|

市場調查報告書

商品編碼

1550027

半導體測試設備:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Semiconductor Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

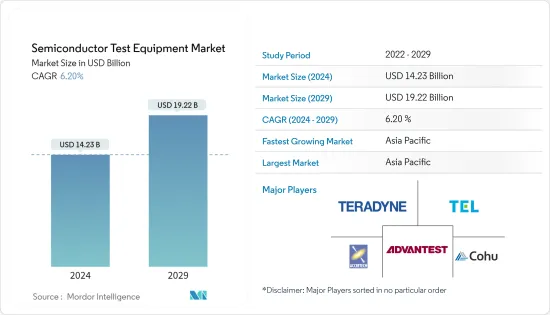

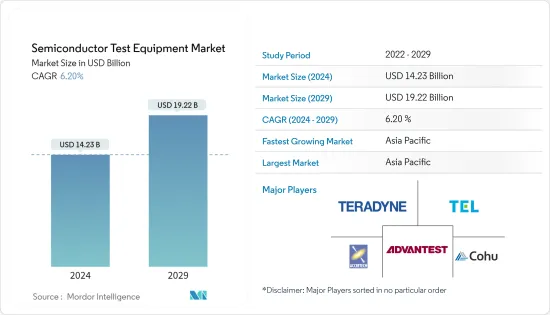

2024年半導體測試設備市場規模預計為142.3億美元,預計2029年將達到192.2億美元,在預測期內(2024-2029年)複合年成長率為6.20%。

主要亮點

- 由於人工智慧、高效能運算、5G 和自動駕駛汽車等技術進步,半導體測試設備市場預計將成長。此外,晶片技術的進步以及 3nm 和 5nm 半導體晶片產量的增加,對用於測試精細製程幾何形狀的高效測試設備產生了巨大的需求。

- 下一代設備採用更小的晶片設計,蘋果宣布 iPhone 15 Pro/Ultra 將採用 3nm 技術。在 5 奈米或更小的製程節點上測試半導體是一項挑戰。製造商專注於開發新的先進測試解決方案,以確保最高的產量比率和品質並控制成本。

- 政府促進主要半導體工廠內部製造和投資的措施可能會增加半導體產量並推動測試設備市場。例如,2024年2月,印度政府核准了三個半導體單位,用於在印度發展半導體和顯示器製造生態系統。

- 電子元件在汽車導航、安全系統和資訊娛樂領域的使用不斷增加,也在推動半導體測試設備的成長方面發揮關鍵作用。此外,智慧型手機、平板電腦和筆記型電腦/個人電腦等消費性電子產品對半導體的需求不斷成長預計將成為該市場的主要促進因素。此外,半導體測試設備市場預計將受益於各工業領域擴大採用物聯網(IoT)。

- 先進測試設備的高成本限制了市場的成長。隨著先進晶片技術的引入,測試設備也不斷升級以包含最新技術,增加了設備成本。此外,與半導體設備相關的嚴格政府法規正在推動市場成長。

- 此外,烏克蘭危機是最近的障礙,可能會對高科技、汽車、家用電器和電器產品等多個製造業領域造成重大干擾。這可能會對整個行業產生深遠的影響。俄羅斯和烏克蘭在全球半導體供應鏈中發揮重要作用,供應鈀和氖等基本材料,這些材料對於生產用於最新裝置和設備的矽晶圓至關重要。半導體生產的暫停將對檢查設備的銷售產生重大影響。由於中國是世界領先的消費電子市場,美國之間持續的爭端預計將對市場成長產生重大影響。然而,我們嚴重依賴其他國家的先進半導體設備。

半導體測試設備市場趨勢

半導體自動測試設備(ATE)佔據主要市場佔有率

- 物聯網應用的擴展導致智慧型裝置和小型半導體的激增,對先進半導體自動測試設備的需求不斷增加。

- 據愛立信稱,2022 年至 2028 年間,全球連網型設備數量將幾乎翻倍。這一成長將由近距離聯網設備的增加所推動,預計到 2028 年將達到 287.2 億個。連網型設備包括穿戴式裝置、聯網汽車、智慧感測器等。

- 自動測試設備可降低製造成本和時間並提高生產力。為了更好的應用,複雜設備的不斷發展增加了對高通量測試設備的需求。 ATE 可以透過自動化易受人為錯誤影響的流程來消除錯誤的測試報告結果。自動測試時,測試結果統一且不失真,確保產品品質的一致性。 ATE 透過減少所需的時間和材料來幫助降低測試成本。這可以使用 ATE 中自動化測試序列的可程式設計功能來實現。

- 當今的車輛擴大採用智慧電子元件和先進技術,例如 ADAS、資訊娛樂系統和人工智慧助手,創造了巨大的成長機會。 ATE 系統可以對 ECU、感測器和資訊娛樂系統等組件進行詳細測試,以確保可靠性、功能性並符合汽車行業規範。

- IEA 表示,預計 2023 年電動車銷量將持續激增。光是第一季就銷售了約230萬輛電動車,與去年同期相比成長了25%。這一成長主要歸功於政府政策和獎勵,以及原油價格上漲,這增加了購買慾望。對電動車和聯網汽車的需求不斷成長預計將推動 ATE 市場的成長。

亞太地區佔主要市場佔有率

- 中國在測試設備市場佔有很大佔有率。該國正在投資 1500 億美元來實現雄心勃勃的半導體議程。該國的目標是加強國內積體電路產業並增加晶片產量。

- 美國之間持續的貿易戰加劇了這一尖端製程技術關鍵領域的緊張局勢,導致許多中國公司投資半導體代工廠。中國宣布了多項加強半導體產業的舉措,包括在代工、氮化鎵 (GaN) 和碳化矽 (SiC) 市場的重大擴張宣傳活動。該地區半導體業務的成長和晶片產能的增加預計將推動測試設備的需求。中國高科技產業的目標是利用其在通訊、可再生能源和電動車(EV)領域的強大影響力,提升全球技術價值鏈的地位。除了這些領域外,該行業目前還專注於先進半導體。這一轉變主要是由先進節點製造的進步、記憶體市場的擴張、積極參與碳化矽(SiC)競爭以及對先進封裝和製造設備的策略性投資所推動的。中國各地代工業務和晶圓廠投資的擴張預計將刺激市場成長。

- 此外,美國在半導體智慧財產權和製造方面的競爭正在加劇。美國在提高自己的晶片產量的同時,也實施了製裁,阻礙了中國在這一重要產業實現自力更生的努力。因此,該地區正在對半導體製造和測試業務進行重大投資,以提高自力更生能力。一個例子是中國於 2023 年 9 月宣佈設立新的國有投資基金,旨在為半導體產業資金籌措約 400 億美元。該基金將主要致力於收購晶片製造設備,以趕上美國和其他競爭對手。

- 晶圓代工廠的擴張直接影響測試設備市場的成長。透過這項激勵措施,北京打算增加對中國晶片公司建設、擴建和升級國內製造、組裝、封裝和研發設施的支援。

- 此外,根據IEA的數據,到2023年,中國將佔全球新註冊電動車的近60%。該地區在電動車生產方面投入巨資,主要由比亞迪等公司投資。該地區電動汽車行業的成長預計將推動市場潛力。

半導體測試設備產業概況

半導體測試設備市場處於半鞏固狀態,由 Advantest Corporation、Teradyne, Inc.、Cohu Inc.、Tokyo Electron Limited、HCT 和 Tokyo Seimitsu Company 等主要企業主導。

- 2024 年 2 月 - Cohu Inc. 宣布,Cohu 最新的 MEMS 測試解決方案組合產品 Sense+ 系統已被選用於測試美國無晶圓廠半導體製造商 Tuo Sense 的下一代高保真麥克風。

- 2023 年 12 月 - Advantest Inc. 宣布推出 ACS 即時資料基礎架構 (RTDI),在單一整合平台中為人工智慧、機器學習和資料分析決策提供支援。這項新的基礎設施可以安全地收集、處理、分析和監控試驗資料,使客戶能夠自動執行步驟,將見解轉化為可行的試驗決策。這使得消費者和合作夥伴能夠最佳化品質、減少測試時間並為智慧包裝提供支援。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 設備類別技術概述

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 人工智慧、物聯網和連網型設備按產業激增

- 擴大半導體在汽車中的使用

- 市場挑戰

- 供應鏈中斷導致半導體短缺

- 由於該技術的動態特性,需要對設備進行多次更改

第6章 市場細分

- 依產品類型

- 半導體自動測試設備(ATE)

- 老化系統

- 處理裝置

- 探針裝置

- 光學檢測設備

- 其他產品類型

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 中東/非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Advantest Corporation

- Tokyo Electron Limited

- Teradyne Inc.

- Cohu Inc.

- HCT Co. Ltd

- Tokyo Seimitsu Co. Ltd

- National Instruments

- Astronics Corporation

- TESEC Inc.

- Chroma ATE Inc.

第8章廠商市場佔有率分析

第9章市場展望

The Semiconductor Test Equipment Market size is estimated at USD 14.23 billion in 2024, and is expected to reach USD 19.22 billion by 2029, growing at a CAGR of 6.20% during the forecast period (2024-2029).

Key Highlights

- The semiconductor test equipment market is expected to grow due to technological advancements such as AI, HPC, 5G, and automated vehicles. Further, the technological advancement in chip technology and growing production of 3nm and 5nm semiconductor chips create a huge demand for efficient test equipment to test small process geometrics.

- As next-generation devices are designed with smaller chips, Apple announced it would use 3nm technology in iPhone 15 Pro/Ultra; such developments drive market growth. Testing semiconductors with 5nm or smaller process nodes is challenging. Manufacturers focus on developing new and advanced test solutions that ensure the best yield, quality, and control costs.

- The government's efforts to increase in-house production and investment by leading semiconductor fabs will increase semiconductor production, which will likely foster the market for testing equipment. For instance, in February 2024, the Government of India approved three semiconductor units for the development of semiconductor and display manufacturing ecosystems in India.

- The rising utilization of electronic components in automobile navigation, safety systems, and infotainment also plays a significant role in propelling the growth of semiconductor testing equipment. Moreover, the increasing demand for semiconductors in consumer electronics like smartphones, tablets, and laptops/PCs is anticipated to be a key driver in this market. Moreover, the semiconductor test equipment market is expected to benefit from the increasing adoption of internet-of-things (IoT) in different industrial sectors.

- The high cost of advanced testing equipment restricts market growth. With the introduction of advanced chip technology, testing equipment was upgraded to include the latest technology, increasing the equipment cost. Further, stringent government regulations related to semiconductor equipment facilitate market growth.

- Also, the crisis in Ukraine is the latest obstacle to arise, and it can cause significant disruptions in various manufacturing sectors such as high-tech, automotive, consumer electronics, and household appliances. This could have far-reaching consequences for the industry as a whole. Russia and Ukraine play crucial roles in the global semiconductor supply chain, supplying essential materials such as palladium and neon, vital for producing silicon wafers used in modern devices and equipment. The suspended semiconductor production significantly impacts the sales of testing equipment. The ongoing dispute between the US and China will significantly impact the market growth as China is the major consumer electronics market in the world. However, it largely depends on other countries for advanced semiconductor equipment.

Semiconductor Test Equipment Market Trends

Semiconductor Automated Test Equipment (ATE) to Hold Significant Market Share

- Owing to the expansion of IoT applications, smart devices, and small semiconductors are becoming more prevalent, driving demand for advanced semiconductor automated testing equipment.

- According to Ericsson, the number of connected devices worldwide will almost double between 2022 and 2028. This growth is expected to be driven by a rise in short-range IoT devices, with a forecast of 28.72 billion such devices by 2028. Connected devices include wearables, connected cars, and smart sensors.

- Automated testing equipment reduces manufacturing costs and time and increases productivity. The ongoing development of complex devices for better applications drives demand for high-throughput test equipment. An ATE can eliminate false test report results by automating processes susceptible to human mistakes. When testing is done automatically, test results are uniform and cannot be distorted, guaranteeing consistency in product quality. An ATE can help reduce testing costs by reducing the time and materials required. This can be achieved by using programmable functions on ATEs that automate test sequences.

- The growing adoption of smart electronics components and advanced technologies such as ADAS, infotainment systems, and AI assistants in today's vehicles creates significant growth opportunities. ATE systems allow for detailed testing of components such as ECUs, sensors, and infotainment systems, guaranteeing reliability, functionality, and compliance with automotive industry norms.

- According to the IEA, EV sales were expected to continue to surge in 2023. Approximately 2.3 million electric cars were sold in the first quarter alone, representing a 25% increase from the same period last year. This growth is largely attributed to national policies and incentives, as well as high oil prices, which are motivating prospective buyers. The increased demand for electric and connected vehicles will drive the ATE market growth.

Asia-Pacific to Hold Significant Market Share

- China holds a significant share of the testing equipment market. The country is pursuing an ambitious semiconductor agenda with USD 150 billion in funding. The country aims to enhance its domestic IC industry and increase its chip production.

- The ongoing US-China trade war has intensified tensions in this crucial sector, where the most advanced process technology is concentrated, leading many Chinese companies to invest in semiconductor foundries. China has unveiled various initiatives to strengthen its semiconductor sector, such as a substantial expansion campaign in the foundry, gallium-nitride (GaN), and silicon carbide (SiC) markets. The growing semiconductor business and increasing chip production capabilities in the region are expected to drive the demand for testing equipment. China's tech industry aims to ascend the global technology value chain by capitalizing on its strong presence in telecommunications, renewables, and electric vehicles (EVs). In addition to these sectors, the industry is now focusing on advanced semiconductors. This transition is primarily driven by advancements in advanced node manufacturing, the expansion of the memory market, active involvement in the silicon carbide (SiC) race, and strategic investments in advanced packaging and manufacturing equipment. The growing foundry business and investments in fabs throughout China are anticipated to stimulate market growth.

- Moreover, China and the United States are growing competition over semiconductor intellectual property and manufacturing. The United States is taking steps to boost its chip production while imposing sanctions to hinder China's efforts to achieve self-reliance in this crucial industry. As a result, the region is making significant investments in the semiconductor manufacturing and testing business to enhance its self-reliance capabilities. An example is the recent announcement in September 2023 of China's new state-backed investment fund, which aims to raise approximately USD 40 billion for the semiconductor sector. This fund will primarily focus on acquiring chip manufacturing equipment to catch up to the United States and other competitors.

- The expansion of foundries directly impacts the growth of the testing equipment market. Through the incentive package, Beijing intends to enhance its assistance to Chinese chip companies in constructing, expanding, or upgrading domestic facilities for fabrication, assembly, packaging, and research and development.

- Further, according to IEA, China accounted for nearly 60% of all new electric car registrations worldwide in 2023. This region is primarily dominated by companies like BYD and others, which are making significant investments in the production of electric vehicles. The growth of the EV sector in the region is expected to drive the market's potential.

Semiconductor Test Equipment Industry Overview

The semiconductor test equipment market is semi-consolidated and dominated by leading vendors such as Advantest Corporation, Teradyne, Inc., Cohu Inc., Tokyo Electron Limited, HCT Co. Ltd, and Tokyo Seimitsu Co. Ltd. Companies continuously focus on enhancing their market presence by launching new products, expanding their operations, or entering strategic mergers and acquisitions, partnerships, and collaborations.

- February 2024 - Cohu Inc. announced that the Sense+ system, Cohu's recent MEMS test solution portfolio product, was selected by the United States fabless semiconductor manufacturer with µ-sense to test their next-generation high-fidelity microphones.

- December 2023 - Advantest Corporation launched ACS Real-time Data Infrastructure (RTDI) to enhance AI, ML, and data analytics decision-making in a single, integrated platform. The new infrastructure securely gathers, processes, analyzes, and monitors test data to enable customers to automate the procedure of converting insights into actionable test decisions. This helps consumers and partners optimize quality, reduce test time, and enhance smart packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technological Overview of Equipment Categories

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Proliferation of Artificial Intelligence, IoT, and Connected Devices across Industry Verticals

- 5.1.2 Increased Applications of Semiconductors in Automotive

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions Resulting in Semiconductor Shortage

- 5.2.2 Dynamic Nature of Technologies Requires Several Changes in Equipment

6 MARKET SEGMENTATION

- 6.1 By Type of Product

- 6.1.1 Semiconductor Automated Test Equipment (ATE)

- 6.1.2 Burn-in Systems

- 6.1.3 Handler Equipment

- 6.1.4 Probe Equipment

- 6.1.5 Optical Inspection Systems

- 6.1.6 Other Equipment Categories

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Middle East and Africa

- 6.2.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Advantest Corporation

- 7.1.2 Tokyo Electron Limited

- 7.1.3 Teradyne Inc.

- 7.1.4 Cohu Inc.

- 7.1.5 HCT Co. Ltd

- 7.1.6 Tokyo Seimitsu Co. Ltd

- 7.1.7 National Instruments

- 7.1.8 Astronics Corporation

- 7.1.9 TESEC Inc.

- 7.1.10 Chroma ATE Inc.