|

市場調查報告書

商品編碼

1550334

日本離散半導體:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Japan Discrete Semiconductors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

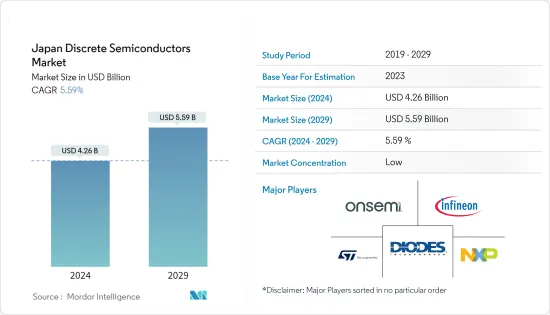

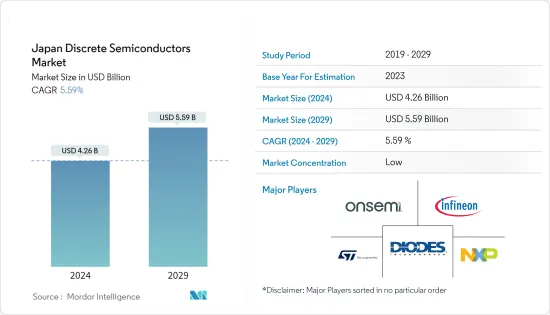

日本離散半導體市場規模預計到 2024 年為 42.6 億美元,預計到 2029 年將達到 55.9 億美元,預測期內(2024-2029 年)複合年成長率為 5.59%。

離散半導體對於技術進步至關重要,尤其是在汽車電子、可再生能源系統和消費性電子領域。物聯網、電動車和智慧設備等新興趨勢正在推動對專用離散半導體的需求。此外,由於這些半導體製造商在世界各地營運,他們經常以多種貨幣採購和銷售材料。因此,外匯波動會對盈利和競爭力產生重大影響。

主要亮點

- 離散半導體或分離式元件或裝置是單獨的電子元件,設計用於在電子電路中執行特定功能並獨立運行,無需整合。離散半導體的常見範例包括二極體、電晶體和閘流體。這些組件通常封裝有兩個或多個用於電路連接的引線(引腳)。離散半導體在電子領域有廣泛的應用,從電源和放大器到控制電路和訊號處理。

- 離散半導體比積體電路具有顯著優勢,包括增強的靈活性、客製化和卓越的功率處理能力。設計人員可以精確控制電路設計和性能,以支援更高的電壓和電流等級。然而,與積體電路相比,分立元件需要更多的基板空間並且可能需要更多的組裝步驟。

- 此外,大宗商品價格的波動,特別是金屬、矽、稀土元素等原料價格的波動,直接影響離散半導體的製造成本。這些波動可能會對利潤率產生重大影響,並需要調整定價策略。

- 高效率電源管理是離散半導體的關鍵促進因素之一。先進的系統結構提高了 AC-DC 電源供應器的效率,同時減少了其尺寸和組件數量。此外,乙太網路供電 (PoE) 標準的更新現在支援更高的功率傳輸,從而促進連網型照明等創新設備的開發。

- 穿戴式設備,從基本物理特性到最終用戶體驗,對於推動消費者採用至關重要。透過在產品設計過程中密切監控市場趨勢和挑戰,離散半導體公司可以大大受益並保持競爭力。具有改進的遷移率和臨界擊穿電場的半導體,特別是碳化矽(SiC),擴大被採用。這種趨勢在電晶體領域尤其明顯,並擴展到肖特基勢壘二極體(SBD)、結型場效電晶體(JFET)和MOSFET電晶體等電力電子元件。

- 俄羅斯入侵烏克蘭、美國競爭、選舉和以色列戰爭等地緣政治挑戰正在擾亂全球供應鏈,特別是對傳統工業、國防、高科技領域、航太和綠色能源至關重要的關鍵原料影響很大。俄羅斯-烏克蘭戰爭和經濟放緩對半導體產業造成了重大干擾。通膨和利率上升減少了消費者支出,抑制了行業需求,並導致離散半導體市場成長放緩。

日本離散半導體市場趨勢

功率電晶體有望佔據較大市場佔有率

- MOSFET 是主要用於在各種應用中切換和放大電子訊號的半導體裝置。它屬於場效電晶體(FET) 系列,因其能夠利用電場控制兩個端子之間的電流而聞名。它在低電壓下工作時提供快速開關和最高效率。

- 傳統功率放大器中的功率損耗催生了對具有整合輸入或輸出電阻電路以及檢驗的輸出功率性能的射頻高功率 MOSFET 模組的需求。三菱電機等主要廠商計劃在明年內推出配備此新型MOSFET的900MHz模組,以擴展頻寬。該公司表示,該型號在763MHz至870MHz頻段的功率輸出為50W,整體效率為40%,可望有助於降低功耗並擴大無線通訊範圍。

- 在電子產業,對智慧型手機、平板電腦、筆記型電腦、智慧型穿戴裝置和物聯網設備等各種電子設備的需求正在快速成長。這些設備需要功率電晶體來實現各種功能。不斷成長的消費者基礎和不斷推出的新電子設備正在推動對功率電晶體的需求。

- 在國內大型製造基地以及SONY和Panasonic等老牌家用電子電器公司的支持下,家用電子電器領域預計將對市場成長做出重大貢獻。預計這將推動家用電子電器產業電子元件製造中對離散半導體的需求增加,從而推動日本市場的成長。

- 此外,根據經濟產業省報告,2023年日本電子產業的電子零件和設備總產值將達到約6.97兆日圓(4,970億美元)。在此期間,日本電子工業總產值達到約10.7兆日圓(760億美元)。

汽車產業預計將出現顯著的市場成長

- 離散半導體對於汽車電子產品的變革至關重要,因為它們是為單獨的電子功能量身定做且密不可分的。與組合功能的積體電路 (IC) 不同,二極體、電晶體和閘流閘流體等離散半導體可以自主運行,從而增強車輛的功能、安全性和連接性。這一轉變預示著技術進步的新時代,並提高了汽車性能和功能的基準。

- 汽車需求主要推動分立元件市場,尤其是功率電晶體和整流器。傳統汽車幾十年來一直依賴 12V 電池系統,但現在它們很難滿足現代汽車日益成長的電子需求,因此對更節能解決方案的需求日益凸顯。

- 日本政府設定了所有到 2050 年在日本銷售的新車均為電動或混合動力汽車的目標。日本政府打算向私人企業提供補貼,以鼓勵電動車電池和馬達的進步。為了減少二氧化碳排放,日本政府正在積極推廣電動車(EV)的使用,並大力投資電動車基礎建設。由於政府對電動車購買者提供補貼,日本的電動車充電站數量迅速增加,以適應不斷成長的電動車數量。

- 此外,根據日本汽車經銷商協會聯合會和日本輕型汽車摩托車協會公佈的資料,2023年標準型電動車(EV)保有量將達到43,991輛,其中日本著名的輕型輕型汽車電動車保有量將達到44,544輛。

日本離散半導體產業概況

日本離散半導體市場已整合,主要企業包括義法半導體、英飛凌科技、恩智浦半導體和 Diodes 公司。市場參與企業正在策略性地利用夥伴關係和收購來加強產品系列併建立永續的競爭優勢。

- 2024 年 6 月:三菱電機公司宣布計劃推出基於網路的服務。該服務為新逆變器的設計和檢驗提供關鍵資料。該逆變器具有一個帶有三個 LV100絕緣柵雙極電晶體(IGBT) 的模組。其主要目標是協助客戶加速開發適用於光電系統等應用的專用高功率逆變器。此逆變器原型是一個配備了三個並聯 LV100 工業 IGBT 的模組,安裝在 100mm x 140mm 的緊湊框架中,這是高功率逆變器系統的標準尺寸。

- 2024 年 3 月:英飛凌科技宣布推出最新產品 IAUCN08S7N013,這標誌著其全新 OptiMOS 7 80V 功率 MOSFET 技術的首次亮相。此新產品的功率密度顯著提高,採用彈性高電流 SSO8 5 x 6 mm2 SMD 封裝。 OptiMOS 7 80V 專為快速成長的 48V 板網應用而設計,是汽車領域的理想選擇。旨在滿足電動車、48 V馬達控制中汽車 DC-DC 轉換器的嚴格標準,包括電動方向盤(EPS)、48 V 電池開關、電動二輪車和三輪車等應用。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19副作用和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 汽車和電子領域對高節能省電元件的需求不斷增加

- 綠色能源發電需求增加帶動市場

- 市場挑戰

- 積體電路需求增加

第6章 市場細分

- 按類型

- 二極體

- 小訊號電晶體

- 功率電晶體

- MOSFET功率電晶體

- IGBT功率電晶體

- 其他功率電晶體

- 整流器

- 閘流體

- 按行業分類

- 車

- 家用電子電器

- 通訊設備

- 工業的

- 其他行業

第7章 競爭格局

- 公司簡介

- On Semiconductor Corporation

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- Diodes Incorporated

- Toshiba Electronic Devices & Storage Corporation

- ABB Ltd.

- Nexperia BV

- Semikron Danfoss Holding A/S(Danfoss A/S)

- Eaton Corporation PLC

- Hitachi Energy Ltd.(Hitachi Ltd.)

- Mitsubishi Electric Corp.

- Fuji Electric Co Ltd

- Analog Devices, Inc.

- Vishay Intertechnology Inc.

- Renesas Electronics Corporation

- ROHM Co. Ltd

- Microchip Technology

- Qorvo Inc.

- Wolfspeed Inc.

- Texas Instruments Inc.

- Littelfuse Inc

- WeEn Semiconductors

第8章投資分析

第9章市場的未來

The Japan Discrete Semiconductors Market size is estimated at USD 4.26 billion in 2024, and is expected to reach USD 5.59 billion by 2029, growing at a CAGR of 5.59% during the forecast period (2024-2029).

Discrete semiconductors are crucial in technological advancements, especially in automotive electronics, renewable energy systems, and consumer electronics. Emerging trends like IoT, electric vehicles, and smart devices fuel the demand for specialized discrete semiconductors. Moreover, given that manufacturers of these semiconductors have a global presence, they often source materials and conduct sales in various currencies. Consequently, fluctuations in exchange rates can significantly affect their profitability and competitive edge.

Key Highlights

- Discrete semiconductors, or discrete components or devices, are individual electronic components designed to carry out specific functions within electronic circuits that operate independently, without integration. Common examples of discrete semiconductors include diodes, transistors, and thyristors. These components are typically housed in packages featuring two or more leads (pins) for circuit connections. Discrete semiconductors find extensive applications across electronics, from power supplies and amplifiers to control circuits and signal processing.

- Discrete semiconductors provide significant advantages over integrated circuits, including enhanced flexibility, customization, and superior power handling capabilities. They enable designers to precisely control circuit design and performance precisely, accommodating higher voltage and current levels. However, discrete components may necessitate more board space and additional assembly steps compared to integrated circuits.

- Furthermore, fluctuations in commodity prices, particularly in raw materials like metals, silicon, and rare earth elements, directly influence the manufacturing costs of discrete semiconductors. These fluctuations can significantly impact profit margins and necessitate adjustments in pricing strategies.

- Efficient power management is one of the significant driving factors in discrete semiconductors. Advanced system architectures are enhancing the efficiency of AC-DC power adapters while reducing their size and component count. Furthermore, updated power-over-ethernet (PoE) standards now support higher power transfers, facilitating the development of innovative devices such as connected lighting.

- Wearable devices, from their fundamental physics to the end-user experience, are crucial in driving consumer adoption. Discrete semiconductor companies can benefit significantly by closely monitoring market trends and challenges during product design, ensuring they maintain a competitive edge. The adoption of semiconductors with enhanced mobility and critical breakdown fields, particularly Silicon Carbide (SiC), is gaining traction. This trend is especially notable in the transistor range and extends to power electronics devices, including Schottky barrier diodes (SBDs), junction field effect transistors (JFETs), and MOSFET transistors.

- Geopolitical challenges, including the Russian invasion of Ukraine, China-US competition, elections, and the war in Israel, significantly impact the global supply chain, especially critical raw materials vital for traditional industries, defense, high-tech sectors, aerospace, and green energy. The Russia-Ukraine war and economic slowdown caused significant disruption in the semiconductor industry. The increased inflation and interest rates reduced consumer spending, hampered the industry's demand, and led to slow growth in the discrete semiconductor market.

Japan Discrete Semiconductors Market Trends

Power Transistors are Expected to Hold a Significant Market Share

- MOSFETs are semiconductor devices used primarily for switching and amplifying electronic signals in various applications. They belong to the family of field-effect transistors (FETs) and are known for their ability for controlling the flow of current between the two terminals using an electric field. They function at low voltages while providing quick switching and maximum efficiency.

- The power loss in conventional power amplifiers creates demand for RF high-power MOSFET modules that offer a built-in input or output impedance-matching circuit and verified output power performance. Key vendors, such as Mitsubishi Electric, plan to expand the frequency range by launching a 900 MHz module equipped with the new MOSFET in the coming year. According to the company, the model with 50 W power output in the 763 MHz to 870 MHz band and a total efficiency of 40% is projected to help reduce power consumption and increase radio communication range.

- The electronics industry is witnessing a surge in the demand for different electronic devices such as smartphones, tablets, laptops, smart wearables, and IoT devices. These devices require power transistors for various functions. The expanding consumer base and the continuous introduction of new electronic devices drive the demand for power transistors.

- The consumer electronic segment would contribute significantly to the market's growth, supported by the country's large manufacturing landscape and the established consumer electronic companies, including Sony and Panasonic, among others. This would fuel the demand for discrete semiconductor growth in the manufacturing of electronic components used in the consumer electronic segments, which would drive the market growth in Japan.

- Furthermore, in 2023, the electronics industry in Japan witnessed electronic components and devices contributing to a total production value of approximately JPY 6.97 trillion (USD 0.497 trillion), as reported by METI (Japan). The overall production value of the Japanese electronics industry during that period reached around JPY 10.7 trillion (USD 0.076 trillion).

Automotive Industry is Expected to Have a Significant Market Growth

- Discrete semiconductors, tailored for distinct electronic functions and inseparable, are pivotal in transforming automotive electronics. Unlike integrated circuits (ICs), which combine functions, discrete semiconductors, like diodes, transistors, and thyristors, operate autonomously, bolstering automotive capabilities, safety, and connectivity. This shift heralds a new age of technological progress, elevating benchmarks for automotive performance and features.

- Automotive demands are primarily fueling the market for discrete components, particularly power transistors and rectifiers. While traditional vehicles have relied on 12-V battery systems for decades, they are now struggling to support the increased electronic demands of modern cars, highlighting the necessity for more energy-efficient solutions.

- By 2050, the Japanese government has set a target to have all newly sold cars in Japan be electric or hybrid. The country intends to provide subsidies to the private sector to expedite the advancement of batteries and motors for electric-powered vehicles. In an effort to decrease its carbon emissions, the Government of Japan is actively promoting the use of electric vehicles (EVs), leading to significant investments in EV infrastructure development. As a result of government subsidies for EV buyers, Japan has experienced a surge in the number of EV charging stations to accommodate the growing number of electric vehicles.

- Moreover, as per the data released by the Japan Automobile Dealers Association and the Japan Light Motor Vehicle and Motorcycle Association, the year 2023 witnessed the sale of 43,991 standard-size electric vehicles (EVs) and 44,544 electric variants of Japan's renowned lightweight keiminicars.

Japan Discrete Semiconductors Industry Overview

The Japan Discrete Semiconductors Market is consolidated and features key players like STMicroelectronics, Infineon Technologies, NXP Semiconductor, and Diodes Incorporated, among others. Market participants strategically leverage partnerships and acquisitions to bolster their product portfolios and establish a sustainable competitive edge.

- June 2024: Mitsubishi Electric Corporation has announced plans to introduce a web-based service. This service will offer crucial data on the design and validation of the new inverter. The inverter is distinctive, featuring a module housing three LV100 insulated gate bipolar transistors (IGBTs). The primary goal is to assist customers in expediting the development of high-power inverters, specifically for applications like photovoltaic power-generation systems. Notably, the prototype inverter boasts a module that houses three parallel LV100 industrial IGBTs, all within a compact 100mm x 140mm frame, a standard size for high-power inverter systems.

- March 2024: Infineon Technologies introduced its latest product, the IAUCN08S7N013, marking the debut of its new OptiMOS 7 80 V power MOSFET technology. This new offering boasts a notable uptick in power density and comes housed in the resilient and high-current SSO8 5 x 6 mm2 SMD package. Designed for the burgeoning 48 V board net applications, the OptiMOS 7 80 V is primed for the automotive sector. It's engineered to meet the exacting standards of automotive DC-DC converters in EVs, 48 V motor control - including applications like electric power steering (EPS), 48 V battery switches, and electric two- and three-wheelers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for High-energy and Power-efficient Devices in the Automotive and Electronics Segment

- 5.1.2 Increasing Demand for Green Energy Power Generation Drives the Market

- 5.2 Market Challenges

- 5.2.1 Rising Demand for Integrated Circuits

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Diode

- 6.1.2 Small Signal Transistor

- 6.1.3 Power Transistor

- 6.1.3.1 MOSFET Power Transistor

- 6.1.3.2 IGBT Power Transistor

- 6.1.3.3 Other Power Transistor

- 6.1.4 Rectifier

- 6.1.5 Thyristor

- 6.2 By End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Communication

- 6.2.4 Industrial

- 6.2.5 Other End-user Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 On Semiconductor Corporation

- 7.1.2 Infineon Technologies AG

- 7.1.3 STMicroelectronics NV

- 7.1.4 NXP Semiconductors NV

- 7.1.5 Diodes Incorporated

- 7.1.6 Toshiba Electronic Devices & Storage Corporation

- 7.1.7 ABB Ltd.

- 7.1.8 Nexperia BV

- 7.1.9 Semikron Danfoss Holding A/S (Danfoss A/S)

- 7.1.10 Eaton Corporation PLC

- 7.1.11 Hitachi Energy Ltd. (Hitachi Ltd.)

- 7.1.12 Mitsubishi Electric Corp.

- 7.1.13 Fuji Electric Co Ltd

- 7.1.14 Analog Devices, Inc.

- 7.1.15 Vishay Intertechnology Inc.

- 7.1.16 Renesas Electronics Corporation

- 7.1.17 ROHM Co. Ltd

- 7.1.18 Microchip Technology

- 7.1.19 Qorvo Inc.

- 7.1.20 Wolfspeed Inc.

- 7.1.21 Texas Instruments Inc.

- 7.1.22 Littelfuse Inc

- 7.1.23 WeEn Semiconductors