|

市場調查報告書

商品編碼

1550029

GPU 即服務 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)GPU As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

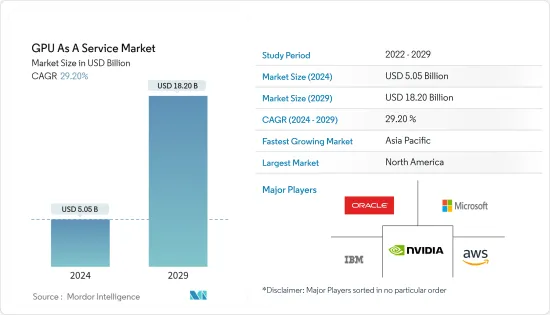

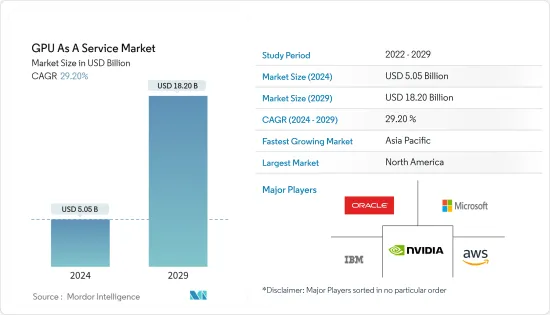

GPU即服務市場規模預計到2024年為50.5億美元,預計到2029年將達到182億美元,在預測期內(2024-2029年)複合年成長率為29.20%。

主要亮點

- 全球圖形處理單元 (GPU) 市場主要是由對專用處理器管理與 2D 和 3D 圖形相關的複雜數學計算的需求不斷成長所推動的。此外,在製造、汽車、房地產和醫療保健等各個行業中支援圖形應用和 3D 內容的處理器的使用不斷增加也推動了市場的成長。例如,在汽車行業,CAD 和模擬軟體支援圖形處理單元產生逼真的圖像和動畫,以促進製造和設計應用。

- GPUaaS 公司為各種應用程式提供可出租的虛擬GPU,從而消除了企業投資昂貴的運算基礎架構的需求。人工智慧和機器學習 (ML) 需要大量程式碼和演算法,跨越數千頁。因此,需要 GPU 等強大的系統來執行 CPU 無法完成的任務。

- 此外,新的汽車模型和機器變得更加先進。隨著電動車領域的出現,使用 GPU 進行資料分析和視覺化的需求不斷增加,推動了市場成長。 GPU 有助於在沒有裝置的情況下完成這些任務,從而支援跨多個行業的工作。

- 事實證明,GPUaaS 產業具有彈性和創新能力,性能和效率不斷提高,推動了各行業的成長。 GPU 即服務 (GPUaaS) 具有多種優勢,包括低成本、雲端服務供應商支援和按需擴充。隨著最終用戶廣泛採用雲端基礎的GPU 解決方案,SaaS 服務模式預計將持續發展。 GPU 市場的參與者越來越重視為客戶提供基於 SaaS 的解決方案。

- 機器學習和人工智慧是醫療保健、金融、製造和供應鏈等多個領域的新興技術。機器學習和人工智慧用於影像識別和自然語言處理。人工智慧和機器學習可以擁有更廣泛的資料庫來進行分析和處理,並且由於快速的學習和介入時間,計算量可能會很大。圖形處理單元已成為人工智慧和機器學習的關鍵技術,因為它們的並行處理使其能夠處理大型資料集。

- 有幾個因素阻礙了 GPU 即服務業的發展。其中之一是實施成本高昂,預計將阻礙未來的市場成長。此外,對先進技術和 GPU 即服務優勢的更深入了解的需求也限制了市場的成長。

- COVID-19 的疫情和後果增加了資料的使用。此外,遠距工作環境的興起為增加資料產生帶來了新的機會。遠端工作環境導致了超大型資料中心的成長,從而產生了對高效網路的需求。

- 資料中心供應商不斷投資新的資料中心,以滿足對資料永不滿足的需求。根據印度國家軟體和服務公司協會(NASSCOM)預測,2025年印度資料中心市場的投資預計將達到46億美元。與新興市場相比,印度資料中心的最大優勢在於其開發和營運成本效益極高。印度的資料中心主要位於孟買、班加羅爾、清奈、德里(NCR)、海得拉巴和普納。加爾各答、喀拉拉邦和艾哈默德巴德將成為未來的資料中心地點。資料中心市場投資的擴大正在推動印度市場的需求。

GPU即服務市場趨勢

預計汽車市場在預測期內將出現顯著成長

- GPU 為娛樂系統和儀表板儀表的圖形提供動力,從而實現流暢且響應靈敏的使用者介面。 GPU 還支援高階車輛,具有射線追蹤等功能,可帶來更高的沉浸感;深度學習超級取樣可在不犧牲效能的情況下提升影像質量,提供Sharp Corporation的視覺效果。

- 隨著 ADAS 和 AV 越來越依賴即時感測器資料(攝影機資料、LiDAR資料、雷達資料等)的分析,GPU 非常適合處理分佈在多個核心上的工作負載,從而加快物件偵測和場景理解等任務的速度。現代 GPU 並不是專門用於圖形渲染。自訂演算法還可以透過 CUDA 等框架執行,使開發人員能夠利用 GPU 的強大功能來實現人工智慧和加速運算等特定汽車功能,從而幫助改變整個汽車行業,這激勵著我。

- 自動駕駛和自動駕駛汽車的日益普及也是 GPU 需求的主要成長要素。許多新車款都配備了多種資訊娛樂系統選項來協助駕駛員。現在停車攝影機是必要的,特別是對於像大多數 SUV 這樣有一些盲點的大型車輛。透過在前部、後部和側面安裝攝影機,駕駛可以避免與其他車輛碰撞或在人行道上刮擦。因此,需要 GPU 來處理所有這些相機/感測器並渲染影像。

- 此外,汽車中的車載資訊娛樂 (IVI) 系統變得越來越複雜。高級型號配備多達 12 個 4K 解析度顯示器以及手勢、語音和臉部辨識等功能。支援 Android Auto 和 Apple CarPlay 等技術以及更大的螢幕大小是消費者購買新車時願望清單上的關鍵要素。為了提高這種能力,汽車製造商開始使用相當複雜的感測器和攝影機來偵測周圍的物體。最新的創新是觀點停車輔助。因此,當 GPU 分析感測器並即時渲染車輛周圍的完整區域時,駕駛員將更好地了解周圍環境。

- 此外,汽車工業在過去十年中也取得了長足的發展。價格實惠、高效且功能強大的電動車的發展是該行業的一個重大轉折點。據分析,自動駕駛將帶來重要的創新。憑藉廣泛的研究和運算能力,自動駕駛汽車預計將在預測期內實現,並且需要強大的 GPU(和 CPU)來為特斯拉、寶馬、保時捷或其他車輛的人工智慧提供動力。 GPU 也是現代汽車的基本功能。

北美佔據主要市場佔有率

- 由於國內採用率的提高以及消費者中區域資料中心、遊戲和人工智慧市場的擴大,北美是全球 GPU 即服務市場的主要投資者和創新者之一。與其他地區相比,對資料中心伺服器、機器對機器通訊和人工智慧等先進技術的需求成長顯著。因此,預計將為GPU即服務市場帶來顯著的成長機會。

- 由於國內市場的規模和大規模生產技術的使用,該地區的汽車和運輸業是世界上最重要的行業之一。在過去的十年中,該地區的汽車行業從製造到分銷取得了巨大的發展,消費者偏好的變化和新技術導致了該行業的歷史性轉型。

- 北美有本田、豐田、福特、雪佛蘭、特斯拉等各種公司。它是汽車行業的先驅,特別是在自動化方面,為該地區的供應商創造了新的機會。根據汽車研究中心的數據,到 2025 年,美國汽車產量將達到 1,170 萬輛。

- 該地區各國政府也制定了國家人工智慧戰略,這是一個政策框架,為美國加速人工智慧研究、開發和採用制定了戰略。我們也促進提供 GPU 即服務和其他運算資源,加強國際合作,增加研發資金,並投資於道德人工智慧開發,以減少偏見並保護隱私。

- 此外,雲端技術的採用、資料中心滲透率的提高以及 5G 技術的增加將進一步擴大該地區的市場成長。該地區資料中心和雲端市場的不斷擴張也將推動對 GPU 技術的需求。

GPU 即服務業概述

GPU 即服務市場由幾家大型供應商整合和主導,包括 NVIDIA、AWS、IBM、Oracle、Google LLC 和 Microsoft Corporation。公司不斷致力於透過推出新產品、擴展業務、進行策略併購、聯盟和合作來提高市場佔有率。

- 2024 年 3 月 - Amazon Web Services (AWS) 和 NVIDIA 宣布 NVIDIA 將把 2024 年宣布的 NVIDIA Blackwell GPU 平台帶到 AWS。 AWS 提供NVIDIA B100 Tensor Core GPU 和GB200 Grace Blackwell Superchip,擴大了我們的策略合作夥伴關係,以提供最先進、最安全的軟體、基礎設施和服務來支援產生人工智慧(AI),幫助客戶釋放他們的潛力。

- 2024 年 3 月 - 新加坡電信在新加坡和東南亞推出 GPU 即服務 (GPUaaS),提供 NVIDIA 的 AI 運算能力,以促進成長和創新。新加坡電信的 GPU 即服務配備了「NVIDIA H100 Tensor Core GPU」。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 後遺症和其他宏觀經濟因素對市場的影響

- 供應商服務價格分析

- 資料中心伺服器的 GPU 供應商分析

第5章市場動態

- 市場促進因素

- 擴大生成式人工智慧和法學碩士模式在企業中的使用

- 拓展AR、VR、AI的應用

- 市場挑戰

- 資料安全問題

- 缺乏熟練勞動力

第6章 市場細分

- 按用途

- 人工智慧

- 高效能運算

- 其他用途

- 按公司類型

- 小型企業

- 主要企業

- 按最終用戶

- BFSI

- 車

- 衛生保健

- 資訊科技/通訊

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 中東/非洲

- 拉丁美洲

第7章 競爭格局

- 公司簡介

- Amazon Web Services Inc.

- Microsoft Corporation

- Nvidia DGX(Nvidia Corporation)

- IBM Corporation

- Oracle Systems Corporation

- Alphabet Inc(Google)

- Latitude.sh

- Seeweb

- Alibaba cloud

- Linode LLC

- CoreWeave

第8章 廠商排名分析

第9章市場展望

The GPU As A Service Market size is estimated at USD 5.05 billion in 2024, and is expected to reach USD 18.20 billion by 2029, growing at a CAGR of 29.20% during the forecast period (2024-2029).

Key Highlights

- The global graphics processing unit market is primarily driven by the growing demand for specialized processors to manage complex mathematical calculations related to 2D and 3D graphics. The augmenting use of processors to support graphics applications and 3D content in several industry verticals, including manufacturing, automotive, real estate, and healthcare, is also increasing market growth. For instance, to encourage manufacturing and design applications in the automotive sector, CAD and simulation software support graphic processing units to generate photorealistic images or animations.

- GPUaaS companies offer virtualized GPUs that can be rented for a wide range of applications, eliminating the need for businesses to invest in costly computing infrastructure. Artificial intelligence and machine learning (ML) require large amounts of code and algorithms that run across thousands of pages. As a result, robust systems like GPUs are required to perform tasks that cannot be done using CPUs.

- In addition, new automotive models and machinery are becoming more advanced. With the advent of EV segments, a growing demand for data analysis and visualization using GPUs drives market growth. GPUs help to enable these operations without using equipment, making tasks possible across many industries.

- The GPUaaS industry has proven resilient and innovative, with continuous enhancements in performance and efficiencies, driving its growth across various industries. GPU as a Service (GPUaaS) has several advantages, including low costs, cloud service provider support, and on-demand scaling. The SaaS service model is projected to develop because of the end user's widespread adoption of cloud-based GPU solutions. The GPU market players increasingly focus on providing clients with SaaS-based solutions.

- Machine learning and artificial intelligence are emerging technologies in various sectors like healthcare, finance, manufacturing, and supply chain. Machine learning and artificial intelligence are utilized in image recognition and natural language processing. With the rapid training and interference times, AI and ML carry more extensive databases for analyzing and processing that can be computationally intensive. The graphic processing unit emerges as the primary technology in artificial intelligence and machine learning due to its parallel processing, which can handle the processing of large datasets.

- A few factors are preventing the GPU as a Service industry from growing. One of them is the high cost of implementation, which is expected to impede the market growth in the future. Further, the need to become more aware of advanced technologies and understand the benefits of GPU as a Service restricts the market growth.

- The outbreak and aftereffects of COVID-19 increased the usage of data. Moreover, it presented new opportunities for growing data generation due to increased remote working environments. The remote working environment is leading to the growth in hyper-scale data centers, creating a need for efficient networking.

- Various data center vendors consistently invest in new data centers that align with the insatiable need for data. According to the National Association of Software and Service Companies (NASSCOM), India's data center market investment is expected to reach USD 4.6 billion in 2025. India's higher cost efficiency in development and operation is its most significant advantage compared to more mature markets. India's data centers are mainly Mumbai, Bengaluru, Chennai, Delhi (NCR), Hyderabad, and Pune. Calcutta, Kerala, and Ahmedabad are the upcoming data center hubs. These growing data center market investments drive the demand in India's market.

GPU as a Service Market Trends

Automotive is Expected to Witness Remarkable Growth During Forecast Period

- GPUs solidify the graphics on the entertainment systems and dashboard instruments, allowing a smooth and reactive user interface. GPUs also support high-end vehicles with features like real-time ray tracing for a better immersive experience and deep learning super sampling to upscale images for sharp visuals without preceding performance.

- As ADAS and AVs increasingly rely on analyzing real-time sensor data (camera data, lidar data, radar data, etc.), GPUs are well-suited to handle the workload distributed across their cores, speeding up tasks such as object detection or scene understanding. Modern GPUs do not focus on graphics rendering. They can also run custom algorithms through frameworks like CUDA, which allow developers to leverage the GPU's power for specific automotive functions, such as AI and accelerated computing, fueling the transformation of the entire auto industry.

- The rising popularity of self-driving or autonomous vehicles is a primary growth factor for the demand for GPUs. Many new automobile models have various infotainment system options to aid the driver. Currently, parking cameras are required, particularly for larger vehicles with several dead angles, such as most SUVs. A camera on the front, back, or sides can help the driver avoid colliding with other vehicles, scraping sidewalks, etc. Consequently, a GPU is required to process all these cameras/sensors and render the image.

- In addition, automotive in-vehicle infotainment (IVI) systems have increasingly become more advanced. Premium models can have up to 12 displays with 4K resolution and features like gesture, voice, and facial recognition. Support for technologies, including Android Auto or Apple CarPlay, and larger screen sizes are the important elements of the consumer's wish lists while buying a new car. Automotive manufacturers have started using considerably more complex sensors and cameras to detect items in the surrounding area to improve this capability. The latest innovation is parking assistance with a bird's eye perspective. As a result, the GPU will analyze the sensors and render the complete area around the vehicle in real-time, allowing drivers to have a better awareness of their surroundings.

- Also, the automotive industry has experienced tremendous expansion during the previous decade. The development of affordable, efficient, and powerful electric cars was a major turning point for the industry. Significant innovations are analyzed to roll out as a result of autonomous driving. With significant research and computing power, autonomous vehicle implementation is analyzed to be witnessed during the forecast period, and a strong GPU (and CPU) is required to power artificial intelligence in a Tesla, BMW, Porsche, or any other vehicle. GPUs are also an integral feature of every modern car.

North America Accounts for Significant Market Share

- North America is one of the major investors and innovators in the global GPU as a Service market owing to the increasing domestic adoption and expanding regional data center, gaming, and AI market among consumers. The increase in demand for advanced technologies, such as data center servers, machine-to-machine communication, and AI, is significant compared to other regions. Therefore, it is expected to bring huge growth opportunities for the GPU as a Service market.

- The region's automotive and transport industry is one of the most important in the world due to the size of the domestic market and the use of mass production techniques. Over the past decade, the region's auto industry has grown dramatically from manufacturing to distribution, changing consumer preferences and new technology, pushing the industry into a historical change.

- North America is home to various companies like Honda, Toyota, Ford, Chevrolet, and Tesla. It has been a pioneer in the automotive industry, especially in terms of automation, thus creating new opportunities for the vendors operating in the region. According to CAR (Center for Automotive Research), US motor vehicle production will reach 11.7 million units by 2025.

- The regional government has also developed a National AI Strategy, a policy framework that sets out a strategy for the United States to accelerate AI R&D and adoption. It also promotes investments to provide GPU as a Service and other computing resources, increase international collaboration, increase R&D funding, and ethically develop AI to reduce bias and protect privacy.

- Also, the adoption of cloud technology, increasing penetration of data centers, and increasing 5G technology further expand the market growth in the region. The increasing expansion of the region's data center and cloud market will also fuel the demand for GPU technology.

GPU as a Service Industry Overview

The GPU as a Service market is consolidated and dominated by a few leading vendors, such as NVIDIA, AWS, IBM, Oracle, Google LLC, and Microsoft Corporation. Companies continuously focus on enhancing their market presence by launching new products, expanding their operations, or entering into strategic mergers and acquisitions, partnerships, and collaborations.

- March 2024 - Amazon Web Services (AWS) and NVIDIA announced that the NVIDIA Blackwell GPU platform launched by NVIDIA in 2024 would be introduced on AWS. AWS will provide the NVIDIA B100 Tensor Core GPUs and GB200 Grace Blackwell Superchip, expanding the companies' strategic partnership to offer the most advanced and secure software, infrastructure, and services to assist customers in unlocking generative artificial intelligence (AI) capabilities.

- March 2024 - Singtel launched a GPU as a Service (GPUaaS) in Singapore and Southeast Asia, offering access to NVIDIA's AI Computing power to boost growth and innovation. Singtel's GPU as-a-service will be powered by "NVIDIA H100 Tensor Core GPU".

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.5 Vendor Service Pricing Analysis

- 4.6 GPU Vendor Analysis for Datacenter Servers

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Usage of Generative AI and LLM Models Across Enterprises

- 5.1.2 Growing Applications of AR, VR, and AI

- 5.2 Market Challenges

- 5.2.1 Data Security Concerns

- 5.2.2 Lack of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Artificial Intelligence

- 6.1.2 High Performance Computing

- 6.1.3 Other Applications

- 6.2 By Enterprise Type

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Automotive

- 6.3.3 Healthcare

- 6.3.4 IT and Communication

- 6.3.5 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Middle East and Africa

- 6.4.6 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amazon Web Services Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 Nvidia DGX (Nvidia Corporation)

- 7.1.4 IBM Corporation

- 7.1.5 Oracle Systems Corporation

- 7.1.6 Alphabet Inc (Google)

- 7.1.7 Latitude.sh

- 7.1.8 Seeweb

- 7.1.9 Alibaba cloud

- 7.1.10 Linode LLC

- 7.1.11 CoreWeave