipro Limited

- IBM Corporation

- Tavant

- Tech Mahindra Limited

- Evia Information Systems Pvt Ltd

- PTC Inc.

- IFS Americas Inc.

- Syncron AB

第8章投資分析

第9章市場的未來

The Warranty Management System Market is expected to register a CAGR of 13.9% during the forecast period.

Key Highlights

- The warranty management system helps service businesses to design, administer, track, and process warranties, claims, and assets through their lifecycles through the automation of warranty claim handling and installed base asset tracking. Innovative warranty management systems (WMS) are linked with AI and machine learning capabilities to guarantee customer satisfaction.

- Through the automation of warranty claim handling and installed base asset tracking, warranty management solutions primarily enable service organizations to create, administer, track, and process warranties, claims, and assets through their full lifecycles.

- As a result, third parties can submit their valid claims and receive credits. Customer service can also verify the coverage and initiate recovery, and field technicians can track asset history and replace the in-warranty parts. These solutions reduce the warranty cost to a minimum, automate warranty claims, streamline the warranty management system, and increase service revenue to the maximum. This software benefits all stakeholders, including manufacturers, service providers, suppliers, dealers, and end-users. This has resulted in significant demand in various end-user industries across the world.

- Modern warranty management systems (WMS) incorporate advanced technologies, machine learning (ML), and artificial intelligence (AI) capabilities to enhance customer satisfaction. As a result, warranty lifecycle management systems have shown strong growth during the assessment period because of AI and ML developments. AI-based systems employ image recognition to quickly and economically identify fraudulent claims. Machine learning algorithms are trained using tens of thousands of photographs, and they can identify actual problems with photoshopped images or old claims.

- The growing production in the automotive sector is a significant factor driving the market growth, as the automotive and supply chain industries account for the largest share in the adoption of warranty software. Moreover, the consumer propensity toward adopting connected vehicles is also expected to influence the global demand for automobiles, thereby driving the market.

- The COVID-19 pandemic significantly impacted the growth of the warranty management system market as manufacturing operations were temporarily suspended across many countries to contain the virus. This increased the need for more warranty management systems in the market, caused by less production of consumer electronic devices. However, with COVID-19, the shift toward automated technologies was significant across the region. The considerable advantages of the adoption mentioned above are luring the customers into the broad adoption of automated warranty management systems with AI and ML and contributing to the market growth.

Warranty Management System Market Trends

Cloud Segment is Expected to Hold Significant Share

- Implementing a warranty management system on the cloud provides a high intensity of scalability, flexibility, and sharing capabilities with defined authority. The players are leveraging this opportunity to penetrate the market further, which is analyzed to proliferate the market over the forecast period.

- The proliferation of connected/smart devices and sensors that comprise the Internet of Things (IoT), as well as the amounts of metadata generated by different machine-to-machine (M2M) communications networks, may offer manufacturers a new level of insight needed to intelligently update the warranty claims process and deliver a seamless customer experience.

- With advancements in the global manufacturing sector with Industry 4.0 and concepts, such as the Industrial Internet of Things (IIoT), the service providers have a massive opportunity to expand their business over the forecast period. The convergence of various technologies in the manufacturing sector, such as predictive analytics, Big Data, cloud computing, digital twin, and smart factories, may also drive the adoption of cloud-based warranty management systems.

- The cloud-based IoT platform enables actions to be taken from the collected data, such as predictive modeling, simulation, test hypothesis, and reporting. The leading industry players are offering cloud-based solutions that could boost market growth over the forecast period.

- In addition, organizations actively invest in cloud computing across various industries, which is expected to positively impact market growth over the forecast period. For instance, according to the Platform9 report, in 2022, single public (32.1%), hybrid (29.8%), and on-premises clouds (14.1%) were organizations' dominant environments to run their workloads.

North America to Hold Significant Share in the Market

- North America is one of the leading markets in terms of adopting warranty management systems across significant end users. The region is also witnessing healthy growth due to the rising acceptance of data security among small- and medium-scale firms. In addition, the presence of major market vendors in the region and continuous innovation in their market offerings resulted in the growing demand for warranty management systems in the region.

- The major trends that are responsible for the growth of the warranty management system market in the region include the growing number of smart devices and the increase in the adoption of intelligent residential devices, which contain audio and video devices, as well as wearables and smart home devices, which creates the adoption of a warranty management solution to provide the best customer experience.

- Therefore, the proliferation of digital services and technological advancements, coupled with the early adoption of the latest technologies such as cloud computing, AI, IoT, and ML in various sectors, supplement the market growth in the region. Warranty management companies in the region are also using data analytics and AI throughout their warranty procedures to improve product quality by identifying defect patterns, improving claims screening, and end-to-end control of supplier chargebacks.

- In addition, the region is also experiencing many investments and technological advancements in warranty management systems. The adoption of a warranty management system in retail space is also emerging. There is a vast shift to organized retail to improve customer behavior experience through analytics applications.

Warranty Management System Industry Overview

The warranty management systems market is moderately consolidated, with few market players holding significant market share. The major players with prominent shares in the market are focusing on expanding their customer base across foreign countries. The companies are leveraging strategic collaborative initiatives to increase their market shares and profitability.

In November 2022, Tavant, a digital products and solutions company and one of the global leaders in service lifecycle management, announced that it partnered with Daimler Truck AG (DTAG), one of the world's largest commercial vehicle manufacturers, to provide warranty and claim management solutions for its European brands.

In May 2022, driving forward with its ambitious business transformation and change strategy for WMS Group (UK) Ltd (WMS), Opteven introduced its highly accessible and market-leading online claims platform for WMS dealers and repairers. It is designed to significantly simplify and speed up the process of making warranty claims. The new platform will reduce administration time while offering a comprehensive and exceptional customer service experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Warranty Management System in the Manufacturing and Automotive Industries

- 5.1.2 Increasing Adoption of AI and ML Capabilities in Next-generation Warranty Management Systems to Ensure Customer Satisfaction

- 5.2 Market Restraints

- 5.2.1 Intense Competition Between Independent Service Providers in Price- sensitive Markets

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Software Type

- 6.2.1 Warranty Intelligence

- 6.2.2 Claim Management

- 6.2.3 Service Contract

- 6.2.4 Administration Management

- 6.3 By Component

- 6.3.1 Solutions

- 6.3.2 Services (Professional and Managed Services)

- 6.4 By End-user Industry

- 6.4.1 Industrial Equipment (Heavy Equipment and Machinery)

- 6.4.2 Automotive and Transportation

- 6.4.3 Consumer Durable (Major Residential Appliances and HVAC Systems)

- 6.4.4 Construction/Building Materials

- 6.4.5 Other End-user Industries (Medical Devices, Aerospace and Defense, etc.)

- 6.5 Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pegasystems Inc.

- 7.1.2 Oracle Corporation

- 7.1.3 Wipro Limited

- 7.1.4 IBM Corporation

- 7.1.5 Tavant

- 7.1.6 Tech Mahindra Limited

- 7.1.7 Evia Information Systems Pvt Ltd

- 7.1.8 PTC Inc.

- 7.1.9 IFS Americas Inc.

- 7.1.10 Syncron AB