|

市場調查報告書

商品編碼

1626334

亞太地區變頻驅動器:市場佔有率分析、產業趨勢、成長預測(2025-2030)APAC Variable Frequency Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

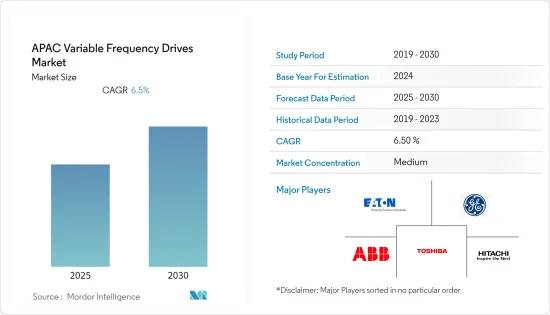

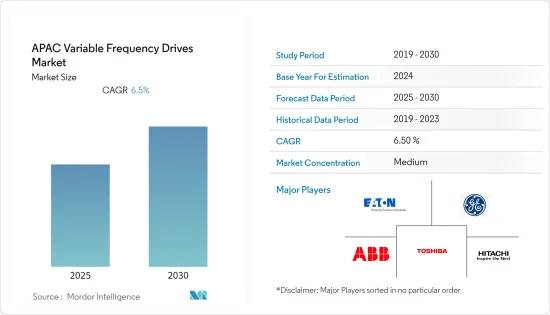

亞太地區變頻驅動器市場預計在預測期內複合年成長率為 6.5%

主要亮點

- 用於監控馬達速度的變頻驅動器由於能夠最佳化各行業的能源使用而廣受歡迎。除了能源效率之外,VFD 的受歡迎還在於它們能夠延長馬達壽命,並透過允許在其生命週期內分散式使用來進一步減少馬達維護,從而使馬達免於持續使用相同的參數。

- 多個 VFD 供應商不斷增加的投資(特別是在研發方面)正在推動技術的進一步進步和變頻驅動器市場的成長。亞太地區基礎建設較為完善,經濟發展先進,投資不斷增加。

- 快速的技術進步正在提高多個行業對驅動器的接受度。這項進步的重點是高可靠性和更低的能源成本,當商業建築配備馬達驅動系統時,每平方英尺的能源消耗可以減少 30-40%。

- 此外,最新的高階硬碟整合了網路和診斷功能,以實現更好的效能和更高的生產力。智慧型馬達控制、節能和降低峰值電流是選擇 VFD 作為所有馬達驅動系統控制器的一些關鍵原因。

- 變頻驅動器廣泛應用於商業和工業領域的暖氣、通風和空調系統。 VFD 使尖峰容量能夠滿足恆定電流 HVAC 系統中尖峰負載的高要求,然後隨著負載需求的減少幫助緩慢控制能量。

- COVID-19 的爆發對受訪市場產生了前所未有的影響,一些部署變頻驅動器的最終用戶產業面臨多項挑戰。各行各業受到全國範圍內停工的打擊,陷入停滯。疫情導致供應鏈中斷,使得變頻驅動廠商難以最佳化生產。此外,全國範圍內的封鎖導致營運停止。疫情也導致邊境關閉,導致零件進出口和安裝現場產品整合變得困難。

亞太地區變頻驅動器市場趨勢

食品加工業佔營運支出最大

在輸送機、泵浦、攪拌機和壓縮機等食品加工系統和設備中使用變頻器不僅可以節省能源,而且可以透過精確控制馬達速度來改善食品製備、輸送和包裝過程。

該地區(尤其是東南亞)的食品加工業預計將在整個預測期內推動變頻驅動器市場的需求。推動東南亞市場的因素包括對高品質加工食品的需求不斷增加以及消費者對食品安全的日益關注。

各種各樣的泵浦普遍用於輸送原料、半成品或最終產品、衛生水和其他流體。這些泵浦的功耗可以透過多種策略保持較低水平,從簡單的維護到先進的節能設計。大多數製造商都誇大了泵浦的壓力能力,故意選擇壽命而不是效率。

離心式幫浦用於通過葉輪輸送液體,葉輪迫使液體通過開口。這些是工業中最常見的泵浦類型。在食品和飲料工廠中,常用於水和像水一樣流動的液體。據估計,大多數離心式幫浦至少有20%至30%的容量。這導致效率大幅降低,工業泵浦的效率約為 40%。

此外,許多麵包店在生產停止後仍然依靠閃爍的警告燈和鳴響的喇叭來通知維護人員介入並找出問題所在。然而,當今的食品處理系統通常應用先進的數位檢測技術來遠端找出潛在問題。

在亞太地區,將變頻驅動器整合到各種食品加工過程中已被證明可以降低能源消耗水準。因此,這一因素預計將導致評估期內變頻驅動器市場呈指數級成長。食品加工業的成長為新參與企業提供了進入市場的機會,他們可以提供更高產量和更好結果的創新產品。

中國佔較大市場佔有率

預計變頻驅動器市場將在中國佔據重要佔有率。這主要是由於發電和石油和天然氣行業業務的增加,以及大膽支出建立製造設施。

- 中國正專注於基礎設施擴張,並將外國直接投資引入許多製造業和工業部門。中國政府的積極支持將鼓勵更多的加值產業,包括風能和太陽能發電、資訊科技和通訊、汽車、石化加工和鋼鐵,這將極大地促進中國經濟的發展。行業的發展。因此,它對變頻驅動器的需求影響最大。因此,中國仍然是變頻器最有價值的市場。

- 此外,國家啟動了「中國製造2025」計畫。這是政府的一項舉措,旨在將國家工業從低成本、大量生產升級為高價值、先進製造。透過這項計劃,中國政府的目標是到2020年在中國生產100萬輛電動車和插電式混合動力汽車,國內產量佔國內市場佔有率的70%以上。

- 變頻驅動器也必須隨著市場的變化而變化,包括控制精度、效率、尺寸和環境耐受性。中國支持新能源、汽車和高科技設備生產的措施預計將創造對變頻驅動器的巨大需求。

- 中國VFD供應商專注於全球市場的低階技術水準。由於起步緩慢、缺乏創新,中國變頻器在與國外變頻器的競爭中處於落後地位,主要集中在鋼鐵業、軌道交通等技術要求較高的垂直領域,這阻礙了變頻器的發展。

- 暖通空調/空調設備市場的快速成長對受訪市場的成長做出了重大貢獻。根據IEA的數據,中國生產了全球約70%的室內空調,約佔全球冷凍能力的22%。

亞太地區變頻驅動器產業概況

亞太地區變頻驅動器市場按伊頓公司、ABB 有限公司、Crompton Greaves、通用電氣公司和霍尼韋爾國際公司等參與企業的存在進行細分。

- 2020年2月-GE再生能源與Angat Hydropower Corporation簽署了菲律賓218MW Angat水力發電廠維修合約。安加特水力發電廠滿足馬尼拉大都會90%以上的飲用水需求,並支持布拉幹省和邦板牙省25,000公頃農田的灌溉。

- 2021年6月-電力管理公司伊頓宣布已完成江蘇億能電氣母線槽業務50%的股權收購,該公司在中國生產和銷售母線槽產品。億能的母線槽能力和在中國的強大影響力,加上伊頓廣泛的配電和電能品質產品組合,將使該公司能夠擴展其包裝解決方案,以滿足亞太地區客戶的需求。

- 2021 年 8 月 - 日立收購泰雷茲的地面運輸系統業務,在新市場創造機會並擴展其核心業務,並收購 GTS 客戶。日立和 GTS 數位技術的結合將使我們能夠向全球基本客群提供行動即服務。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章技術概況

- 按類型

- 交流驅動器

- 直流驅動器

第6章市場動態

- 市場促進因素

- 市場限制因素

第7章 市場區隔

- 按額定輸出

- 低電壓

- 中壓

- 按最終用戶產業

- 石油和天然氣

- 食品加工

- 能源/電力

- 用水和污水管理

- 紙漿/造紙製造

- 其他

- 按國家/地區

- 中國

- 印度

- 日本

- 其他亞太地區

第8章 競爭格局

- 公司簡介

- Eaton Corporation

- ABB Ltd(GE Industrial)

- Crompton Greaves

- General Electric Company

- Honeywell International Inc.

- Rockwell Automation Inc.

- Hitachi Group

- Siemens AG

- Mitsubishi Corporation

- Toshiba Corporation

- Schneider Electric Company

- Johnson Controls

- Emerson Electric Company

第9章投資分析

第10章投資分析市場的未來

The APAC Variable Frequency Drives Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- The Variable Frequency Drives used to monitor the speed of motors have gained significant traction due to their ability to optimize energy usage in various industries. Not only energy efficiency but the popularity of VFDs can also be attributed to their capacity to increase motor life and further reduce the maintenance of motor by allowing it distributed use across the life-cycle, relieving it from constant use under the same parameters.

- Increased investments from several VFD vendors (especially in R&D) have allowed them to further the technology and prompt the growth of the variable frequency drives market. The investment in the Asia-Pacific region has been higher, owing to the opportunities arising from relatively higher infrastructure and economic development in the region.

- Rapid technological advancement has led to higher acceptability of the drives in several industries. The advances are focused on high reliability and reduced energy costs which can potentially reduce the per square foot energy by 30-40% when equipped with motor-driven systems in commercial buildings.

- Additionally, the advanced and modern drives integrate the networking and diagnostic capabilities into better performance and increased productivity. Intelligent motor control, energy savings, and reduction of peak-current drawn are some of the major reasons to choose a VFD as the controller in every motor-driven system.

- For heating, ventilation, and air-conditioning systems used in the commercial and industrial sector, the Variable Frequency Drives find wide usage as they can handle the variable load in several components, like chillers. The VFD helps allow peak capacity to meet the high demands of peak loads in constant flow HVAC systems and then slowly control the energy with decreasing need for the load.

- The COVID-19 outbreak had an unprecedented impact on the studied market, with several end-user industries that deploy variable frequency drives facing several difficulties. The industries were riddled with nationwide lockdowns, which brought them to a standstill. The pandemic led to supply chain disruptions and the manufacturing of Variable Frequency Drives creating difficulties for the vendors to run optimum production. Furthermore, the nationwide lockdown across countries resulted in the shutting down of operations. The pandemic also led to the closing of borders which made imports and exports of parts and the integration of the products at the installation site a challenge.

APAC Variable Frequency Drives Market Trends

Food Processing segment to hold biggest operating expense

The use of VFDs on food processing systems and equipment such as conveyors, pumps, mixers, compressors, and other equipment not only saves the energy, but by precisely controlling motor speed, it enables the fine-tuning and precise control of food preparation, transfer, and packaging processes.

The food processing industry in the region, especially in Southeast Asia, expects to boost the demand for variable frequency drive market throughout the forecast period. The factors that drive the Southeast Asia market include an increase in demand for processed quality food and a rise in consumer concerns over the safety of food products.

Pumps of multiple kinds are ubiquitous for propelling ingredients, semi-finished or finished products, sanitation water, and other fluids. The power consumption of these pumps can be kept low through various strategies, starting from simple maintenance to sophisticated energy-saving designs. Most of the manufacturers oversize the pressure capabilities of the pump and intentionally opt for longevity over efficiency.

Centrifugal pumps are used to move liquid with an impeller, a bladed rotating wheel that propels liquid out an aperture. These are the most common type of pumps in the industry. In food and beverage plants, they are often used with water or fluids that flow like water. According to the estimates, most of the centrifugal pumps have a capacity of at least 20%-30%. This leads to great inefficiency, and the industrial pump's efficiency is about 40%.

Additionally, many bakeries still rely on the flashing warning lights and blaring horns for signaling the maintenance crew to jump into the action and figure out what is gone wrong after production comes to a grinding halt. However, today's ingredient handling systems are often applying for advances in digital detection to pinpoint potential problems remotely.

In the Asia Pacific region, the integration of variable frequency drives in varied food processes has proven to decrease energy consumption levels. Therefore, this factor will help the variable frequency drive market to record exponential growth across the assessment period. The growth in the food processing industry has provided opportunities for new players to enter the market with innovative products offering higher output and better results.

China to hold significant market share

The variable-frequency drive market is anticipated to hold a significant share in China, owing to the increasing operations primarily across power generation and the oil and gas industry, along with bold spending towards the establishment of manufacturing facilities.

- China's focus on infrastructural expansion has translated into FDI in numerous manufacturing and industrial sectors. Active backing from the Chinese Government has empowered accommodation of a higher number of value-addition industries, transforming into overall industry growth that includes several Chinese industrial sectors such as wind and solar power, telecommunications, automotive, petrochemical processing, and steel productions, among the top contributors to the progress of its economy. Therefore, they exhibit the highest impact on the demand for variable frequency drives. As a result, China continues to be the most worthwhile market for VFDs.

- Furthermore, the country started Made in China 2025 program, a government initiative to upgrade the country's industry from low-cost mass production to higher value-added advanced manufacturing. Through this program, the Chinese Government aims to produce 1 million electric and plug-in hybrid cars in China by 2020, with national production accounting for at least 70% of the country's market share.

- The variable frequency drive also needs to change according to market changes, like in control precision, efficiency, size, environmental tolerance, etc. China's policies to support the manufacturing of new energy, new energy, automobiles, and high-tech equipment will create enormous demand for variable frequency drives.

- China VFD suppliers focused on the low-end technology level among the global markets. Late starting and lack of technological innovations make China VFDs at a backfoot position in competition with foreign VFDs, predominantly in the steel industry, rail transportation, and other verticals that require high technical requirements, thereby impeding the domestic inverter drives growth.

- The rapidly growing market for HVAC/AC equipment is significantly contributing to the growth of the market studied. According to IEA, China produces around 70% of the world's room air conditioners and covers about 22% of installed cooling capacity worldwide.

APAC Variable Frequency Drives Industry Overview

The Asia Pacific Variable Frequency Drives Market is fragmented due to the presence of players such as Eaton Corporation, ABB Ltd, Crompton Greaves, General Electric Compnay, and Honeywell International Inc. Companies are investing in R&D and driving towards improving the market.

- Feb 2020 - GE Renewable Energy booked a contract with Angat Hydropower Corporation to rehabilitate the 218 MW Angat hydropower plant located in the Philippines. Angat hydropower facility supplies more than 90% of Metro Manila's potable water needs and supports the irrigation of 25,000 hectares of farmlands in Bulacan and Pampanga.

- June 2021 - Power management company Eaton announced it had completed the acquisition of a 50 percent stake in Jiangsu YiNeng Electric's busway business, which manufactures and markets busway products in China. The combination of YiNeng's busway capabilities and strong presence in China with Eaton's broad power distribution and power quality portfolio enables the company to expand packaged solutions that meet the needs of customers in the Asia-Pacific region.

- Aug 2021 - Hitachi acquired the Thales ground transportation systems business, creating opportunities and expansions of core business in new markets and also for GTS customers. The combination of Hitachi and GTS digital expertise helps accelerate Hitachi's Mobility as a Service offering a global customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain / Supply Chain Analysis

- 4.3 Porters 5 Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 Technology Snapshot

- 5.1 By Type

- 5.1.1 AC Drivers

- 5.1.2 DC Drivers

6 Market Dynamics

- 6.1 Market Drivers

- 6.2 Market Restraints

7 MARKET SEGMENTATION

- 7.1 By Power Rating

- 7.1.1 Low Voltage

- 7.1.2 Medium Voltage

- 7.2 By End-User Industry

- 7.2.1 Oil and Gas

- 7.2.2 Food Processing

- 7.2.3 Energy and Power

- 7.2.4 Water and Wastewater Management

- 7.2.5 Pulp and Paper

- 7.2.6 Other End User Industries

- 7.3 By Country

- 7.3.1 China

- 7.3.2 India

- 7.3.3 Japan

- 7.3.4 Rest of Asia Pacific

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Eaton Corporation

- 8.1.2 ABB Ltd (GE Industrial)

- 8.1.3 Crompton Greaves

- 8.1.4 General Electric Company

- 8.1.5 Honeywell International Inc.

- 8.1.6 Rockwell Automation Inc.

- 8.1.7 Hitachi Group

- 8.1.8 Siemens AG

- 8.1.9 Mitsubishi Corporation

- 8.1.10 Toshiba Corporation

- 8.1.11 Schneider Electric Company

- 8.1.12 Johnson Controls

- 8.1.13 Emerson Electric Company