|

市場調查報告書

商品編碼

1630297

印刷基板檢測設備:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Printed Circuit Board Inspection Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

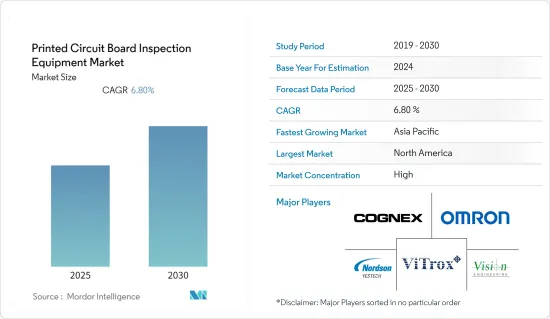

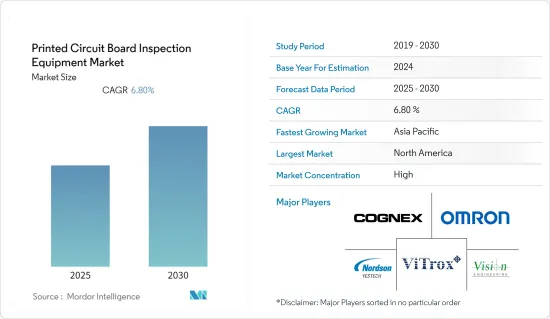

印刷基板檢測設備市場預計在預測期內複合年成長率為 6.8%

主要亮點

- 生產技術的改進帶來了更高密度和更多種類的印刷基板。因此,除了手動影像檢查之外,還需要準確地識別印刷電路基板中的缺陷。機械檢測方法有助於提高印刷電路基板的品質和產量比率。此外,由於工業應用的擴大,印刷電路基板(PCB)產量的增加和PCB製造複雜性的增加是預測期內推動PCB檢測設備需求的關鍵因素之一。不斷增加的產品進步促使公司投資於市場研究。

- 2021 年 8 月,諾信公司宣布計劃透過收購精密測量解決方案和線上製造流程控制提供商 NDC Technologies 來擴展其 Forma 檢驗和檢測平台。因此,PCB檢測設備的技術進步是有利的。

- 根據消費者技術協會預測,2021年美國高科技產業收益將達4,870億美元,與前一年同期比較成長創紀錄的7.5%。此外,智慧型手錶的需求量預計將成長 8%,這主要是由精通技術和時尚意識的消費者推動的,並且可能對整體 PCB 需求做出貢獻。

- 此外,研究市場動態的參與企業也在產品創新方面進行投資,因為不同產業對 PCB 的需求是動態的。這也有望擴大研究市場的範圍。例如,2021年11月,歐姆龍推出了VT-S10系列配備人工智慧的PCB檢測系統,可實現PCB組件高精度檢測製程的自動化。這消除了使用者對特殊操作技能的需求。

- 此外,根據 Sullivanmaine.org 2021 年 6 月發布的報告,預計未來幾年 65 歲以上人群對智慧型手錶的興趣將會增加。報告還指出,據 Apple Watch相關人員稱,65 歲及以上的成年人至少購買了 300 萬至 500 萬塊 Apple Watch。因此,PCB檢測設備的需求不斷增加。

- 對小型化的需求不斷增加導致 PCB 設計的複雜性增加。如此一來,PCB測試的不良率也隨之增加,為市場需求帶來了挑戰。

- 此外,由於中國是原料和成品的主要供應國之一,預計電子業將受到 COVID-19 疫情的嚴重影響。各行業面臨產量減少、供應鏈中斷和價格波動的問題。此外,知名電子公司的銷售在此期間也受到影響。對人員和產品的旅行限制在短期內阻礙了市場成長。

PCB檢測設備市場趨勢

X光偵測佔據主要佔有率

- X 光檢查是最廣泛使用且最具成本效益的診斷影像技術,受到許多人的青睞。在PCB檢查中,在PCB組裝過程中大量使用X光來檢查PCB的品質。

- PCB 在醫療和醫療領域至關重要。未來的創新趨勢正在推動診斷、治療和研究策略的自動化。這意味著醫療器材與設備中的 PCB 需要做更多的工作。此外,根據國際貨幣基金組織的數據,2027年X光診斷成像的收益預計將增加582.7億美元。此類醫療設備的發展預計將進一步推動市場成長。

- 2021 年 11 月,歐姆龍宣布擴展新型 VT-X750-V3 系統,這是世界上最快的基於 CT 的 X 光檢查系統。 VT-X750-V3能夠對電子基板進行先進的3D檢測,以滿足第五代行動通訊系統(5G)、電動車和自動駕駛應用產品日益成長的需求。

- ViTrox 提供先進的 3D X 光偵測(V810i 系列),旨在適應各種尺寸的 PCB 組件。微米級檢測可實現最大吞吐量。此外,Viscom 還提供 3D AXI 系統,具有高速處理和最多 3 個 PCB 的 3D 影像品質。非常適合用於儘管對隱藏焊點進行大量檢查但仍需要高吞吐量的生產線。

- 2021 年 10 月,返工技術先驅和先進 X光檢測和零件計數系統的全球供應商 VJ Electronix, Inc. 預覽了將於 2022 年上半年推出的新型 X光檢測系統。 。

- 此外,2021 年 5 月,電子產業 X 光檢測領先供應商 Nordson DAGE 為故障分析實驗室和生產環境提供了具有最高特徵識別和解析度的 X 光系統。我們推出第四代超高解析度離線X光偵測系統「Quadra系列」。最新的 Quadra 系列 X 光偵測可在最短的時間內提供極高的影像品質。

亞太地區市場顯著成長

- 亞太地區由於PCB製造企業和電子產品製造企業數量眾多,作為PCB檢測設備市場佔有重要的區域地位。

- 在其他亞洲國家中,中國是影響該地區PCB測試設備重要性的關鍵國家之一。根據IPC 2022年1月發布的報告,全球PCB需求為640億美元。美國PCB產量滿足總需求的4%(約29億美元),中國佔比超過56%,供應了整個亞太地區90%的PCB製造。

- 智慧型手機普及率的提高使亞太地區成為全球最大的行動市場之一。這是由於人口成長和都市化。據 GSM 協會稱,到 2025 年,超過五分之四的連接將透過智慧型手機進行。這一趨勢預計將增加該地區的 PCB 使用量並增加 PCB 測試的使用案例。

- 此外,中國還有許多PCB生產設施。 AT&S最大的生產基地位於上海,專注於多層PCB。這是因為該公司專注於為中國的大容量行動通訊客戶提供服務。

- 其他國家也在尋求擴大市場採用率。台灣印刷電路協會(TPCA)與650家會員公司合作,提供國內外印刷電路基板開發資料。近年來,我們與會員共同推動循環經濟和智慧製造,以增強PCB產業的競爭。

- 此外,歐姆龍等公司正在與測試設備製造商合作,設計不需要人工干預的測試設備,進一步提高其產品的準確性。例如,FPCB開發商Cisel最近採用歐姆龍的協作機器人TM5(cobot)來對主要汽車製造商的動力方向盤系統中使用的基板進行自動化電氣檢查。

PCB檢測設備產業概況

PCB檢測設備市場集中,少數參與企業佔據大部分市場佔有率。提供PCB檢測相關產品的供應商正逐漸出現。現有的競爭對手競爭非常激烈。此外,大公司的創新策略推動了所研究的市場。

- 2021年10月-歐姆龍發布PCB檢查系統「VT-S10系列」。由業界領先的成像技術和人工智慧提供支持,可實現電子組件高精度檢測流程的自動化,從而最大限度地提高性能並最大限度地降低技能水平要求。

- 2021 年 1 月 - 以色列 CADY 籌集 300 萬美元用於開發自動化 PCB 檢測。該公司開發了自動化 PCB 設計檢查軟體,透過分析電氣原理圖中電氣元件和晶片的資料並將其與設計連接進行匹配,可以在早期階段檢測到錯誤。這些公司將有助於支持PCB檢測設備的成長和發展。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- PCB多樣化和緻密化推動市場需求

- 市場限制因素

- 由於零件小型化而增加的複雜性是市場成長的一個問題

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 按檢驗方法

- 自動光學檢測 (AOI)

- X光檢查

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭狀況

- 公司簡介

- Nordson YESTECH Inc

- Cognex Corporation

- Vision Engineering Inc

- ViTrox Corp Bhd

- Omron Electronics LLC

- Manncorp Inc.

- Gardien Services Inc

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 67095

The Printed Circuit Board Inspection Equipment Market is expected to register a CAGR of 6.8% during the forecast period.

Key Highlights

- The density and diversity of printed circuit boards are increasing due to improvements in production technology. As such, there is a need for accurately identifying defects on PCBs, apart from manual vision inspection. Machine inspection methods help in better quality and higher yield of the PCB. In addition, the growing production of printed circuit boards (PCB) and increasing complexity in PCB manufacturing due to the growing industrial adoption are some of the major factors driving the demand for PCB inspection equipment over the forecast period. The ever-increasing product advancement motivates companies to invest in the market studied.

- In August 2021, Nordson Corporation announced plans to acquire NDC technologies, a provider of precision measurement solutions and in-line manufacturing process control, to expand the formers test and inspection platform. Thus, favoring technological advancements for PCB inspection equipment.

- According to the Consumer Technology Association, U.S. tech industry revenue will reach a record-breaking USD 487 billion in 2021, a 7.5% jump YoY. Moreover, Smartwatches demand is projected to grow by 8% in unit shipments, essentially driven by tech-savvy and fashion-conscious consumers, likely contributing to the overall PCB demand.

- Further, the market-studied players are also investing in product innovation, as the need for PCBs for different industries is dynamic. This is also expected to expand the scope of the market studied. For instance, in November 2021, Omron launched the PCB inspection system VT-S10 Series which features AI to automate high-precision inspection processes for PCB sub-assemblies. This helps the users to eliminate the need for special operator skills.

- Moreover, According to a report published by Sullivanmaine.org in June 2021, the interest in smartwatches among the 65+ population is expected to increase in the coming years. According to an Apple Watch insider, the report also mentioned that at least 3-5 million Apple Watches have been purchased by adults age 65+. Thus, driving the need for PCB inspection equipment.

- The growing demand for miniaturization has led to the increasing PCB design complexity. This has led to a proportional PCB inspection failure rate, challenging the market demand.

- Furthermore, the electronics device sector is anticipated to be impacted significantly by the COVID-19 outbreak, as China is one of the major suppliers of raw materials and finished products. The industry faced a reduction in production, disruption in the supply chain, and price fluctuations. Further, the sales of prominent electronic companies were affected during the period. The travel restriction on both people and products hampered the market's growth in the short run.

PCB Inspection Equipment Market Trends

X-Ray Inspection to Gain Majority Share

- X-ray is the most widely available and cost-effective diagnostic imagining technique preferred among the population. In PCB inspection, X-ray is massively used in the process of PCB assembly to test the quality of PCBs, which is one of the essential steps for quality-oriented PCB manufacturers.

- PCBs are fundamentally critical in the fields of healthcare and medicine. The movement of innovation into the future, making the diagnostic, treatment, and research strategies progress towards becoming automated. This means there is more work for PCBs in medical devices and equipment. Further, according to IMF, the revenue from X-ray diagnostic imaging is anticipated to grow by USD 58.27 billion in 2027. Such developments in medical devices will further drive market growth.

- In November 2021, OMRON Corporation announced the expansion of a new VT-X750-V3 system, the world's fastest CT-type X-ray inspection device. The VT-X750-V3 delivers advanced 3D inspection of electronic substrates to meet the growing requirements of fifth-generation mobile communication systems (5G), electric automobiles, and autonomous driving application products.

- ViTrox provides advanced 3D X-Ray Inspection (V810i Series), designed to cater to different sizes of PCB assembly. It enables examination at the micron level with maximum throughput. Moreover, Viscom offers a 3D AXI system distinguished by fast handling and 3D image quality of up to 3 PCBs. It is ideal for use in production lines that require high throughput despite an extensive inspection of hidden solder joints.

- In October 2021, VJ Electronix, Inc., a pioneer in rework technologies and a global provider of advanced X-ray inspection and component counting systems, is planning to give SMTAI attendees a preview of a new x-ray inspection system available in the first half of 2022.

- Further, in May 2021, Nordson DAGE, the major player in X-ray inspection for the electronics industry, offered the highest feature recognition and resolution X-ray systems within failure analysis laboratories and the production environment. It is launching its 4th generation, ultra-high resolution, off-line X-ray system, the Quadra Series. The latest Quadra series X-ray inspection delivers unbeatable image quality in the shortest possible time. With its revolutionary QuadraNT X-ray tube and Aspire FP detector.

Asia Pacific to Witness the Significant Market Growth

- Asia-Pacific is a significant PCB inspection equipment market across regions, mainly due to the large number of PCB manufacturing and electronic products manufacturing companies in the region.

- China, among other Asian countries, is one of the significant countries influencing the importance of PCB inspection equipment in the region. According to a report published by IPC in January 2022, the worldwide demand for PCBs was USD 64.0 billion. U.S. PCB production met 4% of the total demand (approximately USD 2.9 billion), while China accounted for more than 56%, and the entire Asia-Pacific region provided 90% of PCB fabrication.

- Increasing smartphone adoption rates have made Asia-Pacific one of the largest mobile markets in the world. This is due to increasing population growth and urbanization. As per GSM Association, more than 4 out of 5 connections will be smartphones by 2025. This trend is expected to increase PCB usage in this region, thus increasing the use cases of PCB inspection.

- In addition, China is home to many PCB production facilities. AT&S' largest production unit is located in Shanghai, focusing on multi-layer PCB. This is because the company focuses on large volumes of mobile communications customers in China.

- Other countries are also aiming to increase market adoption. Taiwan Printed Circuit Association (TPCA) works with its 650 member companies to provide: development material on domestic and overseas printed circuit boards. In recent years, they have promoted the circular economy and smart manufacturing with members to enhance the competitiveness of the PCB industry.

- Companies such as Omron are also collaborating with inspection equipment manufacturers to design testing equipment with no human interaction, which further increases the products' accuracy. For instance, Cisel, a company developing FPCBs, has recently chosen an OMRON TM5 collaborative robot (cobot) to automate the electrical testing of boards used in the power steering system of a leading automotive manufacturer.

PCB Inspection Equipment Industry Overview

The PCB inspection equipment market is concentrated, with few players occupying the majority market share. Vendors are slowly emerging with offerings related to PCB inspection. Existing competitors are fiercely competitive. Further, large companies' innovation strategies will drive the studied market.

- October 2021 - Omron launched the PCB inspection system "VT-S10 series," which features an industry-first imaging technique and AI best to automate the high-precision inspection process for electronic assemblies, maximize performance and minimize skill-level requirements.

- January 2021 - CADY, an Israeli-based company, raised USD 3 million to develop automatic PCB inspections. The company developed an automated PCB design inspection software that parses the datasheets of electrical components and chips in the electrical schematic and cross-checks them against connections in the design to detect errors at early stages. Such companies would help to support the growth and development of PCBs inspection equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Diversity and Density of PCB is Fuelling the Market Demand

- 4.3 Market Restraints

- 4.3.1 Increasing Complexity Due to Miniaturisation of Components is Challenging the Market Growth

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Inspection Method

- 5.1.1 Automatic Optical Inspection (AOI)

- 5.1.2 X-Ray Inspection

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Nordson YESTECH Inc

- 6.1.2 Cognex Corporation

- 6.1.3 Vision Engineering Inc

- 6.1.4 ViTrox Corp Bhd

- 6.1.5 Omron Electronics LLC

- 6.1.6 Manncorp Inc.

- 6.1.7 Gardien Services Inc

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219