|

市場調查報告書

商品編碼

1624581

高性能銅箔:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)High-end Copper Foil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

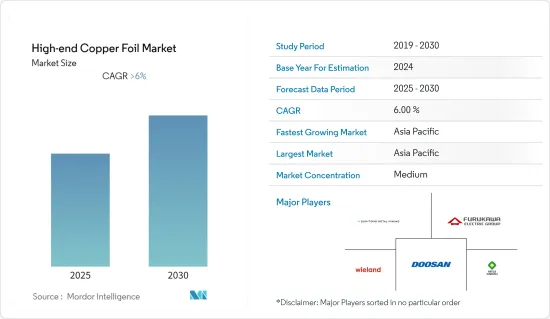

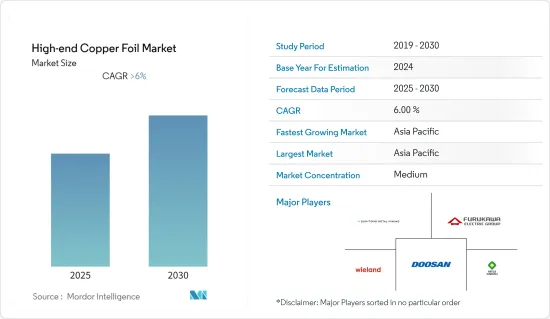

高性能銅箔市場預計在預測期內年複合成長率將超過6%

主要亮點

- 電路基板應用佔據市場主導地位,由於智慧型手機、個人電腦、平板電腦和其他醫療用電子設備產品等消費性電子產品的需求不斷成長,預計在預測期內將出現適度成長。

- 用於變壓器和電網級能源儲存的銅箔可能是一個機會。

- 結晶石墨烯片作為銅箔替代品的開發預計將阻礙市場成長。

- 亞太地區主導全球市場,最大的消費來自中國和印度等國家。

高性能銅箔市場趨勢

電路基板需求增加

- 大多數電子產品都使用印刷電路基板(PCB)。高品質的PCB製造技術使電子產品製造商能夠生產更小、更複雜的產品。它掌握著當今充滿活力且快速發展的電子創新的關鍵。

- 用於製造印刷電路基板的基板是玻璃纖維增強環氧樹脂層壓板。環氧樹脂的一側或兩側粘合有銅箔。

- 用於印刷基板的銅箔主要有兩種類型:電解銅箔和軋延銅箔。這兩種類型都有很多變體,其中電解銅箔提供了最多的選擇。銅箔的特性對於高頻電路至關重要。

- 軋延銅箔廣泛用於要求表面光滑的軟性電路基板。電解銅箔用於剛性和軟性電路。

- 全球對智慧型手機、個人電腦、平板電腦和其他醫療用電子設備產品等消費性電子產品的需求正在迅速成長,印度和中國預計將繼續保持市場成長的領先地位。印刷基板幾乎用於所有電子產品,並可能在未來幾年推動對高品質銅箔的需求。

- 全球有2687家PCB工廠,中國佔55%。自2020年以來,包括覆銅板在內的所有PCB材料價格均有所上漲,但PCB價格漲幅卻沒有那麼快。因此,中國PCB產業正變得越來越無利可圖。低利潤的PCB產業可能會透過減少過剩產能而受益於停電。

- 由於政府為 PCB 工廠提供巨大的獎勵,超過 51% 的 PCB 是在中國製造的。中國也以極低的成本生產這些電路基板。結果,世界各地許多公司正在關閉其業務。

- 過去十年英國有超過300家PCB工廠,但現在已不到35家。南非也同樣受到原料和人事費用上漲的影響。

- 根據IPC的數據,2022年11月來自北美的PCB出貨量與去年同月相比成長了26.1%。 11月出貨量較上月成長13.1%。

- 所有上述因素都可能在未來幾年推動高階銅市場的發展。

亞太地區主導市場

- 由於中國和印度等國家生產活動的增加,亞太地區主導了全球市場佔有率。

- 超過50%的PCB是在中國製造的,部分原因是政府為PCB工廠提供了巨大的激勵措施。

- 印度儲能聯盟(IESA)表示,印度電動車市場將以36%的年複合成長率成長。據重工業部稱,過去三年印度註冊了 52 萬輛電動車。電動車在 2021 年經歷了強勁成長,部分得益於有利的政府立法和舉措。

- 為了鼓勵使用 e-2W,FAME-II 計劃下的需求激勵已從 10,000 印度盧比/千瓦時(122.60 美元/千瓦時)增加到 15,000 印度盧比/千瓦時(183.90 美元/千瓦時),上限為成本車輛的比例從20% 增加到近40%。此外,FAME-印度計畫第二階段已從 2022 年 3 月 31 日起再延長兩年。這可能會推動預測期內研究市場的成長。

- 目前,印度35%的PCB需求透過國內生產滿足,其餘65%依賴進口。印度目前生產人造 PCB 和裸 PCB。後者目前的市場規模約為12億美元,其中30%產自印度。

- 韓國PCB製造商擁有先進技術力,並有望受益高性能銅箔市場。這些廠商都獲得了蘋果的PCB訂單。 TAESUNG 是蘋果主要企業。

- 根據KPCA(韓國印刷電路協會)統計,韓國佔印刷基板市場的13%,位居全球第二,僅次於中國(49%)、台灣(12%)和日本(8%)。

- 上述因素,加上政府的支持,導致預測期內該地區高性能銅箔消費需求增加。

高性能銅箔產業概況

高性能銅箔市場部分整合,五家主要企業佔據了相當大的市場。主要企業包括(排名不分先後)三井金屬礦業、古河電工、住友金屬礦業、斗山公司、維蘭德集團。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大印刷基板(PCB) 材料的應用

- 交通和能源儲存領域對鋰離子電池的需求不斷增加

- 抑制因素

- 開發結晶石墨烯片作為銅箔的替代品

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 軋延銅箔

- 電解銅箔

- 按用途

- 電路基板

- 電池

- 太陽能和替代能源

- 電器產品

- 醫療用途

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲/紐西蘭

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Chang Chun Petrochemical Co. Ltd

- Civen Metal Material(Shanghai)Co. Ltd

- Doosan Corporation

- Fukuda Metal Foil & Powder Co. Ltd

- JX Nippon Mining & Metals Corporation

- Mitsui Mining & Smelting Co. Ltd

- Solus Advanced Materials

- Sumitomo Metal Mining Co. Ltd

- SH Copper Products Co. Ltd

- The Furukawa Electric Co. Ltd

- Targray Technology International Inc.

- UACJ Foil Corporation

- Wieland Group

第7章 市場機會及未來趨勢

- 變壓器和電網級能源儲存中的銅箔

簡介目錄

Product Code: 46374

The High-end Copper Foil Market is expected to register a CAGR of greater than 6% during the forecast period.

Key Highlights

- Circuit board applications dominate the market and are expected to grow at a moderate rate during the forecast period, owing to the increasing demand for consumer gadgets like smartphones, PCs, tablets, and other medical electronics products.

- Copper foils in transformer and grid-level energy storage are likely an opportunity.

- The development of single-crystal graphene sheets as a substitute for copper foil is expected to hinder the market's growth.

- Asia-Pacific dominated the market across the world, with the most significant consumption from countries such as China and India.

High-End Copper Foil Market Trends

Increasing Demand for Circuit Boards

- Most of the electronics products manufactured contain printed circuit boards (PCBs). High-quality PCB manufacturing technology allowed electronics product manufacturers to produce smaller, more complex products. It is the key to today's dynamic and rapidly progressing electronic innovations.

- The substrate used to manufacture printed circuit boards is fiberglass-reinforced epoxy laminate. Epoxy resin includes a copper foil bonded to one or both sides.

- Two main types of copper foil are used in PCBs: electrodeposited and rolled copper foil. Both these types have many possible variations, with the most choices available for ED copper. Copper foil characteristics are essential for high-frequency circuits.

- Rolled copper foil is used extensively for flexible circuit boards where a smooth surface is preferred. Electrodeposited copper foils are used in rigid, flexible circuits.

- The demand for consumer gadgets, such as smartphones, PCs, tablets, and other medical electronics products, is rapidly increasing globally, with India and China expected to remain at the top of market growth. As printed circuit boards are deployed in almost all electronics products, it will likely drive the demand for high-quality copper foil in the coming years.

- There are 2687 PCB plants worldwide, with China having 55%. Since 2020, the prices of all PCB materials, including copper-clad laminates, have been growing, while PCB prices have increased less sharply. It made the PCB sector in China increasingly unprofitable. The low-profit PCB sector may benefit from power cutbacks by reducing the surplus capacity.

- Over 51% of the PCBs are manufactured in China, owing to the offering of huge incentives by the government to the PCB factories. China is also producing these circuit boards at a meager cost. As a result, many companies across the world are closing their operations.

- The United Kingdom used to have over 300 PCB factories over the last decade, but it is now reduced to less than 35. South Africa is also experiencing the same effects due to increased raw materials and labor costs.

- According to IPC, PCB shipments from North America increased by 26.1% while comparing November 2022 to the same month in the previous year. Shipments in November increased by 13.1% over the last month.

- All the above factors are expected to drive the market for high-end copper in the coming years.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share due to the increasing production activities in countries, including China and India.

- More than 50% of PCBs are manufactured in China, owing to the huge incentives offered by the government to PCB factories.

- According to the India Energy Storage Alliance (IESA), the Indian EV market would grow at a CAGR of 36%. According to the Ministry of Heavy Industries, 0.52 million EVs have been registered in India during the previous three years. EVs had strong growth in 2021, aided by the government's adoption of beneficial laws and initiatives.

- For encouraging e-2W use, the demand incentive raised under the FAME-II scheme from INR 10,000/KWh (USD 122.60/KWh) to INR 15,000/KWh (183.90/KWh), with a cap rise from 20% to almost 40% of vehicle cost. Additionally, the FAME-India Scheme's Phase II was extended for an additional two years beginning on March 31, 2022. It would, in turn, promote the growth of the studied market during the forecast period.

- Currently, 35% of India's PCB need is met by domestic production while being dependent on imports for the remaining 65%. India presently produces both populated and bare PCBs. The current market size for the latter is around US$ 1.2 billion, with 30% of that market's production occurring in India.

- The PCB manufacturers in South Korea have advanced technical skills, which will likely benefit the high-end copper foil market. These manufacturers have won orders for PCB from Apple. TAESUNG is the leading company dealing with PCB for Apple manufacturing.

- According to KPCA (Korean Printed Circuits Association), South Korea occupies 13% of the PCB market, which is the second largest in the world behind China (49%), followed by Taiwan (12%) and Japan (8%).

- The factors above, coupled with government support, contribute to the increasing demand for high-end copper foil consumption in the region during the forecast period.

High-End Copper Foil Industry Overview

The high-end copper foil market is partially consolidated, with the top five players accounting for a considerable chunk of the market. The major companies include (not in any particular order) Mitsui Mining & Smelting Co. Ltd, Furukawa Electric Co. Ltd, Sumitomo Metal Mining Co. Ltd, Doosan Corporation, and Wieland Group, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Application as a Printed Circuit Board (PCB) Material

- 4.1.2 Increasing Demand for Lithium Ion Batteries From Transportation and Energy Storage Sector

- 4.2 Restraints

- 4.2.1 Development of Single Crystal Graphene Sheet as a Substitute for Copper Foil

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Rolled Copper Foil

- 5.1.2 Electrodeposited (ED) Copper Foil

- 5.2 Application

- 5.2.1 Circuit Boards

- 5.2.2 Batteries

- 5.2.3 Solar and Alternative Energy

- 5.2.4 Appliances

- 5.2.5 Medical

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Australia & New Zealand

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Russia

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chang Chun Petrochemical Co. Ltd

- 6.4.2 Civen Metal Material(Shanghai) Co. Ltd

- 6.4.3 Doosan Corporation

- 6.4.4 Fukuda Metal Foil & Powder Co. Ltd

- 6.4.5 JX Nippon Mining & Metals Corporation

- 6.4.6 Mitsui Mining & Smelting Co. Ltd

- 6.4.7 Solus Advanced Materials

- 6.4.8 Sumitomo Metal Mining Co. Ltd

- 6.4.9 SH Copper Products Co. Ltd

- 6.4.10 The Furukawa Electric Co. Ltd

- 6.4.11 Targray Technology International Inc.

- 6.4.12 UACJ Foil Corporation

- 6.4.13 Wieland Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Copper Foils In Transformer and Grid-level Energy Storage

02-2729-4219

+886-2-2729-4219